EIA: Saudi Arabia crude production hits four year low as export targets shift

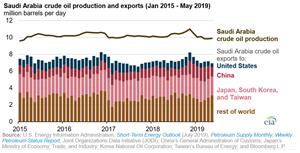

WASHINGTON - The U.S. Energy Information Administration (EIA) reports that Saudi Arabia’s crude oil production approached a four-year low in May 2019, averaging an estimated 9.9 MMbpd, more than 1 MMbpd lower than its all-time high in November 2018. Production in Saudi Arabia dropped following a December 2018 agreement by members of the Organization of the Petroleum Exporting Countries (OPEC) to cut crude oil production. Saudi Arabia’s crude oil exports, especially to the United States, have also fallen. However, some countries—in particular, China—have increased their imports of crude oil from Saudi Arabia.

Four Asia-Pacific countries that publish crude oil imports by country of origin—China, Japan, South Korea, and Taiwan—collectively imported an average of 3.5 MMbpd of crude oil from Saudi Arabia in 2018. China’s, Japan’s, and Taiwan’s 2019 year-to-date crude oil imports from Saudi Arabia are larger than their 2018 annual averages, but South Korea’s have declined slightly, based on data through May 2019.

In contrast, U.S. crude oil imports from Saudi Arabia have declined year-to-date through April 2019 compared with the 2018 average by more than 0.2 MMbpd, averaging 0.6 MMbpd for the first four months of 2019. Weekly estimates through July 12 show continued declines, indicating that U.S. crude oil imports from Saudi Arabia averaged about 0.5 MMbpd in May and in June.

These recent changes in crude oil trade patterns are partially a result of long-term structural trends within China and the United States and partially a result of recent oil market dynamics. From 2010 through 2018, EIA estimates that total Chinese petroleum consumption increased from 9.3 MMbpd to 13.9 MMbpd and that Chinese domestic production increased from 4.6 MMbpd to 4.8 MMbpd. As a result, China’s need to meet incremental oil consumption has been met primarily by imports.