ShaleTech: Permian Shales

As operators squeeze what they can from shrunken budgets, the multiple shales beneath the ever-resilient Permian basin are picking up the spoils, leaving their once-celebrated unconventional peers with noses pressed against windows that get foggier by the week.

“We have virtually eliminated our capital spending in the Williston basin (Bakken shale). In 2015, we will focus our capital spending on the core areas we operate, principally the Permian basin,” Occidental Petroleum Corp. President and CEO Steve Chazen says of the appropriations within a new budget that, as of now, is 33% less than its 2014 rendition.

If typical 2015 guidance is any indication, Chazen could just as well be speaking for many of the active players in the multi-horizon play that stretches roughly 75,000 mi2 across most of West Texas, and eastern New Mexico. As of late March, operators as diverse as Chevron and EOG Resources suggest that considerable chunks of what remains of their unconventional expenditures this year will be funneled into the Permian basin, with the latter actually planning to increase its 2015 fleet to eight active rigs, targeting various zones within its Delaware sub-basin holdings.

And, there certainly is no shortage of idle rigs from which to choose. Over the past few weeks, rigs across the Permian basin have been stacked at near-consistent double-digit clips—a trend clearly illustrated in the most recent Baker Hughes data that show the active rig count, as of the week of March 22, dropping to 292 from the 311 active units drilling the week prior. That compares to 333 active rigs during the week of March 8, and the 514 rigs on location in the Permian basin in March 2014.

Despite the weekly pull-backs, and whether a function of its wide aerial reach, multiple-pay targets, or a combination of factors, the Permian still has more than twice the number of active rigs as does its closest competitor and neighbor, the Eagle Ford. The latter play had the nation’s second-highest unconventional rig count, with 146 units making hole during that same reporting period. Scott Sheffield, CEO of legacy player Pioneer Natural Resources, has a more philosophical take on the reason for this, telling Bloomberg on Feb. 13, “The world still needs the Permian basin.”

Surprisingly, authorizations for new horizontal wells are up significantly this year, compared to the same period last year, when oil hovered around the $100/bbl range, according to the Texas Railroad Commission (RRC), the state’s chief regulator. Between January and March 2015, RRC statistics document 792 horizontal drilling permits approved for the three districts comprising the Permian basin core, compared to 672 similar authorizations for the same period in 2014.

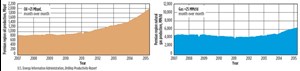

Houston-based Apache Corp., which holds 48 of the permits issued for the first three months of this year, could well be the exemplar for operators looking at the Permian as a safer investment haven, Fig. 1. With its 2015 North American rig count reportedly down nearly 70% compared to last year, President and CEO John Christmann described its Permian acreage as being “at the top of the food chain” in competing for precious capital. “The others have to compete with the Permian, and that’s why we’ve got the lion’s share of our capital there,” he said. “The Permian still will be getting 60% of our total North American capital.”

Production still climbing. Meanwhile, even as operators with sufficient balance sheets elect to leave drilled wells uncompleted until prices recover, Permian production shows no signs of dropping off in the near-term.

At the end of 2014, RRC data show Permian operators delivering just under 1.2 MMbopd, while the EIA estimates that oil production will increase 21,000 bpd between March and April, when it will reach the 2.0 MMbpd milestone, Fig. 2. The EIA also predicts month-over-month gas production in the Permian will increase 25 MMcfd by April.

Although some operators envision production beginning to level off by the second half of 2015, others point to recurring transitions from straight-hole to horizontal drilling with longer laterals, and optimized completion strategies, as sustaining production throughout the year. In addition, with Occidental taking the lead, the Permian continues as one of the nation’s most active CO2 EOR theaters.

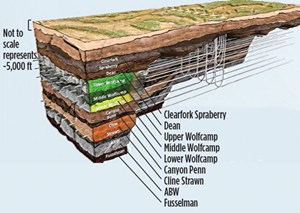

The lofty production volumes, likewise, are being generated from myriad pay zones that represent a geological créme de la créme, from the elder Sprayberry and Wolfcamp producers to the emerging Bone Springs. In addition, if Tulsa-based Laredo Petroleum has its way, the shale-like Canyon formation, lying between the Wolfcamp and Cline shales at depths of 8,250 ft to 9,000 ft, will be added to the production mix, Fig. 3. In fourth-quarter 2014, Laredo completed a Canyon exploratory well in Glasscock County, Texas that recorded peak, 30-day initial production (IP) averaging 1,151 boed, said President and COO Jay Still.

“After extensive evaluation of open-hole logs from vertical wells and corresponding production logs, we were encouraged with Canyon’s potential,” Still told investors on Feb. 26. “By calibrating all of the data, and integrating the petrophysical analysis into our 3D seismic subsurface mapping, we now believe the Canyon may be perspective on at least 50,000 net acres of the company’s Permian-Garden City leasehold.”

Laredo plans a second well this year to further evaluate the Canyon, which Still says has uniform thickness between 600 and 900 ft. The Canyon well was among the 80 horizontal completions that Laredo recorded in 2014, but 2015 plans call for between 45 and 50 gross horizontal completions, the company says. “The Canyon is one of several additional zones we have identified to further expand our resource potential beyond the initial four zones currently under development,” said Chairman and CEO Randy Foutch.

Pioneer, meanwhile, is content to concentrate on its 825,000-acre holdings in the core of the Midland basin’s Sprayberry/Wolfcamp play, which began producing from vertical wells more than 70 years ago. By the end of February, Pioneer had completed its wholesale transition to horizontal drilling (Fig. 4), and in the fourth quarter connected 69 horizontal Sprayberry/Wolfcamp wells to production, including 26 in the southern portion of its Wolfcamp acreage, operated under a JV with China’s Sinochem. Pioneer exited 2014 with average production of 99,000 boepd, which it expects to increase by more than 20% for most of this year. By the fourth quarter, Sheffield said he expects production to flatten after wells drilled in late 2014, but not completed, are put online, and drilling activity drops. Pioneer averaged 33 rigs last year, but expects the firm to average 10 rigs this year, and place 85 to 90 horizontal wells on production, compared to 97 last year.

Newcomer Encana, for one, plans to go fullbore on developing the 140,000 net acres that it acquired in November with the $7.1-billion acquisition of Athlon Energy. The Canadian operator said it plans to average four to six horizontal rigs this year, and drill about 55 net horizontal wells in the Wolfcamp and Sprayberry. Permian production this year is set to average at least 45,000 boed, and the operator has no plans to defer completions, a spokesman said.

Encana reduced its final 2015 capital budget by about $700 million, and 80% of what remains will go into the Permian, Eagle Ford and its home country’s Montney and Duvernay acreage. “One of the reasons why the Permian is so attractive, it’s got a very, very good margin structure. Very good returns,” says President and CEO Doug Suttles.

Apache saw fourth-quarter Permian production set a record 168,728 boed, but Christmann hinted it may be a different picture this year, and not just because of depressed prices. “We are delaying the completion of some wells in backlog until pressure pumping costs reset to levels that better reflect the current commodity price environment,” he said. “Corporate cash flow is the main constraint on our 2015 drilling plans. We would consider using our balance sheet, only to capitalize on lower acreage costs, and other potential opportunities that may occur, rather than to drill wells and chase production in a depressed, and volatile, oil price environment.”

Apache plans to average 10 to 12 rigs this year across its more than 3.2 million net acres—down sharply from the cumulative 42 horizontal and vertical rigs that it operated on average in 2014.

As an aside, with fewer frac crews translating to less water consumed, the recently formed FQS Venture LLC wants to ensure that recycling efforts do not fall by the wayside. The JV between Select Energy Services and Fountain Quail Water Management last year employed its distinctive recycling technology on a saltwater disposal project, where it says more than 500,000 bbl of contaminated water have since been treated for reuse, Fig. 5.

Targets aplenty. Perhaps the most compelling reason that operators are drawn to the Permian basin is the capacity to pick and choose from an assortment of pay zones, typically in the same wellbore. Thus, the primary focus, these days, is optimizing field development strategies to maximize estimated ultimate recoveries (EUR) of typically stacked plays. For Laredo Petroleum, that means the development of an Earth Model that encompasses an integrated workflow, which combines geoscience and engineering data with multivariate statistics. The new-age model, which takes in an analysis of more than 80 seismic, petrophysical and reservoir attributes, essentially correlates the technical data to production in the Upper, Middle and Lower Wolfcamp and Cline intervals, according to Foutch.

“We expect to utilize this data to optimize the landing and steering of 90% of the horizontal wells we plan to drill in 2015. Last year, he said, roughly 70% of Laredo’s operated horizontal wells were completed as stacked intervals, “driving a 29% growth in annual Permian production.”

Premier leaseholder Chevron, likewise, points to the stacked play potential throughout its more than 2-million-acre leasehold in the Midland and Delaware basins as the primary contributors to, what it claims, is a more-than-7-Bboe resource. “We believe our Permian acreage is second to none,” Jay Johnson, Chevron senior V.P. of upstream, said at a March 10 security analysts meeting in New York. “Even better, 85% of our acreage has no or low royalty. This is a significant differentiator in terms of the value of our barrels, and while it is always important, this advantage is even more compelling in the current price environment.”

Chevron, which ran an average 29 rigs last year, also is among the legion of veteran Permian players that have taken to reconfiguring well designs to take advantage of the higher reservoir drainage of laterals. Johnson said Chevron’s recent Bradford Ranch wells, which target the Wolfcamp in the Midland basin, represents the firm’s first horizontal development project in the Permian basin. As of March, two Bradford Ranch wells had been put online, with one delivering an initial production (IP) rate of 1,300 bopd, he said. That well was constructed with a 7,500-ft lateral and completed in the Wolfcamp B bench.

“We’ve really just started the horizontal developments,” he said. “The Bradford Ranch was our first in the Midland basin with horizontal wells. So, the first two wells, they will take some time to see how that works out as we move into that development, but I would expect to see us be very efficient with the horizontal wells.”

Noting that Chevron’s 2015 Permian rig count would likely fluctuate, Johnson said that as of March, the active fleet totaled 25, down five from the 2014 peak. Furthermore, Chevron had planned to drill 500 wells in 2014, but actually drilled about 550 new wells, Johnson said. “Our efficiency was much higher than we expected. But, what we are doing this year is, as we shift away from vertical wells into more horizontals, the actual number of wells will decrease. You will see, more like 375 (new wells) is the current target.”

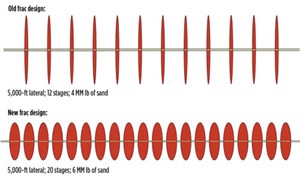

As of March, Concho Resources was still running an aggregate 24 horizontal rigs across its 700,000-net-acre position across the Midland and Delaware basins. Of those, 15 are drilling within the 255,000 net that acres the Midland-based independent controls in the northern Delaware basin, where it added 36 wells in the fourth quarter. In 2015, the homegrown operator said it will focus on its continued downspacing tests in the Avalon shale and the second bench of the Bone Spring shale, and its ongoing completion design optimization, which includes a more-than-30% increase in the stage count, with a corresponding 80% per well hike in proppant concentration.

Concho also is running six rigs in its 170,000 net acres in the southern Delaware basin, with three horizontal rigs drilling in the 110,000 net acres that it controls in the Midland basin fairway, where it targets both the Sprayberry, and the upper and lower Wolfcamp. In fourth-quarter 2014, Concho’s Permian basin holdings delivered 124,000 boed, with 2015 guidance calling for 16% to 20% year-over-year production growth.

In January, aptly named RSP Permian completed its first year as a public company, and ended the fourth quarter with production escalating 106% to 16,100 boed, despite deferring completions as prices dropped. The pure-play company, which owns 46,738 acres on which the primary targets are the Lower Sprayberry and Wolfcamp A and B benches, expects 52% production growth in 2015. RSP says it will run four horizontal rigs until mid-year, when one will be released.

However, one potential downside of geological heterogeneity, is the increased risk of scale, paraffin, H2S and other flow assurance issues. “These deposits not only cost the operator lost or delayed production revenue, but lead to extremely expensive remediation,” says Mark Chapman, CARBO Permian basin technical manager. “New technologies for chemical delivery have the capacity to prevent the development of these deposits, and maintain a clear pathway for hydrocarbon flow, much longer than traditional treatment methods.”

One of those referenced technologies, he said, prevents scale by employing engineered porous proppant grains to carry scale inhibitor into the fracture, using a semi-porous membrane to control the release of the chemical. “Once in contact with water in the fracture, the scale inhibitor is released in a predictable and controlled manner, which safeguards the entire production system, from the fracture through the wellbore to the surface equipment,” he said.

Delaware focus. The mature Midland basin in the Texas fairway has long been the principal landing spot for Permian drilling rigs, but a great deal of activity has shifted westward to the comparatively emergent Delaware basin, primarily traversing southeastern New Mexico, and extending into the Lone Star State. Within the most recent tally of active Permian basin rigs, 50 were operating in its New Mexico segment, down three from the previous week.

Count EOG Resources among those firms with a tightly concentrated foothold in the Delaware, where it holds 140,000 net acres, and primarily targets its relatively mature Leonard shale play, as well as the comparatively emerging second Bone Spring bench and the Wolfcamp. In 2014, EOG said it delineated 90,000 net acres in the oil window of the Wolfcamp, which has now transitioned to the development mode. In a March investor presentation, EOG said it would operate an average eight rigs this year, up from the three it was running at the end of 2014. EOG exited last year with 14 new wells drilled within its Wolfcamp leasehold.

Chairman and CEO Bill Thomas also reinforced to analysts, in March, the company’s intention to defer future completions until prices recover sufficiently. “As we have said, we are going to not grow oil while oil prices are low. We’re going to wait for the recovery, and that will be able to give us much higher returns,” he said.

When asked for a completion timeline, should oil reach $60/bbl by midsummer, Executive V.P. Billy Helms said, “we would start somewhere around September, and start the ramp-up, if we have been encouraged with oil price improvement.”

Cimarex Energy Co. also is one operator focusing entirely on the Delaware, where it holds 235,000 net acres, 104,000 of which are in the Culbertson County joint development agreement (JDA) with Chevron. Cimarex drilled 117 net wells last year, with 39 drilled in the fourth quarter, including five Wolfcamp D wells completed with 10,000-ft laterals and 27 net New Mexico Bone Spring wells, Fig. 6.

The Denver-based independent pumped 38,246 bopd in the fourth quarter, up 29% year-over-year, and expects more of the same in 2015, with production projected to climb 13% to 19% over 2014’s levels. Cimarex said up to 40 of the 50 net wells it expects to drill in 2015 should come online in the first half.

Devon Energy holds 1.3 million net acres across the Permian basin, with nearly 525,000 of those locked down in the Delaware basin and prospective for the Bone Springs, Leonard and Wolfcamp shales, as well as the Delaware sands. The Oklahoma City-based independent said its Permian-wide production grew 175% in the fourth quarter to just over 50,000 bopd, driven largely by the Delaware basin. Of the 21 rigs that it averaged in the Permian basin last year, 14 were drilling in the Delaware basin.

Devon brought 13 Bone Springs wells online last year with its larger completions that include 1,600 lb of sand/lateral ft, compared to the old design that used 600 lb sand/lateral ft. The 13 wells completed with the new design recorded a 60% increase in IP rates, to an average of 940 boed, Devon said.

The company has earmarked $1.3 billion in Permian expenditures for 2015 and plans to drill around 240 gross wells. At the end of 2014, some 35 wells in the Delaware basin were uncompleted, said COO David Hager. “That’s going to be part of the basis of our growth as we move into 2015, as we drive that inventory down to probably more on the order of 20 to 25 uncompleted wells by the end of 2015,” he said.

Oxy pushes CO2. The Permian basin has long reigned as one of the nation’s bastions for CO2 EOR projects, with Occidental Petroleum as the undisputed leader by a wide margin. Occidental’s Vicki Hollub, president of oil and gas in the Americas, says the operator’s EOR and unconventional production businesses are on equal footing in the Permian.

“Our EOR business has unrisked gross resource potential of up to 1.9 Bbbl, providing us with a vast inventory of future CO2 projects, which could be developed over the next 20 years, or accelerated, depending on market conditions,” she told investors. “Our current strategy for this business is to invest sufficient capital to maintain current production, thereby providing cash flow to support growth in our Permian resources business. By exploiting natural synergies between our EOR and resources businesses, Oxy is able to deliver unique advantages, efficiencies and expertise across our Permian basin operations.”

In 2014, Occidental drilled 277 infill wells and continued construction of facilities for new CO2 projects, including the South Hobbs, N.M. venture that, when completed, will develop 28 MMboe of reserves at a cost of $10.60/boe, she said.

“The CO2 floods have remained a strong business through technology advancement that improves recovery from our large portfolio of conventional reservoirs. In the Permian, Oxy operates reservoirs that, collectively, contained approximately 18 Bbbl of original oil-in-place. Hence, even small improvements in recovery efficiency can add significant reserves,” she said. “An example of this has been the recent trend towards vertical expansion of the CO2 flooded interval into residual oil zone (ROZ) targets. Over the last few years, we have had an ongoing program of deepening wells, with 109 wells deepened in 2014, and 81 wells planned in 2015.”

In a related development, by Sept. 30, the University of Texas Permian Basin (UTPB) is expected to release the results of a five-year DOE-funded project, “Using “Next Generation” CO2-EOR Technologies to Optimize the Residual Oil Zone CO2 Flood at Goldsmith Landreth Unit, Ector County, Texas.” The “next generation” technologies examined include detailed reservoir characterization, laboratory and bench-scale testing, full-scale reservoir modeling and state-of-the-art diagnostics, according to UTPB.

As for its resource segment, Oxy operated 29 rigs in 2014, and drilled 85 wells, including 56 horizontals. A total of 44 horizontal wells was included in the cumulative 70 wells put on production last year. In the fourth quarter, Oxy’s Permian basin acreage delivered 84,000 boed, a 9% increase from the 77,000 boed produced in the previous quarter.

As part of its overall 33% budget reduction, Oxy will spend $1.7 billion in the Permian, which is $200 million less than its 2014 expenditures. The operator plans to operate 19 rigs, on average, and drill 167 horizontal wells, which would equal the number drilled in 2014.

Oxy’s Chazen, however, said that contractors and service providers had best be prepared to provide additional cost concessions. “The current service company cost structure is more reflective of a $100 oil price environment, rather than the $50 environment we have today. While service companies have offered modest price reductions, they still do not reflect the current reality,” he said. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)