New seismic data uncovers hidden resources in East Africa’s largest onshore natural gas discovery

(WO) – Aminex, an oil and gas exploration and development company focused on Tanzania, announced that interpretation of recently-acquired 338 km2 3D seismic dataset over the Ruvuma PSA has improved the in-place volumetrics for the Ntorya natural gas discovery and revealed a significantly higher resource potential in the wider license area than previously identified on the existing sparse 2D database.

The interpretation of the 3D seismic has been completed by the Ruvuma PSA operator, ARA Petroleum Tanzania (APT). Seismic inversion geomodelling, undertaken in collaboration with Ikon Geoscience, has defined a high confidence area with a revised in-place volumetric estimate for the Ntorya natural gas discovery.

A most-likely (approximating to P50) estimate of 3.45 Tcf of Gas Initially In Place (GIIP) is now believed to be potentially connected to the reservoir sandstones encountered in the Ntorya-1 (NT1) and Ntorya-2 (NT-2) discovery wells.

This revised Ntorya volume represents a substantial increase to the published P50 GIIP of 1.64 Tcf estimated by RPS Energy (RPS) in their February 2018 Competent Person’s Report (CPR).

Furthermore, the new 3D seismic images shows a possibly even larger area of gas charged reservoir sandstones, beyond the high confidence area established by the new seismic inversion modelling. This provides for potential additional prospective gas volumes associated with the Cretaceous age sand units tested in NT1 and NT-2 (Units 1 and 2) and for the possible existence of an undrilled shallower sand unit (Unit 3), to be tested by the forthcoming Chikumbi-1 (CH-1) appraisal well later in the year.

An upside aggregated GIIP volume for the Ntorya accumulation based on a success case in multiple stacked sands at CH-1, is estimated by APT to be up to 7.95 Tcf (approximated to a mean unrisked P10 GIIP).

RPS has been engaged to undertake a revision of their 2018 CPR to support the initial Field Development Plan. The study is likely to focus on a much narrower area of the reservoir, surrounding the two existing wells and CH-1 location that will be targeted for initial production, with the aim of defining preliminary 1P and 2P reserve estimates.

These reserve estimates are expected to increase substantially as phased development and project maturation progresses in light of the results of the newly reported APT interpretation studies.

The 3D dataset has also revealed, for the first time, considerable undrilled exploration potential within the broader license area. Multiple undrilled structural and stratigraphic plays spanning a range of geological intervals are estimated by APT to contain a total Pmean unrisked GIIP potential of 8.43 Tcf (excluding Ntorya). These new plays and prospectivity currently identified to date contain a risked Pmean

GIIP exploration potential of ca 2.2 Tcf. Ongoing work, including advanced seismic imaging and reinterpretation of existing wells, is being undertaken to reduce geological uncertainty and mature the new exploration portfolio. The new volumetric studies result in a total updated unrisked GIIP volume for the Mtwara Licence of 16.38 Tcf.

While APT awaits award of the Ntorya Development License from the Tanzanian authorities, securing the assets for development for at least 25 years with provision for further extension, the operator continues to work on multiple work-streams to commercialize the discovery and contribute towards Tanzania’s energy security. Upon receipt of the Development License, APT will:

- Contract a rig operator to undertake the drilling of the CH-1 appraisal well to further derisk the asset and, if successful, complete as a gas producer.

- Re-enter and repair a tubular leak in NT-1 to enable the well to be safely completed as a gas producer.

- Undertake further testing on NT-2, currently suspended as a gas producer, using a mobile test unit, to refine the design of in-field gas processing facilities.

- Continue to support the Tanzanian authorities in the early construction of a spur gas pipeline from Ntorya to the Madimba Gas Plant to accommodate gas extraction from the field.

Development activities are ongoing, and first gas production is targeting up to 60 MMcgd from NT-1, NT-2 and CH-1. Tanzanian authorities have indicated that the spur line will be completed during the first half of 2025.

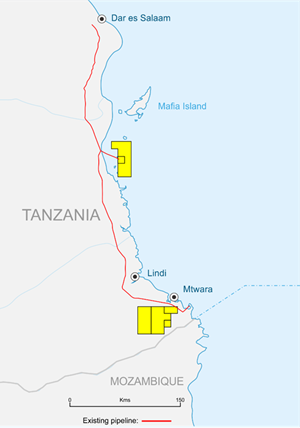

The Ruvuma PSA lies adjacent to a region containing supergiant world-class LNG projects, extending from offshore Tanzania into Mozambique waters to the south. The JV partners intend to produce Ntorya gas into the growing domestic gas market, helping to alleviate energy poverty and boost the energy transition in Tanzania. A multi-year gas sales agreement was signed earlier this year with the Tanzania Petroleum Development Corporation.

Charles Santos, Executive Chairman of Aminex said, “The quality of the new 3D seismic dataset was excellent giving the JV partners the ability to map in detail the Ntorya gas discovery, refine volumetric estimates and provide the basis to locate future appraisal and development drilling targets. We are particularly excited by the significant potential gas volumes now identified in other untested structures within the license area. To place these volumes in context, the Ntorya accumulation is potentially the largest onshore gas discovery in East Africa and, with the sizeable new exploration targets, should be much less expensive to exploit than offshore resources.”