The great saltwater flood in the Permian Basin

The Permian basin (Permian) of Texas (TX) and New Mexico (NM) is the most prolific oil and gas region in the U.S. According to the Energy Information Administration (EIA), Permian oil and gas production has officially grown past pre-pandemic levels, growing from approximately 4.8 MM bopd to over 5.1 MM bopd. Permian producers are responding to the high commodity price environment and looming supply shortages by promising significant production increases from their core acreage. While growth in Permian production is already underway, the industry faces challenges to unleashing the basin’s full potential. One of the greatest obstacles facing Permian production growth is the dynamic logistical challenge associated with produced water management.

Water in the Permian basin. Most Permian oil and gas production comes from the Delaware basin (Delaware) and Midland basin (Midland). However, each sub-basin has unique characteristics that impact production: notably differing geology, location and water volume. The Delaware is divided into the Northern Delaware and Southern Delaware basins, split by the state boundary between Texas and New Mexico. These states have different regulatory policies for oil and gas production and water management, which impacts producer economics, and drilling and production strategies.

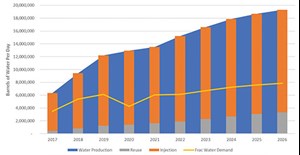

Oil and gas wells in the Permian generate millions of barrels of highly saline “produced water.” For every barrel of oil pumped from a wellhead in the Permian, anywhere from two to eight barrels of produced water are also extracted, depending on the formation and location. Today, 15.1 MMbbl of water are produced in the Permian daily, and the number is growing, Fig. 1. In the Midland, water-to-oil ratios (WOR) range from two to three barrels of water per barrel of oil. WORs in the Delaware are much higher, ranging from four to eight barrels of water per barrel of oil.

Produced water is highly saline and contains other constituents, including production chemicals, organic and inorganic material, and hydrocarbons. This water is mostly managed as a waste product by reinjecting it back into the subsurface at one of the roughly 2,100 saltwater disposal wells (SWDs) operating in the Permian. With annual water production around 5.5 Bbbl, producers must manage millions of barrels of produced water per day by leveraging rapidly growing, but often fragmented infrastructure to provide storage, transportation, treatment and disposal.

A multi-billion-dollar industry has emerged in the past decade, with the sole purpose of addressing the oil field’s water management needs. After water emerges from a wellhead, it must be gathered and transported, often to storage pits and tanks. Then, the produced water is typically transported through a network of pipelines or on trucks to an SWD. Alternatively, some water remains in the production lifecycle and goes through treatment before it is reused in subsequent hydraulic fracturing operations.

This reuse has reduced reliance on limited freshwater resources significantly, but the B3 Insight (B3) 2022 Permian Water Outlook estimates that reuse accounts for only 30% of water used in completions. To facilitate reuse at an economically acceptable cost, produced water is typically treated only lightly to remove some constituents and prevent negative interactions with other hydraulic fracturing fluid components. At this degree of treatment, produced water in the Permian is not suitable for any human consumption, agriculture, or even most industrial uses outside of the oil field.

Produced water reuse is also reliant on operators continuously drilling and completing wells to create a demand for produced water. The real challenge is scale: there is far more water produced than can be reused. Even if operators sourced 100% of the water required for fracing from produced water, it would only offset about 30% of total produced water volumes. In other words, about 70% of water produced in the Permian would still be in need of disposal, Fig. 2. Disposal will likely remain the primary management method for years to come, as there are no other economic, scalable management options that can accommodate the billions of barrels of water produced each year in the Permian.

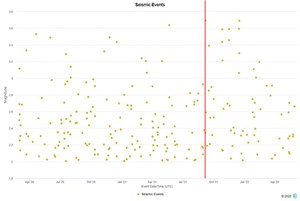

Seismicity. Growing concerns over seismicity add complexity to the pursuit of increased oil and gas production in the basin. Since the early 2010s, the number of seismic events in the Permian has increased by an order of magnitude. Prior to 2014, there were 24 seismic events greater than magnitude (M) 3.5, according to the U.S. Geological Survey (USGS). Since 2014, there have been 102 seismic events over M3.5, with a few as high as M5. This is coincident with the increase in oil and gas operations in the Permian and a steep rise in disposal.

Many scientists are actively seeking to better understand why seismic activity is increasing. Studies from the U.S. Geological Survey, Stanford University, the New Mexico Bureau of Geology, and the Texas Bureau of Economic Geology, among others, have pointed to water disposal in subsurface formations as a significant culprit.

To mitigate increased seismicity, New Mexico and Texas state agencies recently, and independently, acted to mitigate seismicity concerns. Both agencies have established disposal restriction areas, called Seismic Response Areas (SRAs). SRAs were established initially in late 2021 as formal requests to SWD operators to reduce injection rates in certain SWDs located in, or near, very seismically active areas. Operators have generally complied with requested changes in operation. Some SWDs have been mandated to shut down altogether.

Together, the SRA requests in TX curtail permitted disposal capacity by over three MMbwpd. In some SRAs, operators are shutting in SWDs entirely. Others are plugging previously deep SWDs with cement and recompleting (perforating the wellbore to facilitate injection) their deep wells in shallower intervals, effectively converting these wells to shallow disposal wells.

Disposal capacity. Regulators’ efforts to decrease disposal well utilization have the potential to adversely impact planning and economics for producers. Overall, Midland operators are now forced to reshuffle about 2.2 MMbbl every month, while over 2.5 MMbbl are displaced every month in the Delaware. The displacement story is similar in New Mexico, where SRAs could displace anywhere from 1.8 MMbbl to 3.9 MMbbl every month, depending on the curtailment amounts. To fully understand the effect of water disposal constraints in production areas with SRAs, you must first understand the dynamics of operational disposal capacity.

Disposal wells are approved with a permitted injection capacity, based on a barrels-per-day injection rate derived from a maximum allowed injection pressure. However, an SWD’s operational capacity is based on infrastructure and pressure realities in the field. Many SWDs reach their maximum allowed injection pressures long before they reach their maximum allowed injection volume, so the actual volume that SWDs can inject downhole can be significantly lower than what was permitted.

According to OilfieldH2O, B3’s proprietary data platform, injection capacity in the Texas SRAs is decreasing at a faster rate than indicated solely by changes to permitted capacity. A key means of measuring this dynamic is by assessing capacity “utilization,” which is a measure of how much volume an SWD is injecting, compared to its potential operational capacity. In aggregate, SWDs in the Permian have less capacity available now, compared to the same time last year. Utilization in some of the SRAs has increased by as much as 45%. This is troublesome, because the areas experiencing local SWD capacity issues are home to some of the best-performing oil and gas wells in the Permian. The result is that the complexity, and therefore cost, of managing water from prolific areas may increase.

In the Gardendale SRA in the Midland, seismicity has decreased slightly since establishment of injection curtailments in late 2021. In this SRA, there were 34 seismic events over M2.0 during third-quarter 2021, the quarter just prior to the establishment of the SRAs in late September 2021. In the fourth quarter of 2021, there were 25 M2.0+ seismic events, and only 22 events over M2.0+ in the first quarter of 2022, Fig. 3.

If the count and magnitude of seismic events continue to decline in SRAs, current regulatory approaches may continue to be adopted as a treatment. The result: regulatory mandates have become a dynamic factor shaping future oil and gas production planning. To absorb the impacts, the industry is aggressively ramping recycling, developing additional disposal capacity and new infrastructure to move water to areas where seismicity is not a concern. These solutions will require time and capital, as well as significant industry cooperation and regulatory support. Moving disposal farther from production will also likely add significant costs to production operations.

Financial impacts. To date, water disposal restrictions have had minimal impact on oil and gas production. However, operators are facing higher water management costs today, and those costs will rise in the coming years. Immediately after curtailments were issued, some commercial operators in, or proximal to, SRAs implemented disposal rate increases of up to 25%. Increasing disposal curtailments across the Permian could increase SWD capacity utilization past the operational threshold for some wells, and avoiding disposal altogether is not an option. B3’s 2022 Permian Water Outlook indicates that an additional 2.5 MMbpd of disposal capacity will be needed in the Delaware by 2026, based on a current forecast shown in Fig. 1. This is equal to roughly 100 new SWDs and will require more than $400 million in capital expenditure.

Reduced capacity in SRAs may require producers to move their water a further distance by truck or pipeline, resulting in higher marginal costs. Transportation infrastructure will be needed to facilitate this, and developing new pipelines is expensive. The immediate opportunity in areas like the Midland lies in companies constructing new interconnects between existing pipeline and disposal systems to evacuate significant volumes from the SRA. It is also likely that companies will opt to move water outside of SRAs on greenfield pipelines. In both cases, landowner demands for right-of-way fees will limit options or increase costs. In today’s inflation-driven market, this new infrastructure build-out will increase the per-barrel cost of water management.

Another area of potential cost impact is related to the subsurface depth of water injection. Most SWDs inject into shallow injection zones above the oil and gas producing formations, because it is generally less expensive to drill a shallow SWD. Cumulative shallow zone injection has caused the pressure in these formations to increase over time. High pressure makes shallow zones difficult to drill production wells through and requires operators to alter production well casing designs. Adding an additional string of casing to mitigate pressurization issues can add $500,000 to $600,000 per well and $10,000 to $20,000 per day in drilling “costs, according to some operators.

There are also intangible implications. Many producers build their own systems for control purposes. Ownership, in theory, means they can schedule flows, as needed, to efficiently meet the demands inherent to their production plans. Ceding control to a third-party disposal company may be viewed as adding risk to an already risky task. This dynamic can result in increased producer capital expenditure on systems that will soon be redundant and underutilized. These factors will impact production economics, which risks shifting drilling and completions to other less prolific, more economic producing areas with lower total return on investment.

State dichotomy. Water management is a logistics-driven business, and Texas and New Mexico regulate those logistics very differently. New Mexico is home to some of the best geology in the basin, which has resulted in explosive exploration and production growth. Obtaining an SWD permit in New Mexico takes significantly longer than in neighboring Texas, and the conditions placed on SWDs in New Mexico are more restrictive. Producers there need to get their production wells online, so the delays and the lack of local disposal capacity led to New Mexico’s water being disposed of in Texas. B3 estimates that 37% of the produced water in New Mexico is sent via pipeline or truck for disposal in Texas. New Mexico’s operators thus reap the benefits of exporting their produced water across state lines.

This dynamic was less onerous before the Texas SRA restrictions tightened the disposal capacity in areas where SWDs are increasingly being used by New Mexico operators. While capacity is available, this will be tolerated, but once capacity tightens and costs rise, conflicts will likely arise. Texas will be forced to address this unusual form of interstate commerce. Agencies in Texas and New Mexico have entered a Memorandum of Understanding and are developing avenues to jointly address the seismicity-disposal issues. However, differing tactics and enshrined regulation and legislation are making this an uphill battle.

Potential solutions. Fortunately, the oil and gas industry has a history of tackling complex challenges like those posed by the Permian’s water problems. An immediate solution is to aggressively increase produced water reuse for operations. Operators are beginning to enter into agreements with their competitors to optimize water use across their operations, creating a larger amount of reusable resource and efficient infrastructure sharing. This collaborative approach reduces disposal, which is critically important in seismically active areas.

Collaboration has begun to extend beyond physical operations, too. B3 recently launched a data hub in cooperation with Permian operators to facilitate the sharing and benchmarking of key data, including detailed operational information. This cooperative approach allows operators to leverage data to optimize their water management, drilling programs, and advance ESG targets, while allowing for a better understanding of their bottom line.

Untapped potential. Greenfield water infrastructure development also will play an important role in supporting Permian oil production growth. At present, numerous companies are proposing pipelines to transport produced water to less seismically active areas or outside of the basin altogether. Few projects will make it to construction, but some are starting to get serious consideration from oil and gas companies, as they plan for future volumes.

As discussed above, the apparent abundance of permitted SWD capacity in the Permian is deceiving, and new SWDs will be needed, particularly in the Delaware. According to B3’s OilfieldH2O data, there is over 41.1 MMbwpd of permitted, but undrilled SWD capacity waiting to be developed in the Permian. Developing and connecting this capacity to optimize water infrastructure will only occur through collaborative efforts.

Finally, industry groups like the New Mexico and Texas Produced Water Consortiums have brought a diverse group of stakeholders together to discuss the most promising opportunities for non-oilfield beneficial reuse. These groups are clarifying the necessary technological, regulatory and legal steps required to enable crucial water management solutions. There are other potential solutions, like surface discharge, but these have proven challenging and costly to pursue, thus far.

Almost all these solutions will require an influx of investment into the oil and gas industry. For the past five years, many investors considered water management an opportunity to place bets on oil growth while avoiding direct investment in oil and gas companies struggling to generate investor returns. Uncertainty about scale, an evolving industry business model, and the crash in oil prices, choked the flow of capital into the space, but times are rapidly changing.

In a few short years, oil and gas companies have learned to live within their cash flows and generate solid value, and many are earning record profits in the high-commodity-price environment. Coupled with the urgency to increase oil production and prolonged, high oil price expectations, it is reasonable to expect investment dollars to come back to the oil field, with water management providing a key infrastructure investment opportunity.

The last step to entice investors will be developing more harmonious, resilient and stable regulatory policy between the Permian states, based on agreed-upon scientific frameworks. Texas and New Mexico are making strides in some areas, but they still differ on key points of oil and gas regulation. This may cause the industry—and the nation’s oil supply—to suffer. Federal policy that informs testing and safety standards for produced water constituents will need to be clarified before surface discharge and other ambitious produced water solutions can be deployed at scale.

Tidal wave is coming. State agencies in Texas and New Mexico have established SRAs in key areas of the Permian to mitigate the increasing amount and magnitude of seismic events. Some SWDs have even been completely shut-in, and millions of barrels of water have been displaced. Now, operators must continue to adjust their water management strategies to ensure there is no disruption to the necessary increase in Permian oil and gas production.

Over the next few years, B3 estimates that the Permian will add 6 MMbpd of incremental produced water, which means total water management in the basin will approach an astonishing 20 MMbpd. Even with an increase in produced water reuse from the current rate of 30% to 100% (a highly implausible scenario), the Permian would still have billions of barrels of water to manage every year, most of which will go to disposal.

Path forward. Disposal curtailments and increasing water volumes will force operators to spend more on water management to move their water greater distances across the Permian and potentially beyond. A variety of solutions can be employed, like increasing oilfield water reuse, developing and connecting less seismically risky disposal capacity, and forging a path for non-oilfield beneficial reuse.

To realize these solutions, a considerable influx of investment will be required, and the Texas and New Mexico legislators must expeditiously develop more harmonious, consistent water and seismicity policies. The latter is particularly important. Disposal curtailments will continue, but the wave of produced water is just beginning to crest over the region. All parties must work together and increase their use of data and analytics to bring forth sound, thoughtful solutions and ensure the continued health and viability of future Permian production.

- Electric actuation in the Permian basin (July 2024)

- Drilling advances and where they’re headed (July 2024)

- New technology allays permanent magnet motor safety concerns, enables better ESP performance (June 2024)

- Coated continuous sucker rod lowers RRP and PCP operating costs (June 2024)

- Dawn of a new day in completions (May 2024)

- Extracting resources from the Earth’s crust using multi-stage, fraced horizontal wells: First gas, then oil, now heat (May 2024)