Investing in predictive analytics derives true value

Artificial intelligence has the potential to increase safety, and save time and money for upstream oil and gas operations.

As the oil and gas (O&G) industry emerges from the recent downtown, executives are looking for innovative ways to promote growth. Artificial intelligence (AI) is the technology in the headlines, but what does implementation look like from the lens of a business case?

Common uses of AI in O&G are to optimize operations, predict downtime, and minimize safety and environmental issues. With technologies that can be deployed in days or weeks, capitalizing on AI is easier than ever. Still, O&G companies can be hesitant to make the leap, unsure if the investment will pay off. This article will provide input on why a company would choose to invest in AI and how efficiencies translate into numbers.

THE NEED FOR NEW TECHNOLOGY

In the O&G industry, there are no guarantees. A look back at just the last few years in the industry is enough to cement this idea. Right on the heels of a period of massive growth, oil and gas suffered a catastrophic bust around 2014, followed by a downturn that lasted several years.1 Now, it appears that the industry is just beginning to emerge from this depression, but to what extent, and for how long? Aside from the fluctuating economic situation, O&G is also having to come to grips with aging assets and the “Great Crew Change,” wherein experienced industry veterans are retiring, and not enough new employees are taking their places. Furthermore, the new employees lack the knowledge of their disappearing peers.

Surviving in this climate will mean adopting new methods and technologies going forward. To quote Digitalist Magazine, “If volatility in oil prices is the new norm, the push for ‘value over volume’ is the key to success going forward.”2 O&G companies need to streamline production to squeeze out every possible dollar.

Perhaps the best way to accomplish this is with AI; and more specifically, with predictive analytics. AI can be applied to predict asset failures before they occur, optimize drilling operations, and detect and block cyber threats—all of which maximize uptime and production value.

Early adopters are already beginning to see value from their investment into AI. Chevron, for example, has implemented AI and predictive models in many of its processes, and has seen decreased repair expenses and a 30% increase in production as a result.2 Experts see AI as a sea change in the industry. At the Abu Dhabi International Petroleum Exhibition Conference (ADIPEC) this past November, Microsoft Middle East and Africa’s director of manufacturing and resources, Omar Saleh, stated that the disruptions of the past three years are a “wake-up call” for the O&G sector, and that over the next five to 10 years, AI would have the greatest impact of any technology on the industry.3

Certainly, organizations like Chevron are taking advantage of their position on the technological adoption curve to get a head start on the competition. The O&G industry has always leveraged technology to adapt to change, and the early adopters have always benefited the most.

In spite of this, much of the industry has been slow to adopt this technology. According to a Deloitte and MIT Sloan Management Review survey, more than 67% of managers in the O&G industry expect moderate-to-great impacts from digital disruptions like cognitive and predictive analytics, but less than 25% feel adequately prepared for it.4 AI can seem like a daunting field right now, filled with too many wild claims and not enough substance. It’s no surprise that many companies are hesitant to invest in this technology. However, as the oil and gas industry grows more competitive, companies cannot afford to be left behind. Conversely, by availing themselves of AI technology—particularly before their competitors—organizations stand to gain a wealth of benefits, and a substantial return on investment.

WHAT IS PREDICTIVE ANALYTICS?

So what exactly is it that predictive analytics does to be so valuable to oil and gas companies? Predictive analytics uses machine learning to predict asset failures in advance, Fig 1. A machine learning model collects data from sensors on the rig, monitors and analyzes that sensor data, and raises an alert when it detects an impending failure. This prediction can occur months before the actual failure, giving O&G operators substantial lead time to decide how best to address the failure, and when to schedule maintenance without overly interfering with drilling. If a failure cannot be averted, companies instead are able to bring in a replacement beforehand. All together, this vastly decreases unplanned operational downtime.

Traditional approaches to detecting and predicting failures typically rely on condition-based monitoring and physics-based models, which must be calculated painstakingly by human analysts—and which is rendered obsolete if a single variable of the drilling operations changes.

By contrast, AI-powered predictive analytics greatly reduce the time to deployment, and AI models are able to continuously learn and refine themselves over time. Predictive analytics solutions can analyze patterns and catch failures, even if they have never seen them before. This includes edge cases that occur under unusual or extreme operating conditions, which most rules-based systems fail to capture.

FINANCIAL BENEFITS OF AI TECHNOLOGY

The price tag on unexpected asset failures and downtime can be devastating. Cost and size of drilling operations varies widely, but according to a study by Kimberlite, just three days of unplanned downtime can cost an organization $5.037 million. And three days of downtime in an entire year is hopelessly optimistic for most O&G companies—oil and gas operations average a full 27 days of downtime per year.4 This is a massive financial loss in terms of repair, labor, transportation and equipment costs, but far worse is the opportunity cost of lost production. After all, recouping the investment of drilling a well requires significant revenue.

These aren’t even the only costs—just the ones that are easiest to measure. Intangible assets, such as public image, are notoriously difficult to value, but they can have a very real impact on a company’s bottom line. Major drilling disasters decrease public faith in the company involved, and leave both consumers and potential partners feeling that the company is untrustworthy or uncaring. Public relations disasters—and the ensuing lost business—can plague companies for years after the fact.

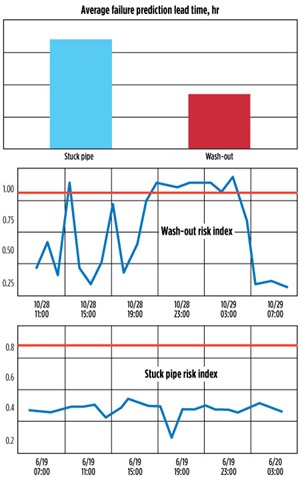

In spite of this, most operations are ill-equipped to avoid these costs, Fig. 2. The most popular approaches to maintenance are not nearly as effective as AI-based approaches. Less than 24% of operators use a predictive maintenance strategy based on AI and data analytics, with the remaining 76% relying on outdated reactive or scheduled maintenance approaches.

The rate of unplanned downtime differs significantly between these methods—in Kimberlite’s study, scheduled maintenance performed at regular, predetermined intervals resulted in a 7.96% rate of unplanned downtime. Reactive maintenance, which performs maintenance on assets after they have run to failure, yielded a downtime rate of 8.43%. By contrast, predictive analytics resulted in a downtime rate of just 5.42%. Overall, the negative annual financial impact of unplanned downtime was 60% lower in respondents that employed predictive analytics. Organizations that used reactive or scheduled maintenance averaged a loss of $59 million per year in unplanned downtime, as compared to an average loss of $24 million annually for organizations using predictive analytics.4

It’s critical to note that predictive analytics also cost less over time than other methods. According to research by the Electric Power Research Institute, the annual cost of scheduled maintenance is $24 per horsepower. Reactive maintenance costs $17 per horsepower per year, before considering the additional costs of the safety hazards or operational damage that may be incurred by asset failure. Predictive maintenance was found to be, by far, the most cost-effective method, costing only $9 per horsepower annually and including no hidden costs or dangers.5

All of this paints a clear picture: Predictive analytics are both more effective and more cost-efficient than other methods of maintenance. In considering adoption of a new technology, it’s important to compare it against current methodologies and alternatives. No matter what kind of calculations are used, predictive analytics have a larger ROI, across the board, than scheduled or reactive approaches.

Determining the precise dollar value of that ROI is a much trickier prospect. No two oil rigs or use cases will ever be exactly the same, and neither will their finances. The question that any operator or contractor considering investing in predictive analytics needs to ask is, “What is the cost of any one of our wells being down?” Most onshore rigs cost anywhere from $50,000/day to $100,000/day to run, and produce roughly 50 to 100 bopd. Unscheduled downtime means eating the cost of daily operations—on top of expensive parts and repairs—with no way to recoup that cost for the day. The longer that a failure goes on, the more these losses will add up.

With predictive analytics, operators can plan ahead and perform repairs before a well has to halt production. Every small percentage of extra time that a well remains up and running creates huge amounts of almost pure profit. There may not be any one-size-fits-all calculation for the ROI of this technology, but in cases where ROI could be measured, adopters of predictive analytics have reported values of 40 to 60 times their initial investment. And naturally, all of these costs—and therefore, the benefits of predictive analytics—increase by orders of magnitude in offshore drilling.

PROCESS OPTIMIZATION, CYBERSECURITY, AND TRIBAL KNOWLEDGE

Maintenance isn’t the only way that predictive analytics can improve an O&G operation’s bottom line. By giving operators a clearer picture of the drilling process as a whole, predictive analytics can automatically discover areas in which inefficiencies exist. The predictive analytics solution can then recommend ways to improve production, so that drilling occurs in as efficient a manner as possible. In the current unpredictable oil market, optimized production is absolutely critical to remain competitive versus other organizations.

Process optimization can be used in areas, such as the monitoring of downhole conditions, as these are volatile, and any unexpected change can disrupt the drilling process massively. Machine learning and predictive analytic models use sensor data to analyze downhole conditions and immediately alert personnel when an issue arises, increasing speed and accuracy of detection.

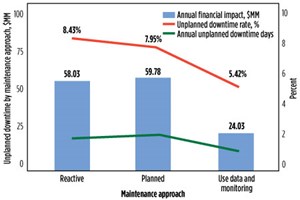

This has been applied already in use cases to great success, Fig. 3. In one such use case, for a top five independent oil and gas operator, predictive analytics were able to improve well efficiency by reducing stuck pipe and drillstring washout failures with more than 90% accuracy. This was accomplished by using a wide variety of data, including pressure, temperature, RPMs, chemicals, flowrate, tubing material grade, wellbore temperature, fluid density, and composition. Where a human would have difficulty monitoring all of these factors, AI does so with ease.

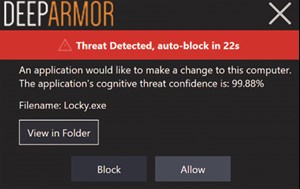

There is also the question of cybersecurity. O&G operations are increasingly being targeted by cyber attacks, and to keep rigs running—and profitable—equipment and networks need to be protected. The same solutions that offer predictive analytics also provide some protection against cyber threats, via anomaly detection.

Predictive analytics and anomaly detection software are designed to monitor the behavior of endpoint devices within the network and flag any unusual behaviors or abnormal signals being sent out. Machine learning accomplishes this by generating hypotheses, using multiple data sets, enabling detection of subtler attacks. Such attacks involve unusual behaviors that still fall within the normal rules of operation, but are statistically unusual. AI software also can be applied strictly to protect endpoints. In this way, an investment in AI can pay dividends in cyber defense, which drilling rigs increasingly need as the cyber threat landscape grows more sophisticated and finds new ways to attack industrial systems, Fig. 4.

Finally, AI and predictive analytics platforms allow for the retention of tribal knowledge. The Great Crew Change is here, and it’s taking away experienced industry workers, along with their years of accumulated knowledge. With AI, companies can capture the knowledge of their veterans in data, preserved there for the newer generation of workers to use. In this way, organizations can train personnel faster and leverage information more effectively. This single application of AI has a healthy ROI, as it is an upfront investment that will continue to pay off over time.

The retention of tribal knowledge through AI also helps oil and gas companies adapt to smaller workforces. The fact of the matter is that O&G are not attracting enough new recruits to replace the people who are retiring, and that trend seems unlikely to reverse. AI provides a way for O&G operations to adjust to this new reality.

THE AI CASE FOR DRILLING CONTRACTORS

It’s important to note that the need for AI is not just a concern for O&G operators. Companies may appear to be the parties that see the most direct financial benefit from investing in AI and predictive analytics, but there is a clear ROI for the drilling contractors who rent out the rigs, as well.

Contractors are in a better position to realize a strong ROI from predictive analytics, as they work with far larger numbers of wells than operators do, and the cost of predictive analytics does not scale up with the number of rigs.

More to the point, contractors do need the operators, who rent their rigs, to profit from the rigs—more so than many contractors realize. While contractors depend strictly on renting rigs to make money, contracts are increasingly on a turnkey or performance-based model, tying some of a contractor’s profits directly back to the success of the operator.

Perhaps most significantly, it’s a buyer’s market for drilling rigs. For instance, of the thousands of rigs in the U.S., only about half are in operation. Increasingly, operators have the luxury to pick and choose what contractor to rent from—and they’re increasingly going to favor contractors that provide them with modern technology, such as predictive analytics. For contractors, investing in AI is less a question of ROI and more a question of survival in a difficult market.

HOW DO YOU GET STARTED?

Even for companies that are convinced of the value of predictive analytics and other AI technologies, it can be difficult to know where to start. For this, there are a few best practice tips that can make the road to AI implementation far smoother.

First is choosing the right vendor. Every other vendor is now claiming to offer AI, and figuring out which ones are legitimate is a major stumbling block for some. A good AI company should employ data scientists with machine learning, statistical and programming expertise. Their models should be adaptive, meaning every implementation of their technology will be unique. They need to be able to handle messy, incomplete, or skewed data, or at least flag problems in data. And they need to be specialists in AI, with a deep understanding of the subject matter.

Of course, it’s important to understand that vendors merely act as force multipliers, so to speak, for a company’s own personnel. A successful AI implementation depends on collaboration between vendors, who have experience with the technology, and the client’s internal data science team, which has experience with their own company’s data and operations. The role of outside vendors is simply to augment a company, as that company builds out its own AI capabilities.

Once a vendor has been chosen, companies need to get engagement from their team on all levels. Good communication is key here—employees need to understand what the goal of the AI implementation is, and how the organization stands to benefit. Good lines of communication with the AI deployment team and the external vendor are crucial to avoiding unnecessary slowdowns, as well. The goals of an AI deployment should be well-defined, so everyone understands what success looks like.

Finally, any company looking to use predictive analytics or other kinds of AI will need data of an appropriate quality. AI is a powerful tool, but its models are only as good as the data that it learns from. While good AI vendors and solutions will have methods for cleaning data, there is still a certain standard of quality that is necessary to produce usable results.

This doesn’t need to all occur at once. Development of predictive analytics can be staged in as many ways as makes a company comfortable. First, an operator or contractor might ask an AI vendor for a proof of concept to demonstrate their technology. Next, the operator could request software built around that proof of concept, followed by a version of the software that can scale. O&G companies can use the optionality built into this process to constantly monitor for ROI. There may be no way to state what the ROI of predictive analytics is for all O&G companies, but by staging out the implementation process, companies can discover their ROI without too much risk.

At the end of the day, while the specific ROI may vary between companies and drilling operations, predictive analytics will improve the bottom line of businesses that decide to invest. It will have an even more dramatic impact for companies that invest early, before their competitors. In the ever-changing O&G market, that’s an edge that businesses need to thrive. ![]()

REFERENCES

- Blackmon, D., “The oil and gas situation: A preview of 2018,” Forbes.com, Dec. 31, 2017.

- Srivastava, A., “Artificial intelligence: The future of oil and gas,” Digitalistmag.com, Aug. 7, 2017.

- Meredith, S., “Artificial intelligence will have huge impact for oil and gas, Microsoft executive says,” CNBC.com, Nov. 15, 2017.

- “The impact of digital on unplanned downtime,” BHGE.com, October, 2017.

- Phillippi, B. “How predictive maintenance drives efficiency for modern plants,” Flowcontrolnetwork.com, Aug. 5, 2015.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Oil and gas in the Capitals (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)