Economics/Statistics

News

March 03, 2022

California, already paying record prices for motor fuel, is set to shell out even more with the Golden State more exposed to surging oil prices than the rest of the country in the wake of Russia’s invasion of Ukraine.

News

March 02, 2022

The CEO of the Energy Workforce & Technology Council, said she agrees with President Biden and the need to optimize reliance on domestic resources, but that must also include energy resources.

News

February 22, 2022

After watching big banks curtail lending and asset managers pare bets, fossil fuel producers are now losing access to some of Wall Street’s deepest pockets.

News

February 17, 2022

BlackRock Inc., one of the leading advocates of sustainable investing, is on a mission to persuade Texas that it’s a strong backer of the oil and gas industry.

News

February 10, 2022

TotalEnergies SE promised to increase its dividend and buy back more shares after posting a record fourth-quarter profit.

News

February 09, 2022

New York’s $280 billion state pension fund will divest more than $238 million in shares and bonds of oil and gas companies.

News

February 09, 2022

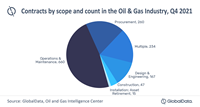

A recent GlobalData report shows a 77% increase in contract value but a 14% decrease in the number of contacts.

News

January 28, 2022

Triple-digit oil prices are possible in the next few months as geopolitical risks and “struggling” supply hit global crude markets, said Chevron Corp.’s top executive.

News

January 27, 2022

U.S. natural gas futures suddenly spiked the most on record Thursday afternoon, a dramatic move that signaled bearish wagers being squeezed out of the market.

News

January 27, 2022

The combined shares of five of the largest oil sands companies have outpaced the broader S&P 500 Energy Index over the past three months. The 25% surge comes as U.S. crude oil prices approach $90 a barrel for the first time since 2014.

News

January 27, 2022

U.S. shale executives have finally achieved something that eluded the industry for more than a decade: the ability to turn over billions of dollars in dividends to shareholders while at the same time boosting production to tap into surging global oil demand.

News

January 26, 2022

A new analysis from McKinsey & Co. estimates that the investment, in new infrastructure and systems, needed to meet international climate goals could be $9.2 trillion a year annually through 2050.

News

January 21, 2022

Oil and gas drilling is big business once again, if the leap in demand for services from Baker Hughes Co., the world’s No. 2 oilfield contractor, is any gauge.

News

January 21, 2022

Schlumberger is gearing up for growth around the world as the No. 1 oilfield contractor expects recovering economies to ignite several years of crude-demand expansion.

News

January 21, 2022

Last year’s blistering rally in natural gas and oil prices pushed mergers and acquisitions in the sector to a three-year high with no slowdown in sight, according to consultant Rystad Energy AS.

News

January 21, 2022

The era of ever-cheaper clean power is over, giving a fresh jolt of uncertainty to global energy markets battered by one supply crisis after another.

News

January 21, 2022

The bank expects stockpiles to slide even lower by the end of the year, after falling substantially in 2021, according to a research note to clients. Spare supply capacity will shrink to 2 million barrels a day from the current 3.4 million.

News

January 19, 2022

Surging demand, fading omicron fears, and OPEC+’s inability to ramp up output have underpinned an eye-watering rally in oil prices.

News

January 11, 2022

Oil jumped by the most in month after Jerome Powell’s comments to the Senate Banking Committee appeared to be less hawkish than the Federal Reserve had recently telegraphed.

News

January 11, 2022

China doubled down on imports of Iranian and Venezuelan crude in 2021, taking the most from the U.S.-sanctioned regimes in three years, as refiners brushed off the risk of penalties to scoop up cheap oil.

News

January 12, 2022

Global oil demand has proven stronger than expected as the latest coronavirus variant inflicts a softer hit to the economy than anticipated, the International Energy Agency said.