Drilling falters while production and reserves register further increases

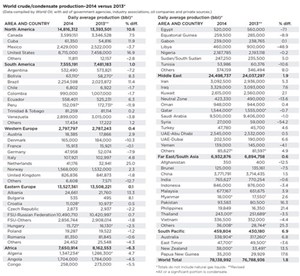

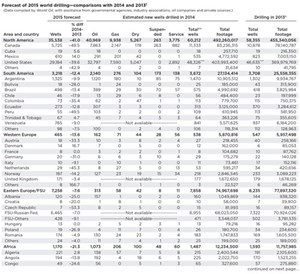

As we look back over the last 12 months and gauge the effect that cratering oil prices have had on global upstream activity, two distinct, somewhat opposed trends emerge. On one hand, worldwide drilling has taken a major hit, with activity, including North America (Fig. 1), expected to be down 26.5%. On the other hand, global oil production and reserves both posted gains.

Some of the increases in production and reserves were spurred by 2014’s very robust drilling rate. Additionally, as pertains to North America, operators saw their expectations for shale well output rates and duration of IP exceeded considerably. This in turn, pushed U.S. oil production 16.9% higher, to rates that have lasted longer than most people expected.

Overall, global crude and condensate production was up 2.0% last year, which compares to a historical trend of average annual gains of 1.0% to 1.5%. Every region posted an increase, except for Africa. In the latter continent, production would have been even with 2013’s rate or even slightly higher, were it not for ongoing instability in Libya that cut the country’s output in half, as well as a temporary 80,000-bopd decline in Angola.

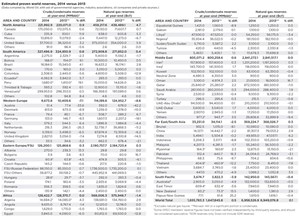

Global oil reserves were up nearly 8.0 Bbbl, gaining 0.5%. Natural gas reserves were up about 9.5% for a modest, 0.1% increase. On the drilling front, the worldwide total for 2014 was just two-tenths of 1% higher than the 2013 figure, at 101,670 wells. In fact, if the U.S. is taken out of the equation, the rest of the world was actually down 2.8% last year, at 54,870 wells. The principal factor was a 1,363-well drop in China, accompanied by a 5.0% decline in Russian drilling.

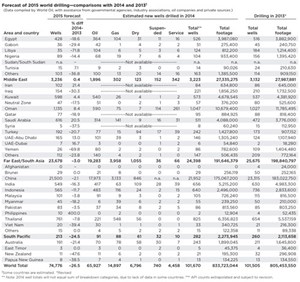

Given these factors and others, we forecast that global drilling will decrease 26.5% during 2015, to 74,776 wells. Some key activity findings include:

- The U.S. will drill 39% of wells globally, down from a very high 47.5% last year, and also down from the 42%-to-44% range of the 2011-2013 period.

- The world’s top four drilling countries remain the U.S. (29,184 wells this year), followed by China (21,500 wells), Russia (6,465 wells) and Canada (5,725 wells), the latter now slipping to fourth place. Together, these four nations will drill 62,874 wells, or 84.1% of all drilling, worldwide. This compares to an 87.1% share in 2014.

- Russia remained the world’s top crude and condensate producer last year at 10.49 MMbpd, followed by Saudi Arabia at 9.50 MMbpd. The U.S. finished third at 8.715 MMbpd, with an astounding gain of 1.257 MMbpd (up 16.9%) from the 2013 figure.

- The top four drillers are also the top four nations operating active oil wells. The U.S. (600,679 wells), China (270,479), Russia (168,300) and Canada (88,178, including 15,500 in situ wells) account for more than 1.12 million wells. This is up 3.5% from the 2013 number.

- The spectacular growth of U.S. oil reserves continued for a sixth straight year. Since its low point of 20.554 Bbbl in 2009, the U.S. number has risen to an official U.S. EIA figure of 33.520 Bbbl at the end of 2013, a 63.1% gain. We believe that this number grew again last year, to well over 37 Bbbl.

The following regional assessments give perspective and explanation to the statistical findings.

NORTH AMERICA

Last year was a time of plenty for operators, as they rode the last wave of expanded activity before low oil prices halted the cycle. Regional drilling was up 3.2%, to 60,212 wells, despite a decline in Mexican activity. In addition, North American oil output was up 10.6%, thanks to healthy gains in the U.S. and Canada. Oil reserves were up 0.9%, while natural gas reserves grew 4.7%. For 2015, regional drilling is forecast to slide 41.0%, to 35,538 wells.

Canada. Low oil prices have had a major effect on Canada’s upstream sector. In response to the downturn, operators have slashed spending, strung out or postponed large projects and laid off considerable numbers of employees. In turn, the spending reductions have impacted drilling levels and produced a very large decrease in land sale revenues to provincial governments. Drilling throughout the country is now expected to be about half of 2014’s level.

Last year, Canadian oil production gained 7.5%, as output averaged 3.599 MMbopd. Oil reserves rose 0.6%, and gas reserves improved 0.7%. Drilling during 2014 rose 4.2%, to 11,333 wells. This year, we predict a 49.5% drop to 5,725 wells. For more details on Canada, please see World Oil, August 2015, p. 53.

Mexico. The last 12 months have been rough for Mexico’s E&P industry, as the country struggles to implement the reform legislation passed in August 2014, which effectively ended state oil company Pemex’s 75-year monopoly. One of the pillars of the reforms, Round One, the first licensing round open to foreign operators, was a major failure in July. Only two of 14 blocks on offer attracted winning bids, with both tracts awarded to the same consortium. In response, regulators have agreed to make a number of changes to the process for the second bidding round, to attract more participation.

Meanwhile, operational results were less than what officials might have hoped for. Drilling fell once again, losing 35% to 535 wells. After appearing to stabilize in 2013, oil production took another hit, losing 3.7%, to average 3.429 MMbpd. Oil reserves were down 2.4%, and gas reserves fell 6.7%. For 2015, Pemex expects drilling to rebound 14%. For more information on Mexico, please see World Oil, August 2015, p. 56.

U.S. It was a stupendous year for E&P activity in the U.S. during 2014, until oil prices began to tank in md-October. Nevertheless, U.S. drilling totaled an impressive 48,326 wells, up 3.6% from 2013’s level. As might be expected, growth was led by strong activity in the major shale plays, particularly the Permian basin, Eagle Ford, Bakken, Niobrara and Marcellus.

Accordingly, U.S. oil production was up 16.9%, to 8.715 MMbpd. Dry natural gas production rose 5.7%, to 25.718 Tcf, or 70.462 Bcfd. Oil reserves are estimated to have gained 3.2%, to hit their highest level since 1974. Gas reserves also were up, rising 5.9% to an estimated 375.0 Tcf. For more details on the U.S., see World Oil, August 2015, p. 45.

SOUTH AMERICA

Regional drilling exceeded our expectations, totaling 3,672 wells and 27.1 MMft of hole. This year, in the lower-price environment, South American operators will drill 12.4% fewer wells. On a happier note, regional oil production gained 1.0%, to average 7.555 MMbpd, due mostly to increases in Brazil and Ecuador. Oil reserves made another modest gain, up 0.8% to 327.5 Bbbl. Gas reserves were up 1.1Tcf, to 272.9 Tcf.

Brazil. In the short run, the country has gone into recession, and corruption investigations are reaching deep into the oil and gas sector, with high-profile officials accumulating as casualties. In turn, investor fears are growing about a deepening of the recession, and large upstream projects are being delayed.

Perhaps the most important detail in the latest corruption scandal is the collusion between Petrobras and a small group of vendors to overcharge for services in the field. Petrobras officials received bribes in exchange for favoritism, and then they shared these kickbacks with politicians, including many in the ruling Workers’ Party. Total value of the various bribes is estimated at around $3 billion.

Nevertheless, a cleanup of Brazilian politics and business, accompanied by a change of attitude within Petrobras, should help the country regain its footing in the longer term. In the meantime, Brazil will try to carry on with regular business as much as possible. The country’s next auction of leases, Round 13, will be in October.

In terms of activity, Brazilian drilling was down 7.0% last year, with offshore wells accounting for 27% of the total. Owing to a combination of the corruption scandal and low oil prices, a further reduction of 13.4% to 498 wells is forecast for 2015. On the positive side, Brazilian oil production was up 11.4%. In addition, oil reserves rose 4.1%, and gas reserves nudged 2.8% higher.

Venezuela. In the short term, Venezuela is a complete mess. Stuck in a recession exacerbated by low oil prices, the country is suffering shortages of everything from consumer goods to oil field equipment and supplies. The situation is worsened by President Nicholas Maduro and his regime, which have continued the incompetent, corrupt policies and practices of his predecessor, the late Hugo Chavez.

The effects on Venezuela’s E&P sector are noticeable. Rumors abound about accidents in the field, equipment breakdowns and debilitating shortages of basic supplies and tools. And lately have come stories of deferred maintenance, which is bound to result in further operational failures and lost production. Yet, Maduro and his administration insist that they are on target to arrest the decline in Venezuelan crude and condensate output, and build it back to well above 3 MMbpd, and eventually reach 5-6 MMbpd.

If officials are even remotely on-track with their production goals, it may only be because they have been soliciting significant investment and loans from ideologically sympathetic countries, such as Russia and China. Last May, Venezuela and Rosneft reached an agreement calling for the Russian firm to invest $14 billion in the South American country’s oil and gas sector, said Maduro. He indicated that the funds would go toward doubling Venezuela’s oil production.

On another front, Venezuela has appealed for a second time to the World Bank’s arbitration panel against its decision in the country’s dispute with ConocoPhillips (COP). The situation dates back to the nationalization of the company’s assets. In a partial ruling last year, the International Centre for Settlement of Investment Disputes (ICSID) said that the 2007 takeover of COP’s field projects by Chavez was unlawful. In August 2015, Venezuela’s attorney general’s office formally requested that ICSID reconsider its position on the ruling.

One bright spot in the upstream picture is Repsol’s start-up of giant Perla gas field, 50 km offshore in the Gulf of Venezuela. This past July, operator Repsol (50%) and partner Eni (50%) put the first producing well onstream. The companies expected to start producing 150 MMcfgd, rising to 450 MMcfgd by the end of 2015. Holding 17 Tcf of gas-in-place, Perla is the largest gas discovery in Repsol’s history, as well as the largest offshore gas field in Latin America.

Speaking of reserves, PDVSA said that the country’s oil figure has risen 1.6 Bbbl to 299.953 Bbbl. Gas reserves reportedly gained 0.6%, to 198.4 Tcf. As alluded to earlier, oil production declined 3.8%, averaging 2.899 MMbpd. Drilling was off 10.2% at 841 wells. This year, a further reduction of 9% is expected.

Colombia. In the eight years since hitting a low point in 2007, Colombian oil production has roughly doubled to about 1.0 MMbpd. This performance was spurred by the regulatory reforms implemented by the government in 2003. Nevertheless, Colombian officials estimate that at current levels, the country’s oil reserves will only last another seven years.

Furthermore, increased rebel attacks on oil infrastructure, coupled with falling oil prices, led to a leveling off of production last year. Output was down 1.7%, averaging 990,000 bopd. Accordingly, oil reserves declined 5.6%, and gas reserves were down nearly 13%. Drilling last year was roughly level with 2013’s figure at 113 wells. The outlook this year is for a 35.4% decline to 73 wells.

WESTERN EUROPE

As we predicted a year ago, Western European drilling during 2014 remained almost level with 2013’s figure, as 538 wells were drilled. Oil and gas reserves took another hit, losing 7.1% and 8.6%, respectively. Paradoxically, regional oil production was up 0.4%, at 2.8 MMbpd.

Norway. This year marks the 50th anniversary of upstream oil and gas activity beginning in Norway, but officials probably aren’t in all that celebratory a mood. Back in mid-2014, the government and operators were already concerned about Norway’s sky-high costs for E&P work, and vowed to find ways to lower those expenses. But then came the rapid downturn in oil prices, which made the effort to lower field costs an absolute imperative. At the same time, several field development projects were either postponed or had their designs altered.

While some field projects have been postponed, others are proceeding. In February, the Plan for Development and Operation (PDO) for Johan Sverdrup field was submitted to Minister of Petroleum and Energy Tord Lien. The oil discovery is the fifth-largest ever made on the Norwegian shelf, and it will be developed in multiple stages. Then, in May, the Norwegian Petroleum Directorate (NPD) received a PDO for the Maria oil discovery. The Maria discovery, in Blocks 6407/1 and 6406/3 on the Halten Bank in the Norwegian Sea, is Wintershall’s first operated development project. It is estimated to contain approximately 28.1 MMcm of oil equivalent—mostly oil, but also some associated gas and NGLs.

Last April, Statoil’s Valemon field was opened officially. Valemon went onstream in January with three producing wells. In all, 10 production wells are planned. Reserves are estimated at about 192 MMboe.

Exploration efforts offshore Norway over the last 12 months were either feast or famine. A large string of 21 dry holes was drilled by 11 different operators. Conversely, 15 discoveries were made by five various operators, including a significant oil and gas find last October. Overall, Norwegian drilling during 2014 was down 6.4%, at 218 wells. This year, a further reduction to 187 wells is expected by NPD. Oil production improved 2.3%, to 1.568 MMbpd, while oil reserves declined 6.5%. Gas reserves were down 6.2%.

UK. The well-documented decline in British oil output continued last year, averaging 826,836 bpd, for a 1.8% decrease. Oil and gas reserves also slid, losing 7.4% and 14.5%, respectively. One small encouraging sign was the fact that operators drilled about the same number of wells (177) as in 2013 (179). This year, a six-well decline to 171 wells is forecast.

The problems that plagued UK E&P activity a year ago still remain in large part, including aging reservoirs and infrastructure that have caused production declines and widespread outages. In addition, the new fields coming online are insufficient to offset declines elsewhere. Meanwhile, the newly established Oil & Gas Authority is now up and running. Officials are looking at a variety of measures to help stimulate activity.

EASTERN EUROPE/FSU

Throughout the region, drilling last year lost 4.6%. A further reduction of 7.6% is forecast for 2015. Conversely, crude and condensate production, regionwide, was up ever so slightly at 13.527 MMbpd. This was due exclusively to a small increase in Russian output. Oil and gas reserves were both up a modest 0.3%.

Russia. For the ninth year in a row, Russia was the world leader for crude and condensate output. Last year, production averaged 10.49 MMbpd (up 0.7%). Rosneft accounted for 36% of Russian oil production, followed by Lukoil (16%), Surgutneftegas (12%), Gazprom (6%), Tatneft (5%), Bashneft (3%) and various other companies (22%). The number of oil wells actively producing in Russia rose 18%, to 168,300.

Oil reserves were up 0.7%, to an estimated 86.2 Bbbl. Gas reserves gained 1.3 Tcf, to total 1,736.5 Tcf. Last year’s drilling eased off 5%, totaling 6,955 wells. This year, Russian drilling is forecast to drop another 7.0%, as most operators curtail their activity in response to low oil prices. However, Rosneft, to a certain degree, is taking a contrarian attitude. The firm said recently that it is perfectly capable of weathering $40/bbl oil. Furthermore, while Rosneft will reduce its CAPEX spending 15% to 20% this year, the firm says that its plans to boost hydrocarbon output 20% by 2020 have not changed.

Other FSU countries. Wells drilled in former Soviet countries outside of Russia last year were down 6.2% at 471. This year, a 9.1% reduction is forecast. Oil production among the 14 republics averaged 2.857 MMbpd, down 1.8%. Oil reserves decreased 0.7%, while gas reserves were up 1.1%.

Within this group, Kazakhstan led in production, at 1.610 MMbopd. Drilling in that republic eased off from 218 wells in 2013 to 212 in 2014. Roughly 200 wells are predicted this year. Second-place producer Azerbaijan averaged 843,326 bopd, down 3.2%. Drilling, both onshore and offshore, totaled 170 wells, down 17.5%. Approximately 160 wells are expected this year. In Belarus, state oil firm Belorusneft said that in June 2015, it set a new record for the deepest well drilled in the country, when it completed the No. 1 Predrechitskoye to a 6,755-m TD. The firm also conducted its first multi-well pad drilling last February.

AFRICA

During 2014, African drilling fell 6.7%, due almost exclusively to declines in violence-plagued Libya and crime-ridden Nigeria. This year, drilling across the continent will fall another 21.3%. While most other regions improved their oil production, African output underperformed, declining 6.3%, to 7.651 MMbpd. Again, Libya (Fig. 2)was a factor, as its output was cut in half. Regional oil reserves remained even, while gas reserves declined 1.4%.

Nigeria’s multi-year problems continue. Despite the fairly high volume that it produces, Nigeria’s oil production suffers from political and social instability, as well as supply disruptions and theft. The natural gas sector is hampered by insufficient infrastructure and cannot monetize gas output that has to be flared.

Nevertheless, a long list of field development projects, mostly offshore, is either underway or proposed. There are five projects actively under development, with production start-up dates ranging from 2016 to 2019. Another seven proposed projects are waiting for a decision on final sanctioning. Any of these that get approval will not have a start-up date before 2020.

Looking at recent activity, drilling last year fell by a third to 104 wells, and the forecast calls for a further reduction, down to 89 wells. Not surprisingly, Nigerian oil production declined slightly again, averaging 2.188 MMbpd. The reserves situation reflected the output performance, with oil reserves slipping to 38.9 Bbbl. Gas reserves also were down less than 1%.

Algeria. According to figures from state firm Sonatrach, Algerian drilling rose 12.6% to 215 wells last year. This year, activity is expected to gain another 2.8%. Crude and condensate output was up 4.7%, averaging 1.347 MMbpd. Oil reserves increased 4.3%, and gas reserves improved 2.9%.

During 2014, Sonatrach struck 30 oil and gas discoveries, and two more were made in partnership with other firms. By the same token, major development projects have been delayed repeatedly, due mostly to slow governmental approvals. Sonatrach owns roughly about 80% of Algerian hydrocarbon production, while IOCs account for the remaining 20%.

Angola. Despite being Africa’s second-largest oil producer, Angola saw its output slip 4.5%, to average 1.704 MMbpd. Oil reserves also declined at a 1.4% rate. Gas reserves remained even at 12.12 Tcf. Drilling was up 32%, totaling 225 wells. However, low oil prices will force a retreat this year to 194 wells.

Angola’s oil production has been somewhat stagnant over the last several years. This results from persistent technical problems related to water injection systems, gas cooling, and FPSOs tied to some projects. These technical problems have caused lengthy, unplanned maintenance work and disrupted output from some fields.

Among the smaller countries, Ghana expects to double its oil production by 2017, due to new deposits being developed by Tullow Oil and Eni. Current output is about 110,000 bopd. In Cameroon, oil production rose from 65,600 bpd in 2013 to 82,200 bpd in 2014, due to the start-up of output from Mvia field, offshore in the Douala-Kribi-Campo basin. And in the Democratic Republic of the Congo, authorities are considering creation of a 40% capital gains tax, in exchange for allowing operators to drill in its national parks.

MIDDLE EAST

Activity remains high in this region, due to a preponderance of NOC-operated projects. If not for declines in Iraq, Qatar and Yemen, the Middle East would be up at least 6%. Nevertheless, this region will be the only area of the world not experiencing a decline, with 3,236 wells forecast for a 0.4% gain. Regional oil production grew 1.1%, to 24.399 MMbpd. Oil reserves were up marginally at 805.1 Bbbl, while gas reserves remained flat at 2,841.3 Tcf.

Saudi Arabia. Production throughout the Kingdom averaged 9.5 MMbopd, up 1.0%. In addition, oil reserves were up 0.3%, and gas reserves rose a stout 1.9%. In addition to maintaining adequate spare crude oil production capacity, state firm Saudi Aramco worked toward its goal of significantly increasing gas output. In 2014, the firm processed 11.3 Bcfd of raw gas, up nearly 3% compared to 2013. All of this increase was from non-associated gas reservoirs.

Engineers continued work on major projects at Shaybah oil field last year. They raised oil production capacity by 250,000 bpd for the second time, bringing total capacity to 1 MMbpd of Arabian Extra Light crude oil by April 2016. This is double its original capacity, when Shaybah went online in 1998.

The Kingdom’s exploration program discovered eight new fields last year. This is the largest annual total in Saudi Aramco’s history. The total includes five gas fields, Abu Ali, Faras, Amjad, Badi, and Faris; two oil fields, Sadawi and Naqa; and one oil and gas field, Qadqad. This brings the number of discovered fields to 129. The company completed a number of offshore wells in the Red Sea, giving engineers and geologists a deeper understanding of that region.

Overall, drilling was up 8.3% last year, at 511 wells. This year, given all the Kingdom’s ongoing work, a 20.5% increase to 616 wells is forecast.

Kuwait. Before oil prices tumbled late last year, state firm Kuwait Petroleum Corporation announced a $40-billion capital spending plan over five years (2015-20) for the upstream sector. This plan includes some of the delayed projects that were part of the five-year spending plan that expired at the end of 2014. Officials intend to upgrade production and export infrastructure, and expand exploration, both domestically and abroad. The goal is to boost total oil production capacity to 4.0 MMbpd by 2020, and maintain that level through 2030.

Accordingly, Kuwaiti drilling continues to increase slowly. Last year, wells drilled were up 6.7%. A further, 4.4% increase is forecast for 2015. Oil production was up 2.1%, at 2.615 MMbpd. Oil and gas reserves remained flat at 102.15 Bbbl and 63.1 Tcf, respectively.

Neutral Zone. After many years of quiet cooperation, the Divided Neutral Zone has become a bone of contention between Kuwait and Saudi Arabia. Over roughly the last year, tensions between the two countries with regard to the Zone have escalated. The root of the problem appears to be that Kuwait is upset that Saudi, back in 2009, renewed Chevron’s concession, for Wafra and surrounding oil fields in the Zone, for 30 years without consulting Kuwaiti officials first.

Then, last October, Saudi and Kuwaiti officials temporarily halted output of as much as 300,000 bopd at Khafji field in the offshore portion of the Zone, due to environmental concerns within the Kingdom’s government. The shutdown came at a time, when the two countries were in a dispute over expanding Khafji’s capacity. All of this comes on top of a decision by the two countries in 2013 to shelve a project to develop Dorra offshore gas field.

Then, this past May, the two countries agreed to shut down their jointly held Wafra oil field area, operated by Chevron, for two weeks, for maintenance, and use that time to sort out all the unresolved disputes that they have in the Zone. However, the two-week shutdown was extended indefinitely in late May, keeping up to 250,000 bpd of oil production off the global market.

UAE-Abu Dhabi. Without any recent, significant discoveries, officials have concentrated on getting the most recovery out of the resources that they do have. One item that may help Abu Dhabi boost oil output is the Zakum area. Operator ZADCO—owned jointly by ADNOC, ExxonMobil and the Japan Oil Development Company—manages production from Upper Zakum field, where output is about 590,000 bopd.

Three years ago, ZADCO awarded an $800-million contract to expand Upper Zakum’s oil production to 750,000 bpd by 2016. Production from Lower Zakum field—operated by Abu Dhabi Marine Operating Company (ADMA-OPCO)—is also set to increase. Production eventually should reach 425,000 bopd, up from the current 345,000-bopd level.

Across the emirate, oil production was up 0.5%. Drilling totaled 146 wells, up 17.7%. With work at Upper and Lower Zakum ongoing, drilling will gain another 13% this year, totaling 165 wells. Oil reserves remained steady at 94.5 Bbbl, while gas reserves were flat at 210.2 Tcf.

Iran. The big news, of course, is the July 14 deal reached between Iran and the P5+1 countries to resolved an ongoing dispute over the country’s nuclear program. Depending on timing, sanctions could be lifted by late this year, and a resurgence of Iran’s upstream sector may be in the offing. For more details on this particular angle, please see the article on page 73.

Meanwhile, a number of field projects continue to move forward. Drilling has progressed at South Yaran oil field, along the border with Iraq, as well as at South Azadegan oil field. Also, Pars Oil & Gas Company is due, by the middle of this month, to finish drilling eight wells at South Pars offshore gas

field (phase 22).

Overall, Iranian production of crude and condensate rose 5.3% in 2014. Oil reserves are estimated to have risen 500 MMbbl during 2014, while gas reserves are up slightly at 1,201.2 Tcf. Drilling last year was about level with the 2013 figure, but a 21.4% increase is expected this year, totaling 102 wells.

FAR EAST/SOUTH ASIA

A 2,363-well decline in Chinese drilling during 2014 pushed the region 5% lower. This year, a 3.0% decline is on tap. Regional oil production managed a small rebound, gaining 0.6%. Oil reserves shrank 2.5%, but gas reserves gained 0.3%.

China. For a second year in a row, Chinese drilling declined during 2014. Wells drilled totaled 21,952, down 5.8%. For 2015, another small decline to 21,500 wells is forecast. Accordingly, oil reserves slipped 2.2%, to 14.1 Bbbl. Gas reserves, on the other hand, grew 2.9%, to 81.3 Tcf.

As of 2014, about 80% of Chinese oil production capacity is onshore, and 20% comes from shallow offshore reserves. China’s NOCs continue to invest heavily in EOR, including water injection, polymer flooding, and steamflooding, to offset production declines in mature, onshore oil fields. New field activity continues to focus on offshore areas, as well as onshore fields in the western and central interior provinces.

India. Wells drilled rose 4.1% last year. Unfortunately, that gain will be wiped out, as a 16.3% decline is expected this year. India’s oil production lost another 0.6%, to average 765,627 bpd. Oil reserves were down slightly, to 5.49 Bbbl, while gas reserves posted a 6.2% gain.

International investment in India’s E&P sector is still rather low, and it appears that the New Exploration Licensing Policy has only been partially successful in reducing India’s oil dependence. Meanwhile, Indian and foreign companies are investing in more frontier developments and marginal fields, to help offset production declines from mature basins.

SOUTH PACIFIC

Throughout this region, drilling gained 8.5%. This year, activity will be noticeably lighter (Fig. 3), with a 24.5% decline expected. Regional production of crude and condensate rose 6.9%, to nearly 460,000 bpd. Conversely, oil reserves slipped 3.9%, and gas reserves shrank 0.4%.

Australia. Drilling last year was 15.2% higher, with about one-fourth of the wells drilled offshore. This year, a 21.4% decline to 191 wells is forecast. Crude and condensate production staged a small recovery, gaining 6.8%, to average nearly 339,000 bopd. Oil reserves were down 4.9%, while gas reserves were off 0.5%.

Australia’s main exploration frontier has shifted in recent years to the deepwater portion of the Timor Sea, yet the Carnarvon basin and Bonaparte basin off the coast of Western Australia remain the busiest areas in terms of overall drilling activity.

Several small offshore fields containing light and heavy sweet crude are under development and should go onstream this year or in early 2016. However, some of these fields may have short lifespans of no more than 10 years. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)