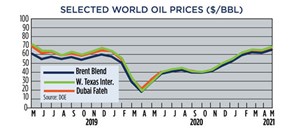

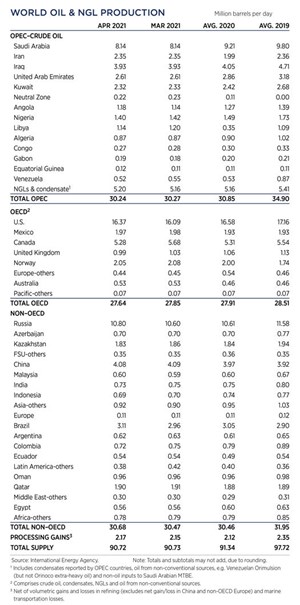

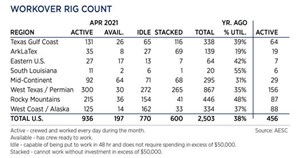

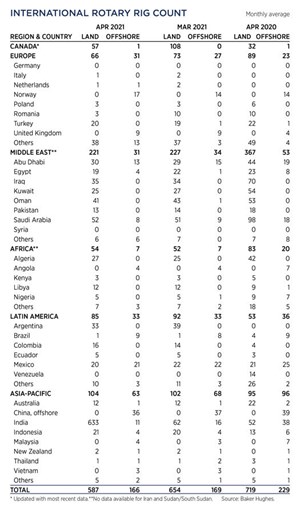

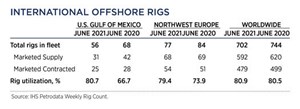

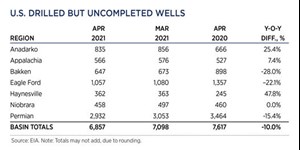

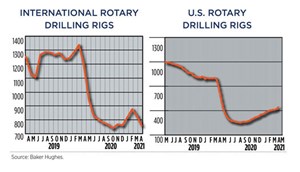

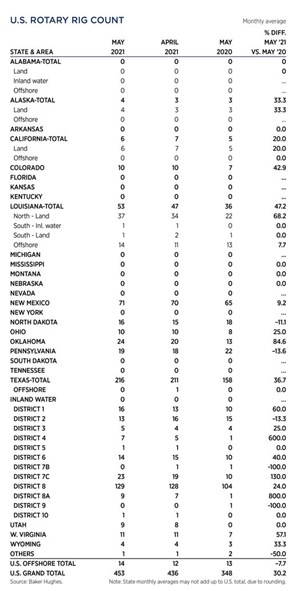

Constricted supply, coupled with growing demand, pushed Brent to a two-year high of $73/bbl in June. Traders forecast another $5/bbl increase, and a new commodity “super-cycle” could cause oil to spike at $100/bbl, due to surging consumption and temporary imbalances triggered by Covid-19 and the subsequent rebound. Saudi Arabia’s energy minister also warned that a lack of new exploration investments could exacerbate the problem. Despite a 6,857-DUC backlog, escalating oil prices caused a surge in U.S. drilling activity, with an average 453 rigs working in May. That’s 17 more, compared to April (+4%), and 105 rigs more than reported in May 2020 (+30%). The majority of this gain was in Texas (+5), Oklahoma (+4) and Louisiana (+3). International activity, including Canada, averaged 753 rigs in April, 70 fewer (-9%) than in March.