|

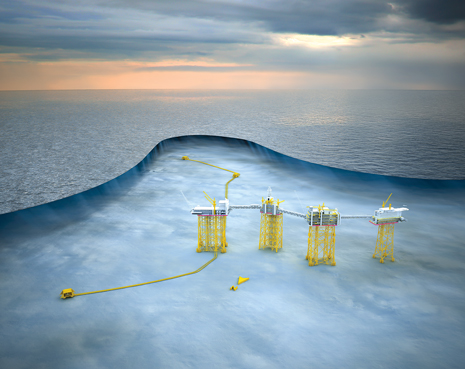

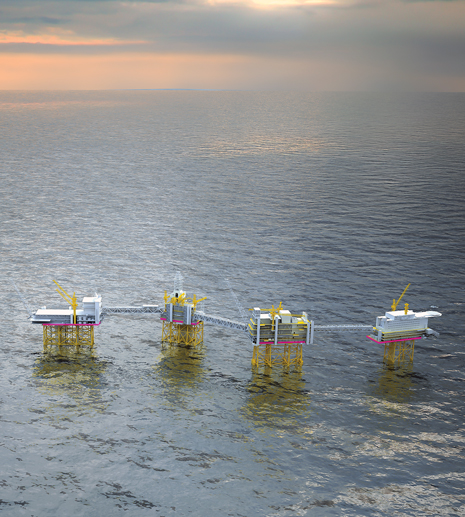

| Phase one of development of Statoil’s Johan Sverdrup oil field will utilize four platforms. This field is the fifth-largest discovery made in the history of the North Sea (image courtesy of Statoil). |

|

These are flush times in Norway’s upstream oil and gas industry. Activity is at record or near-record highs in most categories. Exploration success has been good, yielding a healthy collection of discoveries. Never has there been a more expansive, technologically sophisticated list of development and production enhancement projects underway. By all appearances, the health of the Norwegian Continental Shelf (NCS) couldn’t be better.

Yet, there are concerns that this prosperous market’s future could be jeopardized by one common factor: cost. Governmental officials and company executives all worry that costs for just about everything are high, particularly for drilling. The good news is that government and the industry already have begun to work together, to find ways to contain costs.

BASIC OPERATING DATA

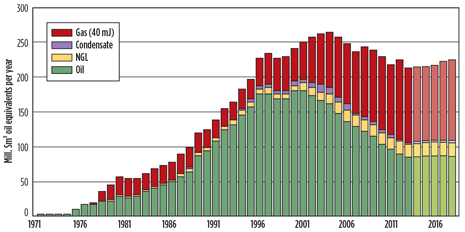

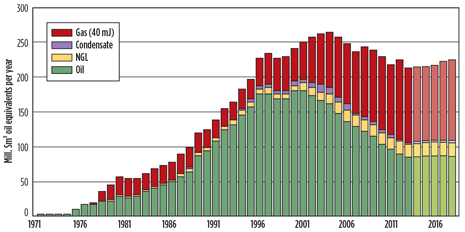

According to the Norwegian Petroleum Directorate (NPD), Norway’s crude production declined 4.8% during 2013, averaging 1.464 MMbpd. Condensate output was 12.6% lower, at 68,483 bpd. Gas production was 5.2% less, averaging 10.52 Bcfd, while NGL output slipped 0.5%, to 304,762 bpd., Fig. 1.

|

| Fig. 1. As Norwegian oil production has declined, and gas output has increased or remained level, the split between the hydrocarbons, in terms of boe’s, has become nearly even. |

|

Drilling totaled a near-record 225 wells (59 exploration, 166 development) last year, along with 2.6 MMft of hole. Forty-four exploration wells were wildcats. The forecast, this year, is for a nearly identical performance. Indeed, at mid-year, exploration wells already totaled 33.

Twenty new discoveries were made in 45 exploration wells. In all, 717 MMboe of new reserves were added. At the end of 2013, said NPD, Norway’s “remaining” reserves included 5.25 Bbbl of oil, 72.4 Tcf of natural gas, 252.2 MMbbl of condensate and 1.34 Bbbl of NGLs. These figures are exclusive of so-called “contingent” resources and the potential from improved recovery, which would add another estimated 7.4 Bbbl of oil, 21.4 Tcf of gas, 400 MMbbl of condensate and 375 MMbbl of NGLs.

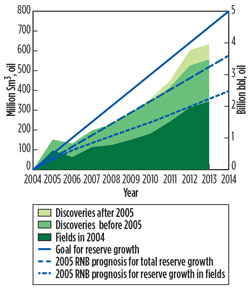

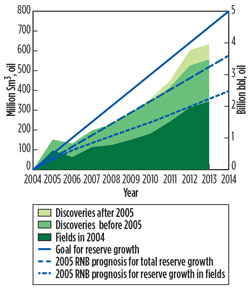

“The exploration situation has turned around since the mid-2000s, when there was a drop in effort,” said NPD Director General Bente Nyland, Fig. 2. “The number of companies present has increased. We are replacing some of the oil production with gas now, so that the split in total boe’s is about half-and-half. The last few years, we’ve had several good discoveries—they will stop the decline in oil production, Fig. 3. Next year, we will have 50 years of activity offshore Norway, with 78 fields in production.”

|

| Fig. 2. NPD Director General Bente Nyland has seen an improvement in Norwegian exploration efforts since the mid-2000s. |

|

|

| Fig. 3. Due to good exploration results in recent years, the decline in oil production should be halted (chart courtesy of Norsk Olje & Gass). |

|

FINANCIAL/REGULATORY

Exclusive of exploration costs, total NCS investment for approved and decided expenditures on fields, discoveries, pipelines and onshore plants was a record NOK 171 billion ($27.9 billion). In addition, another NOK 2 billion ($326.2 million) were spent on planning and initial design for projects not yet approved or decided. This year, NPD forecasts at least NOK 166 billion ($27.1 billion) will be spent on approved projects, with another NOK 10 billion ($1.6 billion) to be spent on projects not yet decided or approved.

Investment levels are just one side of the financial picture. “In some ways, we actually see two trends,” said Erling Kvadsheim, director of Environmental and Industrial Policy at trade association Norsk Olje & Gass (NOG). “Oil production has fallen dramatically since 2000, to 50% of that level, but investment levels are at a record high.” Of course, the need for greater investment, just to keep output level, much less grow it, means that costs for equipment and services have skyrocketed.

“Yes, the authorities are very concerned,” continued Kvadsheim. “There is a big debate over cost elements, particularly for drilling.” NPD’s Nyland agrees: “The biggest challenge is the cost factor, and that is a problem, because companies’ margins are shrinking. The costs of services have risen, and steel prices have increased. The industry needs to look into this—how can we use standardized solutions? I think that we and NOG pretty much agree on that.”

Kvadsheim said that NOG is trying to come to grips with these costs. “We are trying to look within the companies and see what might be the problem. Maybe it’s a case of how work is organized. Here is another thought—we’ve come so far in worrying about meeting HSE regulations and internal company regulations, that the sum of it all has become too much. The ‘better and cheaper’ part has been missed, in an effort to meet the HSE requirements.”

Some additional factors contribute to the cost problem, continued Kvadsheim. “We’re spending too much time before the bit starts drilling, and we’re also suffering from limited rig capacities in Norway. And yes, the ‘2-4’ work agreement (which specifies that field personnel work two weeks offshore and then spend four weeks off the job) is a factor, even though it doesn’t apply to everyone. It affects mostly the operators, large drilling contractors and large service/supply companies.”

NOG’s perspective is shared by some of the larger service/supply firms. “The 2-4 work rule is certainly contributing to the cost situation by the slow learning curve for new hires,” said Schlumberger Norway Chairman Torjer Halle. “And what I call the ‘Dark Side’ of the NCS is the big drop in drilling efficiency that we’ve seen over the last 10 years, whereby the amount of footage drilled per well, per day, has been declining.” Per Harald Kongelf, regional head for Norway at Aker Solutions, said that he is concerned about cost but optimistic that the industry can solve the problem. “To me, it’s much more about increasing efficiency, and also improving the quality and reliability of equipment and services,” said Kongelf. “We have to take the opportunity to make our industry more efficient and ensure proper returns.”

Meanwhile, the Ministry of Petroleum & Energy and NPD continue to provide oversight, including two different types of licensing rounds this year. As part of the numbered rounds that grant new acreage in open areas, the 23rd Round is in process. The latest version of the other license type, Awards in Predefined Areas, has a deadline for nominations in September (see the sidebar interview with Petroleum & Energy Minister Tord Lien).

Norway’s government and the opposition majority in parliament reached a compromise to delay electrification of three North Sea oil fields in the Utsira High area until 2022. This reduces the risk of further delays in starting the Johan Sverdrup oil development. The opposition majority, in May, had demanded that operator Statoil include three more fields in its shore-based power plan for Sverdrup, as part of efforts to cut greenhouse gas emissions.

Accordingly, Statoil would have had to start laying cables to the other fields during Sverdrup’s start-up phase, which, the operator said, would delay the 2019 output start and lead to losses as high as $3.3 billion. Statoil said the compromise means full electrification will not happen until the second phase starts sometime in 2022.

OPERATOR ACTIVITY

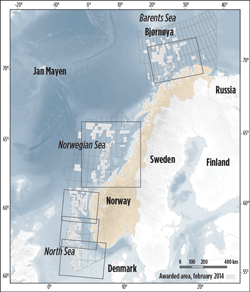

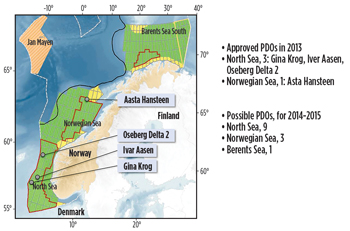

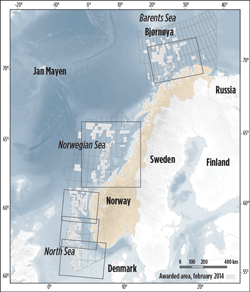

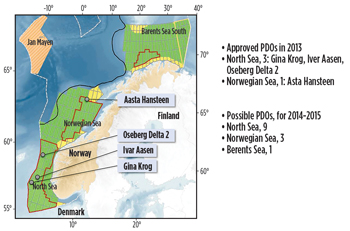

There were 77 fields onstream at the end of 2013, including 60 in the North Sea, 16 in the Norwegian Sea and one in the Barents Sea, Fig. 4. During 2013, production started from Jette field in the North Sea and Hyme, Skarv and Skuld fields in the Norwegian Sea. “Within the next couple of years, we expect 13 development projects,” said NPD’s Nyland, Fig. 5.

|

| Fig. 4. Activity on the NCS is split between the North Sea, Norwegian Sea and Barents Sea (map courtesy of Norwegian Petroleum Directorate). |

|

|

| Fig. 5. During the next two years, NPD’s Nyland expects up to 13 additional field development projects to be sanctioned (map courtesy of Norsk Olje & Gass). |

|

The Norwegian government continues to maintain large holdings in NCS licenses through the State’s Direct Financial Interest (SDFI). After its partial privatization in 2001, Statoil transferred administration of the SDFI holdings to a new state company, Petoro. “We only have 65 employees, and we don’t sell oil and gas, but Petoro is partner in 189 licenses, and we produce around 1 MMboed from shares in 34 fields,” said Sveinung Sletten, Petoro’s head of communications. “Our sole commercial goal is to maximize the value of the SDFI portfolio.”

Statoil. The world’s largest offshore operator is Statoil. “We operate 44 developed fields and 80% of NCS production,” said Rannfrid Skjervold, Statoil’s senior V.P. for Strategy & Portfolio, Fig. 6. “Our NCS equity production during 2012 was 1.33 MMboed. Roughly 50% of our resource base is in Norway, as is 70% of production.”

|

| Fig. 6. Statoil Senior V.P. for Strategy and Portfolio Rannfrid Skjervold says that as the world’s largest offshore operator, her company is working to perfect an “offshore manufacturing process,” to fast-track projects (photo by Kjetil Alsvik, Statoil ASA). |

|

Statoil has six major new developments underway or soon to begin: Johan Sverdrup, Johan Castberg, Aasta Hansteen, Gina Krog, Gudrun and Valemon. The largest of these is Johan Sverdrup, found in 2010 in the North Sea, and estimated to be the fifth-largest discovery in NCS history. With reserves of 1.8 Bbbl to 2.9 Bbbl of oil, Sverdrup should produce for 50 years, with plateau output at 550,000 to 650,000 boed. At peak output, Sverdrup will account for 25% of all NCS oil production. A “plan for development and operation” (PDO) should be ready for regulatory approval within the next 12 months.

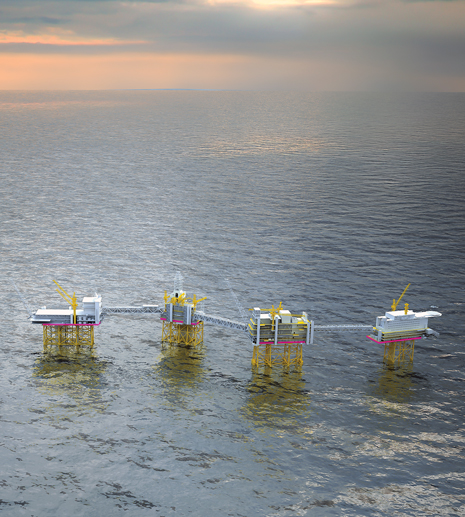

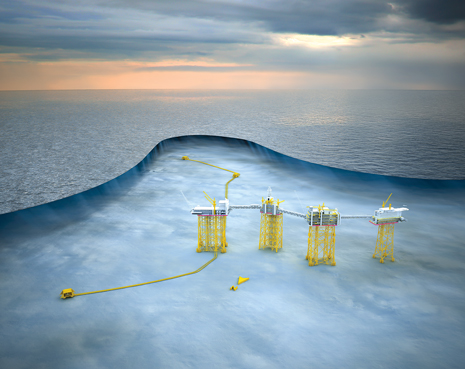

Sverdrup’s phase one development concept includes four platforms, to be installed during 2018 and 2019, Fig. 7. These include one wellhead platform with drilling facilities, one processing platform, one living quarters platform (450 cabins), and one riser platform with deck space for future EOR. Most of the 40-50 production and injection wells will be drilled from the wellhead platform. There will be 11-17 wells drilled prior to first oil. Power will come from shore. A 274-km, 36-in. oil pipeline will run to Mongstad oil terminal, while a 165-km, 18-in. gas pipeline will go to Kårstø gas terminal.

|

| Fig. 7. Assuming that a PDO is approved within the next year, then the four platforms in phase one of the Johan Sverdrup development will be installed during 2018 and 2019 (image courtesy of Statoil). |

|

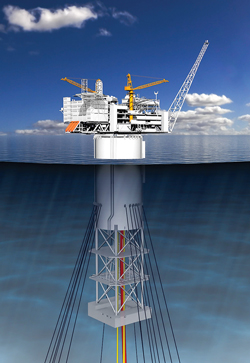

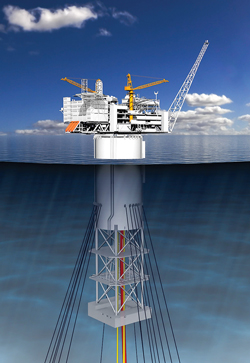

Engineers have postponed a concept decision for Johan Castberg in the Barents Sea until the summer of 2015. Disappointing exploration results around Castberg and mounting costs are behind the decision. In the Norwegian Sea, Aasta Hansteen already has an approved PDO, which calls for two, four-well subsea templates to be tied back to a spar, Fig. 8. Capacity will be 100,000 boed, with start-up in 2017. Originally considered a minor gas discovery after being discovered in 1974, Gina Krog is being developed with a platform and an 850,000-bbl FSU. Capacity should be 50,000 boed, with start-up in 2017.

|

| Fig. 8. In the Norwegian Sea, Aasta Hansteen field will be developed with a large spar (image courtesy of Statoil). |

|

North of Sleipner in the North Sea, Gudrun’s gas/condensate project stayed on schedule. “Capacity is 65,000 boed, and first output began on April 7, 2014,” said Skjervold. Output from the platform is tied back to Sleipner A. Reserves are 70 MMbbl of oil and 1.7 Tcf of gas. At Valemon in the North Sea, west of Bergen, a platform will be controlled remotely from nearby Kvitebjørn field. Production will begin in late 2014, with a 50,000-boed capacity. Reserves are 206 MMboe.

“We are working to perfect an offshore manufacturing process, to fast-track projects,” noted Skjervold. “We have put six fields onstream, using this process, and another six are on their way. These projects have a break-even cost of about $40/boe, 40% shorter execution time, and average IRR greater than 25%.”

Meanwhile, “subsea processing is becoming increasingly important to us for future projects,” said Bjørngulf Eidesen, Statoil’s leader of Technology and Subsea Systems. “We established a subsea factory (SSF) strategy in 2013 that has been approved by our leadership. Further work on developing the SSF concept is planned to be carried out by an operator JIP.” Indeed, “subsea is one of our company’s four priorities,” said André Maerli, project leader for Subsea Technology and Operations. “More than half of Statoil’s production is coming from subsea wells. Our total of 526 subsea wells, all in Norway, is second only to Petrobras.”

ConocoPhillips. One of the firm’s pre-merger predecessors, Phillips Petroleum, became involved offshore Norway when activity began in 1965. Phillips went on to become the country’s first operator of commercial production, when Ekofisk oil field went onstream in June 1971 after being discovered in 1969.

Today, ConocoPhillips produces 118,500 boed, including non-operated assets. The company operates four fields—Ekofisk, Eldfisk, Embla (an HPHT field) and Tor, known as the Greater Ekofisk Area (GEA), which covers PL 018, Fig. 9. Four other fields were shut down in 1997, when the Ekofisk II re-development went onstream.

|

| Fig. 9. The venerable Ekofisk field complex is an example of production extending far beyond initial expectations, thanks to technical advances and improved recovery rates (photo courtesy of ConocoPhillips). |

|

“When production started at Ekofisk in 1971, we estimated that it was possible to extract 17% to 18% of the hydrocarbons,” said Hroar Hermansen, technical manager, partner operated assets. “But that figure, due mostly to water injection, has risen steadily, and we now estimate that it will hit 52% in 2028.” Indeed, by the end of 2013, the GEA fields had produced 5.6 Bboe, including 3.9 Bboe from Ekofisk.

As of spring 2014, 18 GEA platforms were operating. New, ongoing GEA development projects involve investment of NOK 83 billion ($13.54 billion). Among the three largest projects is Ekofisk South, consisting of wellhead platform Ekofisk 2/4Z, subsea installation Ekofisk 2/4VB, other facilities, and the drilling of 44 wells. It will raise the Ekofisk recovery rate 2.5%.

The second major project, Eldfisk II, comprises a new, integrated platform, with 40 new wells planned for production and water injection. It will improve Eldfisk field’s recovery rate by 6.5%. “These investments will allow the fields to produce effectively for the next 40 years,” said Hermansen. “At the same time that we’re adding platforms, we also disposed of nine older platforms between 2008 and 2013.”

The third large project is Ekofisk 2/4L, a new accommodation and field center platform with 552 beds, all in single cabins.

Total. The French company has been active on the NCS from the beginning. After a 10-year lull of not expanding its holdings, the firm is re-establishing itself as a leading operator. As of mid-2014, Total holds 33 operated licenses. “We’ve been investing $2.5 billion annually offshore Norway,” said Martin Tiffen, managing director of Total E&P Norge AS, Fig. 10. “Our production reached 240,000 boe last year. We expect that to grow some more in the next three to five years.”

|

| Fig. 10. Martin Tiffen, managing director of Total Norge E&P AS, says that his firm is working hard to expand its presence on the NCS, including development of Martin Linge field (photo courtesy of Total Norge E&P AS). |

|

The firm’s latest operated development is Martin Linge oil and gas field. Discovered in 1978, the field’s reserves had been stranded, until recently. “The key to unlocking this development was a well drilled in 2009 and 2010,” said Leif Harald Halvorsen, communications manager for Total in Norway. “The limiting factor in not developing the field sooner, was whether gas reserves were interconnected. The well in 2009 answered that question.”

The initial Martin Linge development will drill 11 wells, and the platform will have 21 extra well slots. Reserves are estimated at 189 MMboe, mostly gas. First output is planned for late 2016. “One new thing that we’re doing on this development is using electrical power from shore,” said Tiffen. “It will run about 170 km to the field, and be the longest power cable from shore in the world. It costs a little more up front, but there are better economics later on, and a better environmental footprint.”

Another Total innovation is its Field Operations force, which includes construction of a new building in the Stavanger area, Fig. 11. The building will be Total’s new NCS hub and contain the central control room for Martin Linge. A parallel, redundant control room will be at the field. “Our offshore personnel will spend half of the year in a regular, 2-on, 4-off work pattern, and then the other half of the year, they will be onshore, integrating control from the new building,” explained Tiffen.

|

| Fig. 11. Total’s new Field Operations building in the Stavanger area will be able to remotely control Martin Linge field from shore (photo by Kurt Abraham, Executive Editor). |

|

BP. Offshore Norway, BP operates five fields—Ula, Valhall, Hod, Tambar and Skarv—through 13 platforms and one FPSO. BP’s completion of two major development projects at Skarv and Valhall fields, has significantly increased production. Following the fields’ start-up, BP’s net output roughly doubled in 2013 to 48,100 boed. During first-quarter 2014, net average production jumped to 70,000 boed.

Following commissioning of its new process and hotel platform, Valhall has the potential to continue producing until 2050. BP also has considerable modifications and upgrades to make on the Ula and Skarv assets, as well as potential future tie-backs. In addition, there is the gradual decommissioning and removal of facilities in old installations at Valhall and Hod.

Exxon Mobil. The company has been active on the NCS since 1965, participating in many discoveries. In the deepwater portion of the Norwegian Sea, Exxon Mobil operates the Møre West license, where 2D seismic was conducted during 2013.

Exxon Mobil operates Balder, Ringhorne, Jotun and Sigyn fields, whose combined production in 2012 was just above 65,000 boed. Balder is in the North Sea, 190 km northwest of Stavanger, and includes the Balder FPSO and several subsea production systems. Balder exports gas via the Jotun A FPSO. During 2012, the Balder FPSO processed 36,400 bopd—15,900 bopd from Balder and 20,500 bopd from Ringhorne. Seismic surveys in the area were carried out in 2009 and 2012, to prepare for drilling that began in 2013.

In the North Sea, 200 km west of Stavanger, Jotun field was developed with two installations—a wellhead platform (Jotun B), which transfers resources to an FPSO (Jotun A). Average production in 2013 was 2,710 boed. Jotun’s declining production has created spare capacity, which has been utilized by connecting Balder to Jotun via a gas pipeline. Later, pipelines were installed between Ringhorne and Jotun, allowing Ringhorne output to flow to the Jotun A FPSO, in addition to the Balder FPSO.

Ringhorne field includes a platform with initial processing and water injection. Output is routed to the Balder and Jotun A FPSOs. In 2012, Ringhorne produced an average 31,800 bopd, while Sigyn’s output was 33 MMcfgd and 8,000 bcpd.

Shell. The company operates six NCS production licenses with two actively producing—Ormen Lange gas field and Draugen oil field. In the Norwegian Sea, Ormen Lange is Norway’s second-largest gas field, in water depths between 850 and 1,100 m. The field’s 24 wells are divided between four subsea templates, the last of which was installed in the field’s northern portion in 2011/2012. Ormen Lange also produces significant amounts of condensate.

In April 2014, Shell and the Ormen Lange partners postponed the field’s Offshore Compression Project. The decision was based on an updated economic assessment incorporating new cost information for the current concepts.

Marathon Oil. After many years of NCS operations, Marathon Oil announced on June 2, 2014, that it would sell its Norwegian business to DNO for $2.7 billion. The deal includes the sale of the Alvheim FPSO, 10 company-operated licenses and a number of non-operated interests.

Principal operated asset is the Alvheim area (65%), comprising three licenses. Alvheim field was developed with an FPSO and subsea wells, and went onstream in 2008. Oil is transported via shuttle tanker, and gas is piped to the UK’s SAGE system. Output peaked at more than 93,000 boed in 2009. The field’s total resource has increased through development drilling. An infill program was planned for unswept areas in 2014/2015. In addition, Marathon has been developing the Bøyla discovery as a subsea tieback to Alvheim. Start-up is expected in early 2015.

Talisman Energy. Talisman operates Blane, Gyda, Yme and Varg fields. During 2013, Talisman’s Norwegian production averaged 15,000 boed across nine fields. Last year, the company said that it would sell all of its Norway assets, a process that is ongoing.

Also in 2013, the company reached an agreement with the Yme platform contractor to terminate the Yme field re-development contract. Removal of the Yme platform will occur in 2015. A review of alternative re-development concepts is underway. First oil from Brynhild field is expected during second-half 2014. Drilling will be operated at Gyda and Varg.

Centrica Energy. The company operates Vale field (50%), has an interest in more than 60 licenses, and is drilling three operated wells. In Centrica’s Butch license, an exploration well was drilled 220 km off the coast during second-half 2011. Further drilling is ongoing to prove up additional volumes. A development concept selection is planned for late 2014. First production would be in 2018.

Centrica acquired 40% of PL442 from Statoil in 2012, and the block contains two undeveloped oil discoveries, Gamma and Delta, collectively called Frigg Gamma Delta (FGD), northeast of Heimdal. During 2013, further studies of a potential FGD development indicated that a stand-alone project is potentially attractive. Concept selection is planned for 2015, followed by a final decision in 2016.

Centrica’s Fogelberg discovery found HPHT gas condensate in 2010, north of Åsgard and south of Heidrun. A concept selection was expected in mid-2014.

Other operators. A number of other companies operate fields in production, or fields with approved PDOs. Eni’s Marulk gas/condensate field is about 25 km southwest of Norne field. Marulk was developed with a subsea template tied back to the Norne FPSO, and gas production began in April 2012. Eni’s Goliat oil field is 50 km southeast of Snøhvit in the Barents Sea. It is being developed with a circular FPSO (Sevan 1000), plus eight subsea templates, Fig. 12. The oil will be offloaded to shuttle tankers. Output is planned for late 2014.

|

| Fig. 12. Eni will use a circular FPSO, a Sevan 1000 design, to handle output from subsea wells at Goliat field in the Barents Sea (image courtesy of Eni). |

|

In June 2014, Det norske oljeselskap ASA purchased Marathon Oil’s Norwegian assets for $2.7 billion. Even before that transaction, Det norske’s operated licenses totaled 26. In May 2013, Det norske started its first, operated, Norwegian oil production at Jette field, 6 km south of Jotun and tied-in to Jotun A. Det norske’s Ivar Aasen field development, 30 km south of Grane and Balder fields, was approved in May 2013. The development comprises a PdQ platform with spare well slots. First production is planned for late 2016.

The co-operator of the giant, 1.8-Bbbl-to-2.9-Bbbl, Johan Sverdrup oil field development with Statoil is Lundin Petroleum (for details, see the Statoil section). In addition, Lundin’s Brynhild development is incorporating a four-well, subsea tie-back to Pierce field in the UK North Sea. First oil is now expected late in third-quarter 2014. Also, Lundin’s development of 186-MMboe reserves at Edvard Grieg field is progressing. The 15-well, $4-billion project is expected to go onstream in fourth-quarter 2015.

Since entering Norway in 2003, BG Group has gained 10 operatorships. Production began from a two-well, subsea tie-back at Gaupe field in 2012, in the Central North Sea, and is due to grow in 2014, when the Knarr development starts up.

Trym and Oselvar fields are operated by DONG Energy. Trym’s gas flows from subsea facilities to treatment in Nybro, Denmark, while condensate is routed to the terminal in Fredericia. Most of Oselvar’s gas production goes to Ula field for injection, for enhancing oil output.

Since entering Norway in 2001, GDF SUEZ E&P Norge has steadily expanded its NCS portfolio. The firm’s first operated production is at Gjøa gas field in the North Sea, 60 km west of Florø. Gas reserves are produced through five subsea templates.

Wintershall operates roughly 25 NCS licenses and hopes to operate 50,000 boed by 2015. At Wintershall’s Maria field in the Norwegian Sea, the preferred development scheme is to connect to nearby infrastructure, via a subsea tie-back. Maria should produce around 130 MMbbl of oil and just over 2 Bcm of gas.

SERVICE/SUPPLY SECTOR

The Norwegian service/supply sector is a significant incubator of technical innovation. Not surprisingly, a number of trends have emerged, from both the technical and business sides of the sector.

“We share Statoil’s vision of being able to power a subsea production plant on the sea floor,” said Aker Solutions’ Kongelf. “Helping oil companies to improve recovery rates and be more effective in well intervention are definitely priorities. We need more efficient well access. There is also a big push toward standardization and modularization of equipment.” At technical advisory DNV GL, the director of operations for Norway, Marianne Hauso, said her firm is “trying to drive the industry toward developing common subsea standards, and to operate with more efficiency. We also need common documentation.”

The seismic arena is quite active, thanks to the Barents Sea, said Schlumberger’s Halle. “Our WesternGeco division is participating in a major seismic project there,” explained Halle. “The surveys cover blocks proposed for the 23rd Licensing Round, for an area of about 13,700 km2. Statoil is the operator for this joint acquisition of 3D seismic by 33 participating oil companies—a new approach for the industry. The surveys began in April and, we have two boats working there. It will continue through third-quarter 2014, with data processing following into next year.

At Archer, which provides drilling and well services globally, the company has developed a new addition to its platform drilling operations, said the firm’s executive V.P. and president of the North Sea Region, John Lechner. “Working with German firm Max Streicher GMBH, we have built two highly automated, modular platform drilling rigs (MDRs),” said Lechner. “These rigs can service the platform drilling industry more efficiently and cost-effectively than most fixed drilling facilities or MODU intervention solutions.”

“The first unit, Archer Emerald,” continued Lechner, “is operating in New Zealand, and it will later work for Talisman in the UK. The second rig, Archer Topaz, is going to be working a contract with Statoil for permanent P&A of 12 gas wells at Heimdal field, in the North Sea,” Fig. 13. Performing P&A operations on a modular rig is a first for Archer, as well as the industry. “This will allow safer, faster, more efficient P&A operations, with fewer people on board,” noted Lechner.

|

| Fig. 13. Once its outfitting is finished, the Archer Topaz modular drilling rig will be dispatched to the North Sea, where it will P&A 12 gas wells at Heimdal field for Statoil (photo courtesy of Archer Limited). |

|

One relatively simple category, where the service/supply sector makes a difference in the lifespan and economics of NCS facilities, is offshore paints and coatings. As noted by Miles Buckhurst, global sales director at Jotun A/S, “the use of premium, new-generation paints and coatings ensures longer lifetimes for platforms, decreases the possibility of fire and reduces the incidence of corrosion.” This relates to both structures and deck equipment.

Within the service/supply sector, the government has fostered an atmosphere that encourages new start-up firms. “What you have in Norway is governmental funding of people with good ideas,” said Schlumberger’s Halle. “They see some R&D gaps, and they help people create products and companies. Of course, we have a good record of acquiring and maintaining these companies, as they mature.”

One recent start-up is Mirmorax AS, which now offers five different products. But the firm’s concept for a topside, multiphase sampling system may be the most intriguing. “I had an idea for a multiphase sampling system,” said Mirmorax CEO and President Eivind Gransaether. “The initial idea was for calibrating multiphase meters, but we found that operators were interested in sampling. The main motivation was to get live samples. What we invented was basically a device to get live samples without bringing it up from the seabed to topsides.”

Another niche product is the Fishbones stimulation system, developed by Fishbones AS founder and inventor Rune Freyer. “This system is an open-hole liner completion that connects the well and the reservoir without the drawbacks of hydraulic fracturing,” explained company CEO Eirik Renli. “It’s a simple operation. You run the reservoir liner string as normal, set the liner hanger slips, and circulate fluids with the rig pumps. A large number of small-diameter laterals jet out from the wellbore to penetrate the reservoir.”

The system has tested successfully in two onshore wells—a re-entered Austin Chalk well owned by Enervest that had been shut-in near College Station, Texas, and a CBM well in Indonesia. A third well was planned for July, also in Texas and operated by Enervest, which has 1,200 Austin Chalk wells and obviously sees merit in the system. The firm’s R&D team is also qualifying the tool in a Belgium quarry, whose sandstone has the same properties as a reservoir offshore Norway. “This is a high-risk proposition, to start up a company with a brand-new tool,” said Renli. “But our founder also invented the Swell Packer at a brand-new company, EasyWell, which eventually was bought out by Halliburton. So, he has a good track record.”

EDITOR’S NOTE:

This is the first of a series of articles on Norway’s upstream industry. Subsequent articles will address more specific, technically oriented topics.

NORWAY’S PETROLEUM MINISTER REMAINS CAUTIOUSLY OPTIMISTIC

|

| Norwegian Minister of Petroleum & Energy Tord Lien meets with World Oil Editor Kurt Abraham in Stavanger on May 19, 2014 |

|

World Oil: What areas of Norway are most prospective for additional exploration?

Minister Tord Lien: For decades to come, the North Sea will be very important for Norwegian production. We discovered Johan Sverdrup a few years ago, and it was a major oil discovery. Hopefully, it will be developed, and start producing in 2019. Most of the time, we do find additional, smaller resources that can be tied into existing infrastructure.

That is basically the same situation that we see in the Norwegian Sea. The advantage is that we have good infrastructure already, with some good prospects, making developments profitable. In the future, the Barents Sea will be important for Norway, and the numbers coming out of NPD show loads of gas, but also oil. This summer’s drilling campaign will be very interesting, after which we will know a lot more about the regional geology.

Goliat field will go onstream next year as the first Barents Sea oil producer. Snøhvit field is already producing gas. This will be the first time that we’re opening acreage in the Barents Sea since the mid-1990s—this is in the eastern and southeastern Barents Sea.

WO: What are your licensing round plans?

Lien: We’re working with two licensing rounds right now. The numbered rounds are granting new acreage in open areas. The other type, Awards in Predefined Areas, grant new acreage in mature areas, close to existing infrastructure and where we have very good knowledge of the geology. The deadline for APA nominations is in September. And then we have the 23rd Round in the Barents Sea. There should be a deadline late this summer for announcing which tracts we will award. Nominations came in months ago, and some areas had many nominations.

WO: What are some significant field projects underway, and which others may be sanctioned?

Lien: Well, there’s Johan Sverdrup in the North Sea, of course, which is very interesting, technically. The Sverdrup PDO will come within a year. In the Barents Sea, there is the Johan Castberg greenfield project. Snorre is a brownfield development, in production since 1996. It is going to be redeveloped to produce more oil. Goliat is still under development and will be interesting to follow. Two other interesting projects are Osegard and its subsea compression, and Total’s Martin Linge. And, of course, the Wisting Central discovery in the Barents Sea is very interesting. We’ll know more about that one before Christmas.

WO: What are your goals for Norwegian oil and gas policy?

Lien: I have three objectives. The first one is to keep a sustained level of oil and gas production— I am responsible for creating production. Norway has been a stable exporter for decades, and this has created enormous value for the country. We’ve also created confidence in the reliability of our supplies.

My second objective is to implement Carbon Capture and Sequestration (CCS) in Europe. To that end, I was fortunate to travel with U.S. Energy Secretary Moniz to Mississippi, to visit a project underway there. I do hope to contribute to moving CCS forward and see a European operation created.

My third objective relates to electricity being in my portfolio. We want to contribute to a more renewable Europe and also ensure a reliable, future electricity supply for Norway. So, we need to keep increasing our production of renewables.

WO: How is the effort progressing, to improve the oil recovery rate?

Lien: The oil companies have done a good job. Statoil is the lead company on this effort, and it has goals to do even better. This is a job that the companies have been working on very hard for some time. It’s also about creating a framework that makes it economically viable to increase recovery rates, and also about having the technologists and the technology available, through research and education, to get it done. Worldwide, the average recovery rate is 22%. I believe that for the Shelf, and the North Sea in general, we are above 40% (Statoil is at 46%), heading toward 50%, and hopefully higher. If subsea compression turns out to be the success that we’re all hoping it will be, then that will make more resources commercially and economically viable.

WO: Due to the Russian-Ukraine situation, is there concern about Western European gas supplies? Do you foresee increased development of Norwegian gas supplies?

Lien: The E.U. states have been developing their gas infrastructure for many decades. To have a good market, you need to have good infrastructure. That will strengthen the security of supply. And they (E.U. states) have LNG capacity that’s equal to almost half their annual consumption.

We built production and infrastructure to help support the E.U. countries. The players on the Shelf will have to make decisions on commercial viability and where to sell the gas. If we are to continue making large investments, the companies will have to see the security of the infrastructure. As for short-term output increases, I will say this—90% of pipeline capacity is already in use. We could, for a short while, increase gas output maybe 10%,—but only for a short period, or we would ruin the pressure in Troll field!

|

|