Eagle Ford shale production expected to decline 10% in 2021

LONDON - Shale operators slashed their planned capital expenditure (capex) for 2020 to account for the oil price crash, which inevitably led to decline in drilling and completion activity in the Eagle Ford play. Hence, crude oil production is expected to drop by 10% year-on-year (YOY) in 2021, says GlobalData, a leading data and analytics company.

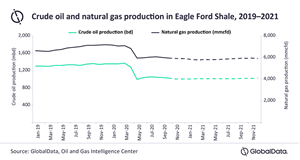

GlobalData’s latest report, ‘Eagle Ford Shale in the US, 2020’, projects that the gross crude oil production in this play would average at 1,017 thousand barrels per day (mbd) in 2021, down from 1,130 mbd in 2020. The gross natural gas production also may decline to 5,873 million cubic feet per day (mmcfd) in 2021, down from 6,327 mmcfd in 2020.

Andrew Folse, Oil & Gas Analyst at GlobalData, said “The Eagle Ford shale experienced one of the most drastic drops in rig count, from 81 rigs in February 2020 to only 18 in October 2020 due to the COVID-19 pandemic and related energy demand crisis. This attributed to a sharp fall in crude oil and natural gas production from the play this year.”

With oil futures averaging US$41.98 per barrel (bbl) for the first half of 2021, GlobalData forecasts that there will not be an uptick in oil activity in the Eagle Ford over the short-term. On the other hand, natural gas futures are expected to average at US$2.95 per thousand cubic feet (mcf) for the first half of 2021, which could spark some activity in the Eagle Ford and Austin Chalk formations.

Folse adds: “The short-term outlook for crude oil remains uncertain due to rising COVID-19 cases, and higher than normal global oil inventory that will restrict the upward pressure on oil price. However, natural gas prices in the US are expected to grow in the short-term due to strong LNG demand trend from Europe and Asia, coupled with the slowdown in shale gas production due to reduced activity.”

Eagle Ford’s 16 major operators cut capital spending by 44% or US$3.14bn, cumulatively, from an initial capex guidance of US$7.07bn in 2020. This had a bearing on the pace of drilling and well completions.

Folse added “The pandemic also forced some Eagle Ford operators, such as Chesapeake Energy and Freedom Oil and Gas, to file for Chapter 11 bankruptcy. Another prominent operator, Ovintiv, has reportedly put its Eagle Ford assets up for sale. Such developments may dampen the growth prospects in this play as long as oil prices remain below US$50/bbl range.”