|

| North Atlantic Drilling’s West Phoenix harsh-environment semisubmersible (left) has been drilling production wells at Total’s development of Loggan and Tormore gas/condensate fields in the Southern North Sea (photo courtesy of North Atlantic Drilling). At ConocoPhillips’ Britannia complex (center), output from the Britannia satellites, Brodgar and Callinash, began in 2008. Work continues on a new mono-column design compression facility for the Britannia platform. When it comes online this year, it will increase Britannia’s gas production by 90 MMcfd (photo courtesy of ConocoPhillips). Dana Petroleum’s Triton FPSO, in the Central North Sea, produces oil and gas from Bittern, Clapham, Pict, Saxon, Guillemot West and North West fields, about 120 mi east of Aberdeen (photo courtesy of Dana Petroleum). |

|

Since the first UK licenses were issued in 1964, 42 Bbbl of oil have been produced from the British North Sea, and it is estimated that there could be up to 24 Bbbl remaining. Since the production peak in 2009, output has declined steadily, due in part to increasing basin maturity, lower drilling activity levels and a changing fiscal regime. However, the recent introduction of tax breaks for brownfield projects, small fields and HPHT fields, to name a few, could spark renewed activity on the UK Continental Shelf (UKCS).

RECENT UKCS ACTIVITY

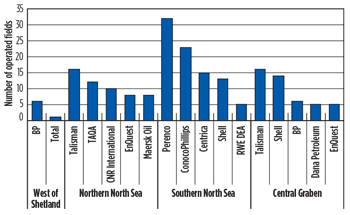

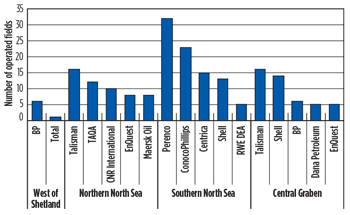

During first-quarter 2014, only one condensate field was approved for development offshore. Although two gas fields went onstream during the first quarter, this is still a considerable drop from an average of five field developments per quarter in 2012. Similarly, in 2013, 10 new fields were granted approval by the Department of Energy & Climate Change (DECC), and 26 incremental projects were sanctioned. This compares to 29 new projects approved during 2012, including 21 new fields and eight incremental fields. A chart shows the total number of fields operated in each UK offshore sector, Fig. 1.

|

| Fig. 1. Significant operators in each UK basin, and their numbers of developed fields. |

|

During first-quarter 2014, 12 exploration and appraisal wells were spudded on the UKCS. This represents an 8% decrease from first-quarter 2013, when 13 wells were drilled. During 2012, the average number of wells spudded per quarter was 16.

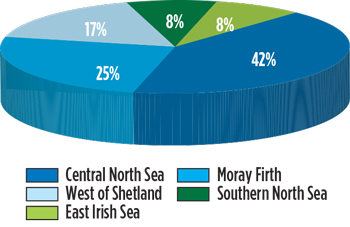

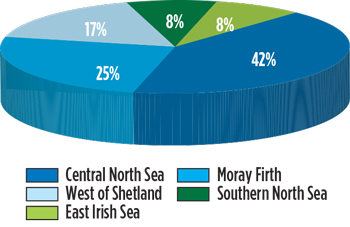

Among the 12 exploration and appraisal wells spudded on the UKCS during the first quarter, five are in the Central North Sea, three in the Moray Firth, two are West of Shetland, and one is in both the Southern North Sea and the East Irish Sea, Fig. 2. The final quarter of 2013 showed a different allocation of well spuds, with three wells drilled in the Northern North Sea, three wells drilled in the Moray Firth and one well drilled West of Shetland.

|

| Fig. 2. Distribution of UK offshore wells drilled, by basin, during first-quarter 2014. |

|

Of the 12 wells spudded during first-quarter 2014, nine were exploration wells and the remaining three were appraisals. Drilling activity during fourth-quarter 2013 was skewed toward appraisal activity, with only one well out of the seven being a wildcat. Despite picking up by the end of 2012, following the low activity numbers seen in 2011, the exploration and appraisal wells spudded during 2013 were down to 47, following a total of 65 in 2012.

NORTH SEA CHALLENGES

The UKCS is a mature province, and the opportunities for big finds are declining, while the geological complexity of new and existing plays increases. According to Oil and Gas UK’s Activity Survey 2014, the number of boe’s in production, under development or being considered for investment, with a >P50 confidence level, has declined from 9.9 Bboe last year to 9.4 Bboe this year. This decrease was attributed to “the struggle to increase recovery from existing fields, the difficulty in commercializing new discoveries, and poor exploration success in recent years.”

The introduction of new field allowances in recent years has allowed investment in areas previously left high and dry by high tax rates. Tax breaks have been introduced for projects West of Shetland, brownfield projects, small fields, deep and shallow gas, and HPHT fields, allowing a portion of a company’s profits to be exempt from taxation, and encouraging development of new technology to exploit difficult plays.

Although the UK fiscal regime is still thought to be complex, with the recently introduced Bare Boat charter set to complicate matters, it is predicted by Oil and Gas UK that activity will improve in 2014, including an increase in production, due to a combination of 25 new field startups over the next two years and existing fields coming back onstream. According to Oil and Gas UK’s Activity Survey 2014, 80% of operators predict that production will increase in 2014.

The North Sea is one of the world’s most expensive offshore provinces. Operating costs continue to rise—it is now almost five times more expensive to extract a barrel of oil than it was in 2001. Among other limiting factors, oil companies list the upkeep of aging equipment; the exploitation of more complex, smaller fields; weather conditions; and high rig rates.

During 2013, two major North Sea projects were postponed, due to rising operating costs. These included the development of Statoil’s Bressay heavy oil field, estimated to contain between 200 MMbbl and 300 MMbbl of recoverable oil, with development costs of $7 billion, as well as Chevron’s Rosebank project.

Although the UK is predominantly a mature oil and gas province, it still presents a number of opportunities and challenges for E&P companies. The Wood Review, published in February 2014, aimed at maximizing economic recovery for the UK, highlights the importance of cluster developments to make projects more viable; government and industry working together; the need for a more proactive and influential independent regulator; and the shift to a more holistic approach, with industry participating and collaborating fully.

SOUTHERN NORTH SEA

The Southern North Sea comprises more than 300 gas fields and 75 Tcf of recoverable gas. The principle source of gas in the Southern North Sea is folded and faulted Carboniferous strata below the regional base Permian unconformity, which underlies the Lower Permian sandstones.

Key operators. Perenco operates 32 fields in the Southern North Sea, followed by ConocoPhillips (23), Centrica (15) and Shell (13). Other active operators in the area are RWE DEA, Tullow Oil, E.ON, GDF Suez, Alpha Petroleum, Bridge Energy, Eni, Ithaca Energy and Wintershall. Perenco became a major player in the Southern North Sea, following acquisition of BP’s gas fields between 2003 and 2012, and operates five compression hubs, allowing it to transport third-party gas, as well as its own. ConocoPhillips operates the Caister Murdoch System (CMS), consisting of the Murdoch complex, the Caister satellite platform and the gas trunk line to the Theddlethorpe gas terminal. The CMS acts as a hub for Caister, Boulton, CMS III, Katy, Kelvin, Munro and Murdoch fields, and also provides third-party transportation.

West Sole Stream. Located approximately 65 km east-northeast of the Dimlington gas terminal, the West Sole Stream includes West Sole, Hyde, Hoton and Newsham fields, and is a major production hub in the Southern North Sea. The West Sole stream is operated by Perenco, which transports its own and third-party gas through its Dimlington terminal. West Sole field is the first commercial discovery made on the UKCS in 1965. It produced first gas in 1968, and like most of the producing gas fields around it, exploits a Leman Permian sandstone reservoir. Initial reserves were quoted as 1.133 Tcf, and remaining reserves are estimated, as of Jan. 1, 2013, to be 109.6 Bcf. Babbage, Hyde and Hoton fields, among others, tie back to West Sole.

Breagh. Sitting 100 km north-northwest of the West Sole stream, Breagh gas field was discovered in 1997, and development was approved in July 2011. First gas was achieved in October 2013. The field is operated by RWE DEA (70%) with partner Sterling Resources UK (30%). The field represents the first UK offshore development of the Carboniferous Yoredale formation, and potentially a new play in the Southern North Sea.

The reservoir is contained within a four-way dip closure under the Permian Zechstein formation. Field reserves are estimated at 19.8 Bcm, with the three first wells brought into production at an initial flowrate of 2.75 MMcmgd.

The first phase of production, during which an annual volume of 1.1 Bcm is predicted, will run from 2014 to 2018, by means of seven wells to the Breagh A platform (Fig. 3) on the field’s west side. The gas from Breagh field flows to Coatham Sands near Teesside, from which it continues to the gas treatment facility in Teeside. Phase 2 of the Breagh development will add a new platform, Breagh Bravo, and wells tied in on the east of the field.

|

| Fig. 3. The first phase of production at RWE DEA’s Breagh field is scheduled to run from 2014 to 2018, flowing from seven wells to the Breagh A platform (photo courtesy of RWE DEA). |

|

Major developments. As stated in Deloitte’s Year End Review for North West Europe, six new developments were reported in the Southern North Sea. Projects listed for future development in the area include RWE DEA-operated Crosgan and Kepler, the Dana Petroleum-operated Platypus, Pharos and 47/10-8 discoveries, the Apache-operated Olympus discovery, and the GDF-Suez-operated Cygnus project. The area, once thought to be mature, has seen an influx of activity, due to the shallow, sometimes small nature of its gas fields. Large shallow-water gas fields qualify for relief of up to £500 million, when reserves of the field and any related field total 20 Bcm or less. Small gas fields also qualify for relief, depending on the size of the field.

Platypus. Located 18 km northwest of the West Sole facilities, the Platypus gas accumulation was discovered in 2010 by Dana Petroleum. The field lies in shallow water, with good Permian reservoir quality. Parkmead indicates a best estimate of 103 Bcf of recoverable reserves. Dana and three partners are now looking to progress to field development, with a final Field Development Plan (FDP) to be submitted during 2014.

Given the prosperous nature of this area, and the potential eligibility of accumulations developed for small field and shallow-water allowances, operators are actively seeking to develop field clusters. Dana seeks to develop the Platypus discovery jointly with the Possum, Pharos and Blackadder gas prospects and the 47/10-8 discovery, which are interpreted as all being part of a consistent structure, on strike with West Sole field.

CENTRAL NORTH SEA

The Central North Sea is an area where operators are challenged technically, due to the HPHT prospects and developments. In some areas, ultra-HPHT developments often combine the challenges of complex structural setting and relatively poor seismic imaging, as a result of deep depth and destructive multiple interference from shallower horizons. Completion designs are also complex for HPHT field wells, and a number of projects have experienced failures as a result of technical issues, in particular with downhole equipment. An example is the ConocoPhillips-operated Jasmine HPHT field wells, and a number of projects have experienced failures as a result of technical issues, in particular with downhole equipment. An example is the ConocoPhillips-operated Jasmine HPHT field, which was discovered in 2006 and, at the time, represented a significant find in the mature Central North Sea.

Most recently, in the UK Budget 2014, the government announced that consultation had begun on a new field allowance for ultra-HPHT clusters. The measures are intended to boost investment in ultra-HPHT fields, by providing an allowance to exempt a portion of a company’s profits from the supplementary charge. The amount of profit exempt will equal at least 62.5% of qualifying capital expenditure that a company incurs on these projects. This measure is extremely important for the commercialization of technically challenging prospects in the region. The allowance has been described by Oil and Gas UK as having “the potential to attract £5–6 billion of investment in the near term, if it is pitched at the appropriate rate.”

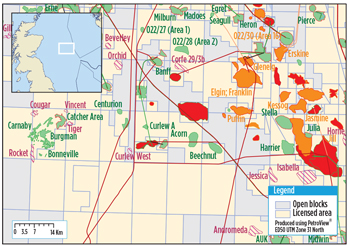

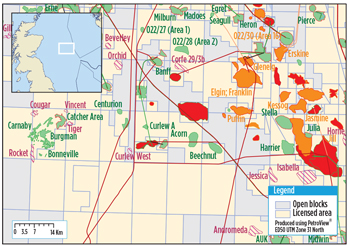

Greater Stella Area. The Ithaca-operated Greater Stella Area (GSA) is in the core of the Central Graben area of the Central North Sea, approximately 240 km southwest of Peterhead and 17 km from the UK/Norway median line, Fig. 4. It is an area surrounded by numerous, large producing fields and undeveloped discoveries, with major companies, including Total, Shell, ConocoPhillips, BP and Talisman, all operating infrastructure.

|

| Fig. 4. Map showing the Greater Stella Area and Catcher Area within the Central North Sea. |

|

The GSA contains Stella and Harrier fields, currently being developed, plus the Hurricane discovery and Twister prospect, which were awarded in the 27th UK Offshore Licensing Round in early 2013. The JV has identified Twister as a target in Block 29/5e, analogous to the appraised Hurricane Rogaland sand interval. The GSA is driven by monetization of over 30 MMboe of net 2P reserves and delivering a forecast of approximately 16,000 boed of net, initial annual production. There is also the potential of additional value via opportunities provided by undeveloped discoveries surrounding the GSA hub.

Stella was discovered by Shell’s 30/6-2 exploration well in 1979. Subsequent well 30/6-3 and sidetrack 30/6-3Z were drilled from 1983 to 1984, and discovered oil. A drillstem test flowed 2,750 bopd and 23 MMcfgd from the Andrew sandstone. Harrier was discovered in 2003 by Maersk with the 30/6-4X exploration well. Three sidetracks were drilled to appraise, core and test the reservoirs on the Harrier structure. Oil at Stella and Harrier is found within two main reservoirs—Andrew and Ekofisk. Andrew is the primary reservoir, a sandstone formation of Paleocene age containing light oil and rich gas condensate, whereas Ekofisk is a chalk reservoir containing a volatile oil.

The joint development plan for the fields was approved by DECC in April 2012. Ithaca’s original development plan for Stella and Harrier entailed the drilling of seven development wells (five on Stella and two on Harrier) and the installation of associated subsea wellheads, manifolds, intra-field pipelines, and the tie-back of facilities to a Floating Production Facility (FPF), called “FPF-1.” Hydrocarbons will be exported via a 10-in., 60-km gas export pipeline to the CATS pipeline. Production is due to start in 2016.

Catcher Area. Another area of significance in the Central North Sea is the Catcher Area, situated approximately 86 km west of the GSA, Fig. 4. Premier Oil gained its initial interest in the area by acquiring Oilexco in 2009. The Catcher discovery was made in 2010 by exploration well 28/9-1. Premier subsequently increased its stake to 50% and assumed operatorship in January 2012. A number of follow-up wells have discovered further hydrocarbon reservoirs in the area. Varadero, Burgman, Carnaby and, most recently in April 2013, Bonneville, have all been discovered close to the Catcher discovery, amounting to 2P reserves of 96 MMboe.

The Catcher Area development concept was agreed in December 2012, and final governmental sanction of the project was expected during second-quarter 2014. All of the fields will be subsea tie-backs to the Catcher FPSO. Continuous development drilling of 14 producers and eight water injectors will commence in 2015. First oil is scheduled for 2017, with production expected to peak at 50,000 bopd. The newbuild FPSO will have a processing capacity of 60,000 bopd and storage capacity of 650,000 bbl. Capital expenditure for the development is estimated at $2.2 billion, including 30% for allowances and contingencies. Catcher will account for approximately 6% of all UKCS output and create a new production hub in the Central North Sea.

NORTHERN NORTH SEA

The Northern North Sea includes the East Shetland basin, Beryl Embayment, Viking Graben and the East Shetland platform. According to an Oil and Gas UK report, 21% of overall reserves sanctioned in 2012 were in the Northern North Sea, which included the approval of Mariner, a large heavy oil field development. According to the same report, the Northern North Sea has 13 new potential developments that have varying probabilities of coming to fruition. The Northern North Sea is second only to the Central North Sea in exploration and appraisal drilling activity. The Northern North Sea accounted for 18% of drilling in 2012, compared to the Central North Sea’s 61% share.

Production hubs. The Northern North Sea is predominantly an oil basin and is one of the most concentrated regions for infrastructure. The vast majority of facilities are fixed, large steel platforms and concrete gravity-based platforms. The concentration of quality major developments in the Northern North Sea tracks the long presence of super-majors, such as BP, Shell and Total, and major independents, such as Marathon Oil, EnQuest, Dana and TAQA. The Northern North Sea also stands out as the most expensive region on the UKCS, conducive to operators with large capital plans. The presence of large cap players and a well-connected network of pipelines and infrastructure has encouraged new entrants into the region, which has boosted activity by attracting third-party businesses and additional proven barrels previously considered uneconomical.

Four fields were approved for development, and three fields started producing during 2012. In 2013, six wells were spudded in the Northern North Sea region. During 2013, two fields were approved for development and brought onstream.

Alwyn hub. The Total-operated Alwyn North field was discovered in October 1975 and began producing in 1987. Alwyn North consists of a four-legged steel platform and an eight-legged, large steel platform, respectively NA-A and NA-B, linked by a 73-m steel bridge. NA-A is the drilling and accommodation platform, whereas NA-B houses the processing facilities. The NA-A wellhead area comprises up to 40 well slots with 26 pre-drilled wells. The processing platform, NA-B, acts as a support center for a number of neighboring fields: Alwyn, Dunbar, Ellon, Grant, Nuggets, Forvie and Jura. The processed oil and gas are exported via Cormorant Alpha and the Brent pipeline system to the Sullom Voe oil terminal in the West of Shetland. Gas is transported to the Total-operated St. Fergus terminal.

The Alwyn area hub has processed and produced over 1 Bboe. The focus on asset integrity in the area has particularly rejuvenated investment in new technologies, to ensure that the hub can facilitate development of new discoveries in the area. The Alwyn hub should continue playing a major role in the area and remain a vital hub to attract more activity to the region.

Other key hubs–Brae area. The Marathon-operated Brae area is a strategically positioned hub for activity in the Northern North Sea. Marathon has operated the hub for more than 30 years and has significantly supported development in the area. More than 30 third-party businesses rely on the Brae area hub for production, transportation and processing of hydrocarbons. The long-standing hub has provided stand-alone marginal projects with a feasible economic option.

The Brae area consists of three large steel platforms: Brae Alpha, Brae Bravo and East Brae, all connected by an intra-field pipeline network. The Brae infrastructure offers transportation of third-party liquids via the Brae-Forties pipeline. Of the total throughput processed and transported from the Brae infrastructure, two-thirds are from third parties.

Brent area. Shell’s (50%) Brent field was discovered in 1971, and BP holds the other 50%. There are four large, concrete gravity-based platforms on Brent field—Alpha, Bravo, Charlie and Delta. The Brent hub has produced oil and gas since 1975. Shell identified decommissioning requirements for the field in 2006.

Major developments–Cladhan. In the Northern North Sea, Cladhan field is approximately 100 km northeast of the Shetland Islands, in water depths of about 500 ft. The field lies 20 km southwest of Tern field, straddling Blocks 210/29a and 210/30a. The field’s development plan was approved by the DECC in April 2013. The initial development phase consists of two producers and one injection well. Cladhan is expected to produce over 17,000 boed initially, with first oil expected in first-quarter 2015.

Production will be tied back to TAQA’s Tern Alpha platform (Fig. 5), 17 km northeast of Cladhan, then routed to Sullom Voe terminal through the Brent oil line. Tern Alpha platform is a fixed installation serving the manned drilling and production installation for Tern. The Tern platform also serves Hudson and Kestrel fields. The Cladhan tie-back to Tern is another example of the Northern North Sea’s continuing investment in operated infrastructure, to support marginal projects and maximize the basin’s recovery.

|

| Fig. 5. Production from the Cladhan field development will be tied back to TAQA’s Tern Alpha platform (photo courtesy of TAQA). |

|

The Cladhan discovery well confirmed a 110-ft light oil column. Further appraisal on the southward extension made a commercial discovery, Cladhan South. The operators expect to continue with a potential appraisal program on the field.

Kinnoull. A £1.1-billion investment is being made to develop 45 MMboe of reserves in the Andrew development, which consists of three reservoirs, the largest of which is Kinnoull. Development at Kinnoull will include three subsea wells drilled as a single cluster. The development will also include installation of a 220-tonne riser caisson on the platform, as well as strengthening of the decks and associated tie-ins. It will be tied back to the Andrew platform via a 28-km pipeline. As part of the project, the partners installed a dedicated subsea system on the Andrew platform to handle production from Kinnoull and to facilitate output from the Lower Cretaceous reservoir below the Andrew reservoir. Oil will be separated at the Andrew facilities, before being exported to the Forties Pipeline System. Gas will be exported through the CATS system.

WEST OF SHETLAND

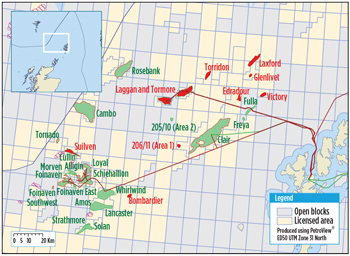

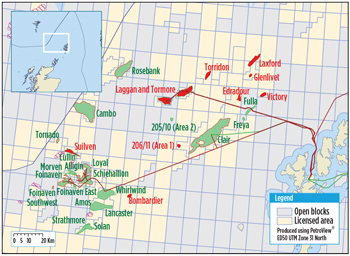

In the West of Shetland, there are two main production hubs, Clair Ridge and Schiehallion (Fig. 6), both are operated by BP and undergoing major redevelopment projects. Each hub has had to tackle the challenges of deepwater metocean conditions and the lack of infrastructure in the area. These challenges have resulted in high development costs compared to the North Sea, due to the specialist equipment required to drill in waters up to 1,000 m deep, and install new infrastructure.

|

| Fig. 6. The two main production hubs in the West of Shetland area are BP’s Clair and Schiehallion fields. |

|

In the 2012 budget, the UK government introduced the deepwater tax allowance for fields in water depths greater than

1,000 m and for gas fields that are over 60 km from infrastructure. This was introduced to encourage investment in the region, despite the challenges. FPSO developments have taken place in the West of Shetland, as well as the construction of new pipelines linking fields to the Sullom Voe terminal in the Shetland Isles. New cutting edge technology, plus the greater regional knowledge now available, have generated a rapidly improving success rate in finding new discoveries. Advanced seismic technology allows better imaging of reservoirs, even below the volcanic material common in the region.

BP operates all of the producing fields in the West of Shetland; however, DONG and Total are active, working on development projects. Ithaca drilled an exploration well at the start of the year on Handcross, and Hurricane spudded an exploration well on the Lancaster discovery. OMV has continued to expand its presence in the UK and has purchased four licenses from Hess, including Cambo and stakes in Schiehallion and Rosebank, for £30 million. There is significant interest and investment in the West of Shetland region, despite the challenges and high costs.

Clair. Production from Clair began in 2005, following installation of a platform, and associated oil and gas export facilities. A 105-km, oil export pipeline was installed, to link to Sullom Voe, and gas is exported via a 10-km spur line to the Magnus trunkline. Total first-phase investment was £650 million. The second phase of the Clair development, Claire Ridge, was approved in October 2011 to target the field’s northern portion. Two new bridge-linked platforms will be installed in 2015, and new pipeline infrastructure will be installed to connect to the processing facilities. This will expand capacity to produce a further 640 MMbbl of oil, due to come onstream in 2016/2017. It will require a total investment of £4.5 billion.

The second phase will allow Clair to become a hub for future expansion. A third-phase appraisal program is underway to develop the area to the east. If the $500-million appraisal program is successful, this will result in a third development phase.

Schiehallion and Loyal. Developed jointly, Schiehallion and Loyal are part of a cluster of producing fields, including Foinaven and Foinaven East, all operated by BP. Schiehallion and Loyal began production in May 2002 and have been developed with 29 subsea wells in four clusters—Schiehallion Central, Schiehallion West, Loyal and Schiehallion North. Oil flows through subsea pipelines and risers into an FPSO, and gas is exported via pipeline to Sullom Voe.

Schiehallion was discovered in the post-rift sandstones that are similar in age to the Forties sandstones in the North Sea, and has provided more confidence in the post-rift play. The thin, almost flat-lying reservoir formations were being drained by production wells in horizontal sections as long as 1.5 km. Non-horizontal wells injected water at other points in the reservoir, to move the hydrocarbons toward the producing wells and maintain reservoir pressure. However, the fields are now shut-in for redevelopment. Forty-nine new production and water injection wells will be drilled in phases, and a new FPSO will be deployed to handle expanding output. The total redevelopment cost is estimated at £3 billion, and first oil is expected in 2015.

Additionally, the Handcross prospect, drilled by Ithaca in December 2013, could, potentially, be tied back to the Schiehallion grouped development. Cambo, drilled by Hess with the Stena Carron deepwater drillship and now operated by OMV, may be developed as a hub, with the prospect of linking to OMV’s Tornado and BP’s Suilven discoveries.

Other projects. Total is developing its Laggan and Tormore fields, which includes construction of gas gathering infrastructure on the fields, as well as a new gas processing plant at Sullom Voe. Together with two proposed 143-km pipelines, this development is estimated to cost £3.3 billion and will benefit from the deepwater gas field allowance.

Investment in this development will allow further exploration and development in the West of Shetland basin, since it will act as a hub for future expansion. For example, DONG is assessing the potential development of a smaller discovery, Glenlivet, as a tie-back to the Laggan and Tormore export pipeline. The field could become a significant part of the new gas gathering system being installed as part of the Laggan/Tormore development, as it is only 15 km from the gas export pipeline. The license contains another discovery, Laxford, and a number of further potential exploration targets. Some of these additional opportunities may have the potential to be commercialized through the Laggan/Tormore system.

CONCLUSIONS

The UKCS is truly a diverse oil and gas province, with both opportunities and challenges across its key basins. There still remains significant potential to unlock additional reserves, production and value in the UKCS. Opportunities include the revival of the Southern North Sea with recent interest and key gas developments; development of HPHT fields in the Central North Sea, the continuing investment in Northern North Sea infrastructure for new tie-ins, and the potential that lies in major redevelopments off the West of Shetland.

|