Shale

News

February 15, 2021

The Arctic blast gripping the central U.S. may threaten crude exports from one of the world’s top producers, amid rapidly-normalizing global stockpiles that point to the success OPEC has had in draining a surplus left in the wake of the pandemic.

News

February 10, 2021

Chesapeake Energy, the once-iconic energy explorer that helped ignite the American shale-gas boom, is emerging from bankruptcy protection a shadow of its former self. And in a way, that’s just fine with its boss.

News

February 10, 2021

Texas’s energy regulator is taking an uncharacteristically critical approach toward burning off excess natural gas, a sign that growing pressure from environmentalists and investors to curb the controversial practice is paying off.

News

February 03, 2021

Creditors of Argentina’s state-run oil company, YPF SA, are sending mixed signals as one group of bondholders rejected the company’s latest debt restructuring plan while another voiced support.

News

January 28, 2021

How the fragmented U.S. shale industry will respond to increased incentives to drill has become a crucial question for traders and industry watchers across the world.

News

January 20, 2021

Traders have piled into oil this year, with output cuts from Saudi Arabia helping drive prices to the highest since February.

News

January 18, 2021

The top U.S. financial regulator’s reported investigation into how Exxon Mobil values shale assets follows years of concerns about the industry’s rosy projections, which have left hundreds of billions of dollars of investor losses and writedowns.

News

January 15, 2021

The probe may cast a shadow over Exxon’s efforts to turn a corner after its shares posted their worst annual performance in 40 years in 2020 amid a collapse in oil prices. CEO Darren Woods has been forced to slash spending, and last month the company said it will write down the value of North and South American natural gas fields by as much as $20 billion.

News

January 14, 2021

The world’s biggest fracking services provider, Halliburton has deployed the industry’s first grid-powered fracking operation on behalf of Cimarex Energy Co. To date, it’s completed almost 340 stages across multiple wells.

News

January 13, 2021

With demand still fragile, shale companies “are wise not to jump the gun and overproduce during the recovery year,” UAE Energy Minister Suhail Al Mazrouei said in an interview, adding they “need to be careful not to flood the market.”

News

January 12, 2021

The U.S. Energy Information Administration said that recent crude price increases and rig additions will help production in the Lower 48 states begin to rise in the second quarter of this year, with total output nearing 11.5 MMbpd in 2022.

News

January 12, 2021

A “big chunk” of U.S. shale is profitable at current oil prices, but drillers should be aware of crude’s declining share in the future global energy mix, International Energy Agency Executive Director Fatih Birol said in an interview.

News

January 08, 2021

“Opening the shale revolution to the world through the export ban lifting helped shift the global oil market psychology from supply scarcity to abundance,” said Karim Fawaz, director of research and analysis for energy at IHS Markit. “It unshackled the U.S. industry to keep growing past its domestic refining limitations.”

News

January 07, 2021

“I have a hard time seeing the need for U.S. producers over the next several years to get back to double-digit growth,” Devon Energy CEO Rick Muncrief said in an interview. “For this management team, if we really think about 2021, let’s keep it flat.”

News

January 07, 2021

“I really don’t see much increase in the Permian basin or the U.S. shale over the next several years,” said Scott Sheffield, chief executive officer of Pioneer Natural Resources Co.

News

December 21, 2020

Diamondback said it agreed to purchase closely held Guidon Operating LLC. That cash-and-stock deal values Guidon, which was co-founded in 2016 by funds managed with Blackstone Group, at about $862 million.

News

December 21, 2020

Diamondback Energy and QEP Resources have entered into a definitive agreement under which Diamondback will acquire QEP in an all-stock transaction valued at approximately $2.2 billion, including QEP’s net debt of $1.6 billion as of September 30, 2020.

News

December 16, 2020

It looks like the mainstream media have finally realized that government intervention in energy markets impacts the cost of energy for consumers, writes Commissioner Wayne Christian, Railroad Commission of Texas.

News

December 15, 2020

Home to the Bakken shale formation, North Dakota won’t see any sustained growth in production sooner than the second half of 2022, Lynn Helms, director of the state’s Department of Mineral Resources, said.

News

December 14, 2020

Steady output from their mines means that oil sands producers are able to keep revenue coming for decades without too much investment, while the short life span of shale wells forces U.S. explorers to constantly burn cash just to keep up production.

News

December 10, 2020

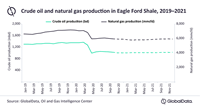

Shale operators slashed their planned capital expenditure (capex) for 2020 to account for the oil price crash, which inevitably led to decline in drilling and completion activity in the Eagle Ford play. Hence, crude oil production is expected to drop by 10% year-on-year (YOY) in 2021, says GlobalData, a leading data and analytics company.