Acquisitions and divestitures: Driving the oil and gas industry’s profitability and growth

The good news about oil and gas (O&G) recoveries is that they tend to follow a pattern; the bad news about these recoveries is that the recovery’s timing and rate of speed are more challenging to predict. The current O&G recovery, which began in the fall of 2020, has accelerated of late, but it still looks slightly different from prior recoveries.

As with most commodities, when demand outpaces supply, the price increases, and vice versa. As it relates to O&G, previous recoveries were driven by producers racing to increase production to meet increased demand, and leverage the higher prices caused by the demand/supply imbalance. Oilfield service (OFS) companies saw a corresponding increase in demand for their services, and the entire value chain benefited from the recovery.

A DIFFERENT RECOVERY

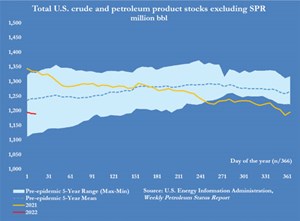

However, this recovery is different from prior ones, due primarily to a lack of increased production activity by O&G producers, coupled with decreasing oil stocks in the U.S., Fig. 1. With demand still hovering around pre-pandemic levels, the reduced supply has kept prices high. The war in Ukraine is also driving prices even higher due to supply uncertainty. After all, prices rise if either demand increases ahead of supply or supply decreases ahead of demand. Why are oil producers letting this fantastic opportunity slip away instead of capitalizing on it? The revenue growth they could generate is significant; why are they unwilling to pursue it with their usual vigor? Such simple questions require a multi-pronged complex answer.

One school of thought is that the operators are merely exercising discipline and restraint not generally seen during prior recoveries. Perhaps they choose, instead, to produce fewer barrels of oil at a higher price to drive up profits and, in turn, raise their stock prices. While this may be part of the answer, the current posture of our federal government is another part of the answer. By aborting the development of the Keystone XL pipeline and immediately thereafter disallowing new drilling for oil and gas on federal lands, the current administration has begun to cripple the industry.

Then, by openly stating that they want to abolish the U.S. O&G industry, pressure has been applied on central banks to limit funding for oil & gas projects. This reduces the opportunities for companies to drill more wells and increase production to meet growing demand, driving prices even higher and fueling inflation that hasn’t been seen in the U.S. for more than 40 years. Oil prices haven’t been this high (topping $110/bbl) since April 2011.

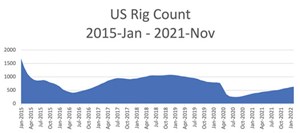

Of course, no discussion regarding oil prices can be complete without U.S. rig counts, another leading indicator, along with OFS employment for predicting oil prices. As is depicted in the U.S. Energy Information Administration chart in Fig. 2, the U.S. rig count has been trending upward steadily since the fall of 2020, which parallels the steady increase in O&G demand over the same period, which coincides with the easing of the Covid pandemic.

SMALLER, SELECT DEALS

The downstream impact on the OFS companies has been significant. With access to capital markets limiting the ability for large-scale mergers/acquisitions, the alternatives have included mid-sized mergers/acquisitions and selective divestitures, as well as outright asset sales to streamline operations and lower the overall cost to support Oil & Gas operations.

For example, while the fluids management business has seen much consolidation over the past five years, the total collapse of Basic Energy Services, once a market leader in fluids management, was a surprise to the market. The result was selling their business units to Select Energy Services, Berry Petroleum, and Ranger Energy Services during the fall of 2021.

Select continued its expansion efforts by acquiring Complete Select Energy Services from Superior Energy Services in July 2021 (Superior will retain certain non-core and non-water-related assets as part of the transaction) and announced an agreement to merge with Nuverra Environmental Solutions, an extensive fluids management and logistics company, in December 2021 as well as acquiring ULTRecovery for an undisclosed amount. The ULTRecovery acquisition expands Select Energy’s chemical solutions through a patented platform of novel biotechnologies designed to uplift production decline curves and increases recoverable reserves.

Ranger’s considerable activity. Along with the Basic Energy asset acquisition, Ranger Energy Services acquired perforating and wireline company, PerfX Wireline Services, for an undisclosed amount. Including the Patriot Completion Solutions acquisition in May 2021, but not counting the Basic Energy asset acquisition, Ranger has added 55 wireline trucks, 10 cranes, and four pump-down pumps to Ranger’s existing Mallard fleet of 13 wireline trucks and eight pumps. Additionally, these acquisitions bring eight locations and 27 incremental customers, as well as full packages of other ancillary equipment into the Ranger fold.

A wide variety of deals. What is noteworthy about the M&A activity within the OFS industry segment during the second half of 2021 is not just the volume of deals but the fact that the deals are spread across all stages of the lifecycle of a well (planning, drilling, completions, production and shutting in) relatively equally. Also, just like during the first half of 2021, there was a total lack of “mega mergers,” such as Technip and FMC, or Halliburton trying to merge with Baker Hughes that occurred during prior recoveries. Instead, there was a high volume of “tuck in” acquisitions, service line expansions, and divestitures of non-core businesses.

The second half of 2021 started with a frenzy of deals, led by Patterson-UTI, a large OFS supplier, which purchased Pioneer Energy Services. Patterson added 16 super-spec drilling rigs (increasing its current U.S. fleet to 166), 123 high-spec workover rigs, 8 Colombia rigs, 90 wireline units, and other related assets to its rig services line, while almost immediately selling the workover rigs and wireline service lines to Clearwell Dynamics. These transactions allowed Patterson-UTI to strengthen its rig business without stretching into the wireline and workover rig businesses.

Also, Wyreline Transformation purchased 11 trucks, eight offshore wireline skids, and other assets from an undisclosed seller, while ChampionX acquired Scientific Aviation for an undisclosed amount. Scientific Aviation is an airborne research company specializing in emissions detection and quantification of greenhouse gases & trace gas measurements for air quality. ChampionX also acquired Group 2 Technologies (a provider of extended-release chemistries) and Tomson Technologies (a commercial research laboratory).

INTERNATIONAL DEALS

The M&A activity was not limited to North America, however, as Tatneft (Russia) acquired TNG ALGIS from TNG Group (Russia), which provides geological and production services to the Russian O&G industry, and Altrad (France) agreed to acquire Valmec (Australia) for an undisclosed amount. Valmec provides services and solutions (e.g., specialized packaged equipment, construction, maintenance, commissioning, and integrity maintenance) to the Australian O&G industry.

Elsewhere, Iceland Drilling Company (Iceland) acquired the assets formerly owned by Ridge Energy Services (a provider of spacer services) through a bankruptcy sale for an undisclosed amount. In addition, Jindal Drilling (India) acquired an offshore jackup rig from Venus Drilling, while Techmar (Singapore) acquired a majority stake in Global 1 IRM, a provider of technical services to offshore service companies. Meanwhile, ADES (United Arab Emirates) acquired four jackup rigs from Noble. The four jackups are located in Saudi Arabia, with drilling depths of 30,000 ft and water depths of 400 ft.

One particularly active segment during the second half of 2021 was the frac business. For example, Profrac acquired FTSI and their 28 frac fleets, while NexTier acquired 100% of the ownership interests of Alamo Pressure Pumping. The Alamo assets included nine hydraulic fracturing fleets, consisting primarily of CAT Tier IV dual-fuel equipment. Post-acquisition, NexTier will operate 46 hydraulic fracturing fleets comprised of 2.5 million hp, primarily fueled by low-emission natural gas. Finally, Liberty Oilfield Services acquired PropX, which provides last-mile proppant delivery solutions, including proppant handling equipment and logistics software to the O&G industry.

ADDITIONAL TRENDS

The flurry of M&A activity seems to signal that the financially strongest OFS companies are strengthening their positions by buying physical assets (tools, rigs, etc.), revenues, and employees either on a geographic or service line basis. Buying complementary service lines can fortify overall customer positions by increasing market share by well site, or customer “walletshare” by region or well site.

The trend of Private Equity firms combining portfolio companies or making acquisitions for portfolio companies diminishes the need for private equity-backed OFS companies to access the financial markets for expansion purposes directly. At the same time, the opportunity is also there for companies to shed assets/service lines that may no longer be strategic to a given OFS company, and that firm can use the divestitures to strengthen its balance sheet and overall financial picture.

More evidence of these trends includes the news that in September 2021, an undisclosed buyer acquired conventional fracturing assets from U.S. Well Services, which provides a diesel-powered hydraulic fracturing fleet that serves in the Appalachian, Eagle Ford, and Permian plays, while Water Energy Services (Charlotte, Texas) agreed to acquire the fluid management and saltwater disposal well assets from Key Energy Services. This divestment completes Key Energy Services’ exit from this line of business in Texas and New Mexico and includes 32 SWDs, frac tanks, transport vehicles, and other equipment. Meanwhile, SPL (Houston, Texas) acquired Assured Flow Solutions to help grow the combined company’s mix of laboratory, engineering, and technology services to the oil & gas industry.

M&A activity also flourished in Canada, as Graham Construction (Canada) agreed to acquire the oil and gas maintenance & turnaround services business from AECOM. In addition, Surepoint Technologies Group (Canada) acquired Ironline Compression, while TerraVest (Canada) acquired an additional interest in Green Energy Services, which provides water management and environmental solutions to the O&G industry. CWC Energy Services (Canada) agreed to acquire ten high-spec triple drilling rigs from an undisclosed seller.

LOOKING AHEAD

In the end, what does all this M&A activity tell us about the current and future state of the OFS business? From my perspective, the M&A activity shows that the OFS companies are reformulating themselves to best compete in a consolidating OFS market. Fortifying strengths is always a good strategy, and acquiring companies and assets that further that effort is, generally, a net positive. At the same time, divesting assets/service lines that are not strategic to a given company is also a positive strategy (addition by subtraction) in this market, as “lean and mean” has proven to be a great way to compete in this challenging period in the Oil & Gas industry.

Lean corresponds to agile, and in this period of constant change, the most agile companies are likely to be the biggest winners. More M&A activity is expected throughout 2022 within the OFS space as the market continues to consolidate during the balance of the current recovery. Mega-mergers will likely remain difficult to execute, but strategic acquisitions and divestitures will continue to drive profitability and growth for OFS companies through 2022.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)