OPEC’s plan will reduce global crude stocks and revive U.S. shale drilling, says EIA

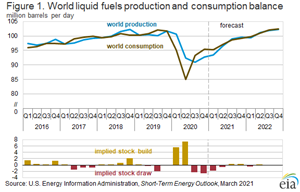

WASHINGTON - At their March 4 meeting, members of the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+) announced they would maintain crude oil production cuts through April, except for relatively small production increases from Russia and Kazakhstan. The announcement also noted that Saudi Arabia would maintain its additional 1.0 million barrel per day (b/d) voluntary production cut through the end of April. In February 2021, OPEC+ cuts, combined with supply disruptions in the United States, contributed to monthly global petroleum inventory withdrawals that the U.S. Energy Information Administration (EIA) estimates totaled 3.7 million b/d, the largest monthly withdrawal since December 2002. The Brent crude oil futures price averaged $63 per barrel (b) in early March leading up to the OPEC+ meeting, and the OPEC+ announcement put further upward pressure on crude oil prices. Front-month Brent futures briefly surpassed $70/b in intraday trading in the days following the announcement, not only because of the announcement but also because of an attack on the Ras Tanura oil facilities in Saudi Arabia on March 7. As a result of the extension of OPEC+ production cuts, EIA expects draws on global petroleum and other liquids inventories of 1.8 million b/d and 0.6 million b/d in the first and second quarters of 2021, respectively, according to EIA’s March Short-Term Energy Outlook (STEO) (Figure 1).

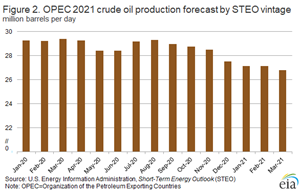

At its meeting on December 3, 2020, OPEC+ announced it would limit its production increase in January 2021 from 2.0 million b/d to only 0.5 million b/d. At its meeting on January 5, 2021, OPEC+ announced that it would maintain January production levels through the first quarter. In addition, Saudi Arabia unilaterally contributed 1.0 million b/d of additional cuts for February and March. Since the OPEC+ December announcement, the group has committed to maintaining more flexible production targets in response to the global demand recovery. This commitment has contributed to regular changes in output targets, resulting in revisions to EIA’s 2021 OPEC production forecast. Since the initial production cuts in May 2020, EIA has reduced its annual average 2021 OPEC crude oil production forecast by 1.6 million b/d to 26.8 million b/d (Figure 2).

The sustained OPEC+ production curtailment through April suggests that supply will remain constrained in the near term, even as demand continues to increase. As a result, EIA expects that further inventory withdrawals to meet rising crude oil demand will support crude oil prices through at least the end of April. In its February STEO, EIA forecast that OPEC would have begun relaxing production cuts in April, but following the March 4 announcement, EIA now expects production cuts to relax beginning in May, which is reflected in the March STEO. EIA expects OPEC crude oil production will increase to an average of 26.6 million b/d in May, which would be an increase of 1.5 million b/d compared with the January–April average.

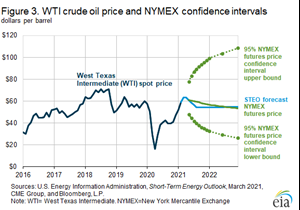

In the March STEO, EIA forecasts Brent crude oil prices will average $67/b in March and April 2021. As a result of EIA’s continued expectation of downward crude oil price pressures emerging in the coming months as the oil market becomes more balanced, Brent is forecast to fall to an average of $58/b during the second half of 2021. EIA forecasts West Texas Intermediate (WTI) crude oil prices to average $63.50/b in both March and April 2021 and to fall to $55/b in the second half of 2021. Market expectations of future price uncertainty is reflected in the value of WTI futures and options, which can be used to determine an implicit market-derived 95% confidence interval. As of March 4, 2021, the value of futures and options contracts determined the lower and upper bound confidence intervals of $44/b and $83/b, respectively, for the June 2021 WTI contract. The 95% confidence interval widens considerably over time (Figure 3).

EIA’s forecast of downward oil price pressure and increased crude oil availability has several key uncertainties. The speed of actual demand recovery, based on COVID-19 vaccination rates and the degree to which travel and employment conditions return to pre-COVID levels, remains an important uncertainty on the demand side. At the same time, the degree to which OPEC+ production cuts will continue after April remains a source of uncertainty on the supply side, especially because increasing crude oil prices will encourage OPEC+ participants to agree to production increases in later meetings or to relax compliance with the existing agreement. Finally, the responsiveness of U.S. tight oil production to higher oil prices is also uncertain.

EIA’s forecast of lower oil prices later in 2021 and 2022 depends in part on the responsiveness of U.S. shale production to recent high prices, which, as discussed in EIA’s March 3 This Week in Petroleum, suggests producers have been adding rigs and completing wells in recent months. The recent increase in crude oil prices means that more U.S. tight oil acreage is profitable. EIA expects U.S. crude oil production will average 11.4 million b/d during the second half of 2021 and rise to an average of 12.0 million b/d in 2022. EIA assesses that if oil prices were to remain at current levels, growing U.S tight oil production would cause global oil inventories to grow persistently by early 2022. However, producers may not deploy capital in the same way they have in the past at given price levels, adding further uncertainty to EIA’s crude oil production and price forecasts.

At the same time, high prices also encourage OPEC+ to relax production targets given current, very large amounts of spare crude oil production capacity, which is available to come online if OPEC+ member countries decide to increase production. To some degree, then, the more prices rise in the near term, the more future downward price pressures they bring.