Nord Stream 2 can start transporting gas this year, Gazprom says

MOSCOW (Bloomberg) --A controversial Russian pipeline to Europe can deliver its first batches of natural gas to Germany this year, according to Gazprom PJSC.

The Nord Stream 2 link can ship 5.6 billion cubic meters of the fuel in 2021, the Russian gas giant said in a statement on the eve of a meeting between President Vladimir Putin and German Chancellor Angela Merkel in Moscow. The new pipeline will help ease a supply crunch in the European market, with the news sending benchmark futures in the Netherlands down as much as 12%.

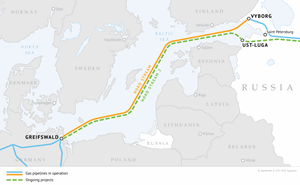

The twin link -- which will double the capacity of the existing undersea route from Russian gas fields to Europe -- has been a major source of friction in trans-Atlantic relations for several years, with the U.S. claiming it could give Russia new leverage over Europe and introducing sanctions targeting the project. Joe Biden‘s administration softened its stance, reaching a deal with Germany last month to end a longstanding rift over the pipeline.

Europe desperately needs gas and Russia has been limiting flows at a time when cargoes of liquefied fuel are being redirected to Asia to meet soaring demand from countries including China, Japan and Korea. With inventories in Europe at their lowest level in more than a decade for this time of year, prices had been breaking records day after day even though it’s summer, when demand is usually low.

Industry watchers from S&P Global Platts to Moscow-based Vygon Consulting expect Nord Stream 2 to start supplies in October and to boost volumes through the winter season.

Mid-October would be “the most realistic timeline” to meet the 5.6 billion-cubic-meters supply plan announced by Gazprom, to have room for a gradual and smooth ramping-up, said Maria Belova, head of research at Vygon Consulting.

Gazprom and the project operator, Switzerland-based Nord Stream 2 AG, declined to comment on when the pipeline may be launched.

More than 99% of the pipeline has been completed, according to its operator. But before carrying the first gas to Germany, the link needs to obtain insurance and certification, a task made difficult by U.S. sanctions that restrict providing these services to the project.

Aside from regulatory issues, Gazprom needs gas to refill underground storage facilities in Russia, which are at abnormally low levels, before the heating season that starts in October. While the company’s daily production climbed 1.1% in the first 15 days of August from a month earlier -- even after a recent fire at a facility in West Siberia -- Gazprom said this week that it’s overwhelmed with high demand both abroad and in Russia.

“We would note that overall Gazprom production is currently limited,” said James Huckstepp, an analyst at S&P Global Platts.

Keeping Up Pressure

Some traders had argued Russia was capping flows to Europe this year as a way to keep up the pressure to get Nord Stream 2 over the finish line.

“I read this to say: ‘there is a supply problem in Europe this winter; we can deliver at least some gas to help this; if you certify the pipeline and be reasonable about the regulation of its capacity, this will be a win-win solution,’” said Jonathan Stern, a distinguished research fellow at the Oxford Institute for Energy Studies.

Technically, the construction of the gas link may be completed this month, Chief Executive Officer Matthias Warnig told Handelsblatt in July. If the launch schedule for the original Nord Stream pipeline provides any guidance, commissioning works necessary for actual gas supplies via Nord Stream 2 may take another six to seven weeks.

“As one line has been completed and testing and commissioning work is being done, we could see flows via Nord Stream 2 sooner than expected,” said Sova Capital senior analyst Mitch Jennings. “But if Gazprom waits for the second line to be completed, flows could start in October.”

Speculation about the start of the Nord Stream 2 pipeline sent European gas markets haywire on Wednesday. Prices plunged 9.5% after the German gas grid posted data on its website suggesting physical gas moving through the link. Futures then pared losses after Gascade said the information was wrong and removed it from its website.