TotalEnergies declines to connect Congolese oil blocks to “famous” pipeline

(Bloomberg) — Democratic Republic of Congo’s vision of earning billions of dollars in revenue from dozens of landlocked oil blocks will remain distant without a connection to a lone export route to be operated by TotalEnergies SE.

Over the last decade, Congo has watched eastern neighbor Uganda discover and develop significant oil fields while some of its own most promising resources were left untouched. Now, the country risks missing out on the best chance to bolster its petroleum industry if it can’t secure access to the planned East African Crude Oil Pipeline that will connect landlocked reservoirs to global markets.

Congo is auctioning blocks in central and eastern areas, nearly a thousand miles from the nearest port. They’re also located on environmentally sensitive land with almost no infrastructure.

The government is in talks with Uganda, Tanzania and South Sudan about building new pipelines or shipping its crude through Eacop, Didier Budimbu Ntubuanga, Congo’s oil minister, said in an interview at his private office in the capital, Kinshasa, last month. Without an exit, a large portion of the country’s estimated 22 Bbbl of crude could be stranded as the world moves toward cleaner sources of energy.

TotalEnergies, the operator of one of Uganda’s Lake Albert oil fields and the pipeline, said it won’t be able to accommodate oil from Congo. “Eacop is expected to be running at or close to full capacity based on Ugandan production for much of the first decade of its operation,” a company spokeswoman said in an emailed response to questions.

The French major’s Chief Executive Officer Patrick Pouyanne told a French parliamentary commission in November that the company won’t bid for Congo’s oil blocks. “TotalEnergies will not be in the DRC to do oil, so this famous pipeline will not be used to do this,” he said.

The remarks upset Budimbu, who wants to bypass the rejection by holding direct talks with the countries to negotiate a connection to the line. “It’s not Total who will have the last word,” he said.

The revenue generated from 5.5 Bboe that Congo estimates lie in just five eastern blocks could be transformative for a country that International Monetary Fund data shows has a gross domestic product of just $69.5 billion dollars and about 100 million people.

“If TotalEnergies doesn’t allow external crude to be transported through the pipeline, then I believe there are no export options available on that side of the country,” Pranav Joshi, an analyst at Rystad Energy, said in a reply to questions.

Awaiting exploration

Uganda’s government is open to shipping Congolese oil, but there are contingencies.

“Considering DRC volumes may take a number of years to be ready for transportation, we believe the pipeline will have spare capacity,” depending on future exploration results by the host nations, said Peter Muliisa, Chief Legal and Corporate Affairs Officer for the Uganda National Oil Company Ltd.

Congo was always expected to be part of Eacop, according to Uganda energy ministry spokesman Solomon Muyita. “The only problem is that Congo hasn’t been moving at the same pace with Uganda” in developing its own oil resources, he said.

Last week, the ministry postponed bid submission deadlines on 24 blocks for the second time and announced another roadshow on May 11 in the City of London to publicize the tender. The ministry is currently accepting bids for three western blocks near its only productive oil fields, a 25,000 bpd project run by Perenco SA.

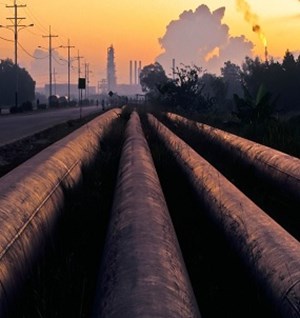

Total and China National Offshore Oil Corp. will build the $4 billion 1,443-kilometer (897 miles) Eacop pipeline to ship oil from Uganda’s side of Lake Albert — along Congo’s border — to the Tanzanian port of Tanga as soon as 2025.

“The discussion with Uganda is to be a stakeholder, to have shares in this pipeline there,” Budimbu said. A more expensive option would be to bypass Uganda entirely by building a pipeline via South Sudan and on through Ethiopia.

Notwithstanding logistical and environmental challenges, Budimbu estimates two blocks on Lake Albert could fetch $1.5 billion alone, which would be difficult for smaller oil companies to afford. “You can’t only think that to be a major is to be Total,” he said. “There are majors even in China these days, they’re everywhere.”