Special Focus: 2021 Forecast & Review – U.S. Oil and Gas Production

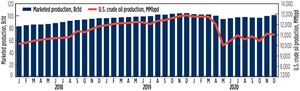

Despite an historically low, 54% decline in drilling activity, U.S. oil production was down just 7.6% on a y-o-y basis, averaging 11.318 MMbopd in 2020. The loss in U.S. output could have been more drastic, but OPEC+ did a masterful job of curtailing production during the year to support benchmark prices. WTI started 2020 at $57.50/bbl, before dropping to $16.55/bbl in April, as Covid-19 decimated demand. Prices steadily improved after that, averaging $47/bbl.

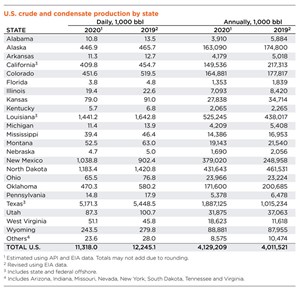

Crude and condensate. As noted, U.S. oil production decreased 7.6% in 2020, with noticeable declines in Oklahoma , Colorado and California. Of the nine major oil-producing states (>100,000 bpd), all suffered loses, with the exception of New Mexico. Texas oil production was down just 5.1%, decreasing to a daily average of 5.17 MMbopd in 2020, despite slumping activity in the Permian and Eagle Ford plays. On the New Mexico side of the Permian, production increased 15.1%, up to 1.038 MMbopd, the only gain of the big-nine states. Bakken production in North Dakota registered a 16.7% decrease, down to 1.18 MMbopd.

In the Western states, Colorado suffered a 13% decrease to 452,000 bopd, while Wyoming was down 13%, to 243,500 bopd. In California, a significant reduction in drilling activity, which started in 2015, has finally started to affect the state’s production, which dropped to 409,800 bopd in 2020, a loss of 10%. A 13% decline in Utah dropped the state down to 87,300 bopd from 100,700 bopd in 2019.

In the Mid-continent, Oklahoma’s production was down a whopping 19%, with disappointing results in the SCOOP and STACK plays causing the state’s output to decline to 470,300 bopd. Conventionally oriented Kansas dropped 13.2%, to average 79,000 bopd, while Louisiana and the federal offshore decreased 12.3%, down to 1.44 MMbopd. Alaska also suffered the same fate, dropping 4% to average 446,900 bopd.

Natural gas. Henry Hub gas prices averaged $2.03/MMBtu in 2020, down $0.53/MMBtu from 2019. HH prices were below $2.00/MMbtu for seven of 12 months and bottomed at $1.63/MMBtu in June. Prices hit a yearly high of $2.61/MMBtu in November, but they retreated back to $2.59/MMBtu by year’s-end. The drop in gas prices during much of 2020 was due to sharp declines in LNG exports, plus a reduction in industrial-sector consumption.

Monthly, averaged, marketed gas production dropped steadily throughout 2020, hitting a low of 94.634 Bcfd in May, before climbing back up 101.063 Bcfd in December.

The EIA says that the U.S. exported 9.8 Bcfd of LNG in December 2020, an increase of 0.4 Bcfd over the previous record set in November.

- From injection to insight: Tracing efficiency in surfactant huff and puff (November 2025)

- Maximizing production with smarter lift solutions (November 2025)

- Production technology: How a minor instrument upgrade led to major oil separator savings (November 2025)

- Engineered components are the difference between survival and failure in HPHT subsea systems (November 2025)

- First Oil: A grand plan designed for U.S. offshore leasing (November 2025)