2022 Forecast: U.S. crude output falls slightly, natural gas rises

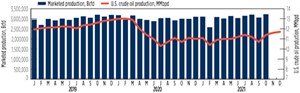

Despite a 12.7% y-o-y increase in drilling activity, U.S. oil production was down 1.13%, averaging 11.19 MMbopd in 2021. The loss in output could have been more drastic, but U.S. operators completed 2,682 DUC wells in 2021, with 2,078 of that total in the Permian basin. WTI started 2021 at $52.00/bbl and climbed steadily throughout the year, hitting a seven-year high of $81.48/bbl in October.

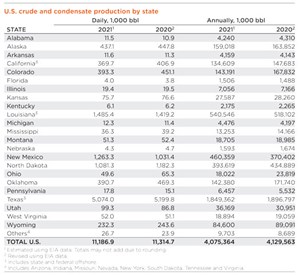

Crude and condensate: As noted, while U.S. oil production decreased mildly during 2021, there were significant declines in Oklahoma, Colorado, California and North Dakota. Of the nine major oil-producing states (>100,000 bopd), seven suffered losses, with the exception of New Mexico and the GOM. Texas oil production was down 2.4%, decreasing to a daily average of 5.07 MMbopd in 2021, despite booming DUC completions in the Permian and Eagle Ford plays (2,350 wells completed). On the New Mexico side of the Permian, production surged 22.5%, up to 1.263 MMbopd, the only onshore gain of the big-nine states/regions. Bakken production in North Dakota registered an 8.5% decrease, down to 1.081 MMbopd.

In the Western states, Colorado’s green initiative caused a 12.8% decrease to 393,300 bopd, while Wyoming was down 4.6%, to 232,300 bopd. In California, waning drilling activity that started in 2015 continues to negatively impact the state’s production, which dropped to 369,700 bopd in 2021, a loss of 9.1%. A 14.4% increase in Utah pushed that state up to 99,300 bopd from 86,800 bopd in 2020.

In the Mid-continent, production in Oklahoma was down a whopping 16.7%, with underperformance in the SCOOP and STACK plays causing the state’s output to decline to 390,700 bopd. The Sooner state had already experienced a 19% loss of crude output between 2019 and 2020. Despite virtually no shale activity, Kansas dropped just 1.2%, to average 75,700 bopd. Alaska also declined moderately, dropping 2.4% to average 437,100 bopd. Louisiana and the federal offshore jumped 4.7%, up to 1.49 MMbopd, as production came back on-line after disruption from Hurricane Ida knocked out 80% of crude output in September.

Natural gas: Henry Hub gas prices averaged $3.91/MMBtu in 2021, up $1.88/MMBtu from 2020. HH prices averaged $3.62/MMbtu for the first nine months of 2021 bottoming at $2.62/MMBtu in March. Prices hit a yearly high of $5.51/MMBtu in October, but retreated back to $3.76/MMBtu by year’s-end. The surge in gas prices during 2021 was influenced by increased demand despite Omicron, geopolitical unrest in Europe.

Monthly average marketed gas production fluctuated throughout 2021, hitting a low of 92.372 Bcfd in February, before climbing back up to 101.884 Bcfd in December.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)