Maximizing efficiencies in an era of evolution

Over the past 50 years, technology across every sector has evolved exponentially. Computer processing power has doubled roughly every 18 months since the mid-1960s. The Internet has exploded, from a small research network into a sprawling system of more than 3 billion users, and computers that once filled rooms now fit into our pockets.

Technological transformation is rapidly changing our everyday lives. And while today’s most buzzed-about innovations—smart phones, self-driving cars, augmented reality—are largely in the consumer space, equally significant and impactful advancements are happening in the industrial space, and most certainly within the oil and gas industry. Technology’s biggest impact has been—and will continue to be—improved efficiency.

INNOVATION IN THE SHALE PATCH

Finding better and more efficient ways to operate has long been essential to thriving in the oil and gas industry, and the advancements in technology and tools—and the smarter application of each—have resulted in exponential increases in efficiencies, particularly during the last few years.

The impact of innovation and technological advancement has been especially important in shale fields. This seems appropriate, given that the shale boom of the 2010s was made possible by innovations from decades earlier, thanks to George Mitchell, the “father of fracing.” Considered by some to be this century’s greatest innovation to date, technology to extract oil from previously unyielding shale was not, in reality, a new technology. Rather, it resulted from advancements in two technologies, beginning in the late 1990s. This ushered in the shale era and the transformation of the U.S. oil and gas industry.

As the oil and gas industry faces the many challenges brought forth by the volatile price environment, achieving increased efficiencies, through the application of new technology and tools, can make the difference in surviving—or even thriving in—the downturn.

Understanding this necessity to evolve, operators have embraced smarter applications of technologies in new and different ways. For the shale patch, this approach allows producers to more effectively drill horizontal wells, to significantly reduce drilling costs, and to push the limits of lateral length to greater distances.

FORECAST FOR CONTINUED ADVANCEMENT

The U.S. Energy Information Administration (EIA) reported recently that the future of U.S. shale oil will largely be determined by how quickly drilling technology can evolve over the next 25 years. While the decline in U.S. shale oil production is likely to continue through next year, the EIA forecasts that rapid technological advancement and high oil prices could, eventually, push shale production up from a predicted 4.2 MMbopd in 2017, to 12.9 MMbopd by 2040. The EIA attributes most of this increase to “higher oil prices and the ongoing exploration and development programs that expand operator knowledge about producing reservoirs.”

As progress continues to accelerate, we must continue to innovate through experimentation, sharing of best practices, and thoughtful application of new and existing technologies.

Today, there are four key areas that shale producers must target, to maximize those efficiencies and create the most value to boost the bottom line: drill bits and cutter development; surface drilling equipment; directional drilling tools; and pad drilling.

In my estimation, operators have realized a more-than-35% increase in efficiencies through these methods over the past eight years, and there is potential for an additional 15%-to-20% jump over the next two years, based on the accelerated rate of innovation in the industry, born out of ingenuity, technological advancements and the simple desire to survive.

DRILL BITS AND CUTTER DEVELOPMENT

The drill bit has shaped the drilling industry more than any other tool or technology over the past 35 years. With continued improvements, it is a prime example of a technological advancement that is leading to a swift evolution in drilling techniques.

The combination of polycrystalline diamond compact (PDC) bit development, cutter placement in the bit, cut depth, range of cutter sizes incorporated into the bit, and the number and type of blades on the bit, have all contributed to the greater efficiency of the PDC bit.

Industry has evolved from crushing rock with tricone insert bits to shearing rock with PDC bits as a primary means of drilling a new hole. Of course, applications remain for tricone and tungsten carbide insert (TCI) bit drilling, but PDC cutter development has enhanced our ability to drill through rock that was previously thought to be too abrasive or too hard.

Three or four bits were once needed to drill a particular hole section. Today, drilling deeper with the surface casing drill-out bit—and being able to use larger, 13-mm PDC cutters in that bit—has allowed many operators to drill intermediate holes with just two bits, without having to sacrifice rate of penetration (ROP). Plus, today’s bits, used for drilling production holes, are designed to minimize reactive torque, thus allowing directional tool face to be maintained more easily while drilling the curve, as well as helping the bit to drill in zone.

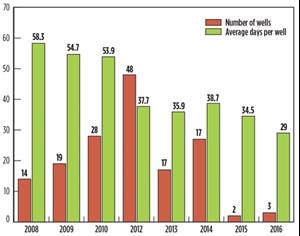

Enhanced PDC bits can not only be controlled by directional drillers, without a significant loss in penetration rate, but they also can drill rock faster. Based on my experiences in drilling Haynesville shale horizontal wells in North Louisiana less than a decade ago, it required an average of 54 days to drill each 4,300-ft lateral well to approximately 16,800 ft, MD, from spud to releasing the drilling rig. Since then, the number of bits required to drill Haynesville shale wells has dropped, while the increased ROP has continued to climb for each type of bit being used in the well. As a result, by 2015, the same type of well could be drilled in approximately 34 days, Fig. 1.

SURFACE DRILLING EQUIPMENT

While drilling rig equipment has not evolved as quickly as the PDC bit, it has undergone significant enhancements and, among the key areas described here, may have the most potential for increased efficiency in the future.

Directional and horizontal wells became significantly less difficult to drill, through the advent of alternating current (AC) drive drilling rigs, with joystick driller’s consoles and top drives; however, as horizontal wells are pushed further and further, operators must look at the pumping capabilities of each rig for every type of horizontal well that they drill.

For example, when horizontal shale wells were first developed, Louisiana state regulations were in place that generally limited wells to approximately 4,600 ft of lateral length and required the operator to stay within one section. This allowed drilling rigs with 5,000-psi pumping systems to effectively drill wells to 16,000 ft, MD. But as the industry has pushed to be more efficient in drilling laterals and developing reservoirs, the lateral lengths of horizontal wells have increased to 7,500 ft, and then stretched even more, to 10,000 ft.

The 5,000-psi pumping systems could not perform efficiently at new MDs of 19,000 ft to 21,000 ft, while having to drill and rely on extremely low hydraulic horsepower at the bit. Consequently, operators tasked drilling contractors with upgrading their pumping systems to 7,500 psi.

Today, pumping systems that can handle 7,500 psi are a standard request by many operators to drilling contractors. Operators will continue seeking rigs that can pump at even higher pressures, allowing drilling engineers to design for, and obtain, higher flowrates with more pressure drop across the bit. As a result, we’ll continue to see the ROP increase, thanks to continued innovation in this area.

DIRECTIONAL DRILLING TOOLS

Directional drillers cannot do their jobs effectively without directional survey tools and mud motors. And when these tools fail, the result is incredibly costly and time-consuming.

Adjustments in the way that a mud motor is set up, such as the number of power stages and the rotor stator fit, are necessary to match the hole conditions that will be encountered in the drilling of the lateral. Mud types, mud properties and knowing the maximum bottomhole temperature that the tools will be working in, are critical in properly setting up the directional drilling tools.

Because these tools are so crucial, industry has worked to improve them by enhancing rotor and stator materials, as well as by advancing the equipment’s design. The result has been increased performance of directional drilling tools, including, for example, a shorter bit-to-bend, and even-wall type mud motors that have allowed for greater torque output and better curve-building performance without sacrificing steerability or ROP.

We’re seeing better results, due to these enhanced tools, which have made it easier and faster to make more accurate curves. The process of building an angle is also becoming more predictable. In 2010, typical curves were drilled in approximately seven days. Fast-forward to today, and typical curves are being drilled in half the time, roughly three-and-a-half days. Personally, I have been able to drill the curve in as little as two days.

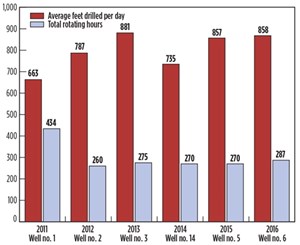

In the East Texas Haynesville shale area, specifically, I have observed improved results in drilling time for the curve and laterals through the use of larger-diameter directional drilling tools that are stiffer and allow for better control of curve building, Fig. 2.

And, as downhole mud motor performance improves, operators have been able to rotate the drill string more in the lateral section of the well, meaning a higher ROP in this section, and less time spent on sliding and making directional corrections.

PAD DRILLING

Because, by definition, horizontal wells require some directional drilling for every well, operators realized that drilling multiple wells from one general surface location would result in substantial cost- and time-savings. Thanks to pad drilling, operators no longer have to rig down, move the rig and rig back up between wells. By realizing these efficiencies, the time to move a drilling rig between wells can be cut by more than 75%, as compared to just four to five years ago, when moving from one well to another could easily require more than four days.

It has become a common practice in the industry today. Depending on the shale play, a drilling pad location may contain as many as six to 10 wells; at least three to four days per well can be saved by drilling them all on the same pad. Operators also should be taking advantage of the ability to have multiple frac crews on the pad location at one time, and being able to frac several wells at the same time, once the drilling rig moves off.

Additionally, now that walking packages are available for drilling rigs, walking from one well to the next, using the same mud system to drill and run casing on multiple wells, has become much easier, and the rig can move between wells in just a few hours.

This also allows the drilling rig to work backwards, drilling each production hole with the same mud system. This technique requires the operator to change out the mud system just once while drilling multiple wells on a pad.

An obvious downside to pad drilling is a large capital expenditure that is caused by drilling several wells from a pad before completion operations can begin. However, on several occasions, I have worked with multiple rigs on one pad, to speed up the completion process. This allowed for the drilling time to be cut in half, while drilling a total of six wells and being able to start the completion of the horizontal wells sooner.

In the future, if there are multiple horizontal objectives within a given area, I can foresee that each horizontal play could be drilled at different times from the same pad, without the concern of communication with an old wellbore or frac.

ON THE HORIZON

While operators should evaluate each of these areas for cost- and time-savings, I believe that cutter and bit technology will remain the major factor in continued reduction of drilling costs, and surface drilling equipment improvements will follow closely behind in maximizing efficiencies. Additionally, wired drill pipe—which is already available—is just another example that could allow for faster detection of changes in hole conditions and tool wear or failure, which could help prevent stuck pipe and fishing operations.

The many new opportunities for greater efficiency in shale production not only show industry’s impressive evolution in recent years, but also indicate how much advancement is to come.

For operators, keeping up with the latest techniques and technologies that impact the bottom line can be the difference between success and failure. Through sharing of best practices and experimentation, they should proactively seek out and employ tools and techniques for increased efficiencies. Industry’s determination and ingenuity, paired with the rapid pace of technological advancements, can enable a successful path forward. ![]()