Mid-Year Forecast: International operators make their way forward carefully

In the months following our February 2021 forecast, it initially appeared as though some stability was primed to return to the global drilling market. However, a fresh round of lockdowns, travel restrictions, and whipsawing demand projections—based upon the impacts of the Delta variant—made quick work of those expectations. Inflation, commodity shortages and a potentially unprecedented shortfall in natural gas stockpiles, just as the Northern Hemisphere prepares for winter, make shorter-term projections challenging once again.

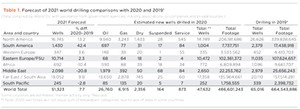

North America, South America and the Far East (principally China) are projected to lead global drilling growth, while Russia, Eastern Europe and Western Europe look to track or slightly exceed 2020’s performance. Meanwhile Africa, the Middle East and South Asia are still sorting out market expectations and thus are showing appreciable declines in drilling, although 2022 will likely be a far better year for these areas. For 2021, World Oil foresees a total of 51,323 wells drilled worldwide, a 7.7% increase over 2020 rates, Table 1. If the U.S. is left out of the total, then the rest of the world will be up 8.2%, at 38,871 wells.

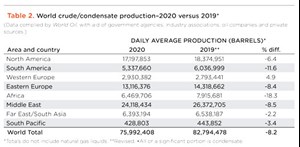

On the production front, thanks to the Covid-19 pandemic and greatly reduced demand, global oil and condensate output dropped 8.2%, to 75.992 MMbpd, Table 2. Seven out of eight regions saw declines in oil production during 2020. Ironically, the region that showed an increase was Western Europe, up nearly 5%. This region posted a gain strictly on the strength of a 258,000-bpd increase in Norwegian oil output.

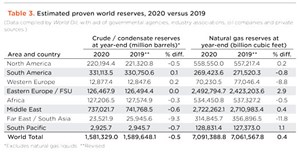

Given the reduced drilling rates worldwide, and the palpable dearth of exploration globally, it is not a surprise that oil reserve figures fell last year, Table 3. Global oil and condensate reserves fell 0.5%, to 1.581 trillion bbl. Natural gas reserves increased 0.4% to 7,091.4 trillion cubic feet.

NORTH AMERICA

Outside the U.S., North American drilling is slated to increase 39.6% during 2021, with strong growth in Canada offsetting a primarily politically driven decline in Mexico.

Canada. Prime Minister Justin Trudeau’s narrow victory in a September snap election ensures that his climate-forward economic policies will become more ingrained in the country’s energy industry. A carbon tax, set to reach US$170 per ton by 2030, will stand, as part of Trudeau’s plan to force energy companies to enact carbon neutrality measures that will achieve net zero emissions by 2050.

Despite the shock to the industry from the cancellation of the Keystone XL pipeline, there are yet other means emerging to deliver Canadian crude to key export markets. As one example, Enbridge’s Line 3 pipeline, transporting oil sands product from Alberta to the U.S. state of Wisconsin, is continuing to move forward, with key legal victories on both sides of the border. An improving regulatory climate for transportation infrastructure, plus growing demand in the U.S., leads the Canadian Association of Petroleum Producers to anticipate drilling to increase 42.8% in 2021.

Mexico. The uncertainty surrounding President Andres Manuel Lopez Obrador’s Mexican Energy Reform Program, designed to reverse efforts to open Mexico’s oil and gas sector to third parties, was well and truly settled when the government took operational control from Talos Energy for its Zama field and handed it over to national partner Pemex. In an effort to support what amounts to the re-nationalization of Mexico’s oil and gas industry, AMLO recently approved a $32 billion budget for Pemex to boost domestic oil production. The generous outlay, to help Pemex lead Mexico to energy self-sufficiency, will be instrumental in ensuring that Zama field is able to operate to its full potential. While the president focuses closely on oil output, we expect the number of wells drilled this year to decline 3.4% from 2020’s level.

SOUTH AMERICA

Continued success in offshore exploration, coupled with increasingly cooperative national-level leadership, will make South America a bright spot for oil and gas operations in 2021. Even with the continued disintegration of Venezuela’s oil industry factored in, South American drilling is set to reverse a multi-year decline trend, with drilling forecast to increase 42.4% in 2021.

Brazil. While South America’s biggest oil and gas producer is focusing on existing production (Fig. 1) in the very near term, Brazil is anticipated to undertake several key exploration projects that will make it the global leader in offshore oil production as soon as 2025. As many as 29 new crude oil projects will start in the next four years, with keystone operations Bacalhau, Lula Oreste and Buizos V (Franco) combining to deliver 44% of Brazil’s crude and condensate production in 2025. Until those projects start, however, drilling in Brazil is projected to decrease 21.7% this year. Last year, Brazilian oil output grew ever closer to the 3.0 MMbpd mark, averaging 2.940 MMbpd.

Colombia. Growing momentum in the exploration of unconventional assets sets Colombia as the clear leader in Latin American drilling, with new wells drilled expected to increase 33%. A push to replace output from conventional onshore fields, which have been in production for decades, is also driving offshore exploration interest. Growing rig fleets in Guyana, Suriname and Brazil are putting Colombian waters in their sights, but none of the new offshore blocks are in production yet. With average oil production sliding 11% in 2020, Colombia is motivated to create a positive fiscal and political environment for drillers.

Venezuela. Any sort of improvement in Venezuela’s oil and gas operations is far in the distance, in spite of oil minister Tareck El Aissami’s assertions that crude output will quadruple by the end of the year. All that depends on tens of billions of dollars in investment that are unlikely to materialize, particularly after the Biden administration signaled no intention to dial back sanctions. Demonstrating that a financial breakthrough is unlikely, Equinor and TotalEnergies both relinquished joint venture positions in a key PDVSA oil production operation in the Orinoco Belt. Based upon these realities, World Oil expects drilling to decrease 30.6% in 2021.

Argentina. Building upon its $5.1 billion subsidy program to encourage domestic shale gas production, Argentina’s government is working to set ceiling and floor prices for domestic crude. The goal is to prevent surging consumer prices, while ensuring operators maintain interest in regions like Vaca Muerta (Fig. 2) when prices decline. These new initiatives, plus other infrastructure projects announced earlier this year, will help Argentina’s 2021 new well count to rise 74.9% to 668.

Guyana and Suriname. Among the world’s most exciting offshore exploration opportunities, Guyana and Suriname continue to pay off with new oil and gas discoveries. ExxonMobil has tallied several new discoveries offshore Guyana this year, going so far as to consider selling down its interest in Iraq’s West Qurna-1 field to focus on this new Latin American frontier. New wells drilled in Guyana and Suriname are expected to increase 33.3% during 2021.

WESTERN EUROPE

Rapidly shifting political attitudes are swiftly, and in some cases severely, impacting the future of oil and gas, particularly in the North Sea. A stem-to-stern reassessment of how the continent wants to approach a post-fossil fuel society is facing the harsh reality of meeting growing energy demands when the winter sun is weak and the winds don’t blow. Two very different outcomes are emerging as a result. Meanwhile, regional drilling is set to increase a modest 3.6%, to 347 wells.

United Kingdom. Bowing to pressure from green parties, Scotland’s First Minister, Nicola Sturgeon, is calling for a “reassessment” of oil and gas drilling permits in the UK sector of the North Sea. Siccar Point’s Cambo development has seen its permit called into question as a result, with more to follow. For the time being, these reassessments only apply to issued permits that have not yet seen drilling activity. A similar legislative threat saw drilling rise in the New Mexico sector of the U.S. Permian basin on existing permits, which in part explains a 9.6% increase in wells drilled for 2021.

Norway. The North Sea stalwart may be the world’s most stable oil and gas region, tallying years of regular oil and gas development growth (Fig. 3). Norway’s approach to decarbonization, namely finding ways to make fossil fuel production more efficient and environmentally friendly, has more than a little to do with this continued growth. The Norwegian people seem satisfied with this more holistic approach to energy production, recently voting in a pro-oil coalition government in advance of key UN COP26 climate talks. Many in the UK likely support Norway’s approach as well; A 1,400-megawatt power transfer cable was recently installed to export Norwegian electricity to England, as it faces shortfalls from under-performing wind installations. As such, Norway’s 2021 new well count is projected to decrease 1.8% from the prior year.

EASTERN EUROPE/FSU

Russia. After the wild swings experienced last year, total oil and gas output is expected to approach post-Soviet highs in 2022, with near record production continuing through 2024, according to Russia’s finance ministry. Relaxed OPEC+ production curbs, plus the need for more gas to fill the Nord Stream 2 pipeline, are key drivers. While drilling (Fig. 4) is projected to increase by only 1.2% in 2021, that still amounts to more than 9,000 new wells drilled. Basically, Russian drilling is returning to 2019 levels in most parts of the country.

Other FSU countries. After taking a bit of a pause in 2020, the two top drillers, Kazakhstan and Azerbaijan, are set to resume a heavier drilling schedule this year. Several other countries are expected to have moderate drilling increases, as well. The dip in development drilling last year caused oil production in the region to fall 6.9%, to 2.784 MMbpd.

Romania. The country’s dominant operator, OMV Petrom, said that it will maintain oil production (Fig. 5) decline at around 6% y-o-y in Romania, excluding portfolio optimization, which “will continue to focus on the most profitable barrels.” The company also will transfer 40 marginal fields in southern Romania to Dacian Petroleum, with closing expected in second-half 2021. The firm plans to drill around 35 new wells and sidetracks and perform around 700 workovers this year, versus 63 new wells and sidetracks and 830 workovers in 2020.

AFRICA

Following an uptick in drilling in 2019 and 2020, wells drilled in the region are expected to decline 10.4% in 2021. Oil production last year was off 18.3%, to 6.470 MMbpd.

Egypt. Undertaking historic efforts to open up its economy, Egypt is splitting out as many as ten separate companies from its National Service Products Organization, structured as part of the defense ministry. The first of these efforts, to sell joint full ownership of Wataniya Petroleum, saw heavy interest from Middle Eastern energy majors. Drilling is expected to decline 1.6% percent in 2021.

Libya. Power struggles continue to threaten Libya’s oil industry recovery, with output leveling around 1.2 MMbpd in 2021. The transnational government currently in power is set to step down in December following new elections–if the vote takes place peacefully, it could reconcile rival factions and end hostilities in the country. World Oil projects a 7.5% increase in drilling during 2021.

Nigeria. The recently passed Petroleum Industry Bill, languishing since 2008, endeavors to create a stable environment for foreign investors, backed by a transparent and strengthened regulatory framework. With historic operators like Shell working to end their operations in Nigeria, as focus shifts to renewables, and Nigerian crude shipments struggle to find buyers in a frantic market, energy reforms can’t come soon enough. We predict that drilling in Nigeria will decline 39.1%. Nigerian oil production (Fig. 6) fell 11.4% last year, to 1.754 MMbpd.

MIDDLE EAST

A multi-year trend of reliable drilling growth in the Middle East appears to be nearing an end, as the region’s key players turn their attention to building economies less reliant on oil and gas revenue. The measured approach to meeting future global needs for renewable technology and hydrogen being taken means that, even if the fossil fuel mix changes, the Middle East will be the seat of energy technology leadership well into the future. As such, World Oil expects drilling activity in the Middle East to post a 20.8% decrease in 2021.

Saudi Arabia. The kingdom finds itself on the horns of a dilemma, as it continues to guide OPEC through a period of production discipline (Fig. 7) to stabilize global oil prices. Stiff competition for Asian markets has required outsized attention, and region-specific discounting, to maintain reliable market share. Meanwhile, the government is working to monetize oil and gas assets, including the unprecedented move to invite foreign investment into a new, $110 billion Japura unconventional gas project. These funds will be used to help broaden Saudi Arabia’s energy mix to include renewables, and to stay ahead of Saudi Aramco’s $75 billion stock divided obligations. Drilling is projected to decline 34.1% in 2021.

Iraq. The Middle East’s second-largest oil producer is the subject of multinational attention, as OPEC members seek to ensure political stability in the conflict-prone nation. France has committed to maintaining a military presence in Iraq, while TotalEnergies has signed a multi-billion-dollar deal to help boost oil and gas output from Ratawi and other key fields. Iraq’s objective is to minimize reliance on Iranian imports to meet domestic energy needs, and raise oil output beyond the current 4.5-MMbpd average. We expect new drilling to decline 22.3% in 2021.

UAE-Abu Dhabi. Energy Minister Suhail Al-Mazrouei has taken an aggressive stance to grow the UAE’s oil output capacity, seeing an opportunity to win market share from other nations keen to end fossil fuel production. In the midst of a bruising battle with OPEC over production quotas that brought the long-term viability of the cartel into question, the UAE also took several steps to increase domestic and foreign investment in production capacity. Building a financial war chest through new lease agreements and IPOs of key state-owned businesses positions the UAE to pivot quickly, as global demand expands quickly to include hydrogen and LNG. As the dust settles from these financial maneuvers, new drilling is expected to decline 20.9% in 2021.

Oman. The largest oil producer in the Middle East outside of OPEC continues to quietly lead development drilling in the region. State-owned firms are working to raise as much as $3.5 billion of foreign debt, as part of Sultan Haitham Bin Tariq’s plan to leverage increased production to breathe life into Oman’s faltering economy. Total drilling volume will handily lead Middle East peers, despite a 7.8% decrease over the year prior.

Turkey. President Recep Tayyip Erdogan has made improving Turkey’s energy independence one of his top priorities, and efforts to increase domestic supply are paying off. In June, state energy company TPAO found 135 Bcm of gas with its Amasra-1 offshore well in the Black Sea, bringing the total amount of deposits discovered over the past year to 540 Bcm.

FAR EAST

China’s drilling programs typically set the pace for the Far East average overall, and this year is no exception. Building upon an already sprawling drilling program, China will help lead the region to a 9.8% increase in wells drilled for 2021.

China. Wary of its dependence on foreign imports, China has granted PetroChina a $37 billion capex budget for 2021, making it the world’s most active oil company. In addition to domestic development, China is also purchasing large shares of foreign energy projects, including a 49% stake in Aramco Oil Pipelines Co., and inking a 25-year oil development deal with Iran. In pursuit of its goal of energy independence, drilling in China will increase 10.5% this year. In spite of the Covid-19 pandemic, oil production (Fig. 8) managed to increase 1.7% last year, to 3.895 MMbpd.

SOUTH PACIFIC

Australia. Draconian Covid restrictions are warping Australia’s approach to its stated goals of increasing tax revenues and meeting domestic energy needs by becoming the world’s largest net exporter of LNG, Fig. 9. World Oil expects drilling to decline 7.4% in Australia during 2021. Oil production was down a minor 2.0%, to 353,597 bpd.

New Zealand. While the country continues to implement a ban on new offshore exploration, thanks to the Labour Party winning an outright victory in October 2020, development drilling is thriving, relatively speaking. After double-digit drilling in 2019, the number of new wells last year dropped to a handful. This year, we expect a return to a double-digit number of wells, and it is likely to exceed 2019’s level, with about 60% onshore and 40% offshore.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- Oil and gas in the Capitals (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)