|

| Above, from left, the Petrobras P-55 floating production unit was towed to location at Roncador field, offshore Brazil, for a January 2014 startup. The FPU has the capacity to produce oil at 180,000 bpd and gas at 141.2 MMscfd. Photo courtesy of Petrobras. Nexen commenced a drilling program for four shale gas wells on two of its four blocks, totalling 1.5 million acres, close to Bogota, Colombia, the nation’s largest gas market. Photo courtesy of Nexen. Spanish oil company Repsol has commenced gas production in the Kinteroni field, Peru. The company reported that the field will produce 20,000 boepd initially, and could double that rate of output by 2016. Photo courtesy of Repsol. |

|

After decades of declining production and reserves in Latin America, this part of the Western Hemisphere is seeing a resurgence of investment and E&P activity in the oil and gas industry. According to the International Monetary Fund (IMF), over the next five years, Latin American economies will experience an average annual growth rate of almost 5%, with the most significant growth concentrated in Brazil, Mexico and Argentina. The success of Latin American countries’ economic strategies will depend heavily on how they address their energy demands.

The Brazilian pre-salt region is considered by analysts to be the largest petroleum discovery in the Western Hemisphere, in the last 30 years. Encompassing around 100,000 sq km off the coast of Espírito Santo, and continuing offshore in ultra-deep waters off Rio de Janeiro, São Paulo and Santa Catarina states, the area represents a great opportunity to add value to Brazil’s oil and gas production. However, it represents a tremendous challenge for the national petroleum industry.

After a hiatus of more than 30 years, Uruguay is once again interested in exploring for hydrocarbons in its territory, and has granted an exploratory contract to Schuepbach Energy. Chile also wants to expand its energy sector, not only with domestic projects, but also with participation in petroleum exploration ventures in other countries.

Colombia is consolidating its oil production at around 1 MMbpd, and is looking to expand natural gas and shale oil output, while also increasing offshore exploration during 2014. Argentina and Venezuela, two countries that continue to have problems capitalizing their traditional hydrocarbon markets, are seeking out new investors to explore for shale oil and shale gas. Along the same lines, Perupetro confirmed that 70% of its exploratory budget will be spent overseas, compared to only 30% domestically. Mexico is investing enormous amounts of capital in exploration and crude oil production, to strengthen a petroleum industry that is in desperate need of structural changes.

BRAZIL

Some years ago, when Petrobras first discovered natural gas, executives expressed disappointment that there was considerable flaring of associated gas. Now, with the pre-salt estimated to hold between 60 billion and 100 billion bbl of oil and gas reserves, reserves of natural gas are also increasing. At present, the company is heavily dependent on Bolivia for its gas needs, via a 3,150-km gas pipeline.

On Jan. 14, 2014, Petrobras achieved a new pre-salt petroleum production record of 390,000 bopd. Of the two basins producing in the pre-salt, Campos and Santos, the latter contributes 51% with nine producing wells which, according to Petrobras, proves the high productivity of the pre-salt reservoirs.

Petrobras geologists point out that, in 2013, there was a geological success of 100%. This means that all wells drilled in the pre-salt showed the presence of hydrocarbons. In the pre-salt Santos basin, the average productivity per well in commercial operation has been 25,000 bopd, larger than what was registered in the North Sea (15,000 bbl of oil per well, per day) and in the Gulf of Mexico, with its 10,000 bbl per well, per day.

In addition, during 2013, pre-salt discoveries were made in fields already producing from post-salt formations in the Campos basin, such as Albacora, Caratinga and Marlim Leste. This contributed to the increased reserves and, in particular, to rapid monetization of wells, brought about by linking wells to operating platforms.

This year, in the Santos basin pre-salt, 17 new wells are being linked to the previously installed platforms. In the second half of the year, two new units will come onstream in the Santos basin: FPSO Cidade de Ilhabela in Sapinhoa Norte field, and FPSO Cidade de Mangaratiba in Iracema Sul field, adding 300,000 bopd to the installed production capacity in the basin. In 2014, five new wells will be linked to these two new FPSOs.

With the two new platforms coming onstream, and 22 new producing wells beginning operation, this year will see new production records in the pre-salt, said Jose Formigli, E&P director of Petrobras.

The company’s current production curve, estimated at about 2 MMbopd today, should show continuous growth during the next years, reaching 2.5 MMbopd in 2016, 2.75 MMbopd in 2017, and 4.2 MMbopd in 2020. Petrobras, which took six years to reach 2 MMbopd, intends to double this figure in just seven years. The company is working to export more than 2 MMbopd (a volume close to that of Iraq and Nigeria’s 2013 totals) making the country one of the world’s largest exporters of petroleum in the world, at a time in which demand will probably be dictated by Asian countries, especially China.

However, exploring the pre-salt requires overcoming several roadblocks. One of them is developing the skilled manpower needed to handle the industry’s growth. The other hurdle is technological, since exploring for oil and gas means working at depths of more than 5,000 m. Other challenges are a need for greater automatization, development of subsea systems, and technically skilled personnel and special-purpose equipment.

In the pre-salt reservoirs, where there is oil, there is also a great quantity of carbonic gas. When it reacts with water, highly corrosive carbonic acid is formed, making it necessary to use special steel alloys for producing wells and in subsea equipment. Therefore, companies have been investing more and more in technology.

Between 2003 and 2005, before the pre-salt revolution, Petrobras invested around $280 million per year in R&D. Between 2010 and 2012, the R&D budget jumped to $1.2 billion. These efforts were worthwhile—the drilling time for a pre-salt well has dropped 50% since 2006, from an average of 134 days to around 70 days.

According to Petrobras CEO and President Maria das Graças Foster, the nine new platforms installed last year represent an additional 1 MMbopd of installed capacity. Four of these platforms are already operational. Petrobras technicians estimate that these new platforms will result at least 2.2 MMbopd, about 10% more than was produced last year. Foster is a longtime friend of Brazil’s President Dilma Rousseff, who has pledged to devote unprecedented resources to unlock the country’s pre-salt potential, Fig. 1.

|

| Fig. 1. Petrobras president and CEO Maria das Graças Foster (left) has a close working relationship with President Dilma Rousseff, the first woman to lead Brazil. Rousseff is a former energy minister, who chaired the Petrobras board for seven years during the administration of her predecessor, Luiz Inácio Lula da Silva. |

|

The country is dominating the subsea segment in Latin America, accounting for more than 90% of the market. According to a recently published study by Rystad Energy, subsea investment in Brazil is expected to total $90 billion between 2014 and 2020, an annual average of about $15 billion. The majority of the investment, about $50 billion, will be directed toward subsea umbilicals, risers and flowlines (SURF). The balance will be for subsea equipment, $25 billion, and services, $15 billion.

The study emphasizes that new FPSOs planned to operate in the country will be equipped with extensive infrastructure and subsea facilities. It also notes that the market for flexible lines will be especially large during this period, due to the company’s option of connecting wet christmas trees directly to platforms, with limited use of manifolds.

COLOMBIA

The average crude oil production in Colombia in 2013 stayed slightly above 1 MMbpd, according to the Ministry of Mines and Energy, registering a 6.6% increase over 2012 production levels, which averaged 944,000 bpd. Gas production for 2013, as of December, was 1.132 MMcfd. For the year, average daily gas production levels were at 1.174 MMcfd, or about 1.6% higher than the average daily production in 2012.

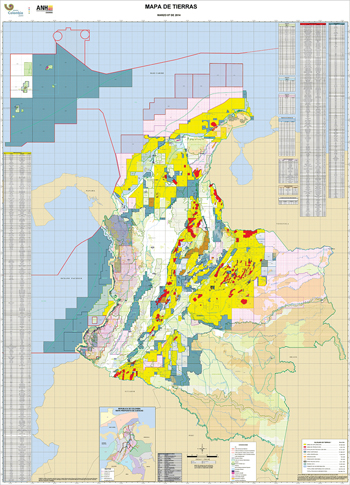

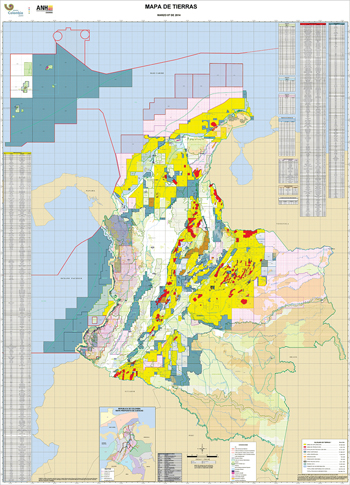

Exploration activity is centered on the middle Magdalena Valley, at depths of between 1,500 ft and 2,400 ft. Ecopetrol, Exxon Mobil and Shell are drilling exploratory wells in this area. In the offshore arena, for the Ronda Colombia 2014 bidding round, the National Hydrocarbon Agency offered 19 blocks of unconventional oil and gas, as well as eight blocks of conventional gas associated with coal deposits, Fig. 2.

|

| Fig. 2. In the Ronda Colombia 2014 bidding round, the National Hydrocarbon Agency offered 19 blocks of unconventional oil and gas, as well as eight blocks of conventional gas. Source: ANH Colombia. |

|

VENEZUELA

Natural gas production in Venezuela is still awaiting the completion of several offshore projects, including Rafael Urdaneta, Mariscal Sucre and the Deltana platform, offshore Falcon, Sucre and Delta Amacuro states, to develop the important natural gas reserves located in these fields, which are estimated to contain 197 Tcf. Mariscal Sucre is estimated to contain about 14.7 Tcf of gas reserves, while the Rio Caribe and Mejillones fields hold wet natural gas containing butane, propane and ethane, which PDVSA plans to develop in cooperation with the Russian oil company Rosneft. PDVSA and Rosneft have signed an agreement to produce 600 MMcfgd, as well as 20,000 bcpd by 2017. PDVSA and Eni have formed a JV to produce natural gas condensate off the coast of Falcon, which is projected to be as much as 37,000 bpd. Venezuelan crude oil production increased in February 2014, according to ODEP, reaching 2.87 MMbpd, an increase of 4.74% over February 2013’s output.

ECUADOR

The national oil company Petroamazonas has set a goal of recruiting new investors to improve crude oil production levels. Ecuador ended 2013 with a crude oil production of 326,593 bopd, which was 1,000 bpd over the goal set last year. The production goal for 2014 is 327,000 bpd. Petroamazonas has been in talks with oil companies from Angola, Qatar, Belarus, Russia, India and China as possible partners to develop oil production.

Sacha field, which has been in operation 42 years, continues to be viable. Ryder Scott recently certified reserves of 243 MMbbl of crude oil in this field. Petroamazonas plans to build 11 platforms, each with nine new wells, in the new production area in the Rio Napo field, bringing the total number of platforms in operation to 36. Petroamazonas also has 114 wells that have been temporarily suspended—it plans to bring 50 of these wells into production in the coming months.

BOLIVIA

YPFB Andina increased its production capacity 25% in 2013, from 170 MMcfd in 2013 to 213 MMcfd. This production increase was accomplished by conducting exploration and production activity in 18 fields where it is the operator, as well as conducting improvements in San Alberto and Sabalo mega fields, where it is a partner of Petrobras Bolivia. YPFB Andina drilled 11 wells in 2013—four exploratory and seven production wells. These wells were drilled in Yapacani and Rio Grande fields, which have the largest reserves. YPFB Andina plans to invest $251.6 million in exploration and production during 2014. Rio Grande field, operated by YPFB Andina, increased its natural gas production from 71,000 cfd to 78,000 cfd thanks to the production from RG89D.

YPFB Petroandina S.A.M., a JV between YPFB (60%) and Venezuela’s PDVSA (40%), began oil and gas exploration and development work last September with the drilling of the Timboy X-2 exploratory well, Fig. 3. Bolivia’s first bi-national well, the project is utilizing the rig PDV 08, under contract for a 10-month term, for a targeted 5,000-m depth.

|

| Fig. 3. The Timboy X-2 exploratory well is a project resulting from a JV between YPFB and Venezuela’s PDVSA. |

|

Compañía Mexicana de Exploraciones S.A. (Comesa) is studying 25 potential fields for YPFB, with the goal of identifying 10, where exploratory drilling can begin. Bolivia’s gas reserves increased by 1 Tcf, and its crude oil reserves by 50 MMbbl, thanks to a discovery at Lliquimuni field in northern La Paz. YPFB began drilling the first well in this field in April of this year.

ARGENTINA

Canadian company Argenta-Azabache hit oil at the beginning of March while drilling an unconventional exploratory well in the area of Covunco Norte-Sur in Neuquen Province, with promising potential. Wildcat well Cvo.X-2 hit oil in the Vaca Muerta geological formation. According to the Energy Secretariat of Argentina, YPF’s crude oil production increased 9.8%, and natural gas output rose by 9.2%, during March 2014, compared to production levels in a year earlier.

YPF said that it increased its crude oil and natural gas reserves by 11% last year. Its combined crude oil and natural gas reserves increased from 979 MMboe to 1.083 billion boe.

At the beginning of the year, YPF announced a new conventional crude oil discovery in the Rio Negro Province, with an estimated 15 MMbbl of reserves. The Caldenas X-2 well was drilled to a depth of 3,154 m in the Los Caldenas block. Another important discovery in Mendoza was announced by YPF last November in the El Manzana block, where exploratory well Valle X-1 found an estimated 15 MMbbl of crude oil. Chevron will drill 140 wells in Vaca Muerta field this year, utilizing 17 rigs. Exxon Mobil has already drilled 11 wells, and is still exploring an area of 400 hectares in Vaca Muerta.

CHILE

National oil company ENAP continues to advance its natural gas business in Chile, recently signing a contract to provide LNG in the north of the country to the electrical generating company, E-CL (owned by GDF Suez). The contract is for an LNG vessel containing 130,000 m3, to be delivered to the port of Mejillones later this year. ENAP’s goal is to triple natural gas production in Magallanes by increasing non-conventional output (tight and shale gas) from 150 Mcmd out of three wells in 2013, to 600 Mcmd–700 Mcmd this year. Adding its conventional gas production to the new unconventional output, ENAP would then produce 1.4 MMcmd. This massive increase would be achieved by bringing into production 14 wells that were drilled last year, and on which ENAP intends to use fracing technology, which will allow the extraction of unconventional gas. ENAP anticipates spending $150 million of its total budget of $400 million to drill 32 new wells (21 natural gas and 11 crude oil) to locate new unconventional reserves.

PERÚ

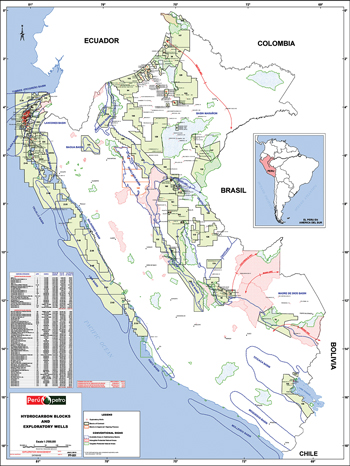

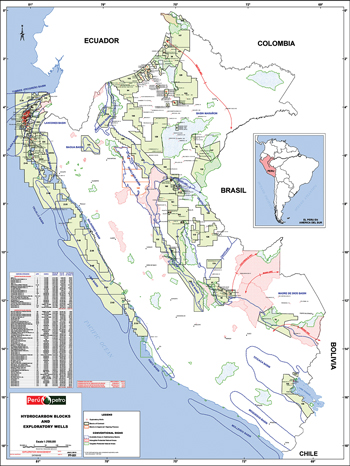

Jorge Merino, the Minister of Energy and Mines of Peru, stated that his country will increase its crude oil production 10%, due to the discovery of new oil fields by Perenco and Gran Tierra Energy, Fig. 4. Current natural gas production is at 1.24 Bcfd, which is an increase of 5% over 2013 production numbers (1.18 Bcfd). Perenco has begun producing heavy crude oil in Lot 67, and Gran Tierra Energy recently announced a find at Bretaña Norte 95-2-1XD exploratory well in Lot 95. Crude oil production in Lot 67, operated by Perenco, started at 1,000 bpd in 2013 and is expected to be 6,000 bpd in 2014. Repsol is going to invest $808 million to explore for natural gas and liquids in Lot 57, where natural gas production this year started at 85 MMcfpd and 5,180 bpd of NGLs. It is expected to peak in 2018, with production levels of 210 MMcfpd of natural gas and 12,000 bpd of NGLs. Estimated natural gas reserves for this field are 0.96 Tcf and 54.7 MMbbl of NGLs.

|

| Fig. 4. Map of the available oil fields in Peru 2014. Source: Perupetro. |

|

Offshore, BPZ Energy spudded a development well, the A-18D, at the Albacora field platform, in Block Z-1. Also, Karoon Gas Australia passed environmental regulations to begin drilling up to 10 exploration and 10 appraisal wells in Block Z‐38 in the Tumbes basin, off the northwest coast. ION Geophysical has been awarded permits to acquire 12,600 km of 2D seismic data from the Talara basin to the Pisco basin.

URUGUAY

French oil company Total, which is exploring for hydrocarbons off the coast of Uruguay, will drill its first well in October 2014, according to a recent announcement from state energy company ANCAP.

The third round of lease offerings, called Ronda Uruguay III, will take place near the end of next year. Uruguay will allow international companies to bid on blocks of offshore areas. Thanks to the leases sold during Rounds II and III, Uruguay will be assured an investment of between $500 million and $2 billion, which will surely increase, once exploration is completed, and they enter a production phase. After more than 30 years without any seismic studies conducted on land, North American company Schuenbach Energy will begin exploration in Uruguay next May. Schuenbach will begin conducting 2D seismic surveys in the states of Salto, Paysandu and Tacurembo.

MEXICO

Pemex has announced that it intends to invest $27.7 billion in exploration and production of crude oil during the coming year. This is the largest investment that the Mexican state-owned oil company has ever made, and 6.5% more than what it spent in 2013. This investment is a drastic increase over what it spent 10 years ago and reflects an increase of 154%. Work on the Exploratus-1 well in the “Cinturon Plegado Perdido” began in November 2013, and oil was found at a depth of 3,600 m. Drilling continues and is expected to reach 6,130 m in about three months. There are currently no production estimates, but Pemex hopes that it will yield between 150 MMboe and 200 MMboe.

HONDURAS

BG Group began exploratory work along the Caribbean coast of Honduras in February. The agreement signed in December 2012 stipulates that BG Group will pay Honduras an undisclosed amount. BG Group will operate in an area measuring 300 sq km on the Mosquitia coast. BG Group will invest about $300 million over the next three years to explore 30% of the coast of Mosquitia. In the 1960s, a North American company discovered traces of oil in this region.

TRINIDAD & TOBAGO

The Energy and Energy Affairs Minister, Kevin Ramnarine, has concurred with the Central Bank’s finding that there was 2.4% growth in the energy sector, in the fourth quarter of 2013. This growth was driven by higher natural gas output and high oil production. This was after the largest maintenance program in the history of the country, which was conducted by BP, BG, Point Lisas companies, and Atlantic and coordinated by the NGC and the Ministry of Energy and Energy Affairs.

Natural gas production will soon commence at the BP Savonette 7 well, along with BP’s Juniper development drilling on Amherstia by BP, and the BG/Chevron Starfish development.

There are eight offshore rigs operating in local waters and BPTT’s Savonette 6 well will be coming online later this year with the company already beginning to drill Savonette 7.

With Savonette 6 going online, natural gas production from the Savonette facility will have a capacity of 900 MMcmgd. For this year, 11 exploration wells are expected to be drilled, 10 offshore and one on land. The Ministry has now signed seven deepwater production-sharing contracts valued $1.9 billion. BPTT plans to invest $6 billion in this country in the next five years.

LIBRA PRODUCTION MAY SURPASS MARLIM FIELD

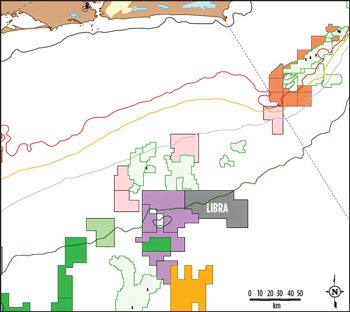

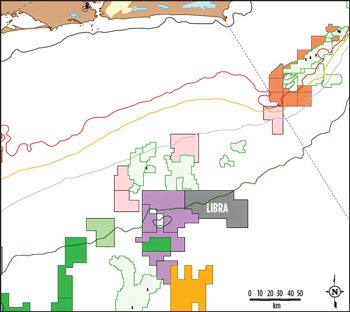

Plans for Brazil’s Libra field call for a production rate of more than 1 MMbpd from a field estimated to hold 12 billion to 15 billion bbl of oil. If this is achieved, Libra will easily surpass Marlim field in the Campos basin, which has been responsible for some 90% of Brazil’s total average output of 2 MMbpd.

Libra was discovered in 2010 with well 2-ANP-0002ARJS. Petrobras sources say that the exploration phase is expected to be completed by 2017, and will include 3D seismic studies, as well as drilling and testing of two exploratory wells and one extended well. In the second half of 2014, two wells will be sunk, with an expected completion in the first half of 2015. An extended well will be drilled for testing at the end of 2016.

Libra will have nine FPSO units linked to 92 production wells and 92 injection wells. Oil from the field should start flowing in 2020, with an initial flowrate projected to be 25,000 bopd from each well, after which one platform per year will come onstream, each one capable of producing 150,000 bpd.

The estimate is that in 2031 production will peak at 1.4 MMbopd, equivalent to 65% of the present petroleum production in the country, 2.2 MMbopd. Petrobras geologists say that Libra field could produce more than 1 MMbopd, twice the output of Ecuador, an OPEC member. By 2017, Brazil should become self-sufficient in petroleum, and even an exporter.

The Brazilian government will take at least 70% from the Libra field, including taxes, a signing bonus, and so-called “profit oil” that companies must pledge when winning a stake in the field. “The figure of 70% may seem like a lot, but countries such as Libya and Venezuela take an even larger chunk of oil projects,” said Magda Chambriard, general director of the National Petroleum, Gas and Biofuels Agency (ANP). According to ANP, reserves at Libra could reach 15 billion bbl, almost twice the initial estimates. If this figure proves to be right, it would be greater than Brazil’s total proven reserves of 14 billion bbl.

Oil was discovered below a layer of salt in the field’s first exploration well, according to a statement from ANP. It lies more than 2,000 m under water and about 5,000 m further below sand, rock and a shifting layer of salt.

Analysts say that the pre-salt region of the Santos basin, off the coasts of Rio de Janeiro and São Paulo states in southeastern Brazil, has yielded the largest discoveries outside the Middle East in the past decade. In October 2013, a consortium of Brazil’s state-owned Petrobras, Shell, French Total and Chinese companies CNOOC and CNPC won a 35-year concession for the development and exploitation of the field, Fig. 1.

|

| Fig. 1. Libra was the first of the pre-salt oil fields to be auctioned off under the new production-sharing regime. |

|

In bids unrelated to the pre-salt, oil blocks were awarded to the consortium that was offering to pay the government the largest share of profits, but Petrobras must have at least a 30% stake in any consortium.

Shell and its consortium partners will start drilling at Brazil’s Libra deepwater oil field in 2014, CEO of Shell Brasil, Andre Araujo, told the local press.

MARLIM OIL FIELD, CAMPOS BASIN

Marlim is a giant Brazilian oil field in the northeastern part of the Campos basin, about 110 km offshore Rio de Janeiro, in water depths ranging from 650 m to 1,050 m. The field produces around 390,000 bopd and 252,000 bbl of water per day (bwpd). About 705,000 bwpd are injected into the field.

Discovered with well 1-RJS-219-A in February 1985, Marlim reservoir was estimated to hold an oil-in-place volume of about 9 billion bbl and an expected 1.7 billion bbl of oil in recoverable reserves. Now, Marlim has some 102 production wells and 50 injection wells. Over 80 km of rigid pipelines and 400 km of flexible lines have been laid on the field. The current development stage of Marlim field will include seven floating production platforms and one floating storage unit.

FMC Technologies secured a $90-million contract to provide a subsea separation system for the project in August 2009, representing just a small portion of the $5 billion total investments over 15 years. The company worked in water depths of about 900 m (2,950 ft), including a subsea separation module that segregates heavy oil, gas and sand.

Recent production increases were mainly influenced by the start-up of new wells on platforms P-26, in Marlim field, and P-56, in Marlim Sul field, both in the Campos basin. These new wells have offset the reduction associated with the scheduled maintenance shutdown of platform P-53, which began at the end of November and was completed in December, and the production shutdown of P-20, in Marlim field, beginning December 27, to repair damage caused by a fire in the chemical products unit of the platform. Up to that point, this unit had been producing 22,000 bpd, and the interruption during the last five days of 2013 affected the month’s average production by 3,500 bpd. The unit restarted production in the first quarter of 2014.

|

|