Tullow has published it trading statement & operational update

LONDON -- Tullow Oil plc issues this statement to summarize recent operational activities and to provide trading guidance in respect of the financial year to Dec. 31, 2018. This is in advance of the group's full year results, which are scheduled for release on Wed., Feb. 13, 2019. The information contained herein has not been audited and may be subject to further review and amendment.

Paul McDade, CEO, Tullow said:

“Tullow is well-placed to deliver on its growth ambitions. In 2019, we will increase oil production in West Africa, target Final Investment Decisions in East Africa and drill the first wells in an exciting exploration campaign in Guyana. Despite a volatile oil price, Tullow’s improved balance sheet, low cost production and strong cash flow generation, even at lower oil prices, will allow us to both invest for growth and pay a sustainable dividend.”

Trading Update summary

- 2018 full year oil production of 88,200 bopd; 2019 oil production forecast of 93,000-101,000 bopd

- Full year revenue of c.$1.8 billion, additional proceeds of c.$0.2 billion from Corporate Business Interruption insurance

- Strong 2018 free cash flow of c.$410 million, net debt at year-end of c.$3.1 billion and gearing of c.1.9x

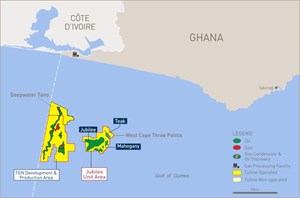

- Seven wells to be drilled and completed in Ghana in 2019 delivering annual gross production of c.180,000 bopd

- Targeting FIDs for Uganda and Kenya developments in 2019; Uganda farm-down negotiations ongoing

- Guyana drilling to commence in mid-2019 with three wells planned to test this high potential acreage