Regional Report: Gulf of Mexico

Between hurricanes, Covid and Democrats, it’s hard to know where to begin assessing the last 12 months of catastrophes. In the last year, the U.S. Gulf industry got hit with a triple whammy—and the beat goes on.

POLITICS RULE

The leader in this trifecta is the Democrats, whose policies present the prospect of doing the most long-term damage to the industry. Cancellation of lease sales is only part of the plan being rolled out. Proposed changes in tax laws threaten a slew of deductions, subsidies and tax breaks, such as those for natural resource damages and drilling costs. People and communities along the Gulf Coast are reeling, the country’s energy outlook is threatened, and the overall implications are simply staggering.

While current drilling operations continue for the present, the future became much less certain, as lease sales took a broadside in mid-February with the cancellation of Lease Sale 257. The step follows the Biden administration’s initial Jan. 21 shutdown of new oil and gas drilling permits, quickly followed by a lease sale suspension.

The termination is not for lack of interest; it cuts short a successful, long-running leasing program. Lease Sale 256, in November 2020, generated $120, 868,274 in high bids for 93 tracts covering 517,733 acres in the federal GOM. Twenty-three companies participated. The sale included 14,862 unleased blocks located from 3 to 231 miles offshore in the Gulf’s Western, Central and Eastern Planning Areas.

Live-streamed from New Orleans, 256 was the seventh offshore sale held under the 2017-2022 National Outer Continental Shelf Oil and Gas Leasing Program, which had scheduled 10 regionwide lease sales for the Gulf. Two sales had been scheduled each year for all available blocks in the combined Western, Central and Eastern Gulf of Mexico Planning Areas.

As the Bureau of Ocean Energy Management (BOEM) had noted previously, resource potential and industry interest in the GOM have been high. At the time of the 256 sale, then-Deputy Secretary of the Interior Kate MacGregor said in a clearly outdated assessment, “The continuation of safe and reliable oil and gas from the Gulf of Mexico is crucial for America’s economy and energy portfolio. Lease sales have been held in Gulf federal waters since 1954, and the sustained presence of large deposits of hydrocarbons in these waters will continue to draw the interest of industry for decades to come.”

The potential repercussions of a ban are huge—not just for the industry, country and states, but for hundreds of highly dependent communities and tens of thousands of jobs. That’s the short list.

For instance, revenues received from Outer Continental Shelf (OCS) leases are directed to the National Parks and Public Land Legacy Restoration Fund, as well as the U.S. Treasury, the Land and Water Conservation Fund, and the Historic Preservation Fund. The Gulf Coast states of Texas, Louisiana, Mississippi and Alabama use these funds to support coastal conservation and restoration projects; hurricane protection programs; and activities to implement marine, coastal or conservation management plans.

The American Petroleum Institute (API) warned in January that suspension of new leases would cost American jobs and make the U.S. more dependent on foreign energy. “Today’s executive action to halt leasing is a step backwards, both for our nation’s economic recovery and environmental progress, threatening to cost thousands of jobs and much-needed revenue while increasing emissions by slowing the transition to cleaner fuels,” said API president and CEO API president and CEO Mike Sommers. “Limiting domestic energy production is nothing more than an ‘import more oil’ policy that runs counter to our shared goal of emissions reductions and will make it harder for local communities to recover from the pandemic.”

In terms of employment, an extended ban would have a catastrophic impact on Gulf Coast states. In Louisiana alone, a permanent prohibition could cost 48,000 jobs by 2023 (Houmatoday). That figure is quickly multiplied. The Louisiana Oil and Gas Association figures the GOM oil and gas industry supports 250,000 jobs in Louisiana, Texas and Mississippi.

Of course, these political actions have been challenged and accompanied by a lot of noise. The cacophony of outrage runs the gamut from prospective legislation that would prohibit the government from blocking permitting on federal lands and waters without congressional approval, to a flurry of industry petitions and lawsuits.

Louisiana Senators John Kennedy and Bill Cassidy, as part of a group of 26 Republicans in the Senate, wrote Biden saying, “Your actions will have grave consequences for our constituents, and taking these actions on your very first week as president, with no input from those of us who represent these hard-working Americans, is counter to the desires of the American people who want practical, bipartisan solutions to our nation’s challenges, and who want policies that support working families.”

U.S. Rep. Steve Scalise (Rep. – Metairie, La.) weighed in, observing the suggestion that oilfield workers can transition to other industries is an “elitist, smug attitude held by folks who really don’t know how energy is produced.”

In late March, 13 states announced that they are suing the Biden administration to reschedule the cancelled lease sales in the GOM, Alaska and Western states. In particular, the suit seeks to reschedule the March 17 GOM sale and another planned for offshore Alaska. The plaintiff states are Louisiana, Alabama, Alaska, Arkansas, Georgia, Mississippi, Missouri, Montana, Nebraska, Oklahoma, Texas, Utah and West Virginia.

Stretching credulity, White House Press Secretary Jen Psaki told a press briefing that claims made in the lawsuit “will not affect oil and gas production or jobs for years to come.” (Editor’s note: Since assuming her present duties in January, Ms. Psaki has repeatedly demonstrated that she has trouble keeping the facts straight.)

COVID’S GRIP

These political challenges are heaped on a Covid pandemic that had already crashed oil prices, and disrupted lives and operations. Comparatively, Covid at least has a vaccine.

The GOM was in relatively good shape when oil prices hit the skids. Leaner, nimbler, and better prepared than the last downturn, is how Wood Mackenzie analysts described the industry. Nearly 82% of GOM oil production had a short-run marginal cost of $10/bbl Brent. Plus, over 60% of rig contracts were short-term, offering flexibility to defer capex and maintain positive cash flow.

Nevertheless, they point to swift budget cuts, shut-in fields, and “major recalibrations” in investment, exploration and project sanctions. Low prices have wiped 30% off the remaining value from the U.S. GOM deepwater asset base, and roughly $4 billion in investment have been cut from 2020—a 22% reduction from 2019. Wood Mackenzie says to expect historic lows in exploration and a slow recovery, based largely on activity among independents.

The pandemic has, and is, producing dramatic changes. In an early white paper on pandemic repercussions, TATA Consultancy Services author Jan Erik Johansson described key steps to Covid 19-related restructuring of business models. Since then, much of this has taken place, as many of us know from the joy of “ZOOMING” at the kitchen table.

Among the steps is the continued automation of work processes, including reducing personnel involved in drilling operations through AI, VR and robotics. Oil field services are further incentivized to re-think ways of providing remote services that minimize travel and close interaction. It’s a heck of a way to sell drill bits.

Ramifications encompass personal interaction and collaboration, with limits on physical meetings, changes in office design and the advent of virtual spaces. Of course, there’s also policy on certification of past infection or vaccination. Over time, says the analyst, Covid-related disruptions may lead operators and service companies to restructure supply chains and increase the use of analytical tools to evaluate bottlenecks and improve efficiency.

Indeed, as the COVID pandemic set in, companies rushed to implement work-from-home initiatives and health checks for land and offshore facilities. The impact was particularly hard-felt offshore, where personnel work in close proximity.

With all this going on, it appears that Gulf operations, with a total offshore population of about 15,000 people, responded very effectively to minimize illness and operational disruptions. But the pandemic still had an impact. In April 2020, the United Sates Coast Guard reported more than 26 workers on GOM platforms tested positive for Covid-19 on seven of 680 platforms. In one reported instance, nine workers were evacuated from a Shell platform for testing and treatment.

Early in the pandemic, National Ocean Industries Association President Erik Milito noted a concerted industry effort to stop the spread of Covid. “It’s our goal to get everyone tested,” he said. “They’re essential workers. And they are in a confined setting.” NOLA also reported industry groups had made requests at the federal and state level for testing to be made available for their workers.

Efforts included input from the Offshore Operators Committee, a member-organization of energy companies operating in the GOM. Its recommendation included what have become all-too-familiar steps, including self-screening and pre-travel screening before transport to platforms; cleaning of frequently touched surfaces; and planning for quarantine and specialized transportation for onboard individuals exhibiting symptoms.

HOT AIR

If politics and COVID were not enough, the GOM industry dealt with five hurricanes and one tropical depression in 2020—all courtesy of a record-setting Atlantic hurricane season.

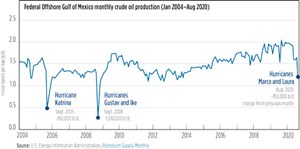

Hurricanes Laura and Marco dropped GOM federal crude production by 453,000 bpd, or 27% in late August. On the bright side, that was about half the loss from Hurricane Katrina in 2005 (which hit near New Orleans) and Gustav and Ike in 2008, according to the Energy Information Administration (EIA), Fig. 1.

The consecutive hurricanes caused 15 days of shut-ins that curtailed a total 14.4 MMbbl of crude oil production, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE). The agency estimates that about 84% of GOM crude oil production was shut in at the peak of the disruption, as crew were evacuated. Total average production for the month was 1.2 MMbopd, the largest monthly decrease since September 2008.

But wait a day or two. Winds and waves ultimately subsided and let production gain some headway. In September 2020, production averaged 1.73 MMbopd, and was expected to recover to nearly 1.92 MMbopd by December 2020, to reach an average 1.71 MMbopd for the year.

PRODUCTION TRENDS/OUTLOOK

Where does it go from here? Long-term project commitments that traditionally insulate GOM activity notwithstanding, the political climate appears unlikely to improve in the near future; Covid still occupies our lives; and only the weather is certain to change.

BOEM said that 2019 was a record year for American offshore oil production, at 596.9 MMbbl, or 15% of domestic oil production, and $5.7 billion in direct revenues to the government. Additionally, offshore oil and gas supported 275,000 total domestic jobs and $60 billion in U.S. economic contributions.

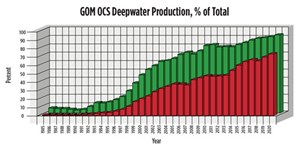

The U.S. Energy Information Administration (EIA) also expects that the 2020 final tally on GOM oil production will set new records. The GOM includes some 2,000 facilities and about 13,135 mi of active pipeline, according to BSEE. Deepwater production is the main source of U.S. Outer Continental Shelf (OCS) output. In 2020, it contributed 92.85% of the oil and 73.35% of the gas in total OCS production, which amounted to 604,999,871 bbl of oil and 803,751,884 Mcf of gas. That’s a 2019-to-2020 production drop of 10.79% (oil) and 18.3% (gas), Fig. 2.

Although the deepwater portion of the GOM has continued to increase, E&P activity was down slightly during first-quarter 2021. There were 35 deepwater prospects with drilling and workover activity, according to a March count. That compares to 40 in March 2020 and 35 in 2019. The majority of this activity is in water depths greater than 500 ft, where there are 56 permanent platforms in over 1,000 ft of water.

World Oil’s annual forecast anticipates a 9.4% increase in GOM drilling and an 8.1% jump in total footage during 2021. In the GOM, average time from discovery to first production has been cut in half over the last four to five years, and final investment decision to first production has declined 33% (Wood Mackenzie). These increased efficiencies are a step in the right direction, notes the forecast, and could lead to a modest recovery in deepwater drilling during 2021-2022.

Globally, 2021 drilling activity is benefiting from an oil and gas demand recovery buoyed by vaccinations and OPEC+ supply cuts, says consulting and data firm Rystad Energy. Offshore drilling is expected to increase about 10%, in both 2021 and 2022 (about 2,500 and 2,700 wells, respectively). Most of the deepwater growth in North America will come from Mexico. In South America, growth will come from Brazil and Guyana, says the consulting firm. While the U.S. GOM is not featured in the outlook, the rising tide may also raise this boat.

DRILLING AHEAD

The GOM rig count for March 19 was 13 rotaries, down from the 19 rigs counted by Baker Hughes for the same period a year ago. The highest on record is 128 rigs in January 2001; the lowest is nine in August 1992.

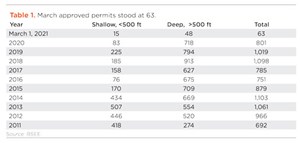

Permits do not suggest much of a gain in activity. In 2020, there were 83 shallow well permits and 718 permits for deepwater wells. The total of 801 permits compares to 1,019 in 2019, made up of 83 shallow wells (vs. 225 in 2019) and 718 deepwater wells (vs. 794 in 2019). As of March 1, there were 63 approved permits, Table 1.

U.S. OPERATOR HIGHLIGHTS

BSEE production ranking of operators remained relatively stable during 2020. The only change in the top four was in gas production, with BP moving into the number three slot held by Fieldwood Energy in 2019.

For 2020, the top four oil producers were Shell Offshore Inc. with 141,625,076 bbl, followed by BP Exploration & Production, Anadarko Petroleum Corporation, and Chevron U.S.A. Inc. The lead gas producers were Shell Offshore Inc. with 180,396,253 MCF, followed by BP, Anadarko and Chevron.

Talos has begun producing from its Bulleit field. After weather-related delays, including Hurricane Delta, first oil and associated gas from the Green Canyon 21 asset started Oct. 15, 2020. It produces through the company’s Green Canyon 18 platform. Operator Talos has a 50.0% interest, with EnVen and Otto Energy holding 33.3% and 16.7% interests, respectively.

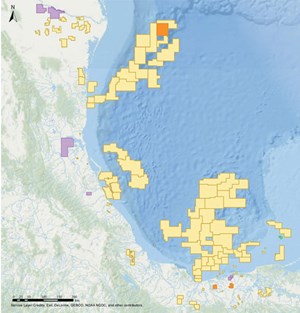

BP’s Atlantis Phase 3 began production in August 2020. The development is 150 mi south of New Orleans in about 7,000 ft of water. The project, including a new subsea production system for eight new wells, is expected to boost peak production at the platform by about 36,000 boed. Atlantis is BP’s deepest moored floating platform in the GOM. The other GOM platforms are Mad Dog, Na Kika and Thunder Horse, Fig. 3.

The Deepwater Horizon Trustees in March announced nearly $100 million in new Gulf restoration projects. To the praise of the National Audubon Society, almost $35 million of that is dedicated to supporting bird populations.

Murphy says storm-related downtime delayed first oil at Calliope that was planned for 2020. Start-up was pushed to the second quarter of 2021.

MEXICO OVERVIEW

While Mexico’s oil patch politics have not exactly been a model of stability, recent twists in the U.S. GOM policy may have improved its relative reputation.

In a March 23 interview in Mexico Business News, Ian Rutherford with industry technical consulting firm ModuResources, said that while work on the U.S. side of the GOM is increasingly difficult, due to potential government restrictions, Mexico’s activity is benefiting from diversification that is attracting international companies.

Still, Mexico continues to thrash a process of undoing energy reform complicated by constitutional issues, international treaties and contracts. A year ago, Finance Minister Arturo Herrera said Mexico would invite private firms to invest in oil and gas projects to offset economic problems exacerbated by the coronavirus. But he also advised that the invitation would not include energy auctions. More recent reports point, instead, to power plants, natural gas pipelines, fuels storage and LNG export terminals.

Petroleos Mexicanos (Pemex), the world’s most indebted oil company (according to Reuters), said in March that it would emphasize refinance of amortization payments while avoiding new debt through 2024. The government plans to pick up Pemex’s debt amortization payments this year, totaling over $6 billion. The company’s financing requirements have risen to $10.7 billion, and at the end of last year, the company’s financial debt reportedly totaled $113.2 billion.

The National Hydrocarbons Commission reported in February 2021 that E&P contracts totaled 111, including 28 deepwater and 32 shallow-water contracts in the Mexican GOM, Fig. 4. Total January 2021 production from 32 land and offshore producing contracts was about 116,000 bopd and 219 MMcfgd.

MEXICAN OPERATOR HIGHLIGHTS

Talos Energy reported on March 26 that the Mexican Ministry of Energy (SENER) would finalize the Zama field unitization process. Pemex and a consortium led by Talos were directed by SENER in July 2020 to find agreement on joint Zama development, but they did not meet the March 25 deadline.

The Block 7 consortium comprises Talos and partners Premier Oil and Wintershall Dea. Discovered by the consortium in 2017, the shared reservoir extends from Block 7 to neighboring Pemex AE-0152-Uchukil Asignación in the Cuencas del Sureste, in the Bay of Campeche. Reserves are estimated at about 700 MMbbl of oil, Fig. 5.

Repsol made two significant offshore oil discoveries with its Polok-1 and Chinwol-1 exploration wells in Block 29 in the Salina basin. Both wells reportedly confirmed high-quality reservoirs. The discoveries are just 12 km apart from each other, and 88 km (55 mi) offshore, in water depths of approximately 600 m (1,969 ft).

Consortium partners are Repsol (30%, operator) PC Carigali Mexico Operations, PETRONAS (28.33%), Wintershall DEA (25%) and PTTEP México E&P Limited (16.67%).

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)