KCA Deutag to purchase the Saipem Onshore Drilling for $550 million

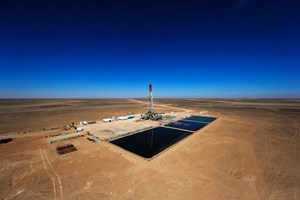

To continue growth and expansion in core markets such as the Middle East region, KCA Deutag announced it has signed a Sale and Purchase Agreement (SPA) to acquire Saipem SpA’s onshore drilling business (Saipem Onshore Drilling) for a total consideration payable at closing of $550 million in cash and 10% equity interest in the Group.

KCA Deutag had revenue of $1.2 billion and EBITDA of $237m in the year ending 31 December 2021. During the same period, Saipem Onshore Drilling generated revenue of $410 million and EBITDA of $98 million from their Middle East, Latin America and other markets.

The group expects the acquired business to deliver an estimated pro forma run rate EBITDA of around $150 million when considering the ongoing and customer-notified rig reactivations.

Upon completion of the acquisition, the combined Group will manage a leading global onshore drilling business generating over 50% of its EBITDA from the Middle East with more than 11,000 employees globally.

Total backlog will increase by $1.6 billion to $7.2 billion.

Strategic highlights of the combined group:

- The acquisition will create a leading global onshore drilling business with over $1.6 billion in revenue across core geographies in the Middle East and key markets in Europe and Latin America.

- $7.2 billion backlog will provide greater revenue visibility across global markets.

- Blue chip customer base with high share of National Oil Companies generating around 50% of the Group revenue.

- Improved market participation across geographies with much lower lifting costs.

- Confidence in generating around $24 million in cost synergies from overhead and operational efficiencies based on track record with previous Dalma acquisition.

“This milestone acquisition of Saipem Onshore Drilling allows us to significantly upgrade our business by expanding in core geographies in the Middle East and key markets in Europe and Latin America,” said Joseph Elkhoury, KCA Deutag CEO. “We have continued to transform our business to #enhancethebrand and create accretive value for all our stakeholders: employees, customers, investors and the communities where we live and work. We look forward to delivering our outstanding safe and quality services to existing and new customers, and to welcoming our new colleagues to the group.”

Barclays and Houlihan Lokey acted as financial and debt advisors respectively, to KCA Deutag on the transaction. Given the nature of the transaction, closing for the Middle East and other markets is expected in Q4 2022 with Latin America to follow at the completion of its carve-out. $50 million of the cash consideration will be withheld pending completion of the Latin America closing.