The last barrel

“I think somebody blew your pilot light out….You’ve got splinters in the windmills of your mind.”—Comments made by the Mama Harper character, played by comedienne Vicki Lawrence, to the Eunice character, played by Carol Burnett, on The Carol Burnett Show, which ran from 1967 to 1978 on CBS.

Recently, I was channel-surfing through the vast, U.S. cable television wasteland, when I came upon a re-run of The Carol Burnett Show, airing on a classic TV channel. Not only were the above quotes from that episode funny in their own context, but now they apply equally to Russian President Vladimir Putin, considering his recent decision-making.

Deteriorating Russian finances. More than six months have passed since the full force of Western sanctions took effect against Russia, in retaliation for Putin’s incursions into Ukraine. These sanctions’ effects have been far more effective than the West imagined, especially when combined falling oil prices. Russia’s foreign currency and gold reserves, as per Central Bank of Russia figures, have fallen from about $600 billion in 2008 to $475 billion in mid-July 2014, and to a mere $365 billion in late February 2015.

During this same period, sanctions and low oil prices have denied Russia billions of dollars in budget revenue; crashed the state currency, the ruble; and sent the national economy into a tailspin, with sinking retail sales. The Central Bank tried to prop up the slumping ruble with high interest rates, which did not work. A month later, the Central Bank lowered them—to stimulate the economy—but that didn’t work either. Not surprisingly, double-digit inflation has hit Russian consumers.

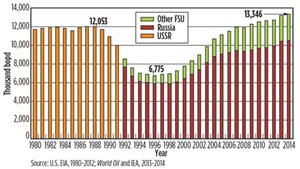

Russian oil activity. Meanwhile, Russian producers have pumped oil like there’s no tomorrow, and Putin does not seem inclined to rein them in. As the chart on this page indicates, Russian producers have done their part to over-supply the global oil market. Over the last 11 years, between 2003 and 2014, Russian oil production has grown 29%, from 8.1 MMbpd to nearly 10.5 MMbpd. During that same period, Russian drilling rose about 108%, from a low of 3,527 wells in 2004 to a high of 7,365 in 2013, followed by about 7,000 wells in 2014. Overall FSU production is now 10.7% higher than the Soviet Union peak of 12.053 MMbopd in 1988.

Yet, despite the price slump, there is no indication that Russian producers will discipline themselves. Rosneft, as late as February, was still planning to increase its owned rig fleet from 213 units in 2014, to 230 in 2015. Furthermore, Lukoil insisted that it would continue exploration in several regions, “to continue building up the company’s resource base.” Surgutneftegas actually increased oil output during January 2015, up 0.2% from a year earlier.

One school of thought says that Russian oil companies, on orders from Putin, will continue to produce at near-record levels, so desperate is the government for revenue, even if no one makes a profit. But if Russian producers maintain their 2014 output levels, they will only exacerbate the global oversupply, keep prices depressed, and put a lid on potential revenue to the government.

Which brings us back to Putin. Are the small territorial gains (so far) in Ukraine, and the moderate damage to its economy, really worth a shrinkage of GDP back in Russia, and a potentially devastated economy? Is it worth reversing the gains made in reducing Russian poverty from 25% of the population in 1999 to just 11% in 2014? Suffice to say, if Putin continues down his current route, which may be an ill-conceived attempt to re-build the Soviet Union, then he will prove that he truly has splinters in the windmills of his mind.

Kasich’s Ohio folly. Ohio operators think that Republican Gov. John Kasich is behaving more like a tax-and-spend Democrat, insinuating that someone must have blown out the pilot light in his mind. It seems that Kasich has revived an idea that he originally had in 2012, to impose a “success tax” on producers, which would raise the extraction tax rate in Ohio to 6.5%. He would then use the proceeds to reduce the average state income tax rate for individuals, which sounds like a Robin Hood scheme.

Never mind that Kasich has twice before tried to push such a tax, and the Republican majority (his own party) in the state legislature has rejected it. And never mind that state spending under Kasich has risen 20% in his four-plus years on the job. Yet, he wants to balance the state budget on the back of an industry that has done so much for Ohio in recent years, but now finds itself struggling with low commodity prices.

In response to objections to his plan from industry executives, Kasich issued a somewhat juvenile retort, saying that their concerns are “a big fat joke.” Ironically, Kasich has periodically been mentioned as a potential Republican presidential candidate in 2016. I would suggest that this idea is a big fat joke, and it should not be allowed to happen. ![]()

- What's new in production: Things go better with Coke (February)

- Before OPEC, there was Texas: A better path for Venezuela’s oil revival (February)

- International E&P shows the way forward (February)

- Drilling advances: Bottlenecks? What bottlenecks? (January)

- What's new in production: Welcome diversion? (December 2025)

- Flexibility and modularity enable tailored solutions for challenging shale plays (December 2025)