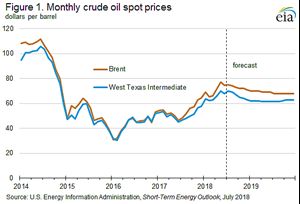

EIA expects crude to average $73/bbl during second half of 2018, fall to $69/bbl in 2019

WASHINGTON, D.C. -- In the July 2018 update of its Short–Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) forecasts that Brent crude oil prices will average $73/bbl in the second half of 2018 and $69/bbl in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $7/bbl lower than Brent prices in the second half of 2018 and $7/bbl lower in 2019, Fig. 1.

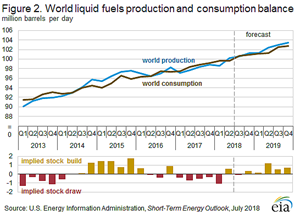

EIA’s forecast of global liquid fuels balances indicates a looser oil market in the second half of 2018 and through the end of 2019 compared with the tight oil market conditions that prevailed in 2017 and the first half of 2018. Although global petroleum and other liquid fuels inventories declined by an average of 0.5 MMbpd in 2017, EIA expects inventories to be relatively unchanged in 2018 and to increase by 0.6 MMbpd in 2019, Fig. 2.

The forecast inventory builds in 2019 are mainly the result of expected liquid fuels production growth in the United States, Brazil, Canada, and Russia. EIA forecasts that these countries will collectively provide 2.2 MMbpd out of the 2.4 MMbpd of total global supply growth in 2019. Supply growth of this magnitude would outpace EIA’s forecast for global liquid fuels consumption growth of 1.7 MMbpd for 2019.

EIA forecasts total U.S. crude oil production to average 10.8 MMbpd in 2018, up 1.4 MMbpd from 2017, and 11.8 MMbpd in 2019. If realized, the forecast level for both years would surpass the previous U.S. record of 9.6 MMbpd set in 1970. Crude oil production at these forecast levels would probably make the United States the world’s leading crude oil producer in both years.

Increased production from tight rock formations within the Permian region in Texas and New Mexico accounts for 0.6 MMbpd of the expected 1.2 MMbpd of crude oil production growth from June 2018 to December 2019. The remaining increase comes from the Bakken, Eagle Ford, other regions in the Lower 48 states, and the Federal Offshore Gulf of Mexico.

However, OECD inventory levels that have fallen below the five-year (2013–2017) average and a forecast of low spare capacity among members of OPEC create conditions for possible price increases if additional supply disruptions occur or if forecast supply growth does not materialize. EIA expects OPEC surplus production capacity to average 1.7 MMbpd in 2018 and to fall to 1.3 MMbpd in 2019, a relatively low level compared with the 2008–2017 average of 2.3 MMbpd. Low OPEC crude oil surplus production capacity can be an indicator of tight oil market conditions. All of OPEC’s currently available surplus production capacity is in Saudi Arabia, Kuwait, the United Arab Emirates and Qatar.

EIA forecasts OPEC crude oil production to average 31.9 MMbpd in 2018, a decrease of 0.6 MMbpd compared with the 2017 level. The forecast decline is mainly the result of Venezuela’s rapidly decreasing crude oil production, which fell to less than 1.4 MMbpd as of June 2018, a 0.6 MMbpd decrease compared with June 2017. OPEC output during the first half of 2018 was also lower as a result of the production caps placed on the group’s producers as agreed upon in the November 2016 OPEC production agreement that aimed to limit OPEC crude oil output to 32.5 MMbpd.

OPEC crude oil production averaged 31.9 MMbpd in June. Although the OPEC and non-OPEC participants agreed on November 30, 2017, to extend the production cuts through the end of 2018 to reduce global oil inventories, tightening market conditions led the group to relax the production cuts starting in July 2018. EIA expects that OPEC crude oil output will decrease by an average of less than 0.1 MMbpd in 2019. This small decline reflects crude oil production increases from some producers that would mostly offset expected combined declines of more than 1.0 MMbpd in Iran and Venezuela.