ONS opens with talk of peak demand, renewables competition

STAVANGER -- As the Offshore Northern Seas (ONS) conference & exhibition got underway on Monday in Stavanger, Norway, it was hard to tell whether it is still mostly a traditional oil and gas event, or whether it has become a renewables advocacy forum. Goodness knows, the rhetoric from several high-profile speakers provided a conflicting impression. Perhaps the organizers intended it to be that way.

In any case, the clearest message delivered was the issuance of greetings to ONS delegates by Norwegian Crown Prince Haakon, as he officially opened the four-day event. In his remarks, the Crown Prince outlined his view on several issues and was easily the least controversial speaker of the morning.

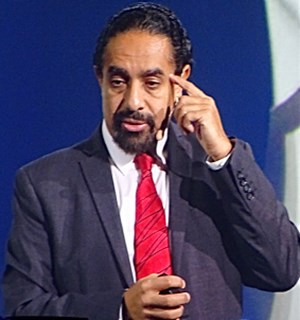

The confusion was started early by the first speaker, Ramez Naam, co-chair for energy and environment, at Singularity University, a think tank in California’s Silicon Valley that also offers educational programs. Naam is also known for authoring The Nexus Trilogy. He strode to the stage, telling attendees to “disrupt yourself,” and learn to embrace new energy technologies that are disrupting the old ways of fossil fuels.

“Technology has a way of disrupting life,” enthused Naam. “For example, in 2011, Peabody Coal was the largest publicly held coal company. Yet, the company declared bankruptcy in 2016. In fact, we had seven large coal company bankruptices. The capitalization of all U.S. coal companies dropped 90% between 2011 and 2016. Sure, they’ve now recovered (via help from President Donald Trump) to being just 75% down, but coal is most likely going to continue to decline.”

In contrast, noted Naam, “renewable fuels are now the fastest-growing energy sector.” He cited the example of wind-driven electricity, which in 1980 costs 52 cents/KWH to produce, while regular coal-fired electricity was at 6 cents/KWH. “About three years ago, I forecast that offshore wind would never be competitive, even by 2030. But I was wrong. It’s down to 4 cents/KWH. And the price of wind power should fall by half again. Also, solar power has gone from $77/KWH to now just 30 cents/KWH. In fact, the price of soar in India has dropped by a factor of four in the last four years. Gas competes with solar and wind, but oil doesn’t.”

Naam also described how lithium batteries are a disruptive technology in making electric cars more viable. So much so, that “we don’t worry about peak oil supply anymore, we now worry about peak oil demand.” He said that in addition to electric vehicles, two other factors help to support the peak oil demand theory, including ridesharing and autonomy (driverless cars). “In the end,” said Naam, “what matters is not the number of vehicles but the number of miles driven. Eventually, the cost of operating an electric vehicle will be down to half that for an internal combustion engine. (Editor’s note: At no time, did Naam ever mention what the fuel source will be, to generate all the extra electricity needed.)

Next up was Equinor President and CEO Eldar Sætre, who sounded like he was trying to work both sides of the street, alternately advocating for oil and gas, as well as renewables. He seemed to start off advocating for the latter, remarking that “change is often perceived as a threat. We should see innovation and change as an opportunity. Things that are constant: 80% of energy supply comes from fossil fuels. But coal needs to be reduced urgently and quickly.”

Yet, Sætre then appeared to swing back to advocating for oil and gas, saying, “the world is heading toward 10 billion people by 2050. Energy will be in even more demand.” He noted that Equinor is working toward cutting its CO2 emissions from operations at its portfolio of assets to less than one-fifth of today’s level. “The best thing we can do right now is to produce the greatest amount of energy with the fewest emissions.”

Following Sætre was his colleague and friend, Patrick Pouyanné, chairman and CEO of Total. “The world needs more energy, but also with more acces to it, better affordability, and it has to be cleaner energy,” observed Pouyanné. With a look toward the future of oil and gas companies, the chairman tried to strike a balance between technologies. “We have to be pragmatic, but also ambitious,” he analyzed. “What I don’t want is to be accused in 10 to 15 years of not developing enough oil and gas. We need to focus on low-cost oil, so that is profitable in 20 years.” Accordingly, said Pouyanné, “we have decided to maintain a certain level of capex, at around $15 billion to $17 billion per year. I think that’s a good figure in anyone’s book.”

Total recently decided to pull out of Iran, where it was developing the massive South Pars gas field offshore, due to renewed imposition of sanctions by the U.S. When asked about the decision, the chairman tried his best to sidestep the issue “I don’t really want to say anything about it, other than we just can’t have exposure to sanctions. We had to pull out.”

Pouyanné said that there is plenty of natural gas on the planet to handle demand, particularly supplies coming from four large gas areas. These include, he said, the Middle East, Australia, the U.S. and Russia. “We strongly believe that the U.S. will be a major factor in LNG production/export,” declared the chairman. In swinging back to renewables advocacy, he also hinted at a new business line for Total: “The world is becoming more and more electrified. We want to get involved in producing low-carbon electricity.”

Toward the end of the session, IEA Executive Director Fatih Birol said that his organization believes that oil usage will remain the same in the near-to-mid term, with gas up and renewables up sharply. He said that he doesn’t see oil and gas disappearing any time soon, although oil usage may begin to decline around 2025.

Birol used that statement as a springboard to lightly scold Haan about his aggressive predictions. “I don’t agree with Haan about renewables outpacing oil and gas so soon. Some usage is irreplaceable; some of the biggest oil demand comes from petrochemicals, trucks, etc. He also noted that renewables have only gone from 2% to 6% of total global energy supply.

And in terms of eliminating coal usage, people need to remember that not all coal-fired generating plants are equal, said Birol. “In the U.S., coal plants are 40 to 45 years old,” said the executive director. “Whereas, in developing countries, they average 11 years old. These countries are not going to shut these plants.” Hence, concluded Birol, some coal usage is here to stay.