Dallas Fed: Oil and gas expansion continues; cost pressures, supply-chain delays persist

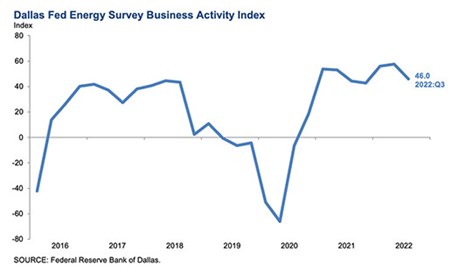

Upstream oil and gas activity in the southwestern U.S. expanded at a strong pace in the third quarter, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—remained elevated at 46.0 but below the record-breaking 57.7 reading of the second quarter, Fig. 1. This suggests the pace of the expansion decelerated slightly but remains solid.

FIG. 1. Measurement of oil and gas activity in Federal Reserve District 11.

OVERVIEW

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly, to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District (Texas, northern Louisiana, southern New Mexico).

Methodology. Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged, compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase.

When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the previous quarter. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Data were collected Sept. 14–22, and 163 energy firms responded. Of the respondents, 105 were exploration and production firms, and 58 were oilfield services firms.

Special questions asked of executives this quarter focused on prospects for significant oil market tightening; whether the era of inexpensive U.S. natural gas will end; expectations for financial investors returning to the oil and gas sector; the impact of the increased 45Q tax credit on profitability of proposed carbon capture, utilization and storage projects; and the net firm-level impact of the methane tax in the 2022 Inflation Reduction Act.

OIL & GAS PRICES

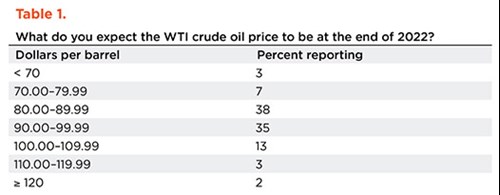

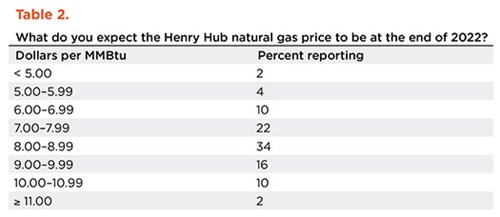

On average, respondents expect a West Texas Intermediate (WTI) oil price of $89/bbl by year-end 2022. Responses ranged from $65/bbl to $122/bbl, Table 1. Survey participants expect Henry Hub natural gas prices of $7.97 per million British thermal units (MMBtu) at year-end, Table 2. For reference, WTI spot prices averaged $85.49/bbl during the survey collection period, while Henry Hub spot prices averaged $8.16/MMBtu.

COSTS/FACTORS

Costs increased for a seventh straight quarter, with the indexes near historical highs. Among oilfield service firms, the index for input costs remained elevated but slipped from its series high to 83.9. None of the 58 responding oilfield service firms reported lower input costs. Among E&P firms, the index for finding and development costs was 64.7, down slightly from its high, last quarter, of 70.6. Additionally, the index for lease operating expenses was 70.2, easing slightly from the high, last quarter, of 74.1.

It is taking longer for firms to receive materials and equipment. The supplier delivery time index remained elevated at 28.4 in the third quarter, down slightly from a series high of 31.9 in the second quarter. Among oilfield service firms, the measure of lag time in delivery of services declined from 36.0 to 21.1 but remained well above average.

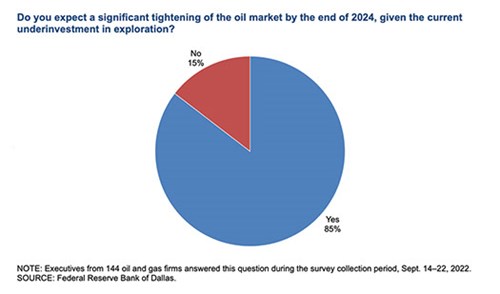

One of the “special questions” asked of survey respondents was “Do you expect a significant tightening of the oil market by the end of 2024, given the current underinvestment in exploration?” Not surprisingly, 85% of executives said they expect a significant tightening of the oil market by the end of 2024, Fig. 2.

FIG. 2. Special Question on oil market tightening.

STRATEGY/REGULATIONS

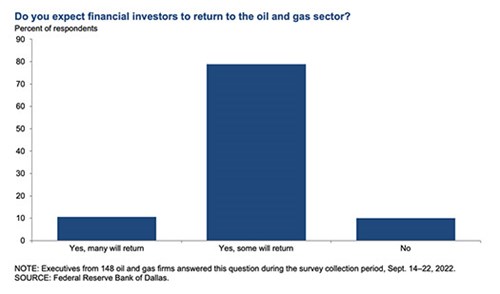

Another “special question” posed to executives was “Do you expect financial investors to return to the oil and gas sector? As shown in Fig. 3, a clear majority of the executives—79%—said they expect some financial investors to return to the oil and gas sector. Eleven percent expect many will return, while 10% expect investors not to return.

FIG. 3. Special Question on financial investors returning.

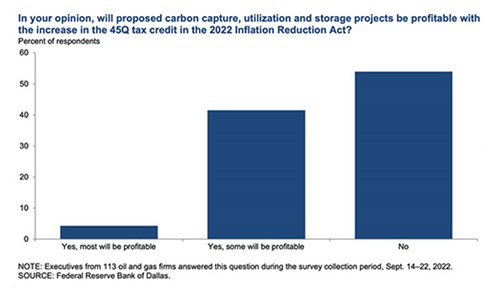

On the regulatory front, a “special question” asked of executives was “In your opinion, will proposed carbon capture, utilization and storage projects be profitable with the increase in the 45Q tax credit in the 2022 Inflation Reduction Act?” As depicted in Fig. 4, slightly over half—54%—of executives expect most proposed carbon capture, utilization and storage projects won’t be profitable, despite the increase in the 45Q tax credit in the Inflation Reduction Act. Forty-two percent expect some proposed projects to be profitable, and 4% expect more projects to be profitable.

FIG. 4. Special Question on whether CCUS projects can be profitable.

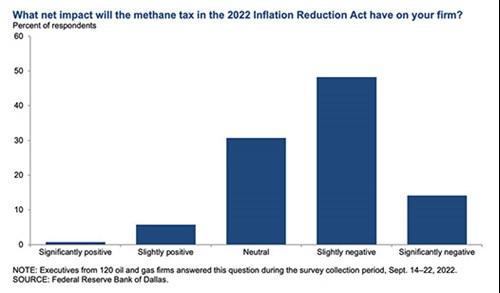

Still on regulatory matters, another “special question” asked executives, “What net impact will the methane tax in the 2022 Inflation Reduction Act have on your firm?” Predictably, most executives expect a negative net impact on their firm from the methane tax in the 2022 Inflation Reduction Act, Fig. 5. Forty-eight percent of executives said they think the net impact will be slightly negative, and an additional 14% anticipate that it will be significantly negative. Thirty-one percent expect a neutral impact. Seven percent anticipate a positive impact.

FIG. 5. Special Question on net impact of a methane tax.

OIL & GAS PRODUCTION

Oil and natural gas production increased at a similar pace, compared with the prior quarter, according to executives at exploration and production (E&P) firms. The oil production index held fairly steady at 31.7 in the third quarter. The natural gas production index was essentially unchanged at 35.6.

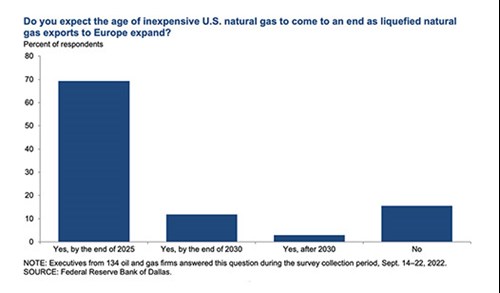

One of the “special questions” posed to survey respondents was “Do you expect the age of inexpensive U.S. natural gas to come to an end, as liquefied natural gas exports to Europe expand?” In response, most executives (69%) expect the age of inexpensive U.S. natural gas to end by year-end 2025, Fig. 6. An additional 12% of executives think it will happen by year-end 2030, and 3% expect it to occur after 2030.The remaining 16% don’t expect the age of inexpensive U.S. natural gas to end.

FIG. 6. Special Question on whether inexpensive U.S. natural gas will end.

OFS SECTOR

Oilfield services firms reported broad-based improvement, with key indicators remaining in solidly positive territory. The equipment utilization index remained elevated but fell from 66.7 in the second quarter to 55.2 in the third. The operating margin index remained positive but declined from 32.7 to 25.4. The index of prices received for services inched higher, from 62.7 to 64.9—a record high.

EMPLOYMENT TRENDS

All labor market indexes in the third quarter remained elevated, pointing to strong growth in employment, hours and wages. The aggregate employment index posted a seventh consecutive positive reading, increasing from 22.6 in the second quarter to a record 30.0. The aggregate employee hours index was 33.3, close to its historical high. The aggregate wages and benefits index remained elevated and was largely unchanged at 47.3. WO

- From injection to insight: Tracing efficiency in surfactant huff and puff (November 2025)

- Maximizing production with smarter lift solutions (November 2025)

- Production technology: How a minor instrument upgrade led to major oil separator savings (November 2025)

- What's new in exploration: “Unleash” Alaska (November 2025)

- Engineered components are the difference between survival and failure in HPHT subsea systems (November 2025)

- First Oil: A grand plan designed for U.S. offshore leasing (November 2025)