Chevron shares jump as Trump signals Venezuela oil revival

(Bloomberg) – U.S. oil stocks jumped Monday after President Donald Trump pledged to revive the Venezuelan energy sector following the capture of Nicolás Maduro over the weekend.

Chevron Corp., the only American oil major currently operating in the South American nation under special U.S. permission, surged as much as 6.3%, the most since April.

ConocoPhillips and Exxon Mobil Corp. also rose. The three largest oil-service companies — Halliburton Co., SLB Ltd and Baker Hughes Co. — all jumped more than 5%.

Trump said U.S. oil companies will spend billions of dollars to rebuild Venezuela’s crumbling energy infrastructure and restore the nation’s oil sector to its former glory.

Chevron — which remained in Venezuela after the seizure of foreign oil assets at the turn of the century — is best positioned among global oil giants to immediately benefit from greater US access to the world’s largest crude reserves. ConocoPhillips is owed more than $8 billion by Venezuela and Exxon is still owed about $1 billion stemming from the nationalization of assets, international arbitrators have ruled.

“We’re going to have our very large United States oil companies — the biggest anywhere in the world — go in, spend billions of dollars, fix the badly broken infrastructure — the oil infrastructure — and start making money for the country,” Trump said on Saturday.

Venezuela produces a heavy form of crude that’s key for many U.S. refineries along the Gulf Coast. Shares of Canadian-oil sands companies, which also produce heavy crude, fell Monday, including Canadian Natural Resources Ltd., Cenovus Energy Inc. and Suncor Energy Inc.

A full revival of the country’s oil industry could take many years and cost upwards of $100 billion, according to Francisco Monaldi, director of Latin American energy policy at Rice University’s Baker Institute for Public Policy.

Years of corruption, underinvestment, fires and thefts have left the nation’s crude infrastructure in tatters, with U.S. sanctions further isolating the country. The main buyer of its crude has been China.

Chevron produces about 20% of the country’s oil under a sanctions waiver and ships the crude to US refineries. The company has been shipping oil from Venezuela even as the Trump administration launched a partial maritime blockade.

“Chevron remains focused on the safety and wellbeing of our employees, as well as the integrity of our assets,” a Chevron spokesperson said in a statement on Monday. “We continue to operate uninterrupted and in full compliance with all relevant laws and regulations.” The only change to what Chevron said previously over the weekend was the addition of the word “uninterrupted.”

It’s unclear how willing global oil companies are to pour substantial sums of money into a country run by a temporary U.S.-backed government without established legal and fiscal rules.

ConocoPhillips said this weekend it is premature to speculate about future business activities. In 2024, the Houston-based company that once dominated production in Venezuela was granted a string of licenses by the U.S. government that better positioned it to recover some or all of the losses from asset seizures in the country.

Exxon would look at any potential opportunity in Venezuela but would be cautious because its assets there have been expropriated in the past, CEO Darren Woods said in a November interview.

See also: Rubio: Venezuela oil quarantine key to U.S. pressure strategy

Analysts and traders say it could take years for critical infrastructure to be fully repaired and for oil to freely flow out of Venezuela, which currently contributes less than 1% of global supplies even though it has the world’s largest reserves.

Italy’s Eni SpA and Spain’s Repsol SA, which also have operations in Venezuela, rose in early European trading. Etablissements Maurel & Prom SA, a French oil company with interests in Venezuela, surged as much as 14%.

Despite the U.S. attacks on Saturday, Venezuela’s oil infrastructure — including the Jose port and Amuay refinery and main producing areas in the Orinoco Belt — wasn’t affected, according to people familiar with the matter.

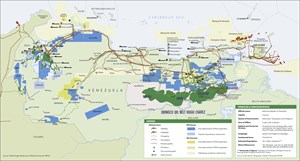

Map created in collaboration with Petroleum Economist and Global Energy Infrastructure. For an overview of this project and other related infrastructure developments, visit Global Energy Infrastructure. Copyright World Oil 2026. All rights reserved.