Agile subsea production system demonstrates value of a standardized approach for operators

Delivering subsea performance agility requires a focus toward streamlined project lifecycles with an ability to adapt quickly. A subsea services provider has taken many steps toward a simplified tender and execution model that will enable operators to leverage a suite of standard configurable production platforms, thereby driving efficiencies during front-end engineering design (FEED) and into execution. Utilizing this agile supplier-led model, a top-10 global independent energy company has realized an 11% reduction in nonconformances, 7% reduction in overall tree manufacturing time, and three-week decrease in tree assembly and test time, as compared with an engineered-to-order model.

The challenge lies in integrating products that leverage standard configurable platforms into the operator-specific environment to efficiently address system and field requirements. The energy company had previously accepted standard material, welding, and quality specifications, from which a capital-efficient, standardized suite of equipment was proposed. Adoption of the standard offering established a clear baseline for discussions about modifications and enabled focusing on configuring the platforms’ functionality instead of extensive specification reviews. A collaborative engineering approach enabled effective and efficient change management while reducing documentation reviews by 50%.

This project maximized subsea performance agility by demonstrating the ability of agile subsea production systems (SPS) to streamline interfaces and minimize engineering hours without compromising product quality or HSE performance. Three production trees and wellheads, and the manifold, were installed with zero non-productive time across more than 1,000 critical path hours.

This article will discuss the varying approaches to standardization we have noticed across the industry, and how these affect the industry suppliers placed in charge of manufacturing the equipment.

WHERE WE ARE TODAY

First, we will look at a snapshot of the market, both in the past and present day. Prior to the big fall-out of 2014/2015, the market saw costly, engineer-to-order projects for most of its developments. Around 2014, there was a shift in focus toward more configure-to-order, standard approaches that would minimize CAPEX for the operator. This was a direct result of the depressed oil market at the time. The priority was placed more on reducing capital expenditure rather than other factors. This is where the true demand for supplier-led solutions began to make its way through the industry.

Now, in the current market the priority lies on accelerated ROI and schedule certainty, Fig. 1. The focus is on obtaining first oil sooner with schedule confidence and delivery assurance, due to the volatility of the current market. This landscape shows a demand for standardization. However, as the industry begins to adopt a standard approach, there is a unique set of challenges, as there are differing methods of adoption.

METHODOLOGIES

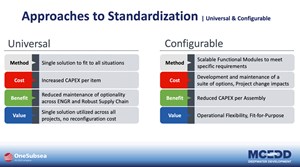

As the industry adopts standardization, there are two clear methodologies we’ve seen: either a universal or configurable approach, Fig. 2. A universal approach seeks to find a solution that is fit for all situations. With this, there is increased CAPEX, due to the high-spec nature of the product. However, it also minimizes optionality across engineering and allows for a more robust supply chain picture. The goal here is to utilize one solution across all projects—eliminating reconfiguration/variation costs.

With a configurable approach, the method is to utilize pre-engineered, scalable functional modules to meet specific requirements. With this, there is maintenance of those options and variations, but one will see reduced CAPEX across each assembly, due to the reduced functionality at project call-off. The goal here is operational flexibility—building fit-for-purpose solutions rather than having one gold-plated solution.

Ideally, leveraging a hybrid of each of these approaches is what we (as a supplier) would like to see across the industry. And it is how we have approached standardizing our offering. However, there is a divide on how, and where, these approaches are being adopted, and that is where the challenge lies.

MWQ CONCERNS

As mentioned before, ideally these two approaches should be used together to achieve the maximum number of efficiencies through a standardized method. To enable subsea agility, there needs to be a true universal adoption to materials, welding and quality (MWQ) specifications (Fig. 3) to build configurable platforms on. This is the approach that OneSubsea takes to standardization.

MWQ specs are the basis of all engineered equipment and are what directly affect project long lead items in particular. So, think about one of the most popular kids’ toys—Legos. As we all know, Legos are identical in their composition and manufactured the exact same way, but they can be configured together into countless assemblies when utilized. All blocks are virtually identical when it comes to MWQ, yet the assemblies vary significantly.

Everyone in the industry agrees this methodology is right, but we are still seeing a major fault on how the Legos Level (foundational level) is manufactured. A good example of universal adoption has been the industry specification, DNV RP-0034. Having all operators agree that this sets the basis of forging requirements allows industry suppliers to confidently stock typical long lead forgings with the expectation that they will be utilized on the next project award.

A challenging example here is DNV RP-B204 for welding and quality. There is still far too much optionality built into RP-B204, and it also has not been universally adopted by the operators. This inhibits the confidence we can get from utilizing our base level products and gives pause to the suppliers, as it is a gamble whether the component will be utilized by future projects, or not.

If the industry achieves true universal MWQ adoption, we can create configurable, functional modules out of those building blocks. Having configurability at a component and sub-assembly level enables adaptable system level solutions to be created at project call-off, to adapt to the majority of basins and customer requirements. At this level, IOGP S-561 is a good example of a specification that the industry leverages to create configurability while steering toward some consistency.

CURRENT TRENDS

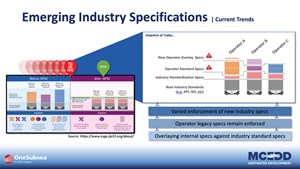

Now that we understand the varying approaches, let’s explore the current trends we see today, Fig. 4.

On the left-hand side of Fig. 4 is a graphic pulled straight from the IOGP-JIP33 site. This graphic shows how specifications looked before JIP33—and after—pointing out the layering of industry and operator-specific requirements that lead to inefficiencies on the supplier side. The ultimate goal is to end up with an enhanced universal suite of specifications (both industry and JIP33) across all operators, and layer on only project-specific configuration datasheets, when necessary.

In all actuality, the industry is NOT there quite yet. Today, a supplier will typically see a varied enforcement of new industry specs that gets layered on top of our base standards. On top of that, legacy operator specs remain enforced, adding on yet another layer of variations in requirements. And finally, we will see varying methods of overlaying new internal specs against both base standards and industry specs.

While the industry has improved through the IOGP-JIP33 initiative, the lack of uniformity in adopting specifications is resulting in the inconsistent layering of requirements. With all of these nuances continuing to take place, the industry has not evolved much from where we started with bespoke solutions from a supplier’s perspective, as shown in the graphic.

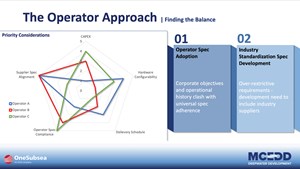

FINDING A BALANCE

The question becomes, how do we find the balance in all of this, for both operators and suppliers, Fig. 5. Levels of adoption are influenced by an operator’s internal objectives, where the operator has operating basins and external influences, such as supply chain volatility. Prioritization of these key factors varies with each operator. This could be due to corporate objectives and operational history clashing with the idea of universal spec adherence.

Over-restrictive industry standardization specification development plays a major role in the balance of this initiative, as well. These developments need to include the industry manufacturers at the development phase to help baseline requirements and ensure a practical approach is taken with consideration to CAPEX increase.

The intent is correct, and we, as an industry, agree on the importance of standardization—finding that balance is key. The varying prioritization and approaches leave the challenge for suppliers to develop an approach to navigate this evolving landscape. When the suppliers are left to choose which specifications are adopted as standard, based on which clients they work with most and which regions they operate in most, then the ultimate burden falls to the operators. This burden results from not being able to easily tender projects on an apples-to-apples comparison across the board.

ONE FIRM’S INITIATIVES

In the meantime, our company is doing a number of things as an industry supplier to navigate this evolving landscape, Fig. 6. OneSubsea has developed a standardization solution that takes a universal approach at the base level to enable a configurable solution throughout the model. Our solution begins with a universal set of foundational specifications. Robust metallurgy, welding, and quality specs are used universally across all equipment, and they form the basis of our configurable products. Our pre-engineered products have flexibility to accommodate customer variations while staying within the boundaries for the standard configurations. This model enables us to leverage economies-of-scale, offering stocking programs at the component level, streamlining the product lifecycle.

We have adopted a universal approach to our foundational specifications. These core components are identical when it comes to MWQ, which inherently enables cost and schedule efficiencies throughout project execution. At the system level, pre-engineered components combine into full platforms at project call-off, resulting in an adaptable solution that is fit for the majority of basins.

Of course, some level of engineer-to-order still exists on a project-by-project basis, but the majority of efficiencies are captured throughout the rest of the model.

Encircling the layers of this model are safety, quality, and reliability. These are always the number-one priority when it comes to OneSubsea and our customers. Standard products require a level of trust that the equipment will perform as specified, while keeping everyone and everything safe in the process. So, to summarize these layers, a universal approach to MWQ and a configurable product portfolio enable a solution-focused model that leverages economies of scale and ensures faster deliveries for the operator.

ENSURING INTEGRITY AND CONSISTENCY

With our model defined, it begs the question—how do we ensure the integrity and consistency of our offering? The answer is in our disciplined approach to program governance, Fig 7.

Governance is defined as ”the system by which an organization is controlled and operates, and the mechanisms by which it, and its people, are held to account.” Not only have we created a suite of specifications and products, but more importantly we’ve created this robust, supplier-driven governance system to stabilize our offering and ensure we are always acting in the best interests of the business and our customers.

In Fig. 7, we are show tree configurability, but this is just one example. Our configurability and governance approach reach across our entire portfolio. We maintain operational discipline by executing changes that are calculated and objectively evaluated by the entire value chain to ensure changes are only made when needed, eliminating “preferential” engineering.

Internally, we maintain involvement and visibility throughout all functions of the business but most importantly, we project that visibility to the operators, as well. Incorporating operator feedback and ensuring regular engagement allows operators to confidently accept changes, as they’ve provided feedback and maintained visibility throughout the change process. We have designed this process to hold transparency paramount, to foster trust with our customers and provide a clear idea of the direction of standardization within our business.

They key takeaway here is that while the meat of our model lies in our universal specifications and configurable platforms, the real differentiator is how we maintain and control our offering. This approach allows us and the operators to systematically reduce risks while enabling healthy and consistent growth in the overall portfolio.

HOW THE APPROACH WORKS

So does this approach work? The answer to that is yes, Fig. 8. In this case, OneSubsea delivered a horizontal tree platform with a common core and configurable modules that expedited subsea development and maximized ROI for the operator. Right up front, the project utilized operator-accepted universal standard material, welding and quality specifications to propose a standardized suite of equipment, fit to operator requirements. Adoption of the standard offering established a clear baseline for discussions about modifications and enabled a focus on functionality instead of extensive specification reviews.

This up-front collaborative engineering approach enabled efficient change management while reducing the number of documentation reviews by 50%. This allowed for an overall leaner project team and expedited evaluation timelines. The offering was adaptable enough to accommodate late changes that surfaced during FEED and execution phases while items with a long lead time were procured or manufactured.

With the goal of establishing a robust and repeatable system solution, the project achieved impressive standardization at about 90% of the products used across all packages. A large reduction in non-conformances validated confidence in quality control and guaranteed cost certainty throughout the manufacturing process. We achieved a 7% reduction in tree manufacturing time and a three-week reduction in tree assembly and test time, as compared with recently executed projects. This overall reduction ensured schedule and delivery certainty across the project – inherently reducing project risk for the operator.

This project bolstered confidence in the ability of supplier-led standardization to streamline interfaces and minimize engineering hours without compromising product quality or HSE performance. In fact, there were no recordable incidents and we achieved zero NPT. This project confirms the value of leveraging impactful program synergies by universally aligning on previously accepted specifications and reusing products instead of creating them from scratch each time, hence reducing cost, lead time, and risk across the operator portfolio. These principles are key to continuing collaboration with this operator (and others) to maximize subsea performance agility throughout the industry.

STANDARDIZATION’S FUTURE

Keeping the above principles in mind, what is our main driver for the future of standardization?, Fig. 9. The focus needs to be an industry-wide effort to align on a universal approach to metallurgy, welding and quality. As alluded to earlier, “Universal” cannot mean anything other than universal, if we want to see the industry-at-large take the next big step on standard, configurable products. We (as an industry) can drive toward leaner projects, maximized ROI, improved reliability and quality, and work toward further cost and schedule certainty in subsea execution, if a true universal adoption of MWQ is at the forefront of that. We’ve shown the results of our model, and we have proved the ability to unlock opportunities to increase the economic viability of subsea execution.

We continue to drive the industry toward joining together to adopt a unified approach to metallurgy, welding and quality, and embrace the opportunities that standardization provides to further leverage execution efficiencies.