Freehold Royalties to attract ExxonMobil, Endeavor, others to Permian assets with $82 million acquisitions

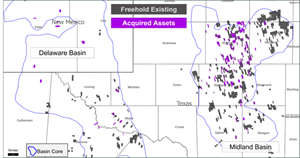

(WO) – Freehold Royalties Ltd. has entered into definitive agreements with two private sellers to acquire high-quality Permian mineral title and royalty assets in the Midland basin and the Delaware basins in New Mexico and Texas for approximately $82.4 million.

The acquired assets are located primarily in Martin County, Texas, capturing some of the thickest stacked pay reservoir quality in North America, with up to ten benches available for development under current practices.

Additionally, the acquired assets have a significant weighting to undeveloped lands, which is expected to maximize development and recoveries. Future development will be led by a strong portfolio of well capitalized operators with this core inventory ranking as some of the best within their portfolio.

Highlights. The acquisition includes approximately 123,000 gross acres concentrated in the core of the Permian basin. Freehold’s total Permian land position will increase by 40% to greater than 0.5 million gross acres and will represent approximately 57% of Freehold’s U.S. gross land base. Over 40% of the acquired assets’ net royalty acres are undeveloped, providing significant future activity potential.

The 2024 forecast average production from the acquired assets is 600 boed, increasing Freehold’s Permian production by approximately 30% and U.S. production by 12%. The acquisition also includes strong well performance, with average 365-day initial gross production rates of approximately 600 boed per Permian well.

The assets have multiple years of future upside, with greater than 2,000 gross development locations identified. Freehold’s total U.S. inventory is expected to increase by 25%, bringing the company’s total proforma U.S. inventory to greater than 10,000 gross locations. This implies approximately 17-years of drilling inventory based on 2022 drilling levels.

Future development is underpinned by some of North America’s top operators, with the combined ExxonMobil and Pioneer Natural Resources expected to move into Freehold’s top five payors and represent greater than 25% of future gross locations within the company’s U.S inventory. Additional payors include other large well capitalized producers such as Marathon Oil, Endeavor Energy Resources LP and Diamondback Energy.

The acquisitions are expected to double Freehold’s Midland basin activity and on a proforma basis. One in every seven wells drilled in 2023 in the Midland basin of the Permian will have occurred on Freehold’s lands.

The Acquisitions are consistent with Freehold’s strategy of positioning its portfolio ahead of the drill bit in high-quality resource plays and complements the company’s existing North American asset base.