Russian Regional Report: Isolation 2.0

The invasion of Ukraine in February has burdened Russia’s exploration and production (E&P) industry with a second round of constraints that have deep and far-ranging consequences. In the wake of the attack, companies have rushed to withdraw from Russian projects, governments have hurled new sanctions on top of those already in place, and Russia’s biggest oil and gas customers are looking for ways to cut those vital ties.

They won’t go it alone. Russia’s massive contribution to global oil and gas production ensures that everybody, and particularly the European Union, is going to share the pain. The West has more options to fill the gap, if it can find the political will, while Russia’s fundamental dependence on O&G exports arguably puts it in a more difficult corner, Fig. 1.

LEAVE THE BEAR ALONE

Russia’s growing isolation is largely imposed through a mix of government sanctions and voluntary corporate abandonment. Many energy-related companies are on the exit list, including some major players still left from the last round of Crimea sanctions.

BP said it will sell its 20% share in Rosneft, Shell is dropping its Russia joint ventures (including a stake in the Nord Stream 2 pipeline), and ExxonMobil is getting out of the Sakhalin-1 project it helped launch in the 1990s. Equinor said it will start withdrawing from Russia, and TotalEnergies hedged a bit and said it won’t invest in new Russian projects, although the firm has not addressed current projects, including interests in the Yamal LNG project.

Continued U.S. and E.U. sanctions imposed in 2014 over Crimea are focused on U.S. capital markets, as well as goods, services and technology that support deepwater exploration and field development.

New sanctions enacted, and in the mill, include a U.S. ban on all Russian oil and gas imports and the U.K.’s phase-out of imports by end of the year. The E.U. is on course, perhaps, to phase out imports in six months and refined products by the end of the year. Germany froze the opening of the NordStream 2 gas pipeline.

UPDATING THE OUTLOOK

From an energy perspective, all this is critical, because Russia’s contribution to global oil and gas production is massive. In 2020, it averaged 10.5 MMbpd of petroleum and other liquids, third in the world behind the U.S. and Saudi Arabia. Russia’s proved oil reserves are about 80 Bbbl. Gas production was an estimated 22.5 Tcf, second to the U.S.

OIL PRODUCTION

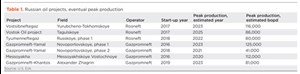

Russia’s oil production outlook is constrained by a difficult balance of greenfield and brownfield items. In the short term, oil production will benefit from the completion of greenfield projects under development, Table 1. But declining output from mature fields, primarily in Western Siberia (the country’s largest oil producing region), may offset any of those gains. Brownfield efforts to improve productivity, seen largely in more drilling and tying smaller fields to existing infrastructure, are unlikely to reverse a decline in total production late this decade, EIA reports.

In the plus column, EIA notes Rosneft’s 2020 formation of Vostok Oil LLC to develop a group of crude oil and natural gas fields, known collectively as the Vostok Oil project in the northern part of the Krasnoyarsk region. The oil project aims to join fields in the Vankor cluster (which consists of the Vankorskoye, Tagulskoye, Suzunskoye, and Lodochnoye fields and is currently producing about 300,000 bopd), as well as some existing discoveries in the Taymyr peninsula.

The fields could produce about 1 MMbopd to 2 MMbopd at peak production, according to Vostok Oil. With much of the required hub infrastructure yet to be built, the company aims to bring the project online in 2024, reach an initial production level of 600,000 bopd, and reach its plateau production level by 2030.

GAS PRODUCTION

Natural gas is at the core of Russia’s energy plans. EIA’s late-2021 update foresaw growing investment in Arctic liquefied natural gas (LNG). That focus aimed to increase exports about 4.5 Tcf, per year, by 2024, and open new markets in addition to European pipeline customers. The priority of those new markets has likely grown, as traditional customers retreat.

While Russia’s annual dry gas production fell slightly in 2020 to approximately 22.5 Tcf, recent efforts may change that curve. Gas discoveries in the Yamal Peninsula, Ob Bay and other areas have the potential to increase overall natural gas production over the next decade. The scale of new development could be significant enough to support new natural gas hubs, in addition to facilities in West Siberia, notes the EIA report.

In 2018, Novatek’s discovery of North Obskoye field in Ob Bay yielded an estimate of 11.3 Tcf of natural gas reserves. In May 2020, Gazprom said its 75 Let Pobedy (75 Years of Victory) field, on the Yamal Peninsula, had an estimated 7.1 Tcf of total recoverable reserves. If both discoveries pan out, they would significantly increase Russia’s natural gas production, Table 2.

OPERATOR NOTES

Russian oil and gas are dominated by just a few companies and subsidiaries.

In terms of oil production, the top firms are Rosneft, Lukoil, Surgutneftegas, Gazprom Neft and Tatneft, accounting for 81% of total production in 2020. Gas leaders are Gazprom, Novatek, Rosneft, Lukoil and Surgutneftegas.

Much of Russian production is in the hands of companies that are held as public companies but are nevertheless state-controlled; some have origins in the fall of the U.S.S.R. That genealogy can make their role in government actions suspect.

In a May 2 article, the Atlantic Council think-tank accused Gazprom of helping set up the Russian invasion through market efforts to deter E.U. support of Ukraine. “Support for Russia’s military operation,” it says, took place well in advance “by keeping EU gas supplies low and prices high in advance of the conflict.

Lukoil. On the other hand, there is Lukoil, the country’s largest non-state enterprise and second-largest oil company. Its sanctions-targeted CEO, Vagit Alekperov, resigned, and the board issued a bold statement of concern and call for an end to the conflict in Ukraine. Alekperov’s April departure took place the day after the U.K. and the E.U. sanctioned the former Soviet oil minister and other Russian oligarchs.

A month prior to Alekperov’s departure, the Lukoil board of directors issued a statement expressing their “deepest concerns about the tragic events in Ukraine.” They called for the “soonest” termination of the armed conflict, and expressed empathy for all victims.

At about the same time, the Lukoil board met with Gazprom, in part to discuss development prospects for Vaneyvisskoye and Layavozhskoye fields in the Nenets Autonomous District. Lukoil supplies natural gas to the Gazprom transportation system, in addition to their development agreement for the two fields.

Lukoil has huge production assets. In February 2022, a reserves study found proved hydrocarbon reserves of 15.3 Bboe with a reserve life of 19 years and a 2021 reserves replacement ratio of 109%.

Exploration and production drilling added 501 MMboe to proved reserves in 2021, up 8% from 2020, said Lukoil. Most of that came from assets in West Siberia, the Ural region and Timan-Pechora, as well as in the Baltic and Caspian Seas. Lukoil’s hydrocarbon production in Russia in 2020 was 657 MMboe.

In Russia, Lukoil’s core operations are in West Siberia, Timan Perchora, Volga, Urals, and the Kaliningrad region. West Siberia is Lukoil’s key oil production region and accounts for more than half of its exploratory drilling in the Khanty-Mansi (mostly oil fields) and Yamal-Nenets (mostly gas fields) areas, Fig. 2. Activity there is mostly focused on replacing production, says Lukoil. The main prospects in West Siberia are hard-to-recover reserves that are making development technology very important. Enhanced oil recovery, fracturing, sidetracking, horizontal drilling and other techniques are actively deployed in the region.

In the Caspian Sea, total production at Lukoil’s Vladimir Filoanovsky field exceeded 30 MMt of oil. As the largest oil field in the Russian sector of the Caspian Sea, it was discovered in 2005. Since 2018, it has been producing at a design peak of 6 MMt of oil per year. Five development wells were added in 2021— four producers and one injector—to maintain that level.

The company also completed the wellhead platform in a second stage of development at Yury Korchagin field and drilled eight development wells there. In the Russian sector of the Caspian, this is the first field brought online there by Lukoil, occurring in 2010.

Lukoil’s third Caspian Sea development, Valery Grayfer field, is scheduled to start up this year. Proximity to the V. Filoanovsky field will allow sharing of some infrastructure. A unique float-over technology will be used to install topside facilities on the platform jacket.

Rosneft. BP’s February disengagement from Rosneft, the country’s largest oil producer, made an emphatic statement. BP says it will give up its share in Rosneft, where it has held a 19.75% interest since 2013. Also, two key executives are leaving the Rosneft board: BP CEO Bernard Looney and former BP group CEO Bob Dudley have resigned.

In closing the door, BP Chair Helge Lund blistered Russia, saying, “Russia’s attack on Ukraine is an act of aggression which is having tragic consequences across the region. BP has operated in Russia for over 30 years, working with brilliant Russian colleagues. However, this military action represents a fundamental change. It has led the BP board to conclude, after a thorough process, that our involvement with Rosneft, a state-owned enterprise, simply cannot continue.”

Another bit of news about Rosneft regards failed efforts to sell its crude. Following the invasion of Ukraine, European buyers did not bid on a tender for Urals oil, while Rosneft felt bids from Asian refiners were too low, reported Bloomberg. Some of the prospects said Rosneft’s requirements, such as 100% pre-payment, were too stringent.

Gazprom/Gazprom Neft. Gazprom is majority state-owned and was formed from the Soviet Ministry of Gas Industry in 1989. It is one of the world’s largest producers of natural gas, with total 2021 production of 514.8 Bcm, the highest in 13 years, says Reuters.

Subsidiary Gazprom Neft said last December that it expected to increase oil and gas condensate production by 2.5% for 2021, and 7% this year. Production in 2020 was about 96.1 MMt, boe.

Gazprom and Novatek were among the 50 Russian oligarchs and companies sanctioned by Poland in late April. The sanctions include freezing of assets and plans to end the use of Russian oil by the end of this year. At any rate, a payment dispute over conversion to rubles led to Gazprom cutting gas supplies on April 27.

Gazprom said in February that it would supply gas to China from the Russian Far East under a second contract. The first in 2019 was for the supply of up to 38 Bcm of gas through the Power of Siberia pipeline.

Novatek. In a March statement on the Ukraine conflict, Novatek said, “We strongly support every diplomatic effort at restoring peace and look forward to the prompt resolution of this current tragic situation. We also extend our sincere sympathy to all those affected by these events.” April saw election of a new board that included the departure of Gennady Timchenko, who is subject to sanctions by the U.S., E.U., Japan and the U.K.

Novatek claims to be the largest independent natural gas producer in Russia. Key operating areas are in the Yamal-Nenets Autonomous Region in Western Siberia, which produces about 80% of Russian gas and approximately 15% of global gas production. In December 2021, the company reported proved reserves of 16,409 MMboe, including 2,261 Bcm of natural gas and 189 MMt of liquid hydrocarbons.

A process module for the Arctic LNG 2 project was delivered in February from the Chinese port of Tianjin to Murmansk, reports Novatek. The 12,000-tonne module will be installed on the gravity-based structure for Arctic LNG 2 Train 1.

The Arctic LNG 2 project includes the construction of three LNG trains, each with a capacity of 6.6 mtpa. The project uses an innovative construction concept incorporating gravity-based structures, Fig. 3.

Novatek started pilot production from gas condensate deposits in Kharbeyskoye field, part of the North-Russkiy cluster, in November. The annual production level for the field’s gas and gas condensate program is 3.6 Bcm of natural gas and 0.6 MMt of gas condensate. The field is in the Yamal-Nenets autonomous region.

Also, in the Yamal-Nenets Autonomous Region, Novatek’s subsidiary, Yamal LNG Resource, recently won the auctions for geological survey, exploration and production licenses for Arkticheskoye and Neytinskoye fields, which are close to other Novatek operations on the Yamal Peninsula. The fields have combined, estimated hydrocarbon reserves of 2.9 Bboe, including 413 Bcm of natural gas and 28 MMt of liquids.

Surgutneftegas. Production from Surgutneftegas assets in Western and Eastern Siberia accounts for 11% of Russian oil. The company says it does 17% of Russian development drilling and 22% of exploration drilling.

Tatneft. The company’s primary resource base is in the Russian Republic of Tartarstan in Eastern Europe. Its assets include Romashkinskoye field, the largest in the Volga-Ural basin. The company also has exploration and production activities in the nearby Ulyanovsk, Samara and Orenburg Regions, as well as the Nenets Autonomous region in the northern Yamal area.

Oil production from its well intervention program, comprised mostly of workovers and hydraulic fracturing, totaled 1.391 MMt, says Tatneft. In 2020, hydraulic fracturing was performed on 272 wells. The same year, it drilled 76 vertical and horizontal infill wells.

Outside of Tatarstan and within the Russian Federation, the company says its 2020 budget included drilling of E&P wells (37%), seismic (47%) and well interventions (9%).

- From injection to insight: Tracing efficiency in surfactant huff and puff (November 2025)

- Maximizing production with smarter lift solutions (November 2025)

- Production technology: How a minor instrument upgrade led to major oil separator savings (November 2025)

- What's new in exploration: “Unleash” Alaska (November 2025)

- Engineered components are the difference between survival and failure in HPHT subsea systems (November 2025)