Industry Trends

News

August 25, 2022

U.S. shale producers are on course to make nearly $200 billion this year, enough to make the industry debt-free by 2024 and potentially fund a pivot toward more natural gas production, according to Deloitte LLP.

News

August 25, 2022

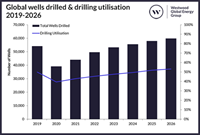

Latest analysis from Westwood Global Energy Group reveals a healthy recovery roadmap for the global land rig market, driven by higher commodity pricing and mounting pressures around energy security.

News

August 24, 2022

New figures show domestic gas production in the first half of 2022 was 26% higher than the same period in 2021, which is enough to heat almost 3.5 million UK homes for a year.

News

August 24, 2022

Saudi Arabia’s oil exports reached $31 billion in June, the highest in at least six years, driven by a rally in prices and rising production.

News

August 23, 2022

At a time when global oil markets are experiencing significant volatility, member countries of OPEC+ have the means to address these challenges, and Equatorial Guinea will continue to support efforts to improve market stability.

News

August 22, 2022

A new study indicates that unnecessary growth in the number of processes and procedures and lack of equipment reliability are the biggest concerns for maintenance managers in the oil and gas industry.

News

August 19, 2022

Warren Buffett’s Berkshire Hathaway Inc. won approval from U.S. regulators to buy as much as 50% of Occidental Petroleum Corp. after spending months acquiring its shares. Occidental’s shares surged on news of the authorization.

News

August 17, 2022

U.S. oil and gas producers recovered and reset in 2021, posting increased profits of $73.7 billion and $211.9 billion in revenues, according to the EY U.S. oil and gas reserves, production and ESG benchmarking study.

News

August 17, 2022

Global oil markets face a high risk of a supply squeeze this year as demand remains resilient and spare production capacity dwindles, the new head of OPEC said.

News

August 15, 2022

Nigerian President Muhammadu Buhari’s flip-flop over the sale of Exxon Mobil Corp.’s assets could discourage investment in Africa’s largest oil producer in the wake of industry reform meant to grow the sector.

News

August 15, 2022

Russia defied expectations of a collapse in oil production following its invasion of Ukraine. But Moscow will have to redouble its efforts to find new buyers if it’s to keep output from shrinking in the coming months.

News

August 15, 2022

Saudi Aramco posted the biggest quarterly adjusted profit of any listed company globally driven by high crude prices and production.

News

August 12, 2022

Oil & Natural Gas Corp.’s profit beat estimates to rise more than three times after oil prices surged in the wake of Russia’s invasion of Ukraine and an increase in local gas prices.

News

August 12, 2022

The World Oil judging team selected finalists for each of the 18 categories from a pool of 303 nominations. The winners will be announced at the 2022 World Oil Awards ceremony on Oct. 13 in Houston, Texas.

News

August 12, 2022

As the race to number 10 accelerates, Offshore Energies UK has written open letters to Rishi Sunak and Liz Truss asking them to help consumers over the short and long term by ensuring the next cabinet prioritizes reliable and cleaner energy produced in the UK.

News

August 10, 2022

The American Petroleum Institute announced a new initiative designed to attract more veterans and transitioning service members into meaningful and well-paying careers in the natural gas and oil industry.

News

August 05, 2022

Employment in the U.S. oilfield services, and equipment sector rose by an estimated 7,131 jobs to 643,092 in July, according to preliminary data from the Bureau of Labor Statistics and analysis by the Energy Workforce & Technology Council.

News

August 04, 2022

As oil prices continue to linger around the $100-plus/bbl price, mergers and acquisitions in the sector have been pushed to a three-year high, as well as private equity deals that may experience a record year.

News

August 02, 2022

Quarterly and annual results only give you a snapshot showing what has been happening in recent months, so they do not tell you much about longer-term trends, said Will Webster, energy policy manager at Offshore Energies UK.

News

August 01, 2022

Baker Hughes agreed to sell its Oilfield Services business in Russia to its local management team, and the business will operate independently going forward, the company announced.

News

July 29, 2022

As the U.S. experiences two straight quarters of negative GDP growth, which meets the common definition of recession, Railroad Commission of Texas Chairman Wayne Christian said high taxes, unnecessary regulations, and irresponsible deficit spending is what caused the mess we are in.