Israel’s chief geologist touts improved offshore bidding round, sees potential onshore

World Oil (WO): Where is the bidding round process at present?

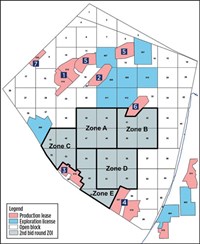

Dr. Michael Gardosh (MG): We did one that ended in late 2017. And a year later, in late 2018, we came up with the second round, which is the one we’re running now. From November 2018, it goes to June 17, 2019. So, it is a couple of months before closing. In this second round (Fig. 1), we introduced quite a lot of changes and upgrades, so to speak, because we learned from experience. So, we decided to change a few things. One of the good things that I think we’ve done is to open up larger areas. For independents in the past, we offered small blocks; now, we offer clusters. So, each bidding unit will be a group of four licenses; we have five of these clusters, what we call Zones A, B, C, D and E—19 blocks in total. And, within each zone, we have good targets that we’ve already identified, so we think these blocks being big, and allowing for more options to shoot seismic and do more original-type work is one upside.

And then, the other upside is that we already did part of the work and identified targets there, and we actually point to specific targets with some estimations of the prospective resources and the play, etc. So, another thing that we see as an upside is relatively loose work program commitments—we have licenses granted for up to seven years. So, within the seven-year period, you can move up from only exploration in the first three years, and then you have the first well commitment between years three and five, and then the last two years, you need to drill any additional wells. But you can take it gradually from exploration to initial discovery, hopefully, and then to some more appraisal work,

So, I think this combination of relatively big areas, along with some proven systems at existing fields with world-class discoveries, should make it quite interesting to oil companies in that part of the world.

WO: You're really part of an up-and-coming region for exploration, aren't you?

MG: Yes, we’re in a corner of this region, which has seen quite a lot of activity recently. Cyprus is near us, and Egypt obviously is in the middle of it, so this region is showing itself to be in the interest of many big companies, because it offers the proximity to Europe and to its big markets, as well as to some local countries, which are good markets for gas,like our neighbors, Jordan and Egypt. We have some contracts already signed with them—Jordan is $12 billion, and the gas is already flowing to there from Tamar. And just a year ago, in February 2018, we signed a contract with Egypt to supply gas for $15 billion. So, referring back to the bidding round changes, definitely commercialization is a big part, as well as export to Jordan and Egypt.

Also, in the [Israeli] domestic market, we’re moving from coal to 85% natural gas-fueled by 2022, and 15% renewables. So, a huge step in that direction. There’s been a governmental decision that by 2030, we’re going to ban all imports of diesel- and gasoline-fueled cars, so we’ll move into electricity and gas as the main fuel sources. So various industries are switching to natural gas. One of the first questions that E&P companies were asking us was, “well, okay, if we find gas, what are we going to do with it, because the Israeli market is small. But there’s also Jordan and Egypt, and the last thing that we’ve opened up is that the Israeli Energy Minister has approached Cyprus, Greece and Italy, and they’ve all signed an MOU agreeing to build a subsea pipeline, from Israel to Cyprus to Greece to Italy (Fig. 2). And thus, supplying natural gas from the Eastern Mediterranean to Western Europe, diversifying their energy sources.

If we look at the numbers and examine the “yet-to-find category,” we still have 75 Tcf of gas yet to be found, and 6.6 Bbbl of oil. That’s a significant amount [of hydrocarbons] in Israel’s waters. So, all of that gas needs to go somewhere. And that’s one of the new, improved things that we’ve done in this bidding round. On that pipeline, first gas is expected in 2025. The European Union is supporting this project and has mentioned that it’s crucial for Europe’s energy future, and they’ve already invested €100 million for the FEED. So, it’s been looked at very seriously by both the countries here in the region, and by the European leadership. It’s challenging—it’s a very big project, probably the largest subsea pipeline system in the world. Nevertheless, it’s feasible, and there’s a big market here, which looks for alternatives. You know, the Europeans are buying gas mostly from Russia, and they would like to have an alternative source. While the countries are interested, and there’s a good base for the development of this project, ultimately the companies will need to finance that.

WO: Does anybody know how long it will take to construct that pipeline?

MG: A matter of a few years—four to five years. It’s estimated to cost $7 billion, or less than a major LNG plant. We need to be careful—we cannot say that the [finished] line will be there in 2025. Given the interest of the companies to pick up on this opportunity, it could advance very quickly. So, it can be 2025, but the private sector will still need to sponsor that, or at least a fair amount of it. The European Union will be investing there through its financial institutions. There are two major advantages to the project—the fact that these are very safe and stable countries, holding to European Union standards, and the second major advantage is the proximity to Europe.

WO: What is Israel's current gas production?

MG: I can put it in terms of consumption. We consume annually 11 Bcm presently, and we expect by 2040 that we will be consuming 25 Bcm, or more than double the present rate. We are the second-fastest growing gas market in the world. The 11-Bcm figure is less some exports to Jordan. There will be additional exports to Jordan through the northern part of the country (Israel) to the electric generating company there, and this should start up later this year, after Leviathan [field] is connected. So, we will be supplying larger quantities to Jordan next year.

Then, later on, we also will connect a pipeline to Egypt. There are also two more routes that we’re looking at—with two major LNG plants, one owned by Shell, and one owned by Eni—they’re idle, practically, because there’s not enough gas for export yet. So, this is a good time for us to jump in and sign contracts for exports to those LNG plants, beating those other companies, which are just now starting to explore and expand activity [offshore Egypt]. In Egypt, for quite a few years, there was a very big slowdown—all the companies pulled out, because the government was forcing ridiculous gas prices. But then, the new president said, “let’s just change the rules,” and more companies are in again, and things are starting to pick up. But we already have the gas, so it’s a window for us to sign contracts and connect to those pipes to the LNG plants.

WO: So, interest in Israel's offshore has been fairly good, right?

MG: Yes—we cannot disclose the names of the companies [that are interested], but interest is good. In general, the region is a hotbed for exploration. We’re seeing it in Egypt, as well as Cyprus and Lebanon. And we see a lot of companies coming into the region. Just in [early February], it was announced that ExxonMobil is making a new entry into Egypt, adding to Shell, Eni and DEA. And these existing players are increasing their presence, as well.

WO: What is the status of the various field projects offshore Israel?

MG: First gas was originally from Mari-B, which was connected to shore in 2004. There’s still some production, but it’s almost depleted now. And then the bigger one, Tamar field, has been connected (online) since 2013. At that time, it was the largest, longest tie-back from field to platform, about 150 km to the coast in the south. But they did that very quickly. They completed this project in less than three years, which at the time was very fast. And now, we’re looking at the connection of two more fields.

We have Leviathan, which will be connected in late 2019, and built with a platform offshore the northern part of the country. This is important for us, because, up to now, the only connection from the fields to onshore was in the southern corner through the port of Ashdod. Now, this (Leviathan’s output) will be the second entry in the northern part of the country, giving us more security of supply. The platform’s jacket, constructed in Corpus Christi, is already installed. The topsides are also being constructed there. It will probably be ready to move, sometime in the summer. It will be moved on a big barge across the Atlantic and then installed, with first output connected in late 2019.

Meanwhile, Karish is an interesting story, because it will be the first FPSO to be installed in the [Eastern Med] region, and this is a new thing for us. It’s a smaller field, not the size of Leviathan. Nevertheless, it’s quite significant, and has 55 Bcm of discovered gas reserves (2P). It will be connected to the shore, but the treatment will be on the FPSO, to be connected in 2021. So, that will create security of supply for us from three different sources, allowing not only enough gas for the domestic market, but plenty also for exports to other countries. This is one of the fastest regions to be developed, worldwide. In less than 10 years, we’re going to have three major fields developed here—it’s quite impressive.

WO: How are exploration efforts faring at the moment?

MG: In areas already granted in 2017, there was a seismic shooting by Energean. This company is owner of two fields, Karish and Tanin. On five blocks that they took in 2017, they have been shooting seismic. They are drilling their first well in Block 12 this spring. So, we’re expecting new exploration wells to be drilled, including another one later this year in the Royee Block, to be drilled by a consortium of Edison and Ratio. So, we’re looking at two exploration wells to be drilled. If these blocks (in the new bidding round) are granted this summer, then we’ll start to see some additional new activity.

WO: We know that most of Israel's E&P activity is concentrated offshore, but what has been taking place onshore?

MG: First discoveries in Israel were made onshore, back in 1955. Since then, there’s been quite a lot of activity, but, at best, there has been what I would say is moderate success. Nevertheless, there’s still always an interest in the onshore, because it’s less expensive to operate, and there are some interesting areas. The Dead Sea region, for example, has the Dead Sea Rift running from north to south in the eastern part of the country. So, the Dead Sea is an interesting area. Recently, there’s been a well drilled south of Tiberias, near the Sea of Galilee, which was a dry well, but it was an important well in the sense of revealing some new stratigraphy, some new rock types.

This is the one drilled by Zion, called the Megiddo Jezreel 1. It had some shows, but when they tested it, they couldn’t get it to produce [commercial quantities]. But they’re still optimistic that they can develop this area, because they found that the target is much shorter than they expected. They apparently ran into a block that was not known to them before. So, I hope they’ll continue, because there’s a promising situation. Since they didn’t know about this block and didn’t expect it to be there, they didn’t plan to find it. So, this is an active area, with this one project going on.

There also has been some activity further south. We are seeing some interest in the southern portion of the Dead Sea Valley, with companies looking at possibly drilling there. And then there is activity near the coastal area. We have several licenses being operated there—one near the coast, and the other a little bit inland. They are looking again into some targets that have already been identified and were drilled. Also, we recently found quite a lot of oil in what is called the Meged field—the first discovery was made in the 1990s. But then they started to produce with a new well—the Meged 5—in 2011. This is a new play that was opened, with deep oil from Jurassic layers that have not been producing significantly in Israel until now. One well produced closed to 1 MMbbl, so there is good potential in this area, and we could see more wells being drilled in this structure. It’s east of Tel Aviv. There are two license-holders looking at the possibility of drilling into this structure. So, it’s not as big as the offshore, but there are four operations being run right now. Again, it’s an opportunity for smaller operations, relatively less expensive, and oil is proven to be found.

WO: Last. but not least, the Ministry maintains a Houston office, and it just opened a data center, correct?

MG: Because this is relatively new for us, and we progress as we go, one of the things that we felt was needed is more direct contacts and a way to reach more companies in Houston. So, a year-and-a-half ago, we opened an office in Houston, in the Galleria area, with two people, and have a leg in the ground there. They’re open for communication and just recently opened a data room, as well. WO

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- When electric meets intelligence: Powering a new era in hydraulic fracturing (January 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)