Moody's: Outlook for the global energy industry revised to positive on higher oil prices, recovery in demand

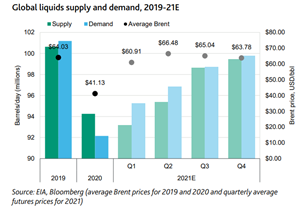

The outlook for the global energy industry has been changed to positive from stable, Moody's Investors Service says in research published Monday. A sustained uptick in commodity prices on the back of a recovering global economy is set to bolster a turnaround in industry fundamentals over the coming 12 to 18 months.

Moody's maintains its medium-term commodity price ranges of $45-$65/barrel for oil and $2.00-$3.00/MMBtu for Henry Hub natural gas.

"Pent-up consumer demand and increasing trade and manufacturing activity as the Covid-19 pandemic is brought under control are driving a rebound in global economic activity," said Elena Nadtotchi, a Moody's Senior Vice President. "This, in turn, is quickening the pace of a recovery in demand for oil and gas through late 2021 and into early 2022."

Favorable market dynamics and relatively low operating and offshore services costs will bolster exploration and production (E&P) companies' earnings and operating cash flow in 2021 on the back of higher oil prices, Nadtotchi says. Producers will focus on capital discipline and operating efficiencies in order to generate stronger free cash flow, pay down debt and strengthen their overall credit quality following a very difficult 2020.

Similarly, pent-up demand for travel and seasonally higher second- and third-quarter earnings in 2021 bode well for the refining and marketing segment through 2022. Moody's estimates that global demand for refined products will rise by about 6% this year, and by almost 4% in 2022.

Meanwhile, strong earnings in the global E&P and refining sectors will see integrated oil companies' earnings rise by a median rate of about 50%, though off a low base. Adjusted EBITDA almost halved in 2020, and likely won't return to pre-pandemic level before the end of 2022.

Tepid fundamental conditions point to a stable direction for the oilfield services (OFS) and drilling sector over the next 12 to 18 months amid lukewarm growth in demand for services. Large investment-grade OFS companies will see a modest improvement in cash flow and will gain market share during the recovery, Moody's says, while smaller, regional and service-focused firms that have insufficient liquidity to await a full recovery will likely have to consider bankruptcy filings or liquidation.

To see the full report, click here.