Guyana-Suriname Regional Report: The overly generous PSA may be history

Pay-to-play time is likely nigh in Guyana, as the tiny nation appears poised to flex the economic muscle that comes with the rapid ascension from an obscure extra to a starring role on the world petroleum stage.

Much like new stores that offer steep discounts to attract customers, Guyana, and its emerging neighbor on South America’s northern Atlantic coast, Suriname, have negotiated atypically operator-friendly offshore production sharing agreements (PSA), with royalty rates generally around 41% less than elsewhere in South America and beyond. In Guyana especially, that may be about to change.

“We have made it clear that in any new PSA, we negotiate for those blocks, the conditions will be very, very different than the ones from the Stabroek Block,” Guyana Vice President Bharrat Jagdeo told Reuters on Aug. 17, during the belated 2021 Offshore Technology Conference in Houston.

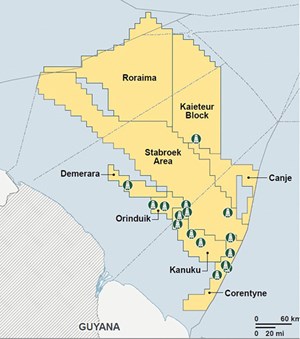

He was referring to the nation’s first offshore PSA, executed for the 6.6-million-acre deepwater tract, licensed to an ExxonMobil-led consortium that includes Hess Corp. (30%) and China’s CNOOC (25%). For now, the group controls the whole of Guyana’s production, which kicked off in December 2019 and is on track to cross the exclusive 1 MMbopd club by 2027, at the latest.

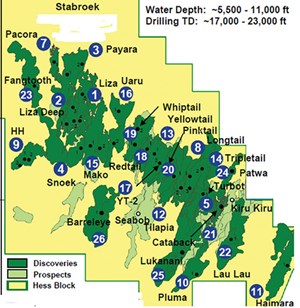

The Stabroek Block lies in water depths from 5,000 ft to 11,000 ft, with wells typically drilled from 17,000 ft to 23,000 ft, TD, largely targeting the Upper Cretaceous New Amsterdam formation and the Eocene-Miocene-aged Saramacca and Pomeroon formations’ secondary pay zones, according to S&P Global.

ExxonMobil ushered Guyana into the deepwater realm with the May 2015 Liza-1 discovery well. Less than five years later, the Liza Destiny floating production, storage and offloading (FPSO) system was online, producing between 120,000 and 125,000 bopd. Another FPSO began delivering first oil, from the second phase of the Liza development, in February.

The consortium was rewarded with relaxed terms and royalties, far less than the already discounted 6.5% rate purportedly extended in Suriname, which remains in the early offshore exploration stage. Partner Hess described the Stabroek Block as offering “low entry costs,” with sanctioned projects realizing a break-even oil price of $25-$35/bbl Brent.

Guyana’s resolve to get a bigger share of the growing pie will be tested with next month’s lease offering and the execution of new operating licenses.

Virgin ultra-deepwater Block C is expected to be on the block in the sale, along with surrendered areas from previously allocated blocks. While not providing specifics of the sale’s rejiggered regulatory framework, Jagdeo told S&P Global Commodity Insights on June 1 the revised PSA structure would include, among other provisions, a new profit share and royalty rate. Citing the high price of oil nowadays, he added the government would also not conduct new seismic on the blocks to be auctioned.

Given the current geopolitical environment, getting more favorable terms should be a no-brainer, says Jennapher Lunde Seefeldt, Assistant Professor of Government and International Affairs, Augustana University Sioux Falls, S.D. who studies the relationship of natural resources and economic to nations’ level of democracy and social justice. “Oil companies typically pay host countries royalties on their revenues that average about 16%. To date, Guyana and Suriname have accepted fees of less than 6.5% in an effort to attract investors,” she wrote on March 15. “As world markets grapple with the current oil price shock, niche producers are in especially favorable positions to secure advantageous contracts and more favorable terms from international energy companies.”

Whether the ExxonMobil consortium will be allowed to participate, given its outsized footprint, remains an open question. “The other argument is if you reduce the number of bidders, it may become less competitive and a lower bid, so it’s between those two variables that we need to make the decision,” Jagdeo told S&P.

The government, likewise, is considering the establishment of a national oil company (NOC) like its far less-developed eastern neighbor, Suriname, where state-owned Staatsolie will get a 20% to 40% share of eventual offshore production. As of now, Suriname also extends unusually long 30-year contractual terms.

DRILLING HOT SPOT

The stakes are high, as Guyana is seen as a key cog in efforts to make up a global oil shortfall, aggravated in no small part by the ongoing war in Ukraine and western sanctions on Russian crude. In its April Oil Market Report, the International Energy Agency (IEA) lumped Guyana with production heavyweights the US, Canada and Brazil as the four primary areas for oil production growth outside of the OPEC+ alliance.

In May, Guyana’s oil and gas production averaged 208,000 bpd and 250,360 Mcfd, respectively, according to S&P Global. This was expected to rise to 260,000 bopd by the end of the month, when the second Liza FPSO reaches peak capacity. “This rate is expected to hold for the rest of the year,” says Magda Rodriguez, S&P Global senior analyst, Americas, adding that gas is being flared or re-injected, pending pipeline construction.

“Our development priorities are weighted toward liquid. We’re doing some things with the government of Guyana to bring gas onshore to help deliver more cost-efficient and environmentally better power to the people of Guyana, “ ExxonMobil CEO Darren Woods said on April 29.

By contrast, Suriname produces only 16,440 bopd and 692 Mcfgd from two mature onshore fields, but with five discoveries over the past two years, the country is projected to begin offshore production no later than 2025.

According to S&P, six offshore rigs were drilling Guyana’s deep water in May, with 10 floaters set to be in the country over the next three years. So far, 108 wells have been drilled, with another 20 permitted for drilling.

Two drillships are on location in Suriname, drilling around nine wells per year, with a third ship expected in-country by 2025, Rodriquez said. A cumulative 56 offshore wells have been drilled in Suriname with varying success, with permits in place for 14 new drills.

With drilling conditions strikingly similar to the deepwater Gulf of Mexico, requiring new-generation drilling and platform support vessels with higher-than-conventional mud and brine storage capacity, 41 U.S.-flagged vessels have relocated to the region (Fig. 1), with utilization rates as high as 95%, Rodriquez said.

STABROEK SHATTERS ASSESSMENT

The U.S. Geological Survey (USGS), meanwhile, needs to revisit its “vastly underestimated” 2000 reserve assessment for the Guyana-Suriname basin that pegged the small and underdeveloped nations, sandwiched between Venezuela and French Guinea, as holding cumulative mean recoverable oil and gas reserves estimated at around 13.6 Bbbl and 32 Tcf, respectively. Bolstered by five Stabroek discoveries this year, the ExxonMobil consortium, alone, claims estimated recoverable resources of nearly 11 Bboe.

The block (Fig. 2) has accounted for 26 major discoveries to date, with the potential for up to 10 FPSOs by 2027, according to partner Hess, which envisions oil production capacity of more than 1 MMbpd, gross. “In terms of exploration and appraisal in Guyana, we continue to invest in an active exploration program, with approximately 12 wells planned for the Stabroek Block in 2022,” CEO John Hess said on an April 27 call (Fig. 3).

Following the fast-track development of Liza Phase 1, the Liza Unity FPSO delivered first oil in Phase 2 during February, raising current total oil production capacity in Guyana to more than 340,000 bpd, says Woods. “Our third project, Payara, is running ahead of schedule with start-up now likely by year-end 2023. Yellowtail, the fourth and largest project to date on the Stabroek Block, received government approval of our development plan, and is on schedule to start up in 2025,” Woods said.

Payara sits due north of Lisa, in water depths of just over 6,500 ft, and once the new Prosperity FPSO is on location, it is expected to produce roughly 220,000 bopd from a new sandstone reservoir.

In April, Guyana gave the green light for development of the $10-billion Yellowtail oil and gas field, south of Liza. The block’s fourth and largest field to date, Yellowtail is expected to produce around 250,000 bopd when the One Guyana FPSO comes online, also in 2025. The discovery well was completed in April 2019 at 18,445 ft, TD, in 6,064 ft of water, where it intercepted 292 ft of oil-bearing sandstone.

Added to these are the quintet of discoveries that the partnership has made since January, including three back-to-back hits announced in April, southeast of the Liza and Payara developments.

Drilled to the south in 3,840 ft of water, the Barreleye-1 well encountered 230 ft of hydrocarbon-bearing sandstone, while the Patwa-1 to the northwest encountered 108 ft of pay and was completed in 6,315 ft of water. The Lukanani-1 well was drilled in 4,068 ft of water to the southeast, where it intercepted 115 ft of hydrocarbon-bearing sandstone.

The discovered trio followed the Fangtooth-1 and Lau Lau-1 discovery wells, announced in January, 11 mi northwest and 42 mi southeast of Liza field, respectively. Fangtooth-1 penetrated around 164 ft of pay in 6,030 ft of water; Lau Lau-1 encountered 315 ft of sandstone reservoirs in 4,793 ft of water.

“These (three) discoveries and the updated resource estimate increase the confidence we have in our ambitious exploration strategy for the Stabroek Block and will help to inform our future development plans for the southeast part of the block,” said Liam Mallon, president of ExxonMobil Upstream Company.

THE KAWA-1 EFFECT

“The Fangtooth discovery is a successful result of our strategy to test deeper prospectivity, and the Lau Lau discovery adds to the large inventory of development opportunities in the southeast part of the Stabroek block. Both discoveries increase our understanding of the resource, our continued confidence in the block’s exploration potential, and our view that the many discoveries to date could result in up to 10 development projects.” said Mike Cousins, ExxonMobil senior vice president of exploration and new ventures.

Outside of Stabroek, a “complicated” exploration well drilled by a Canadian joint venture has buoyed prospects along the Guyana shelf. CGX Energy Inc., as operator, teamed up with fellow Canadian Frontera Energy Corp. to drill the Kawa-1 “rank” exploration well on the southernmost Corentyne Block, later described as a “remarkably successful” light oil and condensate prospect.

In January, Kawa-1 was drilled to 21,578 ft, TD, and encountered 228 ft of net stacked pay potential across five zones, including the Maastrichtian, Campanian and Santonian horizons with effective porosity up to 26%. While saying it was premature to declare the well a commercial discovery, Dr. Mark Zoback, CGX technical advisor, said, “we are very optimistic at this point.”

“Importantly, hydrocarbons were encountered in multiple zones, extending over a 6,000-ft vertical interval, from approximately 15,120 ft to 21,500 ft. Essentially, every sand we encountered in this interval indicated the presence of hydrocarbons,” he said during a joint CGX-Frontera technical informational webinar in May.

The well was plugged and abandoned, and the Maersk Discoverer semisubmersible will mobilize some 9 mi to the northwest, to drill the Wei-1 exploration well in the third quarter. The second exploration well is mandated in the operating license.

If the experience on Kawa-1 is any indication, drilling the Wei-1 wildcat may not be a walk in the park. It took nearly six months for the JV’s first offshore Guyana well to transition from spud to programmed depth. Along the way, the crew encountered multiple changes in pressures and lithologies unique to the basin and not visible from seismic, including kicks, very hard “cherty” rock and high temperature at TD that degraded the drilling fluid, requiring four days to stabilize the well. “It wasn’t the riskiest well I’ve ever drilled, but it was complicated,” said CGX Drilling Director Kevin Lacy.

The JV also holds a license for the Demerara Block, northwest of Corentyne, giving it a total a leasehold of more than 1.4 million gross acres.

Elsewhere, the Repsol-operated joint venture with the UK’s Tullow Oil Plc is drilling ahead on the Beebei-Potaro exploration well, which was spudded in May, in the shallow water of the Kanuku Block. An earlier Kanuku well near shore, drilled in 262 ft of water, was deemed noncommercial as a stand-alone development.

Tullow also holds a 60% stake in the adjoining Orinduik Block, with partners Eco Atlantic Oil and Gas Co. (15%) and TOQAP (Total E&P Guyana B.V. and Qatar Petroleum), holding a 25% interest. Two heavy oil discovery wells were drilled on the block in 2019, but they were found to have high sulphur content, with no additional appraisal or exploration plans yet announced.

SURINAME RISING

A mixed roster of majors and independents also has flocked into the comparatively shallower waters of Guyana’s eastern neighbor, where the offshore sector remains relatively virgin territory (Fig. 4). “No bid rounds are planned for 2022 in Suriname, outside of individual deals between operators and Staatsolie,” says S&P’s Rodriquez.

For now, Block 58 is shaping up as Suriname’s version of Stabroek, where operator TotalEnergies SE is in a 50/50 partnership with Houston’s APA Corp. (Apache). The partners have hit five exploration discoveries since January 2020.

The latest hit came in late February, with the Krabdagu-1 exploration well, which the partnership described as a “significant new oil and associated gas discovery,” drilled in about 2,560 ft of water. Flow testing of two zones has been completed, and as of May 5, the well was in the pressure build-up stage, says APA. Following operations at Krabdagu, the Maersk Valiant drillship will proceed to the north of Block 58, to drill the Dikkop exploration well.

“This successful exploration well at Krabdagu-1 is a significant addition to the discovered resources in the central area of Block 58. This result encourages us to continue our exploration and appraisal strategy of this prolific Block 58, in order to identify sufficient resources by year-end 2022 for first oil development,” says TotalEnergies Senior VP, Exploration, Kevin McLachlan.

A year ago, TotalEnergies contracted Yinson Holdings of Malaysia to perform preliminary front-end engineering design (pre-FEED) for a planned FPSO on Block 58.

Krabdagu-1 follows the Maka, Sapakara, Kwaskwasi and Keskesi discovery wells and the successfully tested Sapakara South-1 appraisal well. “As we think about a path to FID (final investment decision) in Suriname, we’re kind of moving more toward what I’ll call a central area hub concept,” says APA president and CEO John Christmann. “You’ve got a foundational piece at Sapakara South. We think Krabdagu can also be a foundational piece.”

The joint venture also holds a PSA for Block 53, where APA, as operator, spudded the Rasper prospect in March with the Noble Gerry de Souza drillship, which Christmann says will likely remain in the country after drilling the exploration well.

On April 27, Staatsolie also signed a PSA with Chevron, giving the operator an 80% stake in Block 7, in the western portion of the shallow-water area. Chevron has provided no details on near-term exploration plans.

In December 2021, Chevron farmed out a third of its 60% equity in Suriname’s 863-sq-mi Block 5 to Shell, which also holds a 33.33% interest in Block 42, acquired from Kosmos Energy in December 2020. The PSC for Block 5 gave Staatsolie a 40% share, which the NOC retained after the farm-out.

- Regional report: Guyana-Suriname: Rapid expansion of production continues (July 2024)

- Annular safety valves advance flexibility, reliability and safety in completion operations (July 2024)

- Well decommissioning: Simple solutions to complex problems (June 2024)

- Rethinking sand management for optimized production (June 2024)

- Can an offshore drilling rig run on green methanol? (May 2024)

- Custom-made blueprint for optimizing late-life assets (April 2024)