Prospects for hydrogen’s growth to 2050

As DNV's Low Carbon Segment Leader for North America, Pedram Fanailoo supports customers in their decarbonization plans and investments. Recently, World Oil visited with him to get his assessment of how hydrogen production and usage are progressing, as well as his opinion on where effort needs to be increased, to meet global targets by 2050.

World Oil (WO): According to the Hydrogen Forecast to 2050 report, hydrogen is expected to be 0.5% of the energy mix in 2030 and 5% in 2050. Have these numbers changed since the report was published?

Pedram Fanailoo (PF): Hydrogen Forecast to 2050 is DNV’s first stand-alone forecast of hydrogen in the energy transition to mid-century. The study predicts that hydrogen will have less than a 5% share of the energy mix by 2050, at a time when it needs to reach 15% to support global commitments to the Paris Agreement.

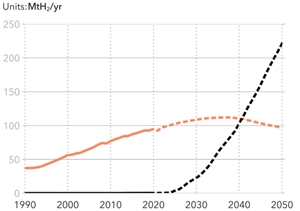

While the emerging consensus is that low carbon and renewable hydrogen will be central to the decarbonized energy system of the future, the prominence of hydrogen’s role is still unclear. As an industrial feedstock, global demand for hydrogen and its derivatives is around 90 million tonnes per year.1 As an energy carrier, however, it’ll take at least another 20 years before it reaches this level, Fig. 1.

Electricity-based green hydrogen—produced by splitting hydrogen from water, using electrolyzers—will be the dominant form of production by the middle of the century, accounting for 72% of output. This will require a surplus of renewable energy, to power an electrolyzer capacity of 3,100 gigawatts. This is more than twice the total installed generation capacity of solar and wind today. Blue hydrogen—produced from natural gas with emissions captured—has a greater role to play in the shorter term (around 30% of total production in 2030), but its competitiveness will reduce as renewable energy capacity increases and prices drop.

We predict that between now and 2050, around $6.8 trillion will be spent globally, producing hydrogen for energy purposes. There also will be an additional $180 billion spent on hydrogen pipelines and a further $530 billion on building and operating ammonia terminals.

For hydrogen to scale beyond today’s forecast, much stronger policies are needed in the form of tougher mandates, demand-side measures giving confidence in offtake to producers, and higher carbon prices. It will be interesting to see whether the Inflation Reduction Act (IRA) in the U.S., for example, could have an influence on the hydrogen energy mix in the future.

Hydrogen Forecast to 2050 is part of DNV’s annual Energy Transition Outlook (ETO) suite of reports. The latest version, now in its sixth year, was launched on Oct. 13, 2022.

WO: What methods did DNV use to collect the data and analysis used in the report?

PF: As an independent advisor to the energy industry, we make use of our global network of experts within DNV to provide specialist quantitative input to the ETO, to enhance knowledge and support long-term decision-making with up-to-date insights. Unlike other reports, our forecasting methodologies are not scenario-based. Instead, we present a single “best estimate” forecast of the energy future, with sensitivities in relation to our main conclusions. Our model simulates the interactions over time of the consumers of energy, as well as all sources of supply. This transparency is important to us and our customers.

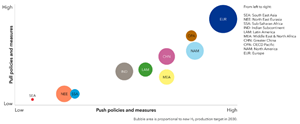

The report encompasses global demand and supply of energy, and the use and exchange of energy between and within ten world regions. The forecast, itself, is an output of our own proprietary system dynamics model, which takes historical data, policies, costs, etc., into account, and models the interactions within the energy system, Fig. 2.

The structure and input of data to the model is updated regularly to truly reflect the times we are living in. For instance, the impact of Covid-19 on world markets and societies from 2020. Most importantly, we make use of our global network of experts within DNV to provide specialist quantitative input to the ETO, to enhance knowledge and support long-term decision-making.

WO: What factors inhibit policymakers from encouraging hydrogen uptake?

PF: Not all regions have comprehensive policy frameworks in place to implement hydrogen ambitions. While some are galvanizing policy, strategy and technologies, others are far less mature. Figure 3 shows the renewable and low-carbon production goals of ten regions by 2030.

To be blunt, half-hearted policies are holding back hydrogen’s transformational aspirations, which will have a direct impact on global goals to reach net zero.

Regulatory frameworks must be revived and revamped to accelerate the creation of a hydrogen economy. This will catapult stakeholder cooperation, government policy and industry regulation to incentivize coordination through codes of practice and standards. There’s no doubt that scaling hydrogen value chains will also require managing safety risk and public acceptance, as well as employing policies to make hydrogen projects competitive and bankable. It will be a complex and difficult undertaking, but it will make a substantial difference to the future energy mix.

Inspired by the work of IRENA and WEF 20221 Fig. 4 showcases the hurdles standing in the way of safely facilitating a speedy scale-up of hydrogen.

Hydrogen Forecast to 2050 factors in policy measures that exert influence in three main areas:

- Supporting technology development and activating markets that close the profitability gap for low-carbon technologies competing with existing technologies.

- Applying technology requirements or standards to restrict use of inefficient or polluting products/technologies.

- Providing economic signals; for example, a price incentive to reduce carbon-intensive behavior.

These consider carbon pricing schemes, taxation of fuel, energy, carbon and grid connections, support for hydrogen and renewable power.

The $433-billion Inflation Reduction Act (IRA), passed by the U.S. Senate in August, is a clear example of how some countries are tackling the issue of financial support. The scheme is already being hailed as the “single, most important event in the history of green hydrogen to date.”3 It's expected that such an incentivization will make the U.S. the cheapest place for homegrown, renewable hydrogen in the world. The bill will create a ten-year tax credit of up to $3/kg (adjusted for inflation) for clean hydrogen producers.

The yearly credit amount is calculated from a basis set at $0.60/kg of qualified clean hydrogen produced, multiplied by an applicable percentage, based on the project’s “well to gate” greenhouse gas emissions (lifecycle emissions, including upstream methane emissions in the production of blue hydrogen, measured in carbon dioxide-equivalent and verified by an unrelated third party). The amount is multiplied by five, if the IRA’s prevailing labor (mainly wage and apprenticeship) requirements are met, and only projects that start construction before 2033 qualify.

This policy is likely to create a global trend, with RePowerEU also introducing funds for green energy projects.

WO: How can hydrogen power be incorporated into the upstream oil and gas industry?

Across production, storage, transportation, use and consumption, hydrogen is an extremely versatile gas: the range of emerging value chains reflects that. By 2050, the majority of hydrogen produced will be low-carbon, either from renewable sources or carbon capture and storage-based (CCS) fossil production. Existing oil and gas infrastructure has potential, particularly in offshore clean hydrogen. For example, we are seeing pilot projects exploring how to mix hydrogen in natural gas pipelines and use oil and gas platforms for electrolysis.

Skills and standards are key to successful implementation of new value chains and will likely be transferred from the oil and gas sector to support both blue and green hydrogen. Standards and procedures for existing offshore operations will help ensure the safety and success of new hydrogen industries for logistics; pipeline design and manufacture; transmission and distribution infrastructure; safety assessments; and storage.

WO: How would oilfield electrification impact this process?

PF: We expect increased electrification of oil and gas fields, especially in countries like Norway and the UK, as a means to cut emissions, extend asset and field life, and improve operational economics. For instance, in December 2021, the Oil & Gas Authority (now the North Sea Transition Authority) in the UK announced grants to fund studies to advance offshore electrification in the North Sea.2

Although electricity and hydrogen currently rely heavily on fossil fuels, their potential makes them key for the energy transition. Once energy end-uses shift to being powered by electricity and hydrogen, they will benefit from fast decarbonization of these energy carriers. The prospects for indirect electrification, through hydrogen, will see total installed electrolysis capacity continue to rise. However, in the absence of substantial policy changes, green hydrogen arrives too late and at insufficient scale for a net-zero energy system by 2050.

WO: Do you have estimates of what the hydrogen usage could be in specific areas, like the U.S. and EU, by 2050?

PF: Hydrogen is essential to decarbonizing sectors that cannot be electrified, like aviation, maritime, and high-heat manufacturing and should, therefore, be prioritized for these sectors. Policies will also need to support the scaling of renewable energy generation and carbon capture and storage (CCS) as crucial elements in producing low-carbon hydrogen.

The uptake of hydrogen will differ significantly by region and will be influenced heavily by policy. Europe is the frontrunner, with hydrogen set to take 11% of the energy mix by 2050, as enabling policies, such as the transformative Green Deal, kick-start the scaling of hydrogen production and stimulate end-use.

The EU’s hydrogen strategy (2020) aims for at least 40 GW of electrolyzer capacity installed in 2030. By the end of the decade, REPower EU (2022) will boost ambitions, aiming for 10Mt of domestic renewable hydrogen and 10Mt of renewable imports. To support EU goals, several countries across the continent have their own specific strategies and targets for installed hydrogen production capacity over the next few years.

Just behind Europe is OECD Pacific, closely followed by North America, with hydrogen making up a respective 8% and 7% slice of the energy pie. While both regions have strategies, targets, and funding pushing the supply side, each has lower carbon prices and less concrete targets and policies than Europe.

However, fervor and favor are now rising in North America for a holistic set of fiscal policy measures to achieve net zero greenhouse gases (GHGs) by 2050. So far, the U.S. has dedicated $8 billion to advance production hubs in blue hydrogen and electrolysis, based on renewables or nuclear. Congress hopes the hubs will eventually become the backbone of a national clean hydrogen network and facilitate a clean hydrogen economy. For R&D into hydrogen electrolysis, $1 billion has been pledged. A further $500 million will support a clean hydrogen supply chain initiative to include recycling. End use plans include switching of existing grey hydrogen, industrial processes, road transport, and grid balancing.

The recently approved IRA will also create a tax credit that would pay clean hydrogen producers up to $3/kg (adjusted for inflation) for ten years. The size of the tax credits available depends on the “well to gate” GHG emissions of each project and, more importantly, on wages—multiplying the size of the tax credit by a factor of five. In other words, they would include upstream methane emissions in the production of blue hydrogen. The basic tax credit rate for “qualified clean hydrogen” is set at $0.60/kg, with a sliding scale depending on lifecycle emissions—measured in carbon dioxide-equivalent (CO2e)—of the hydrogen produced. The lifecycle emissions would have to be verified “by an unrelated third party,” and only projects that start construction before 2033 would qualify. Incentivizations, such as this, could also be the spur needed to force discussion into action for a transformational green hydrogen economy.

Together, Europe, OECD Pacific, North America, and Greater China—which recently provided more clarity on funding and hydrogen prospects towards 2035, coupled with an expanding national emissions trading scheme—will consume two-thirds of global hydrogen demand for energy purposes by 2050.

WO: From an operational and engineering standpoint, what are the biggest problems that still need to be overcome, to produce hydrogen on a commercial scale?

PF: The high cost of hydrogen currently prevents widespread adoption as an energy carrier. However, with declining costs of production and an increasing push for decarbonization, hydrogen is a major contender for hard-to-abate sectors, where electrification is either infeasible, due to the low energy density of batteries, or very costly.

Policies to advance new technology, manage demand-pull and, importantly, control carbon pricing, are the trinity of tactics to effectively progress investment and deployment of meaningful hydrogen initiatives.

More sector coupling is also needed to create stronger bonds and break the silos of a varied set of subsectors and players. However, this requires harmonized regulatory frameworks that view electricity and gas sectors as collaborators and not competitors while simultaneously addressing several hydrogen production and use areas. For instance:

- Decarbonizing existing hydrogen production and usage

- Retrofitting or modifying infrastructure across established industries to allow fuel switching; for example, from natural gas to hydrogen

- Establishing new infrastructure for conversion of energy carriers, such as from diesel trucks to hydrogen electric fuel cell versions, which are largely “outside the fence” of industry-regulated areas.

The DNV report identifies key considerations for policymakers. These include addressing safety gaps, ramping up technologies to support hydrogen use, accelerating production and offtake, and, importantly, removing barriers to large-scale investments.

Global, regional and national policy and regulatory frameworks are critical, if hydrogen is to play a meaningful role as a strategic, decarbonized energy carrier to combat the catastrophic consequences of climate change.

REFERENCES

- IEA (2021) Hydrogen Tracking report — November 2021, International Energy Agency, Paris. https://www. iea.org/reports/hydrogen

- https://www.nstauthority.co.uk/media/7915/december-2021-nstd-update-one-pager.pdf

- https://www.rechargenews.com/energy-transition/analysis-why-the-us-climate-bill-may-be-the-single-most-important-moment-in-the-history-of-green-hydrogen/2-1-1275143

Author

PEDRAM FANAILOO is DNV's Low Carbon Segment Leader for North America, where he supports customers in their decarbonization plans and investments. He applies his two decades of experience in risk management and assurance processes to develop and deploy services supporting hydrogen, ammonia, carbon capture and storage, and low-carbon fuels. Mr. Fanailoo actively participates in business development, marketing, and project delivery. As a Segment Leader, he assists DNV's customers in addressing some of the most complex issues facing the energy industry, including strategic, technological, and policy decisions needed to navigate the energy transition successfully. He coordinates DNV’s resources to deliver project teams tailored to customer needs.