|

| Oilfield companies are beginning to see the value in R&D outsourcing that the aerospace and automobile industries have experienced for several decades. |

|

It is commonly understood that the “days of easy oil are over.” In a speech at the IHS CERAWeek conference during March, Chevron Chairman and CEO John Watson said, “The projects that the industry will be undertaking to meet the global demands will be bigger, more complex, in harsher environments, with longer lead times. The new reality for our industry is that costs have caught up to revenues for many classes of projects.” Watson further added, “the labor and capital costs have more than doubled in the last decade, and the offshore rig rates have gone up more than five-fold during the same period.”

Total CEO Christophe de Margerie said at the same conference that “the subcontractors are partly to blame for the increase in capital costs.” Adding to the skyrocketing costs are new and stricter regulations on health, safety and environment. As operators attempt to exploit the ultra-deepwater prospects, drill and complete the shale formations, and improve recoveries from the mature fields, they will demand, from the service companies, new technologies to solve the complex problems at a lower cost.

The oilfield service (OFS) companies are responding to these challenges with new product innovations; reducing time to market; leveraging the dwindling domain expertise; and expanding their core competencies. Achieving these objectives, and outperforming competition, against the backdrop of tighter regulations, political uncertainty, rising costs, and intense competition, has never been more challenging. Increasing innovation, and, at the same time, supporting an ever-growing portfolio of legacy products, while keeping costs down, requires some new thinking and new strategies. The solutions to these problems require a paradigm shift in how the engineering is accomplished in technology-intensive organizations.

Technology managers at OFS companies are starting to focus their limited-domain experts on innovation, and outsourcing non-critical activities. Although OFS outsourcing is not as mature as it is in the aerospace and automobile industries, the early success in outsourcing back-office work has led many companies to look at outsourcing for improving performance in the core areas of technology, supply chain management and operations. There had been a reluctance to outsource technology development, due to intellectual property and confidentiality concerns. These concerns have lessened through trust and contractual arrangements. OFS companies are realizing that engineering outsourcing providers are not in the business to compete with them, but, in fact, to make them more competitive and successful.

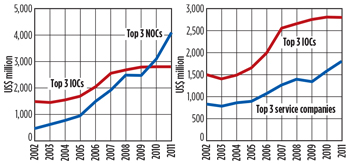

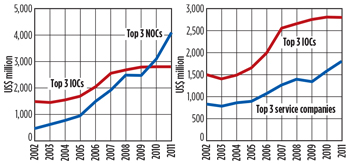

INCREASING R&D INVESTMENT

Energy industry companies are increasingly investing in R&D, Fig. 1. R&D investment has increased significantly for all three groups since 2002. Just as CEOs actively seek to manage their asset portfolios to secure the highest returns, so, too, are technology managers assessing in what areas, and at what levels, they should be investing in technology development to deliver the most value to their businesses, over both the short and long term. Because of incentives and business needs, companies are looking beyond the traditional research hubs of the U.S., UK and Western Europe, and toward countries, such as India and China.

|

| Fig. 1. R&D investment of the top three NOCs, IOCs and service companies. |

|

SHIFTING ENGINEERING OURSOURCING

Traditional engineering outsourcing in the oil and gas industry has been focused predominantly on onsite staffing or, at best, near-shore outsourcing (resources located close to customer offices, but not at their site). It has been largely tactical, with the companies reaching out to suppliers to take care of peak requirements. Engineering outsourcing was random, tactical-based, and, mostly, not by design.

New market forces are creating the need for greater discipline in engineering outsourcing. The senior management is looking to outsourcing more strategically. They find that global outsourcing of certain aspects of R&D allows cost-effective access to experts and engineering talent. By accessing the vast talent pool of engineers, scientists and software people, in countries like India, a company can position itself strategically in the technology arena to be competitive.

STRATEGIC OUTSOURCING

A company planning to outsource engineering activity, and globalize its engineering effort, should first define its core and non-core engineering activities in all technology areas. Once the company has identified the non-core activities, the question is to whom, and where, to outsource? Local and global engineering service providers, with a footprint in the geographies possessing a strong engineering talent base, emerge as obvious choices. However, factors such as cultural differences, functional knowledge, domain knowledge, capacity, and ability to scale up, should be the key factors that drive the selection. Such a process shifts the outsourcing focus from seeking a tactical or a convenient supplier to a strategic, trusted partner. The process of identifying and outsourcing work evolves into a more collaborative effort between the company and the service provider.

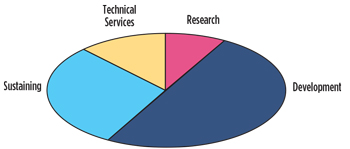

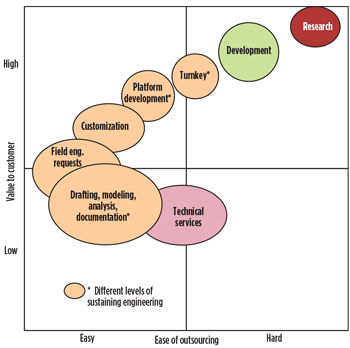

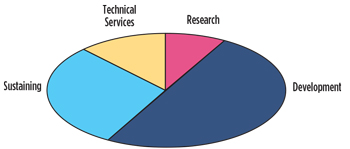

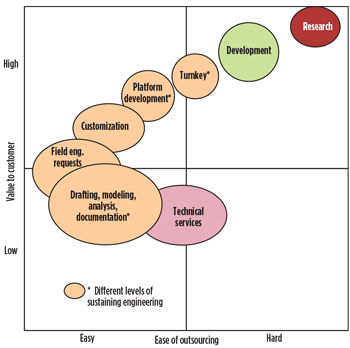

To gain a deeper perspective on what to outsource, and how to outsource, we will examine the issues in the four main functions of technology: research, development, sustaining engineering, and technical services, Fig. 2.

|

| Fig. 2. Typical spend in the four technology areas of an OFS company. |

|

In the past, these four areas have been considered the “core crown jewels” of the company, and guarded carefully, due to intellectual property and competitive issues. It was unthinkable to consider outsourcing any of these activities. But this landscape is changing.

Outsourcing opportunities in research. In any company, research is considered a core activity, as it involves discovering or inventing new knowledge to develop products and services that give the company a competitive advantage. Research is rich in intellectual property, and can be fuzzy in scope and specifications. The usual thinking is that, in the research phase, there is very limited scope to outsource. While this is partly true, there are many opportunities to outsource tasks, work packages or some activities. The initial stages of concept development and feasibility are high in domain content, and require experts to address them. And this is the phase in which IP is created. But once the feasibility is completed, the next stages that follow are similar to a development project.

The design phase of the project generates a large number of engineering tasks, which are candidates for outsourcing. This could include drafting, modeling, engineering analysis (FEA, CFD, simulations), and documentation. Normally, a research project goes through more iterations than a typical development project. Thus, it makes more sense to outsource the tedious task of engineering.

The main issue in choosing the outsourcing service partner is trust: will that party maintain confidentiality, and protect the IP? Service providers handle the IP in two ways:

- In cases where the service provider creates the IP as a part of the project, then it is assigned to the company.

- In cases where the service provider brings their own IP to the project, then it is handled through a commercial arrangement.

Outsourcing opportunities in development. The main performance measures in a development project are quality, speed, and on-budget and on-time delivery. During each step of the development process, such as concept generation, design, prototyping, testing and documentation, there are several activities that can be outsourced as either tasks or work packages. The goal should be to meet or exceed the performance measures. One way to achieve this goal is by outsourcing and globalizing execution; leveraging time zones; and using internal and external (outsourced) experts to innovate and design. Using the service provider to perform more tedious and voluminous tasks, such as drafting, modeling, analyses and documentation, will lower costs and shorten the cycle time, Fig. 3.

|

| Fig. 3. Typical development cycle. |

|

Strategic outsourcing can improve the execution and overall efficiency of a development project. Some projects may require professionals, with varied domain knowledge and engineering skills for a limited time. It is not cost-effective to source these resources internally, if their utilization is not high.

Outsourcing opportunities in sustaining engineering. A typical OFS company must support hundreds of thousands of products and components. These products are the “bread and butter” of the company. Billions of dollars will have gone into developing these products, and they have to be maintained, improved and expanded on an ongoing basis. Generally, the number of projects in sustaining engineering is very large, and resources are stretched to manage the required tasks.

Sustaining effort can easily consume the best and brightest of the engineering resources, burden the technology organization, and hamper innovation. The problem is compounded by the fact that the workforce is aging, and knowledgeable workers are retiring at a rapid pace. In addition, there is a shortage of engineers and scientists graduating from schools, who can eventually take their places. Capacity and capability of qualified employees is the real issue. Another problem is the cost of sustaining engineering. Sustaining engineering, if not properly managed, could engulf a major share of the technology budget. All of these issues make sustaining engineering an ideal candidate for outsourcing.

A majority of the work in sustaining engineering is non-core, and IP issues are either minimal or non-existent. Typically, sustaining work falls into two categories: first is the real, large volume of low-end work, such as drafting, modeling, analysis and documentation. This type of work is ideally suited for offshore, where there is a large capacity of low-cost resource. The second category is a little high-end work that would require some domain knowledge. This type of work would require both local and offshore resources. The local resources would provide some of the domain content, and the offshore resources would perform the bulk of the work. Depending on the level of maturity of offshore resources, they can also add domain content. Examples of the second type of sustaining engineering include:

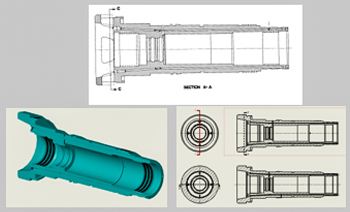

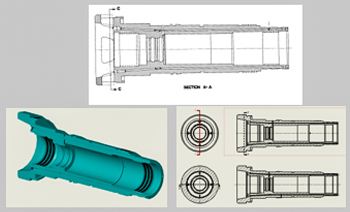

- Requests from the field for engineering changes. Field operations groups require changes to designs, due to customer requests, improvements to products, obsolescence and other reasons. Tasks required for making the engineering changes could involve design, drafting or modeling, analysis and documentation, depending on the nature of the work. Figure 4 shows an example of a part that has been modified to suit a customer requirement.

|

| Fig. 4. Example of a request for an engineering change. |

|

- Customization. In these projects, products are modified specifically for a customer well or a project. These could involve material, manufacturing process, and design changes to the parts, to meet specific customer requirements and specifications. A customization project may involve one or more products. In a well completions project, customization could involve modifying an entire downhole assembly to suit well conditions. Figure 5 shows an example of a generic design of a product that was modified, per customer specification.

|

| Fig. 5. Example of a customization project. |

|

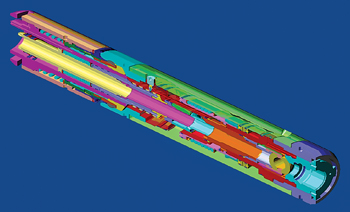

- Platform development. In this case, the outsourcing partner takes on the bulk of the responsibility for expanding the product family. The customer generally has an existing product or design. The job would be to take that design or product, and expand the product family by adding more sizes, etc. This is a typical high-end engineering project, requiring the outsourcing provider to design new assemblies and components. All the part drawings and 3D models will have to be developed, and FEA, CFD and other analysis may have to be performed. The design will have to be documented in a product data management system, and all the support manuals will have to be developed. Figure 6 shows four sizes of a tool that were added to the product family, starting with one basic size.

|

| Fig. 6. Example of a platform development. |

|

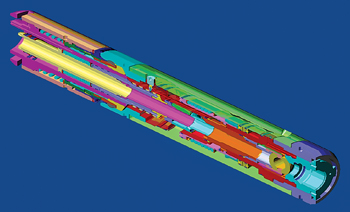

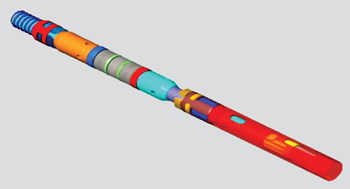

- Turnkey projects. The highest level of sustaining engineering is required for turnkey projects. In many cases, it is similar to a new product development. The outsourcing partner would get the scope of work, and the product specifications from the company. It would then be the responsibility of the outsourcing partner to come up with the concepts, get them approved by the company, and then do the detailed design. The project would involve the usual activities of generating the drawings; models; assembly and installation drawings; analysis; and engineering documentation. In some cases, it could involve making the prototypes and performing the testing. IP issues, if any, would be handled, similar to what was discussed earlier. Figure 7 shows an example of a downhole tool that was developed from a simple scope and specification document.

|

| Fig. 7. Example of a turnkey project. |

|

With a proper outsourcing strategy, an OFS company can work with a strategic outsourcing partner to take on significant parts of sustaining engineering. By doing so, the company can lower the costs and have access to scalable capacity of a large pool of global resources, including domain and discipline experts.

Outsourcing opportunities in technical services. A technical services group supports field operations; sales and marketing; manufacturing; procurement; and in some cases, the end customer. The field support comes in many forms: introducing new products, providing repair and maintenance support, assisting sales and marketing, training etc. Providing technical assistance is just a part of the work done by the technical advisors in a technical services group. A large part of their work involves developing and maintaining many of the documents required to accomplish the technology transfer. Some of the documents are manuals, such as operations manuals; repair and maintenance manuals; operator training manuals; equipment assembly manuals; marketing collateral material, etc. The generation and maintenance of these manuals can be outsourced, allowing the global technical advisors to concentrate on supporting their customers.

We have now seen that one or more of the four main areas of R&D can be outsourced. Sustaining engineering and portions of development are the most popular outsourcing candidates. Within sustaining engineering, there are many areas that can be outsourced. The ability to create value depends on the type of activity. Different companies are comfortable with different forms or levels of outsourcing. Figure 8 illustrates the value created, and ease of outsourcing, for the various technology activities. The activities in the left quadrants are easy to outsource and can create varying degrees of value.

|

| Fig. 8. Matrix of value to customer and ease of outsourcing. |

|

OUTSOURCING OPTIONS

Managers of OFS companies should not only determine what to outsource (core vs. non-core), but also where, and to whom, to outsource and what activity.

Ease of outsourcing is based on the following major factors:

- Degree of interaction required

- Product and process complexity

- Discipline knowledge

- Level of domain expertise

- Capacity to scale up

- Cultural fit.

Value from outsourcing. Depending on the actual outsourcing engagement, it may be easy or hard to quantify the value creation. Where there is a defined activity, such as a turnkey project, it is quite easy to measure the value created. When a whole process is outsourced, the cost before, and after, can be identified. Soft measures, such as improvement in productivity or speed, are harder to measure.

SOLUTION TO RISING COSTS

The oil and gas industry is facing many challenges. Business costs are escalating; drilling and completions are getting more complex; regulations are becoming more stringent; and the lead times are increasing. To meet these challenges, operators are tasking the service industry to reduce well construction and production costs through innovation and business process changes. Outsourcing non-core activities to strategic engineering service providers is a solution that OFS companies are using to address the problem.

The industry is still in its infancy regarding outsourcing of R&D. One size does not fit all, and each company will have to develop its own unique situations. Best practices from other industries, and lessons learned from the early adopters, can help companies as they embark on their engineering outsourcing journey.

|