PRAMOD KULKARNI, Editor

|

|

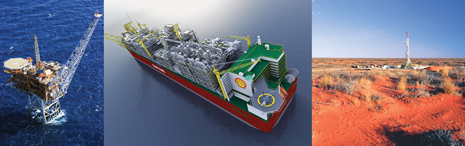

From left: Woodside Petroleum’s Pluto platform in the Carnarvon basin will produce gas and condensate from Pluto and Xena fields. In mid-May, Shell announced its investment decision for the construction of the Prelude floating LNG plant to commercialize stranded gas in the Browse basin. Beach Energy is drilling for gas in the Cooper basin.

|

|

The Asia-Pacific region is divided into nations of energy “haves” and “have-nots.” Japan and South Korea are highly industrialized nations with virtually no oil and gas resources. China and India have substantial energy resources, but without imports they will not be able to cope with the expected rise in energy demand due to population growth and rapid industrialization. Malaysia and Indonesia are the traditional energy “haves” in the region, but are suffering from production declines in their mature fields.

The emerging energy giant in the region is Australia. The country has estimated potential gas resources of 400 Tcf, a number that is expected to grow as exploration continues in frontier offshore conventional gas and onshore coal seam and shale gas plays. According to the Australia Petroleum Production and Exploration Association (APPEA), Australia’s annual gas production for domestic consumption grew during the 2000–2009 decade from 726 Bcf to 1,001 Bcf and annual LNG exports grew from 345 Bcf to 736 Bcf. The country currently ranks as the world’s fourth largest LNG exporter and is aiming to move up the ranks as mega-LNG projects such as Gorgon and Wheatstone begin production by 2015.

OFFSHORE OIL AND GAS

Australia’s western, northern and southern coasts have yielded relatively little oil but vast volumes of natural gas and condensate. The incentive for E&P projects is strong because of LNG exports to neighboring Asia-Pacific countries and domestic demand for low-carbon energy, which is expected to increase sharply with the implementation of a planned carbon tax in July 2012 and a cap-and-trade scheme soon after. (Only 9% of Australia’s current electricity generation is gas fired, compared with 80% from coal.) Offshore drilling extends from the North West Shelf to the Bass Strait in the south to the deepwater Timor Sea in the north, Table 1.

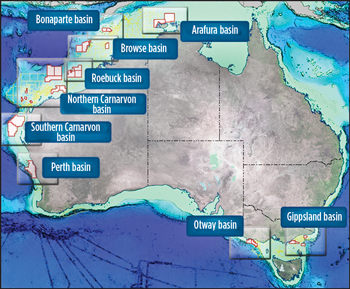

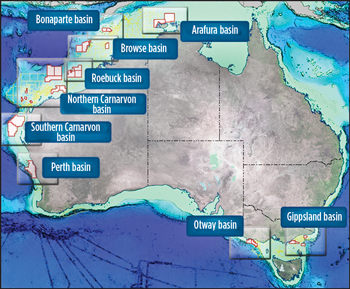

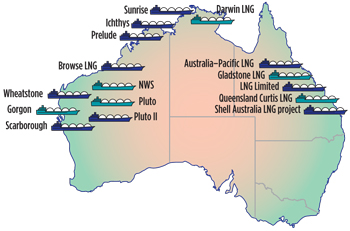

Exploration opportunities. Australia’s Department of Resources, Energy and Tourism is the agency responsible for releasing new offshore petroleum acreage. The available acreage in the current release comprises 29 areas, located across nine basins in commonwealth waters offshore Western Australia, Victoria, the Northern Territory, the Territory of Ashmore and Cartier Islands, and Tasmania, Fig. 1. Round 1 of the 2011 release will close on Oct. 13, 2011, and Round 2 will closes on April 12, 2012. Significant exploratory and development drilling is underway on all three of Australia’s coasts.

Many of the recent offshore discoveries have taken place in the Carnarvon basin, where Chevron is the leading leaseholder. In 2010, the company achieved nine significant discoveries in the area. The latest, announced in January, is the Yellowglen-1 well in the WA-268-P permit in the greater Gorgon area, 250 km northwest of Onslow, with results indicating a gas column of 137 m . Yellowglen-1 follows two other recent greater-Gorgon discoveries, Satyr-1 and Achilles-1. Also in the Carnarvon basin, Woodside Petroleum announced on May 23 that its Xerex-1 well intersected 51 m of gas in the WA-34-L permit, 12 km east-southeast of its Pluto-1 discovery. The well reached a TD of 2,385 m.

In late May, Santos announced the discovery of an oil column of 18 m while drilling in the Finucane South field in the Carnarvon Basin. The oil discovery is located approximately 7 km from the Fletcher oil field discovered in 2009 and 14 km from the existing oil production facilities at Mutineer Exeter. A number of development options are under consideration, including a subsea tie back to its FPSO servicing the Mutineer Exeter field, enabling first oil production from Finucane South and Fletcher by the end of 2013. In April, Santos announced that its Zola-1 exploration well in the WA-290-P permit in the Carnarvon basin had intersected over 100 m of net gas pay sands over a 400-m gross interval in the Mungaroo formation. The well is located 27 km southwest of Gorgon-1, with a water depth of 280 m. In the adjacent Browse basin, ConocoPhillips has begun exploratory and appraisal drilling as a follow-up to its Poseidon-1 and Poseidon-2 discoveries made in 2010.

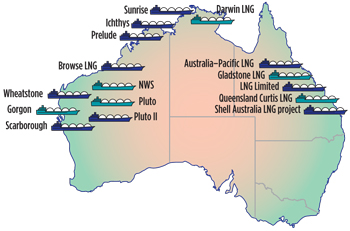

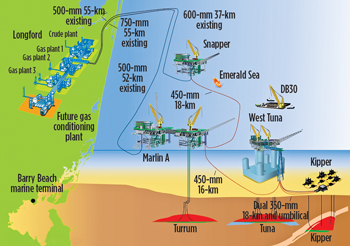

Major projects. Australia’s offshore E&P activity is centered on massive projects ranging from mature operations such as the North West Shelf and Bass Strait developments to LNG projects such as Gorgon, which are in the construction phase, and initial proposals such as Sunrise LNG, Fig. 2.

North West Shelf. Woodside Petroleum has been operating the North West Shelf Venture for the last 27 years. The largest of Australia’s oil and gas projects, the North West Shelf delivers oil and gas from the fields in the Carnarvon basin on Australia’s northwest continental shelf for domestic use and LNG export. The central hub of the offshore gas production system is the North Rankin-A platform, located 135 km northwest of Karratha in 125-m water depth. The platform gathers gas and condensate from 22 wells in North Rankin field and seven in Perseus field. The platform has a daily production capacity of 51,000 tonnes of gas and 5,400 tonnes of condensate, with dry gas and condensate transported via a trunk-line system to the onshore Karratha gas plant for processing.

In March 2008, the North West Shelf Venture partners approved funding for a North Rankin redevelopment project, which will access additional reserves by recovering remaining low-pressure gas and extend the field life to 2040. The project involves installation of the North Rankin-B platform, which will be connected by two 100-m bridges to North Rankin-A. North Rankin-B is scheduled for startup in 2013, at which time both platforms will be operated as a single integrated hub facility. The redevelopment scope also includes necessary tie-ins and refurbishment of the North Rankin-A platform.

The Karratha gas plant also processes gas and condensate from the Goodwyn-A platform, 23 km southwest of North Rankin-A, and the remotely operated Angel platform, 120 km northwest of Karratha. The Goodwyn platform gathers production from 25 wells with five injection wells and has a daily production capacity of 36,000 tonnes of gas and 11,000 tonnes of condensate. The Angel platform has a capacity for 800 MMcfd of raw gas and 50,000 bpd of condensate. Later this year, Woodside is planning to replace the FPSO Cossack Pioneer, which is moored 34 km east of the North Rankin-A platform. The FPSO gathers 140,000 bopd and 3,800 tonnes of gas from Cossack, Wanaea, Lambert and Hermes fields. The crude oil is offloaded via a flexible line to bulk tankers moored astern, while a pipeline exports LPG-rich gas from Cossack and Wanaea fields to the North Rankin-A platform, for transport to the Karratha gas plant.

|

|

Fig. 1. Australia’s offshore acreage available for leasing in 2011 encom-passes nine basins and 29 areas. Image courtesy of the Australian Department of Resources, Energy and Tourism.

|

|

|

|

Fig. 2. Mega-LNG projects on Australia’s western and northern coasts are dedicated to the conversion of offshore gas, while east-coast projects are associated with liquefaction of coal seam gas. Image courtesy of APPEA.

|

|

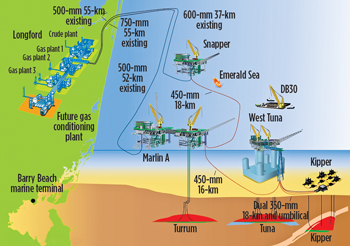

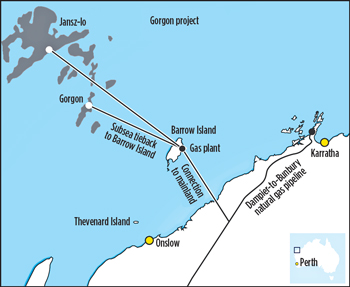

Bass Strait. Operated by ExxonMobil with BHP Billiton as its 50:50 partner, the Bass Strait development, off Australia’s southern Gippsland coast, consists of 21 offshore platforms and 600 km of subsea pipelines used to transport oil and associated gas to a processing facility in Longford. The fields have been producing oil and gas for more than 42 years. While the mature fields are suffering production declines, ExxonMobil is planning to increase production with the addition of the Marlin-B platform and Kipper subsea wells during 2011.

The Kipper-Tuna-Turrum project will gather production from Kipper, Tuna and Turrum fields, Fig. 3. Once online, Kipper is expected to produce 10,000 bpd of condensate and 80 MMcfd of gas and Turrum will produce 11,000 bcpd and 200 MMcfd. Tuna, which has produced oil for many years, is being further developed to produce gas and associated liquids. Based on the results of a 3D seismic survey in 2001, ExxonMobil feels confident that it will discover smaller fields that could be commercialized due to their proximity to existing platforms, allowing continued Bass Strait production at least until 2030.

|

TABLE 1. DRILLING ACTIVITY OFFSHORE AUSTRALIA

|

|

Darwin. Commissioned in 2006 by ConocoPhillips, the Darwin LNG plant processes gas from Bayu and Undan fields in the Timor Sea, 500 km north of Darwin and 250 km south of Timor Leste. Part of a joint petroleum development area (JPDA) of Australia and Timor Leste, the 3.4-Tcf Bayu-Undan complex is connected via a 504-km pipeline to the Darwin plant, which has an LNG capacity of 3.24 million tonnes per annum (mtpa). The project enables Australia and Timor Leste to commercialize a common hydrocarbon resource within the JPDA.

Baker Hughes recently established an under-reaming run-length record for a challenging well in the Bayu-Undain development. The GaugePro XPR bit under-reamed 2,011 m while drilling to a total measured depth of 4,467 m. The interval was completed at a 64° tangent and achieved an average penetration rate of 21.4 m/hr. The run was completed 13% faster and drilled 21% farther than offset under-reaming intervals.

Icthys. Japanese oil and gas company Inpex, in partnership with Total, operates Icthys field, located 850 km southwest of Darwin. The field has an estimated 12.8 Tcf of gas and 527 million bbl of condensate of proved and probable reserves. The proposed project consists of an offshore central processing facility above Icthys field connected to an LNG liquefaction and condensate plant in Darwin by an 805-km pipeline, the longest in the Southern Hemisphere. An FPSO would be used to store and offload condensate. A final investment decision (FID) is expected in the fourth quarter of 2011, with a timeline calling for construction to begin in 2014 and first LNG production in 2016.

|

|

Fig. 3. Installation of the Marlin-B platform and Kipper subsea wells during 2011 will help ExxonMobil produce from Turrum, Tuna and Kipper fields and extend the life of the Bass Strait project.

|

|

|

|

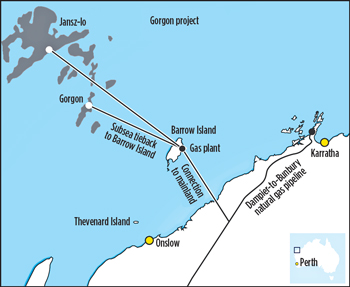

Fig. 4. The Gorgon project will gather gas from Gorgon and Jansz-lo fields for processing and liquefaction on Barrow Island.

|

|

Gorgon. Billed as the world’s largest LNG project, Gorgon has Chevron as the operator with ExxonMobil and Shell as minority partners. The project will utilize a subsea gathering system to develop the greater Gorgon-area gas fields, which hold an estimated 40-Tcf recoverable resource base. The fields are located west of Barrow Island and about 130 km off the northwest coast of Western Australia, in water depths ranging 656–4,265 ft, Fig. 4. The downstream component of the project calls for the construction on Barrow Island of both a three-train, 15-mtpa LNG plant and a domestic plant with capacity to provide 300 terajoules per day of gas to Western Australia via pipeline. Gorgon LNG will be offloaded via a 4-km-long jetty for transport to international markets. Earlier this year, Chevron signed agreements with Kyushu Electric and JX Nippon to sell 0.3 mtpa of Gorgon LNG to each company for up to 20 years beginning in 2015.

An innovative component of the LNG project is an A$2 billion carbon dioxide injection program. The plan is to separate the CO2 from the produced gas stream and inject it into a containment reservoir about 2.5 km beneath Barrow Island, thereby reducing Gorgon’s overall greenhouse gas emissions by about 40%. At full capacity in 2015, a CO2 injection volume of 3.4–4 mtpa is expected. The containment reservoir will be carefully monitored via surveillance wells and repeated seismic surveying. In mid-May, Chevron accepted delivery of the newly constructed semisubmersible Atwood Osprey, which will conduct development drilling during 2011 and 2012 in the Gorgon fields. The sixth-generation ultra-deepwater rig is capable of drilling in 8,000-ft water depth, Fig. 5.

Wheatstone. Chevron’s Wheatstone LNG project will process gas and condensate from Wheatstone, Iago, Julimar and Brunello fields via a central processing platform. There, the gas stream will be dehydrated, compressed and sent via a 200-km subsea trunk line to the onshore gas plant at Ashburton North, in Western Australia. Following the Wheatstone discovery in 2004, Chevron began the FEED phase in August 2009.

Apache and the Kuwait Foreign Petroleum Exploration Company, an investment arm of the Kuwaiti government, recently signed agreements with Chevron to supply gas from Julimar and Brunello fields to Wheatstone LNG in exchange for equity stakes in the project. In April, Shell also joined the project as a gas supplier and equity participant. Chevron has sales agreements for Wheatstone LNG with utilities in Japan and Korea.

Pluto. The latest Woodside LNG project is Pluto, which will process gas from Pluto and Xena gas fields, located in the Carnavaron basin about 190 km northwest of Karratha. Discovered in 2005, the fields are estimated to contain 4.8 Tcf of dry gas reserves and an additional 0.25 Tcf of contingent resources. The offshore platform has been installed in 85 m of water and is connected to five subsea wells.

The gas will be piped via a 180-km trunk line to the onshore facility, located between the North West Shelf gas plant and the Dampier port on the Burrup peninsula. The A$14 billion initial LNG train at the onshore gas processing plant is expected to come online in August with a production capacity of 4.3 mtpa. Woodside has completed FEED for two additional onshore trains.

Scarborough. BHP Billiton and ExxonMobil are in the early stages of making a conceptual decision about how to process gas from Scarborough field, which the two companies own in a 50:50 partnership. The options are to build a standalone onshore processing plant or to connect the gas production to Woodside’s Pluto platform.

Browse. A joint venture operated by Woodside plans to commercialize three gas and condensate fields in the Browse basin—Brecknock, Calliance and Torosa—located 400 km offshore the Kimberley region of Western Australia. The development concept calls for gas and liquids from these fields to be brought to an onshore LNG plant 60 km north of Broome. Basis-of-design studies were completed in November, and the project has entered the FEED phase. Woodside expects to obtain primary environmental approvals, secure a land access agreement and complete FEED for the LNG plant by the end of 2011, with FID planned by mid-2012 and liquefaction of first gas from the Browse fields by 2017. The other JV participants are BHP Billiton, BP, Chevron and Shell.

Macedon. BHP Billiton is in the execution phase of its Macedon gas project offshore Western Australia. The concept involves four offshore production wells supplying a wet gas pipeline to an onshore gas treatment plant to be constructed at Ashburton North. The gas plant will have a design capacity of 200 MMcfd. A sales gas pipeline will be connected to the Dampier-to-Bunbury gas pipeline for sale to the Western Australian gas market.

Devil Creek. A greenfield development operated by Apache, the Devil Creek project consists of an unmanned production platform that will produce 100 MMcfd and 500 bcpd from Reindeer field, offshore Western Australia. The gas and condensate will be transported via a 120-km supply line to an onshore processing plant 40 km southwest of Dampier. The raw gas will be processed and then supplied into the Dampier-to-Bunbury pipeline. Condensate from the gas stream will be shipped south via heavy tankers to Kwinana. Gas production is expected to commence during second half of 2011.

Sunrise LNG. A consortium led by Woodside plans to use a floating liquefaction (FLNG) concept to commercialize gas from Sunrise and Troubadour fields, located in the Timor Sea north of Australia, at an estimated cost of A$14 billion. The fields are estimated to hold a combined 5.13 Tcf and 226 million bbl of condensate. The development concept must still be approved by the government of Timor Leste, which opposes the FLNG concept and instead wants the gas piped across the Timor trench to an LNG plant on the island nation’s southwest coast. The country is entitled to 20% of the gas that would be developed. A preliminary field development plan will be submitted for regulatory approval prior to the FID. Woodside’s project partners are ConocoPhillips, Shell and Japan’s Osaka Gas.

Prelude. FLNG is also the concept chosen by Shell to commercialize stranded gas from Prelude and Concerto fields in the Browse basin, located 475 km north-northeast of Broome. The company announced its FID on May 20 approving the 480-m × 75-m vessel, which will be moored in 250 m of water and will be capable of producing 3.5 mtpa of LNG. FEED is being conducted by a consortium of Technip and Samsung, and first production is planned for 2016. Once a field is depleted, the FLNG vessel will be able to relocate to another virgin field.

Bonaparte. GDF Suez also plans to use an FLNG vessel to commercialize production from its Petrel, Tern and Frigate fields in the Bonaparte basin offshore northern Australia at a rate of 2 mpta. The operator acquired 60% of the fields from Santos in August 2009 to create a 60:40 joint venture. The project is currently undergoing pre-FEED analysis with FID scheduled for 2014 and first production in 2018.

Pyrenees. Operated by BHP Billiton with Apache as a partner, the Pyrenees project gathers oil production from Ravensworth, Crosby and Stickle fields in water depths ranging 170–250 m about 19 km off the North West Cape of Western Australia through a subsea development tied to the FPSO Pyrenees Venture. Thirteen subsea wells—nine horizontal producers, three water injectors and one gas injector—are connected via flowlines to seven subsea manifolds. The project commenced production in March 2010 and has a field life expectancy of 25 years.

Aftermath of Montara oil spill. Two years after a blowout at its Montara well in the Timor Sea resulted in an oil spill of at least 400 bpd lasting 74 days, PTTEP, a division of the Thai national oil company, has applied to drill two new exploration wells in commonwealth waters. The new wells would also be in the Timor Sea, one located about 600 km west of Darwin and the other 765 km northeast of Broome. Federal Resources Minister Martin Ferguson had earlier cleared PTTEP to continue its Australian operations after an independent review found it was on the path to achieving “good oilfield practice.” However, a decision by the Northern Territory Department of Resources to issue the permit is still pending.

ONSHORE OIL AND GAS

The north-central region of Australia has several basins that provide opportunities for some oil and mostly gas and condensate production for scores of small, independent operators. As conventional gas is depleted, operators are targeting shale and coal seam gas opportunities in the region.

Cooper basin. Australia’s leading oil and gas basin straddles the states of South Australia and Queensland. Active since 1965, the Cooper basin contains more than 190 gas fields and 115 oil fields on production. The output of about 820 gas wells and more than 400 oil wells is gathered at processing facilities at Moomba in South Australia and Ballera in Queensland via approximately 5,600 km of pipelines. Natural gas liquids are recovered via a refrigeration process in the Moomba plant and sent together with stabilized crude oil and condensate via pipeline to Port Bonython. Ethane is transported to Sydney via a dedicated pipeline and sales gas is shipped to Adelaide, Sydney and Brisbane via pipeline. The major operators include Santos, Origin Energy and Beach Petroleum.

|

|

Fig. 5. The newly built, ultra-deepwater semisubmersible Atwood Osprey will begin development drilling in the Gorgon-area fields this year.

|

|

Amadeus basin. A sedimentary basin located primarily in the Northern Territory, the Amadeus basin includes the Mereenie oil and gas/condensate field, the Palm Valley gas/condensate field and the Dingo gas field. Magellan Petroleum, one of the basin’s operators, has begun feasibility work with Mustang Engineering to determine the economic viability of Mustang’s small-scale LNG technology at Darwin to monetize gas volumes from the Amadeus basin and the offshore Bonaparte basin fields.

Coal seam gas. Australia’s coal seam gas resources (CSG, known as coalbed methane in other parts of the world) are located in the eastern states of Queensland and New South Wales. The Commonwealth Scientific and Industrial Research Organization (CSIRO), Australia’s national science agency, estimates the eastern region’s CSG resources at about 250 Tcf, primarily in the Surat and Bowen basins.

CSG exploration in a known coal seam begins with seismic acquisition to select sites in which to drill a series of core holes to identify prospective gas content. A pilot well program will consist of five to six well clusters with a temporary dam for storing produced water. If a pilot program is successful, production wells are drilled at about 1,000-m spacing. High-density polymer piping connects the wellheads to central gas processing and water treatment facilities. GSG exploration has been spurred by the Queensland government’s requirement that an increasing share of electricity in the state come from gas-fired generators (13% by 2005 and 15% by 2010, with an option to increase to 18% by 2020).

Gladstone. Operated by Santos, the Gladstone LNG project will involve supplying CSG from Santos’ eastern Queensland fields to a gas processing and liquefaction plant on Curtis Island near Gladstone. The plant will produce 7.8 mtpa of LNG through two liquefaction trains. Santos expects to support the first train from its own CSG reserves. The Gladstone project received environmental approval from the Queensland government in May 2010, and sales agreements were signed with Korea Gas Corporation and Total in December, clearing the way for the FID, which was made the following month.

Asia-Pacific LNG. Origin Energy and 50% partner ConocoPhillips are also planning to convert CSG production to LNG at a liquefaction plant to be located near Laird Point on Curtis Island. Two trains at the Asia-Pacific plant, located near Gladstone, are expected to process gas from Surat and Bowen fields at a rate of 4.5 mtpa per year.

Surat. Arrow Energy has undertaken a project for the staged development of about 1,500 wells in its Surat basin acreage. The resulting gas will be directed to the Queensland market and potentially as supply to the LNG plants proposed for Fisherman’s Landing at Gladstone and the Shell Australia LNG Project on Curtis Island.

|

|

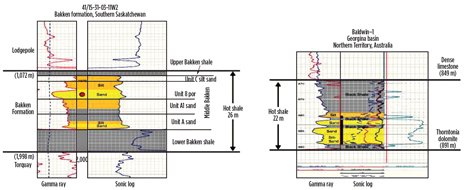

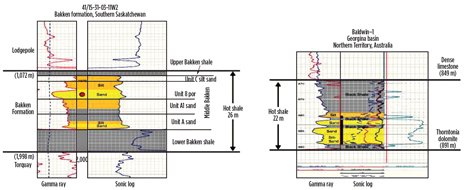

Fig. 6. PetroFrontier is exploring a potential analog between the Arthur Creek shale within the Georgina basin in Australia’s Northern Territory and the Bakken formation in southern Saskatchewan, Canada.

|

|

The fulfillment of these LNG projects will require CSG operators to drill as many as 5,000 producing wells. Some operators are planning to drill multiple extended reach laterals from a single mother wellbore in order to reduce costs and environmental footprint.

A major problem associated with such a high volume of drilling is how to handle the water generated from dewatering the coal seams. Beginning in 2012, the Queensland government will no longer approve the use of evaporation ponds to store the produced water. As a result, operators are evaluating water recycling and reinjection options. To support the expected increase in CSG drilling and production, oilfield service companies are increasing their infrastructure in the region. Schlumberger recently opened three operating facilities in Queensland to provide cementing, fracturing, wireline logging and directional drilling services.

Shale oil and gas. Exploration for oil and gas from shales is in its infancy in Australia. Initial exploration activity is taking place in the Cooper basin and the southern Georgina basin in the Northern Territory.

Beach Energy estimates potential shale gas in place to be 40–80 Tcf at its holdings in Petroleum Exploration License 218 in the Cooper basin. At its Encounter-1 well drilled in late 2010, the company found the target zone in the early Permian shale of the Rosneath, Epsilon and Murteree formations to be thicker than anticipated and gas saturated with no water. Located at depths ranging 2,300–3,500 m, the shale is 120–260 m thick. In January, Beach’s Holdfast-1 well also encountered thick shale. In June, the company will begin flow simulation of both the wells in preparation for the development of pilot production wells in 2012. Beach compares its target shale to the Barnett and Haynesville shale plays.

According to a November 2010 report by petroleum consultancy Ryder Scott, there are strong technical similarities between the lower section of the organic-rich Arthur Creek “hot oil” shale in the Southern Georgina basin and the unconventional oil targets within the Bakken shale in North America’s Williston basin, Fig. 6. PetroFrontier, a Canadian company, has acquired two phases of 2D seismic surveys in its 13.6 million-acre exploration permit. Based on seismic and petrophysical evaluation, the company is planning a four-well drilling program, including two horizontal extensions of existing wells to test the shale play.

E&P FRONTIER

After Brazil and West Africa, Australia is currently the most vibrant oil and gas sector in the world. Offshore operators are involved in projects to increase production from the mature North West Shelf and Bass Strait, participating in engineering and construction activities for mega-LNG projects, and advancing the exploration frontier in the deepwater Timor Sea as well as the onshore coal seam gas and shale plays. If the E&P activities continue at the current pace, Australia will rank as a leading gas producer and the world’s second largest LNG exporter by 2015.

|