Oil and gas producers make progress on ESG

As stakeholder demand for environmental, social and governance (ESG) information has continued to increase, oil and gas companies are providing ESG disclosures through sustainability reports and information on company websites, according to the 2022 EY US oil and gas reserves, production and ESG benchmarking study. The study is an analysis Ernst & Young LLP (EY) conducts annually of the industry’s 50 largest publicly traded exploration and production (E&P) companies, based on year-end 2021 U.S. oil and gas reserves. While progress is being made on ESG reporting, improvements will be necessary to keep pace with regulatory requirements.

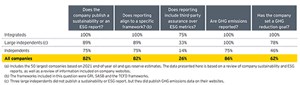

Increasing six percentage points from 2020, 82% of all companies in the EY study published a sustainability or ESG report. The integrated companies and large independents have led the charge, as 100% and 89% of these companies, respectively, published a report, while just three-quarters of independents published results. This reflects an overall increase from 2020, when EY found that 76% of all the study companies published a sustainability or ESG report.

Most of the published reports by the study companies align with the Global Reporting Initiative, Sustainability Accounting Standards Board or the Task Force on Climate-Related Financial Disclosures frameworks. However, the regulatory environment around ESG reporting is evolving, Table 1. The Securities and Exchange Commission (SEC) proposed new rules for climate-related disclosures in an effort to standardize and enhance information to investors.

Transparency and accountability around progress on ESG issues will continue to be a point of emphasis for all companies, Fig. 1. As proposed in the SEC rules, companies will need to obtain third-party assurance over certain climate-related disclosures. The EY study showed that of the 50 companies, just 13 obtained third-party assurance of their reported ESG metrics, with only two of those companies obtaining reasonable assurance. While 75% of integrated companies included third-party assurance over ESG metrics, large independents and other independents were significantly less likely to include third-party assurance (33% and 14%, respectively).

Tracking and reporting on greenhouse gas (GHG) emissions across an oil and gas company’s global value chain is an immense task. Therefore, many oil and gas companies continue to view ESG as a compliance issue and are waiting until specific governmental regulations are implemented to make changes. A significant majority of the study companies (86% or 43 companies) report at least one scope of GHG emissions. Within the 43 companies reporting, at least one scope of GHG emissions, 28% only reported Scope 1 emissions, while 39% reported both Scope 1 and Scope 2 emissions. Nearly a third (33%) of the companies reporting GHG emissions reported at least one category of Scope 3 emissions, in addition to their Scope 1 and Scope 2 emissions. All of the companies reported Scopes 1 and 2 and at least one category of Scope 3 GHG emissions.

Furthermore, a significant majority (75%) of the study companies reporting at least one scope of GHG emissions reported their Scope 1 emissions using the operational control approach, Fig. 2. Only 9% reported their Scope 1 GHG emissions using the equity share approach, and 11% reported their Scope 1 GHG emissions using both the operational control and equity share approaches. ESG will continue to gain momentum in the industry, because shareholders, regulators and investors are making it near-mandatory. How oil and gas companies view shifting environmental expectations—and how they respond to regulatory requirements—will have a major impact on their success in the decades to come. Right now, progress in ESG among oil and gas companies is likely viewed as a strategic decision to differentiate themselves and provide a competitive advantage. Yet, it will soon become table stakes.

ACKNOWLEDGEMENT

The author would like to thank EY colleagues Andrew Morrison and Alex Miller-Brown for their contributions to the EY U.S. oil and gas reserves, production and ESG benchmarking study referenced in this article.