Chevron inks offshore $2 billion exploration, production deal with Equatorial Guinea following multiple oil and gas discoveries

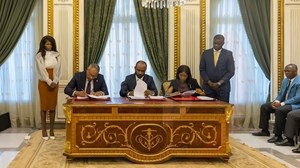

(WO) – The African Energy Chamber (AEC) announced that Chevron and Equatorial Guinea’s state-owned oil company GEPetrol have signed two production sharing contracts (PSC) for offshore blocks EG-06 and EG-11 in Equatorial Guinea- representing a $2 billion investment.

Situated close to producing Block B, which houses the Zafiro field, the blocks are considered to be highly-prospective and are poised to play a major part in revitalizing exploration and production offshore Equatorial Guinea.

According to the AEC, the deal marks an “important step” towards reversing production decline in the country and looks forward to a fruitful collaboration between the companies. As a major oil and gas producer with proven offshore plays, Equatorial Guinea has the potential to play an even greater role in supporting energy security in West Africa.

Despite a proven track record of production, declines in mature fields and lack of investment in undeveloped assets has seen national oil output in Equatorial Guinea decline.

To reverse this trend, the government is incentivizing investment in offshore exploration; the recent contract with Chevron and GEPetrol represents a notable step towards making a new discovery.

Previously held by energy major ExxonMobil before its exit from the country this year, Blocks EG-06 and EG-11 are in deepwater acreage. Block EG-11 measures approximately 1,242 km², while Block EG-06 featured an oil discovery at the Acestruz-1 well in 2017.

With the new PSCs, Chevron and GEPetrol will kick off a new exploration and production campaign at the blocks. The contracts include provisions on aspects such as minimum investments, exploration programs, sustainable development and benefits for the state, therefore outlining a clear development plan for the assets.

“The recent Production Sharing Contract (PSC) signing between Chevron, the Ministry, and GEPetrol marks a significant milestone in Minister Antonio Oburu’s upstream investment drive. This partnership is a testament to the country’s commitment to revitalizing exploration and boosting production offshore,” says NJ Ayuk, Executive Chairman of the AEC, noting that Equatorial Guinea is on the verge of a major comeback in oil and gas production, driven by a surge in investment, adding that “The country’s existing infrastructure and attractive fiscal policies create a compelling case for new investment.”

Beyond Blocks EG-06 and EG-11, Equatorial Guinea has seen a wave of activity in recent months. E&P company Trident Energy launched a three-well infill drilling campaign on Block G at the start of 2024, with all three wells expected to come online mid-year.

The program utilizes the Island Innovator rig, which will then proceed to drill the Akeng deep exploration well in the Kosmos Energy-operated Block S. This campaign targets 180 MMbbl of oil.

Additionally, VAALCO Energy is developing the Venus field in Block P. The upstream program involves the drilling of two producer wells and one water injector, and the company aims to bring them online by 2026.

Meanwhile, Atlas Petroleum is seeking farm-in and drilling partners for Blocks EG-02 and H while three PSCs were signed in 2023 for Blocks EG-18 and EG-31 (Africa Oil Corp) and Block EG-01 (Panoro Energy).

With 1.1 Bbbl of proven crude oil reserves and 1.7 Tcf of proven natural gas reserves, Equatorial Guinea has seen great success in monetizing offshore oil and gas in both the domestic and regional landscape.

Through infrastructure such as processing facilities at Punta Europa and a system of pipelines, the country has intentions to become a regional hub for petroleum, with development spearheaded under the country’s Gas Mega Hub (GMH) initiative – aimed at positioning the country as a central hub for processing, liquefaction and distribution.

In 2023, Chevron signed a Heads of Agreement to move forward with the next phases of the development of the GMH initiative. This includes processing gas from the Alba field under new contractual terms (phase II) and from the Aseng field (phase III) – operated by Chevron’s affiliate, Noble Energy.

Ongoing offshore E&P campaigns stand to support the country’s gas production, with the country’s zero-flaring policies ensuring associated gas is monetized. Equatorial Guinea aims to integrate natural gas into the economy, leveraging rising demand in both the domestic and regional landscape to commercialize previously stranded resources.

As such, developments such as Blocks EG-06 and EG-11 are expected to not only increase oil production but support the country’s energy security efforts.

“The African Energy Chamber fully supports these efforts, which are expected to reverse the decline in production and pave the way for a new era of exploration, growth and prosperity in the region,” concludes Ayuk.