U.S. blacklists CNOOC for “bullying” in the South China Sea

(Bloomberg) --China’s biggest offshore driller is being targeted in the final days of President Donald Trump’s administration for its activity in the South China Sea.

China National Offshore Oil Corp. has for years drilled in waters far from its borders, and within 200 miles of countries including Vietnam and the Philippines. The activity amounts to the oil giant acting like a “bully” for China’s military to intimidate its neighbors, U.S. Commerce Secretary Wilbur Ross said in a statement Thursday announcing the move, which restricts access to U.S. technologies without specific permission.

“This measure by the Trump administration, once again, demonstrates to the public, to the international community what is unilateralism, double standards and bullying,” China Foreign Ministry spokesman Zhao Lijian told a briefing in Beijing on Friday. “The Chinese side will take necessary measures to ensure the legitimate and lawful rights and interests of Chinese companies, and we will stand by our companies, to protect, to uphold their rights and interests in accordance with law.”

CNOOC is aware of the U.S. decision and will continue to monitor the progress, the company said in an emailed statement.

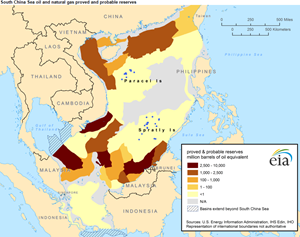

While CNOOC has been embroiled in territorial disputes for drilling near Vietnam and the Philippines, most of its actual production in the South China Sea is much closer to home. The region is a “core operation area,” according to the firm’s most recent annual report.

The eastern South China Sea accounted for about 242,000 barrels of oil equivalent a day for the company in 2019, about 17% of total production, in depths ranging from 100 to 1,500 meters, according to CNOOC filings. The firm is developing the Yangjiang Sag, a subsea fault southwest of Hong Kong, and made seven new discoveries across the region in 2019.

The western South China Sea provided about 164,000 barrels a day, about 12% of its total production. Projects there range in depth from 40 to 1,500 meters, and include fields surrounding Hainan island such as Lingshui 17-2, the first major deepwater gas field independently developed in China.

Philippine company PXP Energy Corp. said in October it was in talks with CNOOC for joint oil and gas exploration in the South China Sea.

“It’s unlikely that CNOOC would stop its long-standing offshore drilling in China’s territory for Trump’s random decision-making in the last days of his tenure,” said Lin Boqiang, director at Xiamen University’s China Center for Energy Economics Research.

China National Petroleum Corp. and Sinopec, which have not been targeted with sanctions, are major oil importers, including of U.S. crude. Unlike its larger peers, CNOOC’s focus is on offshore drilling and exploration. Such activity is deeply technical, requiring sophisticated software and technology sourced from a variety of global firms, including several from the U.S.

“The biggest concern for CNOOC is if the sanctions disrupt technology and equipment imports,” said Li Li, an analyst with Shanghai-based commodities researcher ICIS-China. The firm relies on international companies for things such as rig equipment, shipping and maintenance work. “China may not have comparable patented domestic products for replacement,” Li said.

CNOOC does have an equipment subsidiary, China Oilfield Services Ltd., with advanced technology of its own. State media reported on Friday that CNOOC launched the world’s first 100,000-ton deep-water semi-submersible oil production and storage facility for a field near Hainan.