World Oil survey results: U.S. industry favors strong government action

During last week, March 16-20, 2020, World Oil conducted an extensive survey of its U.S. subscribers/readers on their views of the current global oil market and what steps, if any, should be taken to adjust the situation. This survey covered the entire swath of E&P-related companies: operators, equipment/service firms, drilling and workover contractors, engineering firms and consultants.

There is no doubt that the actions of Russia and Saudi Arabia have been predatory. And many industry professionals, as evidenced by our survey, are highly concerned about the potential effect/damage to the U.S. upstream industry. Accordingly, our survey results bear out that a clear majority of the U.S. E&P sector favors strong federal government action to counter recent actions in the global oil market.

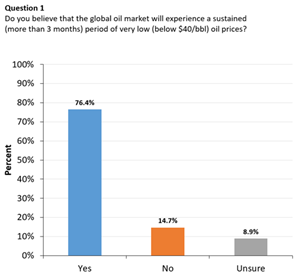

A pessimistic outlook on the future. Specifically, we asked our readers in question #1, “Do you believe that the global oil market will experience a sustained (more than 3 months) period of very low (below $40/bbl) oil prices?” We had 875 people respond, which is a very good sample group. The answers for the entire group of respondents broke out as follows—Yes: 76.5%; No: 14.6%; Unsure: 8.9%.

Among just operators, the percentage believing that there will be a period longer than 3 months was even higher—Yes: 81.3%; No: 12.2%; Unsure: 6.4%.

Clearly, our survey group, overwhelmingly, believes that the industry could be in for a prolonged period of very low oil prices. Only 14.6% do not think this will happen.

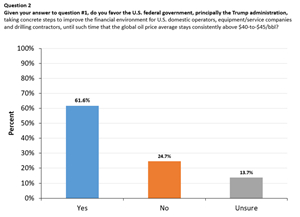

Strong government action favored. Based on question #1, we asked our readers in question #2, “Given your answer to question #1, do you favor the U.S. federal government, principally the Trump administration, taking concrete steps to improve the financial environment for U.S. domestic operators, equipment/service companies and drilling contractors, until such time that the global oil price average stays consistently above $40-to-$45/bbl?” We had 726 people answer this question. The answers for the entire survey group were as follows—Yes: 61.7%; No: 24.7%; Unsure: 13.6%.

Among just operators, the answers as regards favoring strong U.S. federal action were as follows—Yes: 58.3%; No: 28.3%; Unsure: 13.4%.

Thus, a significant majority of respondents are in favor of the U.S. federal government taking strong, concrete steps, to counteract production-dumping by the two state actors, Russia and Saudi Arabia.

Interesting actions over the weekend. While we were tallying our survey results over the weekend, it is worth noting that two particular developments occurred. One was the idea floated by Texas Railroad Commissioner Ryan Sitton that the state of Texas could cut 10% of its output temporarily, and that this could be complemented by Saudi Arabia cutting 10% and Russia reducing output by 10%. At current output rates, that would generate a production reduction of about 2.5 MMbopd, or higher.

Yet, it took no time at all for some industry and governmental people to try to shout down Sitton and his creative, out-of-the-box idea. There were expressions of dismay that a Railroad commissioner might be colluding with OPEC (not helped, of course by OPEC’s invitation to attend their next meeting in June), or that he might be tampering with the free market.

The other development over the weekend was API’s sudden “press release” distributed on Sunday (we can’t remember the last time API sent anything out on a Sunday) that contained an op-ed piece that was published in Forbes. In that note, API made it clear that it is totally against any significant U.S. governmental action to influence the global oil market, saying instead that the Trump administration should “resolve these issues diplomatically.” Good luck with that. And then, today (March 23), API put out another release to the media, wanting to make sure that everyone had seen their release from Sunday.

These actions and statements prompt a couple of questions: 1) “What are you afraid of, that you take these unusual steps?” and 2) “Why do you appear to be trying to stifle free, valid discussion of oil market issues (as per the Sitton situation)?”

World Oil will release additional results from its U.S. industry survey on its website tomorrow, March 24.

Click here to view Part Two of the survey results.