World Oil survey: U.S. industry prefers some form of import tariff

In yesterday’s story (March 23), in which we released initial results of our survey of our U.S. E&P readership, we told you that 76.5% of all respondents “believe that the global oil market will experience a sustained (more than 3 months) period of very low (below $40/bbl) oil prices.” And among just operators, the percentage believing that there will be a period longer than 3 months was even higher, at 81.3%.

We also found that 61.7% of all respondents favor the Trump administration taking strong action to counteract the actions of Russia and Saudi Arabia in the global oil market. Among just operators, the percentage favoring strong action was 58.3%.

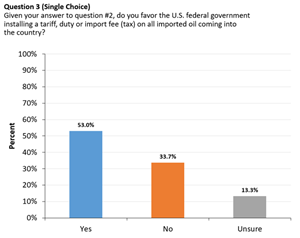

Import fee favored as the remedy. Today, we report the results of questions on what form of action should be taken by the U.S. In question 3, we asked, “Do you favor the U.S. federal government installing a tariff, duty or import fee (tax) on all imported oil coming into the country? In the total group of operators, equipment/service firms, drilling/workover contractors, engineering firms and consultants, the answers (see Chart 1) were: Yes, 53.1%; No, 33.6%; Unsure, 13.3%.

Among just operators, the results were: Yes, 54.5%; No, 32.9%; Unsure, 12.5%. Thus, in both groups, there are solid majorities in favor of some form of import tariff.

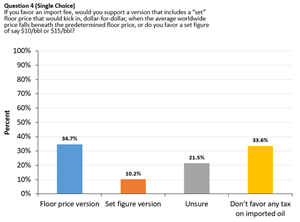

Which form of import fee? In a follow-on to question 3, we then asked respondents in question 4, “If you favor an import fee, would you support a version that includes a “set” floor price that would kick in, dollar-for-dollar, when the average worldwide price falls beneath the predetermined floor price, or do you favor a set figure of say $10/bbl or $15/bbl? In the total group, the answers (Chart 2) were: Floor price version, 34.8%; Set figure version, 10.2%; Unsure, 21.4%; Don’t favor any tax, 33.5%.

Among operators, the results were: Floor price version, 35.1%; Set figure version, 9.6%; Unsure, 22.5%; Don’t favor any tax, 32.7%. It should be noted that among those respondents that answered “Yes” to question 3 about whether an import fee is the proper remedy, 58% favored either a floor price version 17% like a set price version.

Thus, a majority of the U.S. E&P industry is in favor of an import fee. WorId Oil will release additional results from this survey on its website tomorrow, March 25, which cover actual implementation and potential effects of an import fee.