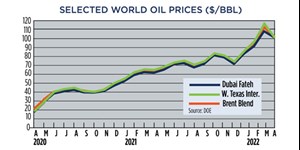

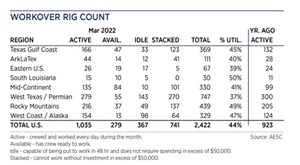

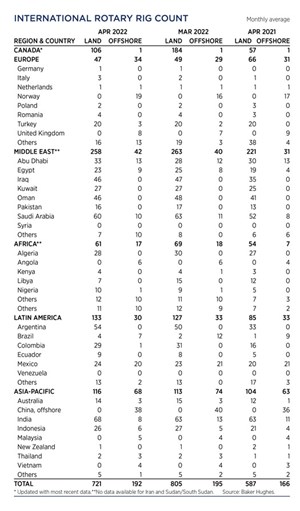

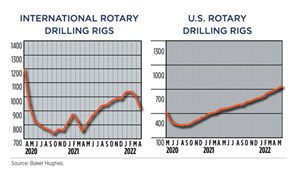

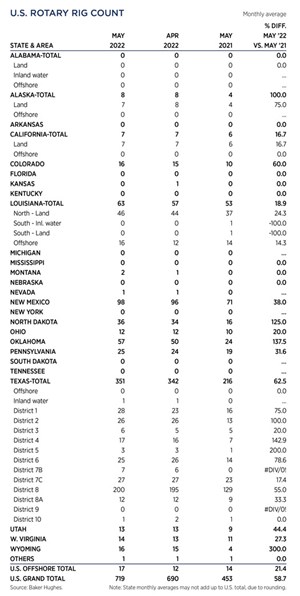

Crude prices climbed in May, as the war in Ukraine persisted. Experts predicted a drawn-out battle, which exacerbated concerns over the loss of Russian supplies, even after the war ends. WTI surged 7.4%, hitting $109.55/bbl, with Brent trading at $113.34/bbl, up 8.4% compared to April. Higher commodity prices have caused U.S. operators to slowly ramp up drilling activity, although at a slower pace than previous high price cycles. The U.S. rig count averaged 719 units in May, up 4.2% from 690 counted in April. Texas was up nine rigs to 351, and Oklahoma experienced a 14% increase to 57 units. The average rig count in May 2022 is 475 units more than the all-time low of 244 tallied during the week of Aug. 14, 2020, an increase of 195%. International activity averaged 913 rigs in April, 87 fewer than in March, due mainly to a 78-unit decline in Canada caused by spring thaw.

Related Articles

©2025 World Oil, © 2025 Gulf Publishing Company LLC.

Copyright © 2022. All market data is provided by Barchart Solutions.

Futures: at least 10 minute delayed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

Copyright © 2022. All market data is provided by Barchart Solutions.

Futures: at least 10 minute delayed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. To see all exchange delays and terms of use, please see disclaimer.

All material subject to strictly enforced copyright laws

Please read our Terms & Conditions, Cookies Policy and Privacy Policy before using the site.

Do Not Sell or Share My Personal Information.