Haynesville-Bossier Shale

When Jerry Jones bought the Dallas Cowboys 30 years ago, he gambled on an American football team that was floundering, both on the field and on the balance sheet. His $140-million investment, in a once-proud team that was nearly bankrupt in February 1989, has since evolved into a perennial winner worth nearly $5 billion and at the top of Forbes list of the world’s most valuable professional sports franchises.

The flamboyant Jones is now betting that he can replicate that tour de force, but on a much more precarious playing field. With the $2.2-billion acquisition of pure play Covey Park Energy LLC in July, Jones’ Comstock Resources, Inc. emerged as a premier player among the condensed collection of largely privately held operators still at work in the dry gas Haynesville shale. The deal gave Comstock a 309,000-net-acre position in the northern Louisiana core of the Haynesville and overlying Bossier play, which extends into East Texas.

Jones, who owns 75% of Comstock, paralleled the purchase of the once-woebegone Cowboys to that of a company wholly engaged in a gas market that shows no signs of emerging from a years-long funk anytime soon. “I bought [the team] when everything was down and out. This is opportune times, especially when you can deal with a world-class [gas] asset located where it is,” Jones said of the deal that closed on July 16, as quoted by Bloomberg.

For the operators still at work, location ranks as a principal selling point for the deep and high-pressured Haynesville, where the shale ranges from 200 to 300 ft thick and is recognized for delivering high flowrates and returns. They cite a still-growing infrastructure that provides a direct link to the Gulf Coast, home turf for an expanding petrochemical and liquefied natural gas (LNG) export hub.

Shrugging off concerns that the continued buildup of LNG export capacity could eventually mimic the oversaturated domestic market, the foremost Gulf Coast exporter says the global attraction to cleaner-burning natural gas will create more than enough demand to justify increased supplies. “There’s a lot of infrastructure that continues to be built in support to natural gas consumption worldwide, and we feel very, very good about our position in the world market and our customers’ position on how they are utilizing natural gas in that overall cost of production,” Cheniere Energy Partner’s President and CEO Jack Fusco said in a Nov. 1 earnings call.

PRODUCTION STILL CLIMBS

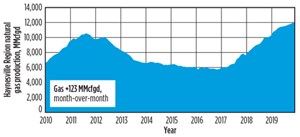

Operators are listening, as evidenced by the play-record 12,052 MMcfd expected to be produced in December (Fig. 1), according to a U.S. Energy Information Administration (EIA) guesstimate. By contrast, EIA data show the Haynesville delivering 9,667 MMcfd in December 2018.

Further, while operators are laying down rigs elsewhere to comply with investor demands for returns over growth, the Haynesville surprisingly has maintained a relatively steady average of 52 active rigs for the first 11 months of 2019, according to Baker Hughes. Correspondingly, Louisiana Department of Natural Resources (DNR) data show 261 horizontal drilling permits approved between Jan. 1 and Nov. 5 in the pertinent Haynesville parishes, compared to the 340 Haynesville permits that the state regulator authorized for all of 2018.

All this comes as natural gas futures for December delivery settled at $2.60/MBtu on Nov. 13, after rallying to $2.86/MBtu on the New York Mercantile Exchange (NYME) a week earlier, as an early season Arctic blast gripped much of the U.S. The EIA had spot prices on the Henry Hub benchmark closing at $2.72/MBtu on Nov. 12.

While northern Louisiana is the recognized core of the Haynesville, approved drilling permits would have East Texas staking a claim as the play’s de facto epicenter. As of Nov. 13, the Texas Railroad Commission (RRC), that state’s chief regulator, had issued 308 horizontal drilling permits for RRC District 6, comprising applicable Haynesville counties.

With an East Texas leasehold of more than 250,000 net acres, privately owned Rockcliff Energy, LLC has emerged as the most active operator. According to its website, the Houston-based operator’s primary focus is developing both the Haynesville and overlying Cotton Valley sands “with a multi-rig program.” Rockcliff has not responded to numerous requests for details on its planned drilling and completion program.

A dissection of RRC new well authorizations shows Rockcliff as the clear drilling leader, with 58 permits issued this year, followed by XTO Energy with 31, Tanos Exploration LLC with 29, and BP plc with 25.

Once-active Sabine Oil and Gas Corp. fell out on July 29 with its planned acquisition by Japan’s Osaka Gas Co. Ltd. for $610 million, which is expected to close by the end of 2019. The deal marks Osaka’s first acquisition of a U.S. shale gas producer and includes an aggregate 175,000 net acres and some 1,200 producing wells, mostly concentrated in East Texas’ Panola, Rusk and Upshur counties.

BEEFING UP

Jones may not yet be done laying down high-stakes bets on the Haynesville-Bossier. According to a Nov. 13 Reuters report, Comstock is engaged in “late-stage” negotiations to buy the commanding 339,000-net-acre leasehold of Haynesville early-mover Chesapeake Energy Corp, in a prospective deal reportedly valued at more than $1 billion.

After putting five wells on production in the third quarter, Chesapeake laid down its operated rigs and completion crews for the remainder of the year. After issuing a warning that low commodity prices threaten its continued survival, Chesapeake will reduce capital spending by some 30% next year and suggests others follow suit. “Because when you see a company like Chesapeake with the strength and quality of our gas portfolio reducing capital, I think it should be a good indication of directionally where others should be reducing activity as well,” Executive V.P. and CFO Nick Dell’Osso told analysts on Nov. 5.

In a tacit acknowledgment of puny gas prices, Comstock will drop from a nine- to six-rig program in the early going of 2020. Nevertheless, the Frisco, Texas-based operator expects 2020 production to increase 6% to 8%, to between 1.25 Bcfd and 1.45 Bcfd. Combined third-quarter production amounted to just over 1.1 Bcfd, with 19 net wells earmarked for completions in the fourth quarter.

The company expects to drill 62 gross (44.4 net) and complete 18 gross (10.7 net) wells in 2020. As of Nov. 7, Comstock had drilled 41 gross operated wells and plans to wrap up 2019 with 65 new drills at average lateral lengths of roughly 8,000 ft. The wells were completed with average sand loadings of 3,550 lb/lateral ft and 21-ft cluster spacing, said COO Dan Harrison, with medium initial production (IP) rates of 25 MMcfd.

SAND IN DEMAND

Comstock completions are representative of the industry-high proppant loadings/well required to stimulate the generally overpressured Haynesville. To reduce last-mile costs, the Haynesville is served by roughly six in-basin sand mines, including one by Gen6 Proppants’ that recently commenced operations in Red River Parish, Fig. 2. Pure play Indigo Natural Resources LLC had a since-sold equity stake in the mine, which is currently ramping up to nameplate capacity of 1.5 million tons/yr, said General Manager Will Pritchard.

Privately held Indigo holds a 255,000-net-acre Haynesville-Bossier position and expects 2020 activity to be generally consistent with this year’s average of six to seven rigs and two frac crews. The company plans to exit 2019 with approximately 1.0-Bcfed net (1.4-Bcfed gross) production.

Along with its interest in the sand mine, Indigo and Momentum Midstream sold their jointly owned gas gathering and pipeline network to Michigan-based DTE Midstream in October for $2.25 billion. A former Momentum entity, Gen6 has also been folded into the DTE organization, Pritchard said.

The sweeping DTE acquisition, which is expected to close in the fourth quarter, includes an existing gathering system and a 150-mi pipeline that is under construction and expected to be in service by the second half of 2020, providing access to multiple networks serving Gulf Coast petrochemical and LNG export facilities.

Goodrich Petroleum Corp., meanwhile, pointed to six earlier completed wells as providing ample evidence in support of stout proppant concentrations. Drilled with comparably modest 4,097-ft laterals and stimulated with sand loadings of 4,100 lb/ft, the sextet outperformed offsets drilled with 4,600-ft reaches and 3,100 lb/ft sand loadings, Goodrich said. “They’re not only a good bit better than the industry average composite curve, but they exceed our 2.5 Bcf/1,000-ft curve by a good bit,” Senior V.P. and CFO Robert Barker said. “In general, there’s a high correlation between tighter interval spacing and higher proppant concentrations to EURs (estimated ultimate recoveries). But as we have said before, we are more focused on the returns we’re generating versus just EURs.”

Goodrich is running a single rig on its 22,000-net-acre leasehold in northern Louisiana, while reining in completions until early next year. After completing one well in the third quarter, the company plans to enter 2020 with a five-well drilled-but-uncompleted (DUC) inventory, including three non-operated wells with 10,000-ft laterals in the Bethany-Longstreet field in DeSoto Parish.

LNG GLUT AFOOT?

While most Haynesville producers cite a growing Gulf Coast LNG export hub as justification for increasing production, BP, for one, believes the market is nearing imbalance. “Looking ahead, we expect natural gas markets to remain oversupplied through 2021,” CFO Brian Gilvary told analysts on Oct. 29. “The combination of slower economic growth, slower Asian LNG demand growth and new LNG projects starting up is expected to result in some LNG export capacity being curtailed or underutilized.”

Accordingly, the company’s U.S. onshore entity, BPX Energy, will focus primarily on the wetter Eagle Ford and Permian assets acquired in last year’s $10.5-billion acquisition of BHP Billiton’s shale holdings, which included 193,000 net acres in Louisiana. BPX drilled 13 Haynesville wells in the third quarter, less than half of the 32 and 28 wells constructed in the Eagle Ford and Permian basin, respectively.

As of now, LNG exporters show no signs of curtailing deliveries, saying current and forecasted global LNG demand will outpace supply. “Lower imports from Japan and South Korea were offset by strong imports in the third quarter from China, India, Bangladesh, Pakistan and Malaysia, all of which have experienced double-digit growth from last year,” said Cheniere Executive V.P. and Chief Commercial Officer Anatol Feygin. “Looking ahead, there are several developments and themes worth following that are expected to be favorable to Asian LNG demand growth.”

Cheniere kick-started LNG exports from the Gulf Coast in February 2016 and has since been joined by a number of projects in various stages of development. Cameron LNG joined the export community in May with a debut commissioning cargo from the single-train Hackberry, La., liquefaction facility, Fig. 3. The second and third trains are under construction and are expected to begin producing LNG in the first and second quarters of 2020, respectively.

Boosted by a pending $7.5-billion investment by India’s Petronet LNG Ltd., Tellurian Inc. says it remains on track to begin shipments from its Driftwood LNG export terminal by 2023. A company spokesperson said construction will likely begin next year on the facility located on the west bank of the Calcasieu River, south of Lake Charles, La. The Petronet deal, which is expected to be finalized by March 2020, would give the Indian importer an 18% equity stake in the Driftwood export terminal and provide for the purchase of 5 million tons/yr of LNG.

In an October corporate presentation, Tellurian forecast year-end 2019 global LNG demand will have increased roughly 14% year-over-year, with U.S. exports expected to reach approximately 30 Bcfd by 2025. In a unique approach to providing feedstock for its Driftwood facility, Tellurian acquired 10,233 net acres in Red River and DeSoto parishes between 2017 and 2018 with 20 operated producing wells. “Our 2019 drilling program included three operated wells,” the spokesperson said.

- E&P spending: Global capex to remain steady in 2025 (February 2025)

- Dallas Fed: Oil and gas activity edges lower as outlooks dim, uncertainty rises (November 2024)

- Executive viewpoint: President-elect Trump’s path towards unleashing the economic power of American energy (November 2024)

- Shale technology: Using expandable casing patches to reinforce well integrity (November 2024)

- First oil: How the U.S. election goes will shape future O&G policy (October 2024)

- To frac, or not to frac, that is the question (September 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)